Today’s edition is brought to you by TLDR Newsletter - catch up on the latest tech, startup, and coding stories.

GM to all of you nutcases. It’s Crypto Nutshell #634 clockin’ in… ⏰🥜

We're the crypto newsletter that's more wild than a conman blurring the line between reality and illusion in a twisted magic show... 🎩🃏

What we’ve cooked up for you today…

🏦 Relentless

🏠 Real Estate investors are coming

💪 Hanging on

💰 And more…

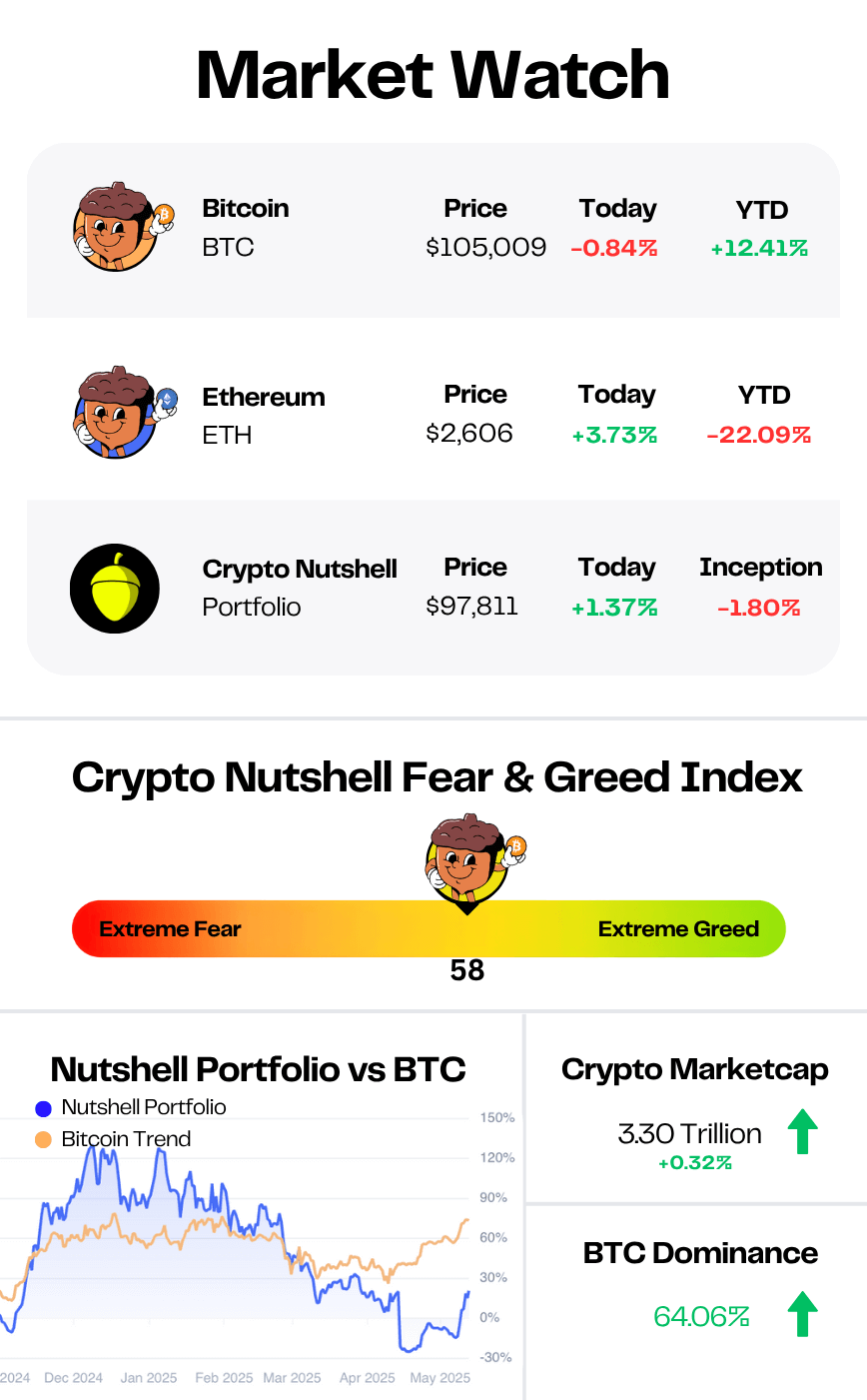

Prices as at 4:35am ET

RELENTESS 🏦

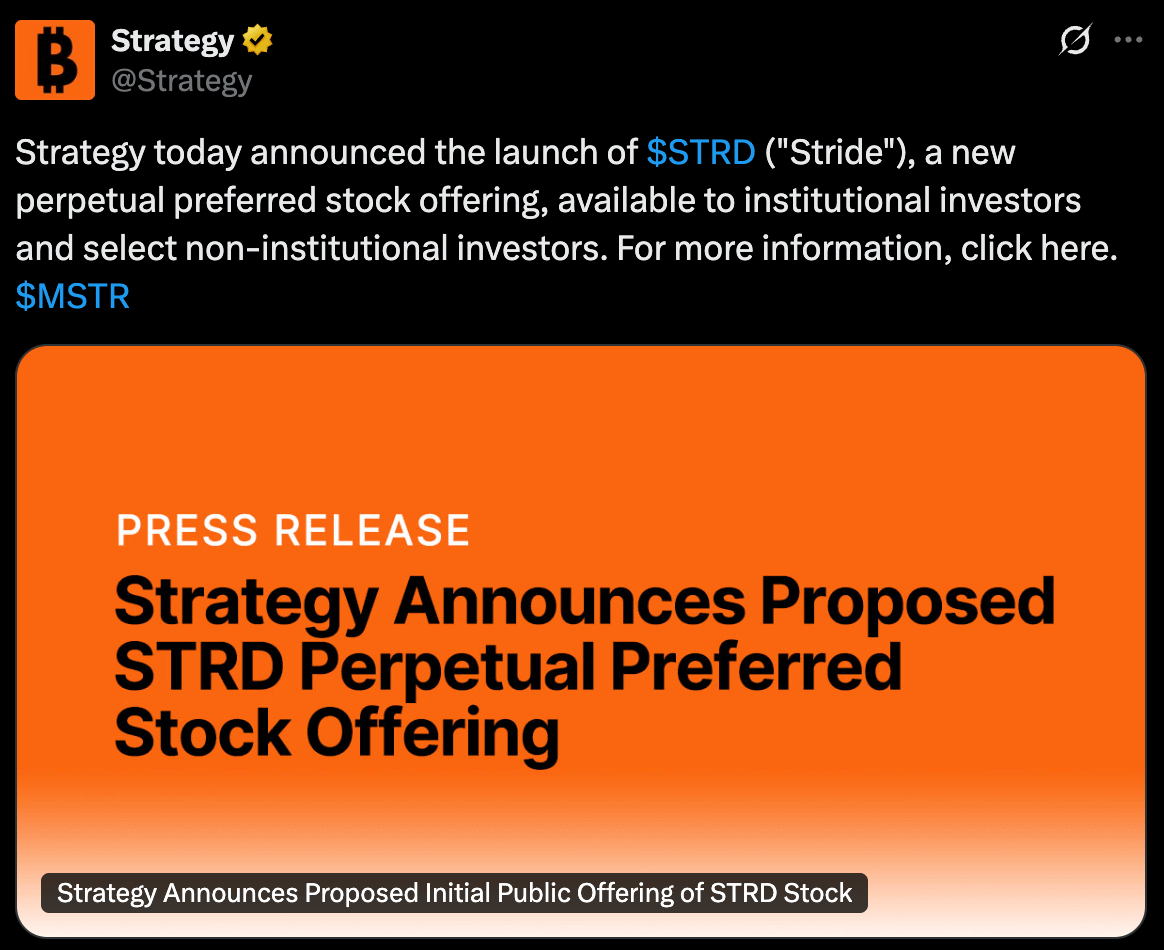

BREAKING: Michael Saylor’s Strategy offers $250M preferred stock to buy more Bitcoin

Michael Saylor’s Strategy just can’t stop stacking sats.

On June 2, the company unveiled its latest move:

A $250 million raise via 2.5 million shares of a new 10% Series A Perpetual Preferred Stock (ticker: $STRD), priced at $100 each.

The goal?

No surprise - buy more Bitcoin.

This is Strategy’s third preferred stock play of the year, after launching Strike ($STRK) and Strife ($STRF) - a bold fundraising engine that’s already powered their $61.7B BTC treasury.

Here’s the breakdown:

10% annual dividend (if declared - it’s not guaranteed)

Non-cumulative - miss a quarter, no catch-up

Perpetual shares - no maturity date

Redeemable if fewer than 25% of original shares remain

And the IPO is being led by Wall Street giants like Morgan Stanley, Barclays, and TD Securities

Saylor’s firm now holds 580,955 BTC - more than double the Bitcoin held by every other public company combined.

At current prices, the new raise could buy ~2,350 more BTC.

But don’t expect them to stop there...

“There’s no specific target for how much Bitcoin we’ll hold. We’ll keep monitoring market conditions.”

The Bottom Line:

Strategy is turning Wall Street into a Bitcoin ATM - pumping out yield-bearing stock to fund the hardest asset on earth.

While others debate allocation…

Saylor is going all in. 🚀

STAY UP TO DATE ON ALL THINGS TECH 🤖

Love Hacker News but don’t have the time to read it every day? Try TLDR’s free daily newsletter.

TLDR covers the best tech, startup, and coding stories in a quick email that takes 5 minutes to read.

No politics, sports, or weather (we promise).

Subscribe for free now and you'll get their next newsletter tomorrow morning.

REAL ESTATE INVESTORS ARE COMING 🏠

Grant Cardone is one of the most well-known real estate investors on the planet.

He runs a $4+ billion portfolio.

He’s built his brand on property, leverage, and cash flow.

But at Bitcoin 2025 in Vegas, he wasn’t talking about houses…

He was talking about Bitcoin:

“I think before the end of this year, we see $250K… Then it’ll pull back to the $140s. And in 2–3 years? $500,000.”

Read that again.

A man whose entire empire is built on real estate...

Now sees Bitcoin as the next massive opportunity.

And Grant isn’t alone.

The money is shifting.

The narrative is shifting.

When the biggest names in real estate start talking like this?

You know something big is underway. 📦

HANGING ON 💪

The streak is still alive…

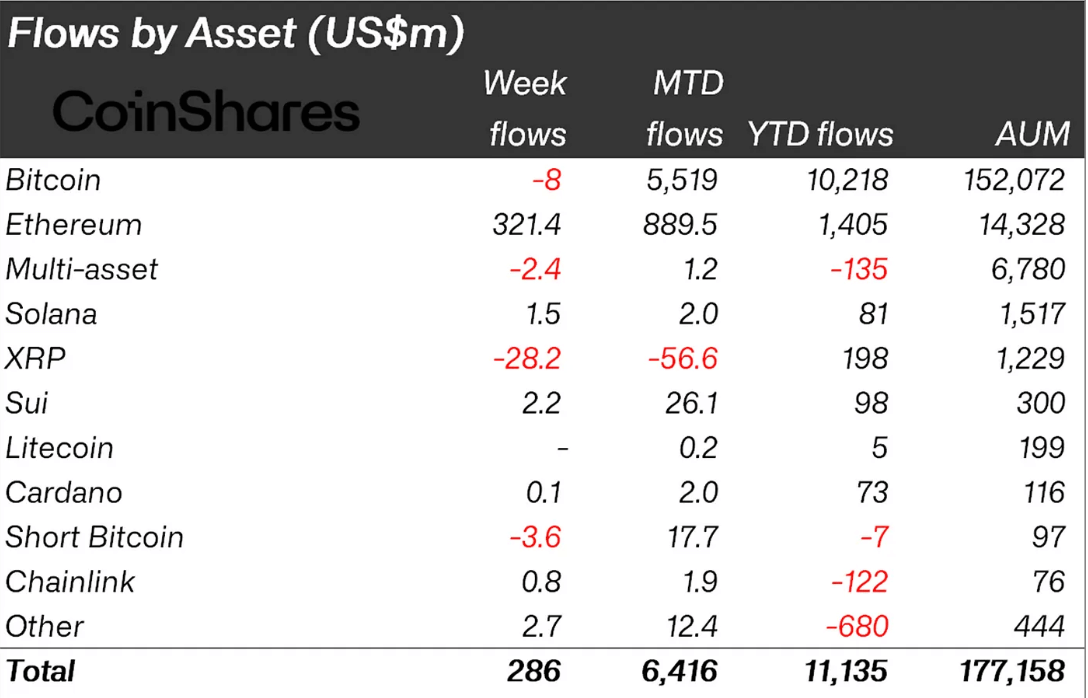

For the seventh week in a row, digital asset funds saw net inflows of $286 million last week.

This pushes the 7-week run of inflows to $10.9 billion.

Let’s break it down.

Leading the charge?

Ethereum - with a surprising $321.4 million in inflows.

That brings ETH’s six-week total to a massive $1.19 billion.

Bitcoin, meanwhile, saw modest outflows of $8 million.

While XRP posted its second straight week of outflows of $28.2 million.

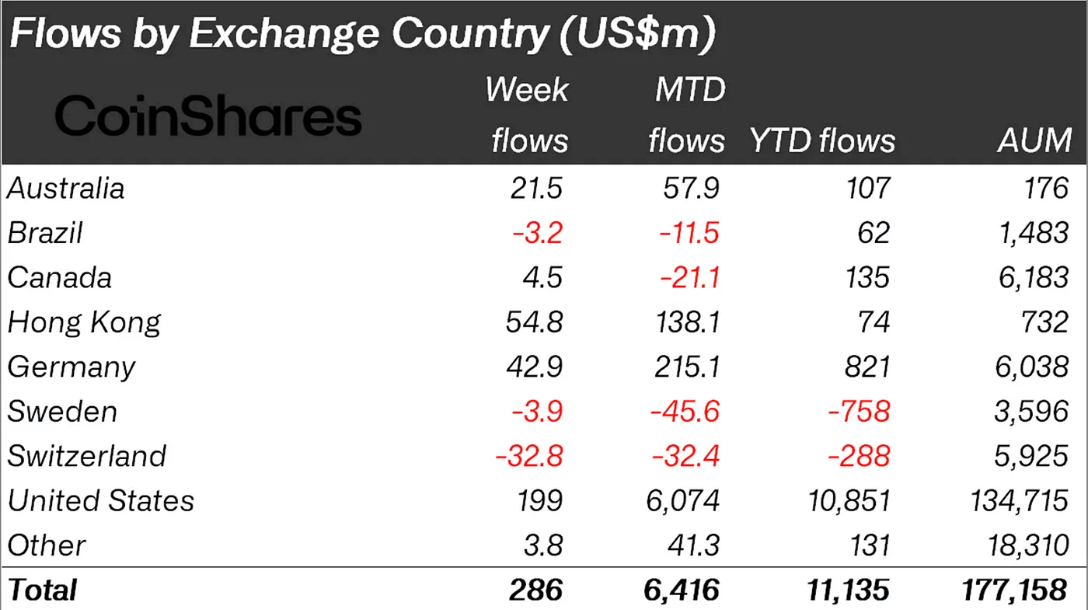

The U.S. came out on top again this week, with net inflows of $199 million.

Hong Kong followed with $54.8m, then Germany ($42.9m) and Australia ($21.5m).

Switzerland, however, saw $32.8m in outflows.

CoinShares notes that Bitcoin kicked the week off with strong inflows…

Unfortunately that reversed mid-week as a New York Court decision declared US tariffs as illegal.

Macro uncertainty has returned…

And as you all know, markets absolutely hate uncertainty.

CRACKING CRYPTO 🥜

Nobel prize-winning economist says ‘stablecoins don’t serve any clearly useful function ’; Coinmetrics co-founder disagrees. Paul Krugman believes that the ‘only economic reason’ to use stablecoins is that they ‘facilitate criminal activity.’

Metaplanet becomes 8th largest Bitcoin holder with $118M buy. Metaplanet is now the eighth-largest corporate Bitcoin holder after reaching 8,888 BTC with its latest investment.

USDC Stablecoin Issuer Circle Eyes $7.2B Valuation in Upsized IPO. Circle raises its IPO share count and price range as strong investor demand fuels interest.

Strategy acquires another 705 bitcoin for $75.1 million, taking total holdings to 580,955 BTC. The company's holdings now total around 2.8% of the total 21 million bitcoin supply — worth over $60 billion.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is a seed phrase used for in crypto?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Recovering access to a crypto wallet 🥳

A seed phrase is a series of words (usually 12 or 24) that acts as a master key to your wallet. If you lose it — say goodbye to your crypto forever. No password reset. No second chances. 🧱🪦

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.