GM to all of you nutcases. It’s Crypto Nutshell #645 keepin’ tight… 🪢🥜

We're the crypto newsletter that's more dangerous than hunting an apex predator that can cloak itself in the jungle... 🌴🔫

What we’ve cooked up for you today…

🏦 Big win for crypto

🧠 Is $1.5 Million Bitcoin still realistic?

📈 New all-time high

💰 And more…

Prices as at 4:00am ET

BIG WIN FOR CRYPTO 🏦

BREAKING: U.S. Senate Passes GENIUS Act to Regulate Stablecoins, Marking Crypto Industry Win

It finally happened…

The U.S. Senate just passed the GENIUS Act - a landmark bill that lays down the first-ever federal framework for stablecoin issuers.

Passed 68–30 with strong bipartisan support

First major crypto bill to ever clear the Senate

Now heading to the House for final approval

The legislation sets strict ground rules:

Full 1:1 backing with cash or Treasuries

Mandatory audits for large issuers

AML compliance and robust capital requirements

“Super-priority” protections for user funds in bankruptcy

But don’t expect Big Tech to jump in unchecked…

Firms like Amazon and Meta face major restrictions unless they meet tough data privacy and financial risk thresholds.

So why does this bill matter?

Because stablecoins aren’t just tokens - they’re infrastructure.

They power on-chain trading, cross-border payments, and soon, everyday spending.

Over 60% of all crypto transactions already rely on them.

And with clear regulations?

Wall Street, major banks, and giants like Walmart are expected to roll out their own stablecoins - unlocking trillions in potential capital.

Treasury Secretary Scott Bessent put it simply:

“Stablecoins will drive demand for U.S. Treasuries, lower borrowing costs, and onramp millions globally to the dollar-based digital economy.”

Still, it’s not without controversy…

Critics warn the bill leaves the door open for Trump-affiliated coins like USD1, despite concerns over political conflicts of interest.

The Bottom Line:

This is the breakthrough the crypto industry’s been waiting for.

Stablecoins just got their regulatory greenlight.

Now all eyes turn to the House - and the final sprint to the White House. 🏛️🚀

Hands Down Some Of The Best 0% Interest Credit Cards

Pay no interest until nearly 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

IS $1.5 MILLION BITCOIN STILL REALISTIC? 💰

That’s still the call from ARK Invest CEO Cathie Wood.

Despite flat market sentiment - she’s not backing down.

In her latest interview with Bloomberg, Cathie was asked if her bold base case = Bitcoin to $1.5 million by 2030 - was still on the table.

Her answer?

“Yes, it is our view.”

Cathie Wood is a long-time Bitcoin bull and one of the first major fund managers to go big on Bitcoin.

Here’s why she’s doubling down:

Bitcoin is leading risk sentiment 🪙

It's become the canary in the coal mine for risk-on vs risk-off periods. When fear spikes, Bitcoin moves first.We’re mid-cycle in a bull market 📈

Based on ARK's on-chain analysis, we’re just past halfway through Bitcoin’s typical 4-year cycle. If history rhymes, the next leg up is coming.Deregulation is gaining momentum 🧾

US policy is softening. Regulatory clarity is growing. That paves the way for serious institutional allocation.Institutions can’t ignore it anymore 🏛️

Bitcoin is no longer fringe. Asset allocators must have a stance. And even a small allocation can improve overall risk-adjusted returns.

Cathie believes an institutional tidal wave is inevitable. 🌊

And when it happens?

The floodgates open 🌊

Supply dries up 🧊

And Bitcoin doesn’t just rise - it rerates 🚀

$1.5 million per coin by 2030 isn’t a wild guess.

It’s the logical endpoint of a system waking up.

NEW ALL-TIME HIGH 📈

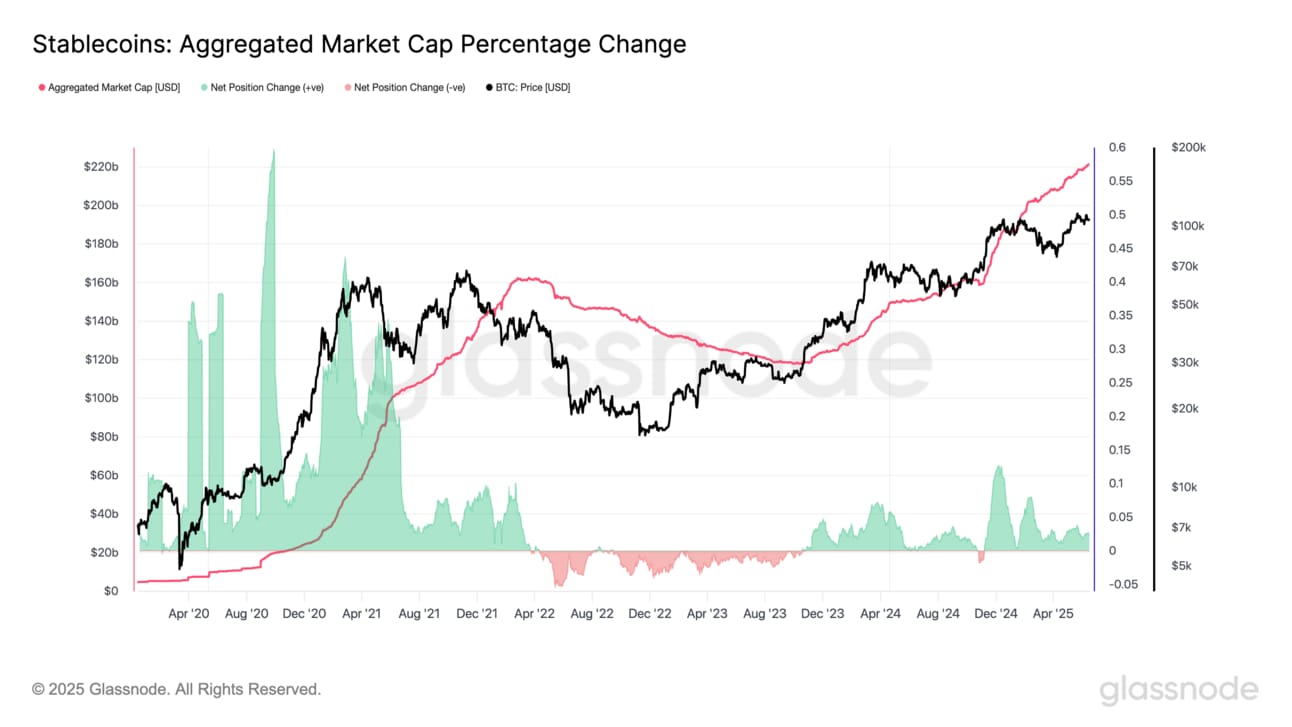

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Back on June 4, total stablecoin supply was sitting at $218.19B.

Today?

We’re at $221.29B - a $3.01B jump in just two weeks.

And it gets even better…

That’s a new all-time high!

It also marks a $36.24B increase year-to-date, with momentum still building.

So… why does this matter?

Because stablecoins = dry powder.

Rising supply means fresh capital is entering the system - sitting on the sidelines, fully liquid, and ready to move.

And historically?

Stablecoin spikes tend to front-run major altcoin rallies.

CRACKING CRYPTO 🥜

Canada beats US to launch first spot XRP ETF amid Ripple-SEC legal pause. Ripple and SEC alliance aims to pause legal appeal while Canada approves first spot XRP exchange-traded fund (ETF).

US Senate passes GENIUS stablecoin bill in 68-30 vote. A majority of lawmakers in the US Senate voted in favor of the GENIUS Act to regulate stablecoins, marking a significant milestone for crypto-related legislation.

ARK Invest Offloads Over $50M in Circle (CRCL) Shares as Stock Extends Rally. Cathie Wood’s firm looks to take profit as CRCL shares surge nearly 5x from its IPO.

JPMorgan to launch 'deposit token' JPMD on Base in pilot involving Coinbase. JPMD, to be launched on Base, is a "permissioned" deposit token that will digitally represent commercial bank holdings.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which U.S. spot Bitcoin ETF saw the highest net inflows during its first month of trading in 2024?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: BlackRock iShares Bitcoin Trust (IBIT) 🥳

BlackRock’s IBIT dominated launch month — pulling in billions in net inflows and quickly becoming the largest and most liquid U.S. spot Bitcoin ETF. 💼🚀

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.