Today’s edition is brought to you by Exodus

Trade crypto your way. Fast swaps, thousands of pairs, secure wallet. No account needed. Download Exodus now!

GM to all you crypto nuts. Crypto Nutshell #365 dancin’ on in..💃🥜

We’re the crypto newsletter that’s more mysterious than exploring an eerie town with dark secrets... 🌌🔦

What we’ve cooked up for you today…

🏦 Ethereum ETFs almost here

💨 Ethereum tailwinds

📈 It keeps getting better for Ethereum

💰 And more…

MARKET WATCH ⚖️

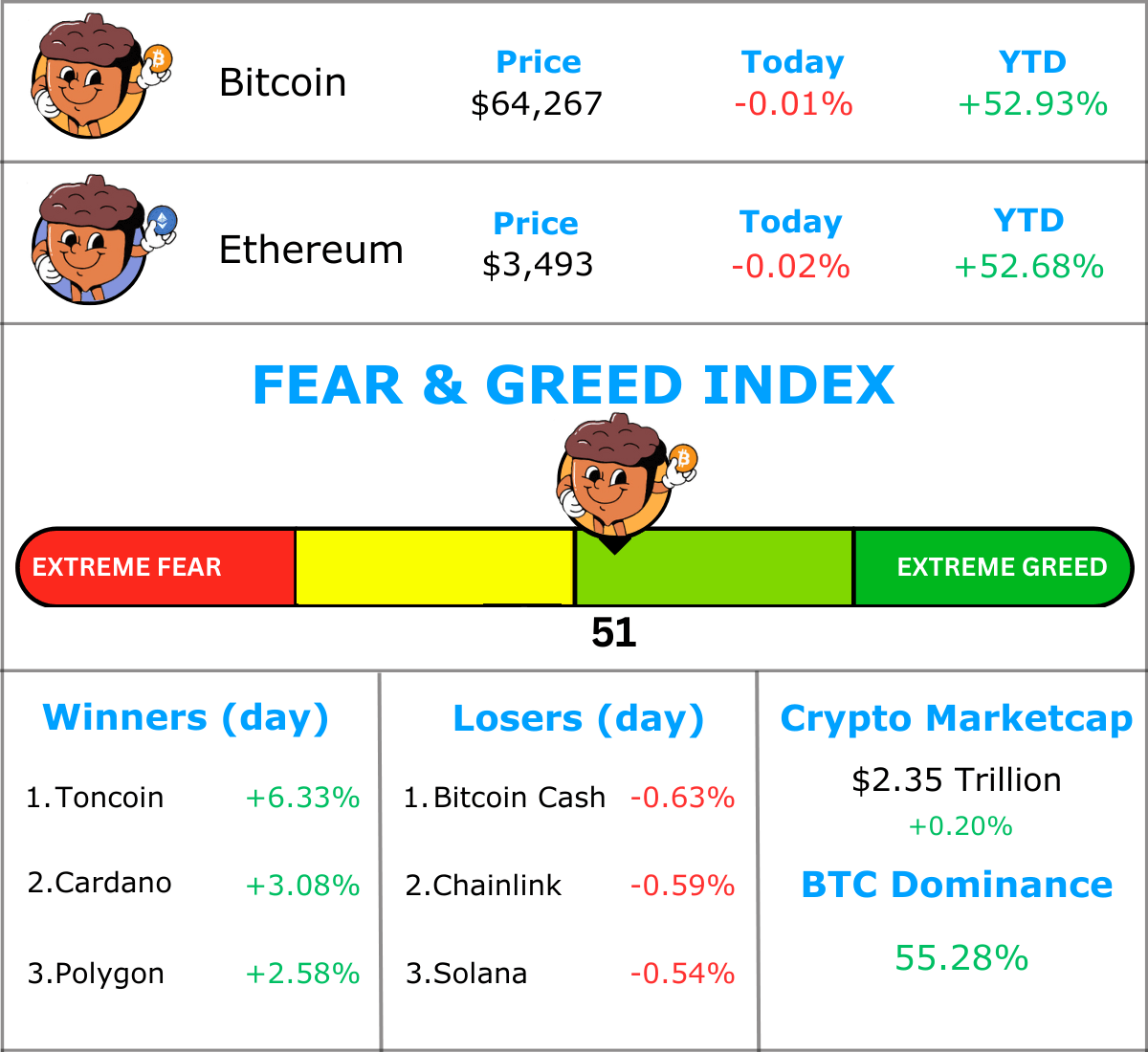

Prices as at 7:55am ET

Only the top 20 coins measured by market cap feature in this section

ETHEREUM ETFs ALMOST HERE 🏦

BREAKING: Asset managers update proposals for Ether ETFs, eyeing July launch

Here we go.

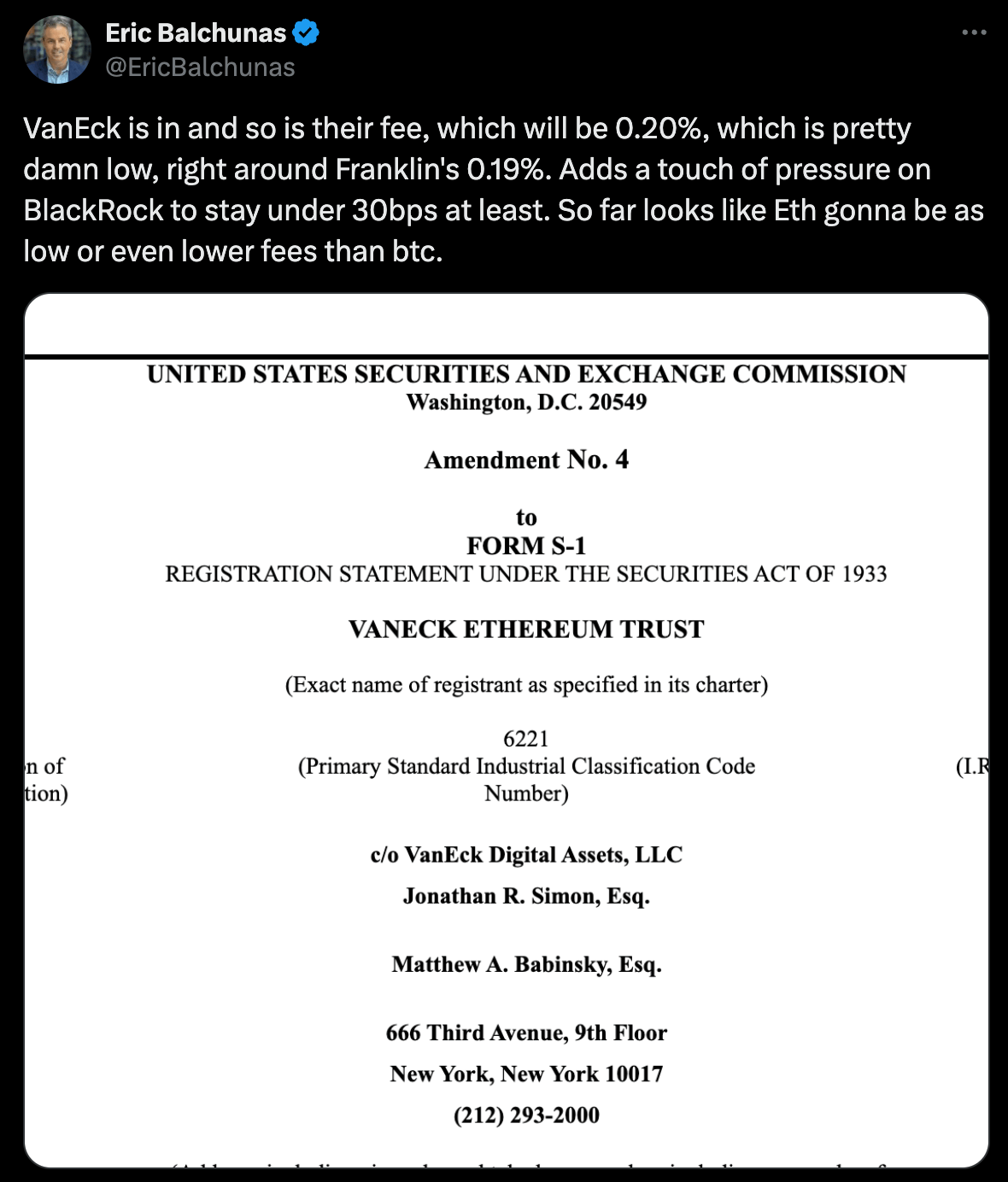

All asset managers have now submitted their updated Ethereum ETF S-1 filings.

This is the final missing piece of the puzzle.

Once these are approved, it’s game on. 👏

The Ethereum ETFs can finally begin trading.

The biggest thing to come out of these S-1 filings were the fees for VanEck and Franklin Templeton being revealed.

VanEck: 0.20%

Franklin Templeton: 0.19%

Nate Geraci, president of ETFStore still believes that the Ethereum ETFs could launch before July 4th.

“based on Bitwise filing yesterday, doesn’t look like anything noteworthy left for SEC to address/comment on. I’m still going w/ launch before July 4th.”

All we can do now is sit and wait.

The ball is in the SEC’s court.

Stay tuned, we’ll keep you updated on any major developments.

TRADE CRYPTO YOUR WAY 🤑

The crypto bull run is now well underway.

That means 2 things:

Altcoin Season

Self-Custodying your crypto is more important than ever

To make the most of the bull cycle, you need a wallet that’s fast, effortless & secure.

That’s why Exodus is the only wallet you'll ever need:

Storage – access coins and tokens from 50+ supported networks in one, convenient wallet (Bitcoin, Ethereum, Solana etc.)

Swaps – in-app swaps allow users to effortlessly exchange crypto for a number of different tokens (100,000+ trading pairs)

Crypto staking – staking options available for a dozen different tokens

Where do you get Exodus?

Easy - It’s available everywhere. We’re talking mobile apps (IOS & Android), desktop apps and browser extensions. Click here to download it in 2 clicks.

The best part?

It’s completely free..

Ready to join the millions of customers who choose Exodus to self-custody their crypto? Download Exodus now!

ETHEREUM TAILWINDS 💨

In a recent Twitter post, Matt Hougan broke down some significant tail winds coming up for Ethereum in the second half 2024.

And when you lay it out like this…

It’s hard not to be extremely bullish…

Matt Hougan is the Chief Investment Officer at Bitwise, the 4th largest Bitcoin ETF issuer.

Here’s 3 tailwinds he laid out:

Significant New Demand

The launch of the Bitcoin ETFs was by far the most successful ETF launch of all time.

BlackRock’s IBIT was the fastest ETF ever to reach $20 billion in assets (137 days)

That is ridiculous.

Ethereum is currently 1/3 the size of Bitcoin (in terms of market cap).

It’s not unreasonable to think that the launch of the Ethereum ETFs will also be insanely successful.

A fresh wave of demand is coming for Ethereum. 🌊

Improved Regulatory Clarity

The approval of the Ethereum ETFs also made on thing clear:

Ethereum is now a commodity.

This was also backed up by the SEC dropping its lawsuit against Consensys (company behind MetaMask) over Ethereum’s security status.

And previously, regulatory uncertainty surrounding Ethereum has held professional investors back from getting involved.

Now things are changing…

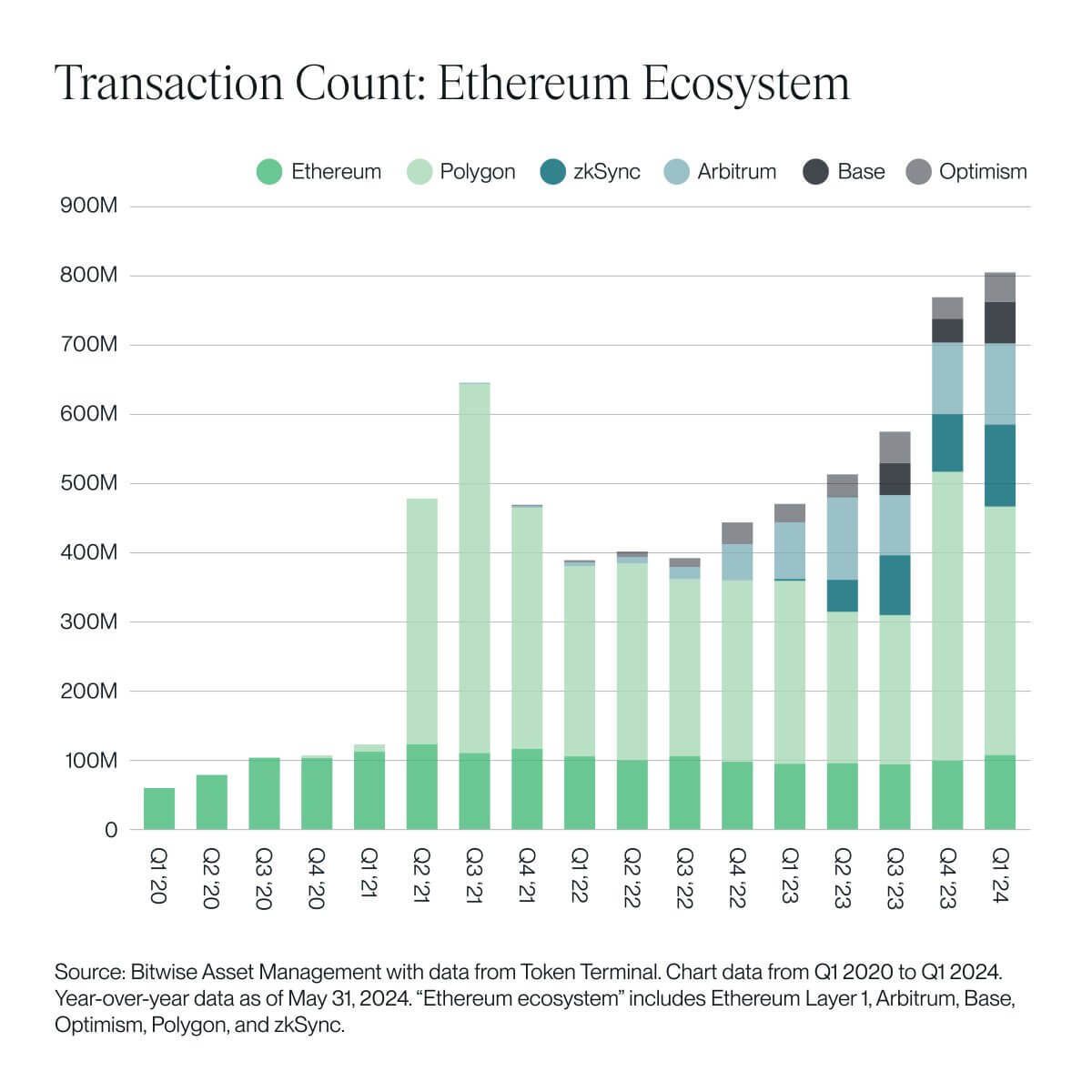

Ethereum Network Activity

Ethereum’s recent Dencun upgrade has seemingly gone under the radar.

This upgrade drastically reduced the transaction fees for Ethereum Layer 2 solutions.

Layer 2s are seperate blockchains built on top of Ethereum that reduce transaction fees and increase transaction speed.

(addressing Ethereum’s two biggest complaints)

The most notable ones being Polygon, Base, Arbitrum and Optimism.

The rise of Layer 2’s has seen the amount of Ethereum network transactions increase by over 84.65% since last year.

Ethereum’s set up for the second half of the year is seriously solid.

But it get’s even better.

In the next section we’ll be breaking down Ethereum’s supply dynamics.

(spoiler alert: they are also insanely bullish)

IT KEEPS GETTING BETTER FOR ETH 📈

Continuing this talk on Ethereum, let’s take a look at the current supply dynamics.

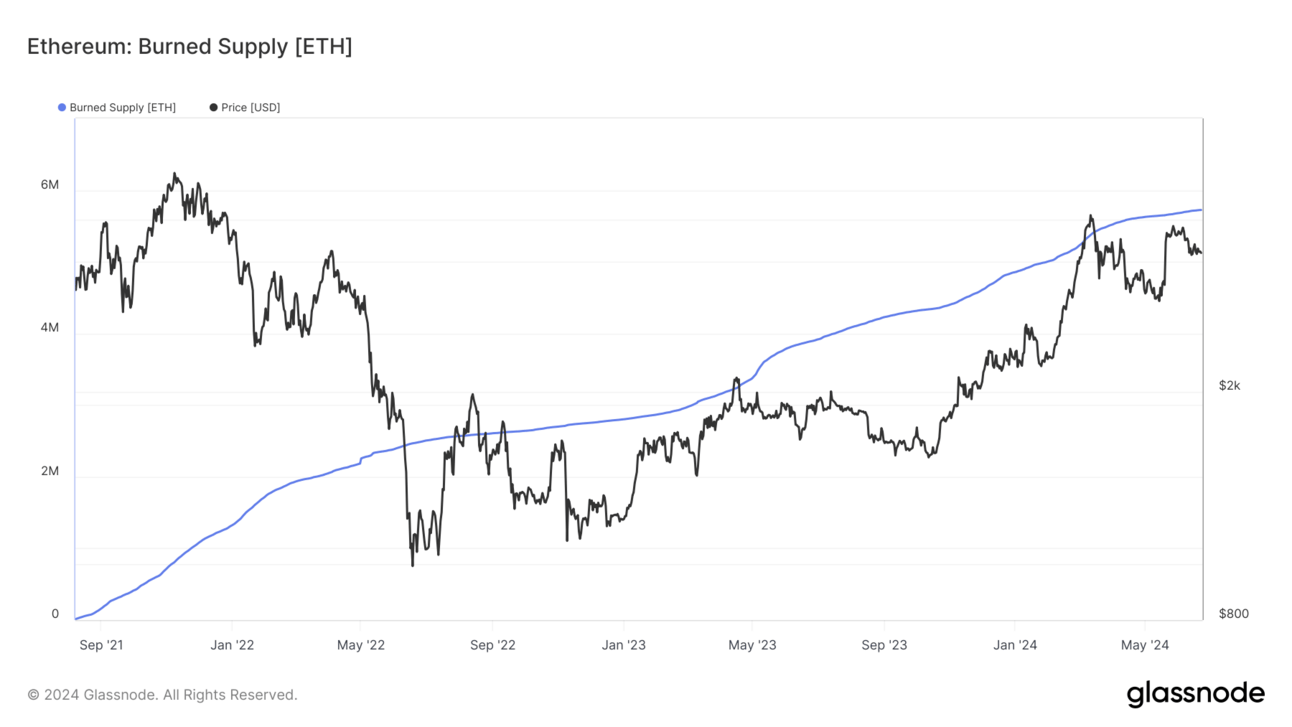

One of Ethereum’s core features is it’s token burning mechanism.

When interacting with the Ethereum blockchain, users are required to pay a base fee. This base fee is then “burnt”, meaning it is permanently removed from the supply.

As of today 5,722,384 ETH have been burnt.

That’s over $20 billion at todays prices.

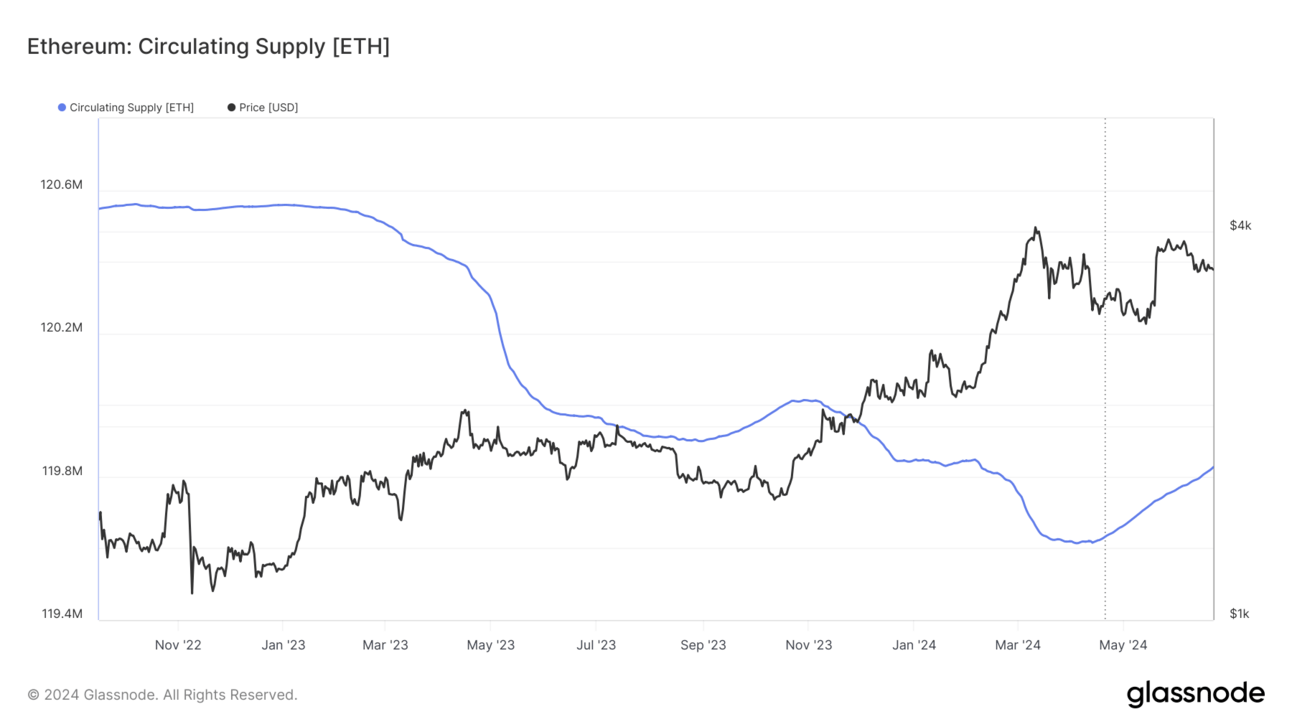

Due to this burning mechanism, the circulating supply has decreased over the last 2 years.

The chart below shows Ethereum’s circulating supply since The Merge.

Currently it’s at 119,826,862 ETH and depreciating at a rate of -0.164% per year.

Although you may notice that the circulating supply has been increasing since April this year.

But as discussed earlier, activity on the Ethereum network has been picking up due to the rise of Layer 2’s.

So on a long enough time frame, we can expect to see the circulating supply continue decreasing.

But here’s where it gets even better.

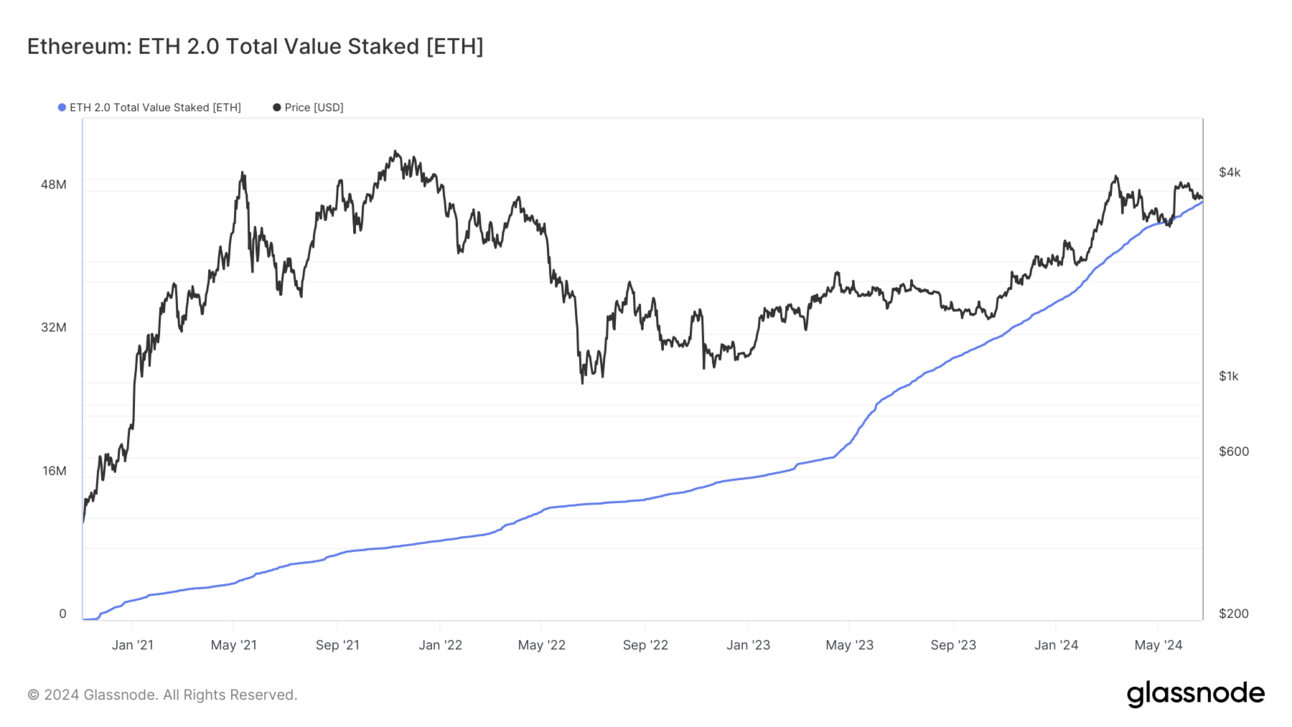

Another one of Ethereum’s core features is its ability to be staked.

This means users can “lock” it up and earn rewards for securing the network.

(A major benefit Ethereum has over Bitcoin)

To learn more about how staking works, click here.

As of today 46,687,005 ETH has been locked for staking. (that’s an all-time high by the way)

And, that’s also ~38.96% of the circulating supply.

A testament to the long-term conviction in Ethereum from it’s holders.

Here’s the main takeaway from all of this data:

Ethereum’s supply side dynamics are insanely good

Circulating Supply: 119,826,862 ETH

Ethereum Staked: 46,687,005 ETH (~38.96% of the circulating supply)

Exchange Balances: 12,253,958 ETH (~10.23% of the circulating supply)

We’ll say it again…

It’s hard not to be EXTREMELY bullish on Ethereum right now. 🐂

And the ETFs are just around the corner…

CRACKING CRYPTO 🥜

CoinStats suspends app after security breach compromises 1,590 wallets. CoinStats app temporarily shuts down due to a security incident.

Michael Dell’s Bitcoin post sparks massive BTC purchase speculations. Dell's tweet comes on the heels of his $2.1 billion cashout from his Dell Technologies Class C common stock holdings.

McKinsey Sees Just $2T of Tokenized RWAs by 2030 in Base Case, With Broad Adoption 'Still Far Away'. Previous reports from Boston Consulting Group and 21Shares forecasted over $10 trillion of tokenized assets by the end of the decade in their optimistic scenarios.

Ripple CEO faces trial over alleged 'misleading statements' in 2017 interview. A judge has decided civil securities charges alleging Ripple CEO Brad Garlinghouse made "misleading statements" will go to trial.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

In order to comply regulations, crypto exchanges must gather specific information about their customers. This process is typically known as:

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) KYC 🥳

Know your customer (KYC) is the first stage of anti-money laundering (AML) due diligence.

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.