Today’s edition is brought to you by RAREMINTS

GM to all of you nutcases. It’s Crypto Nutshell #585 climbin’ up… 🐐🥜

We're the crypto newsletter that's more nerve-racking than defusing bombs under enemy fire with seconds to spare... 💣🕒

What we’ve cooked up for you today…

💰 The Strategy playbook

🇺🇸 Will crypto ever recover?

💪 Another all-time high

💰 And more…

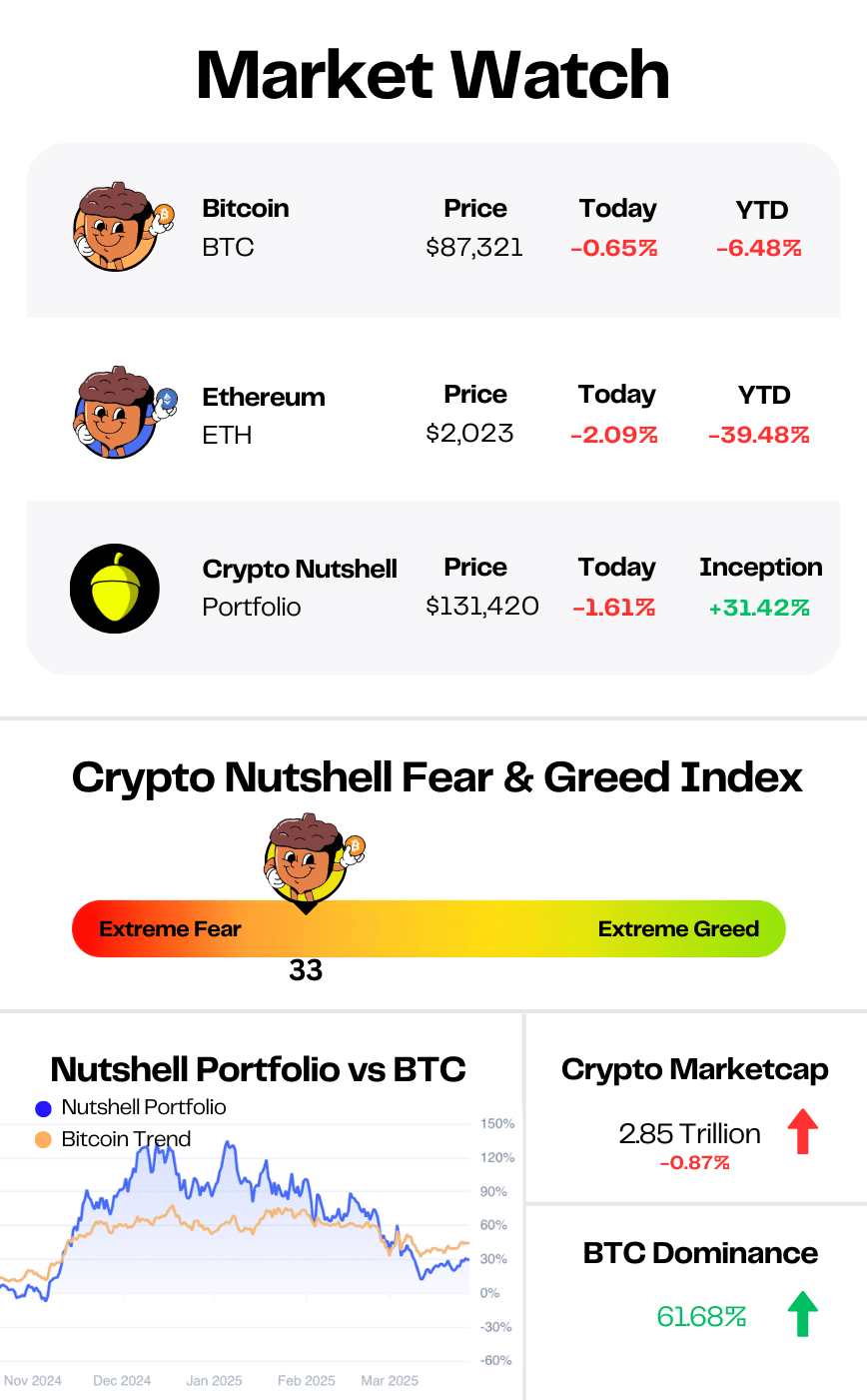

Prices as at 3:05am ET

THE STRATEGY PLAYBOOK 💰

BREAKING: GameStop Raising $1.3B Via Convertible Debt to Buy Bitcoin

Following on from yesterday’s news…

It looks like GameStop really is going all-in on their Bitcoin play.

Just 24 hours after its Bitcoin announcement, the meme stock is already raising $1.3 billion via convertible debt to acquire Bitcoin. (Sound familiar?)

This move is a carbon copy of Michael Saylor’s Strategy playbook - and it’s pretty clear he played a role in influencing it.

GameStop is offering $1.3 billion in convertible notes (A type of debt that can later be converted into stock) without any interest payments.

These notes are due in 2030 and are only available to large institutional investors.

The company is also giving these investors the option to buy up to an additional $200 million in notes within 13 days of the initial sale.

“GameStop expects to use the net proceeds from the offering for general corporate purposes, including the acquisition of Bitcoin in a manner consistent with GameStop’s Investment Policy,”

How did the markets react?

GME stock popped 12% on the news, closing at $28.36 on the day. (That’s +19.92% over the past 5 days.)

However it has since fallen ~7% in after hours trading.

Meanwhile…

Bitcoin bounced off its lows on the news, reclaiming $87,000 after briefly dipping below $86,000 earlier in the day.

Here’s a fun fact for you:

GameStop currently has ~$4.6 billion in cash on its balance sheet.

When Strategy (formerly MicroStrategy) began accumulating Bitcoin in 2020, they had nowhere near that kind of capital.

In fact, the total amount injected from Strategy’s existing treasury was only around $650 million.

The rest? All debt-funded.

GameStop could be gearing up to be a serious player in the Bitcoin treasury game. 🤔

DISCOVER THE NEXT 100X TOKEN 💎

The Harsh Truth About Crypto: Most retail traders lose money.

While those late to the party finally get in, project founders, VCs and early investors sell their bags for millions.

That said, there are still hundreds of tokens with 100X potential, you just need to find the right ones.

Crypto is an alpha-driven industry, where those who are early gain outsized returns, often for FREE via airdrops.

If you want to join RAREMINTS exclusive community where they break down trending crypto news, hand-pick tokens with 100X potential and share ALL of their trades, click on THIS LINK here.

What to expect:

Trending news, price alerts, and exclusive alpha to stay ahead of the curve

New projects and innovations broken down in under 5 minutes

Hand-picked tokens and memecoins with 100X potential, based on historical data and macro narratives

Join for FREE before others do. Your portfolio will thank you.

WILL CRYPTO EVER RECOVER? 📈

It’s been over a month since Bitcoin was over $100,000.

Alts have been nuked. Everyone is either bored, or full of panic.

So… is crypto actually dead?

You already know the answer - of course not. That’s the latest from Raoul Pal.

By now, you should know Raoul Pal.

He’s a renowned macroeconomic expert with over a decade of experience and one of the best track records in the game.

This week, Raoul did a livestream to prove why crypto is not dead. 💀

During the stream, Raoul delivered what he always does best: macro clarity.

“It’s the same charts I show you every time… and yet people still panic.”

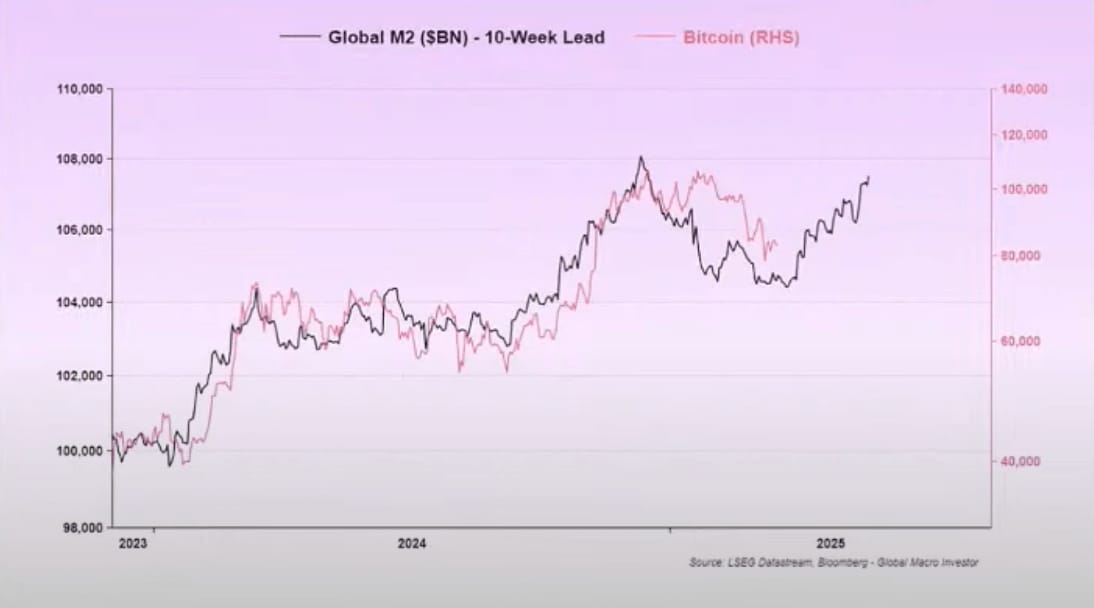

Raoul focussed on the below chart:

As you can see, the price of Bitcoin is strongly correlated with Global M2.

But here’s the cool part:

Bitcoin tends to follow Global M2 with a 10-week lag.

So if you track M2, you get a sneak peek at where Bitcoin is probably be headed next.

And right now?

It’s pointing up.

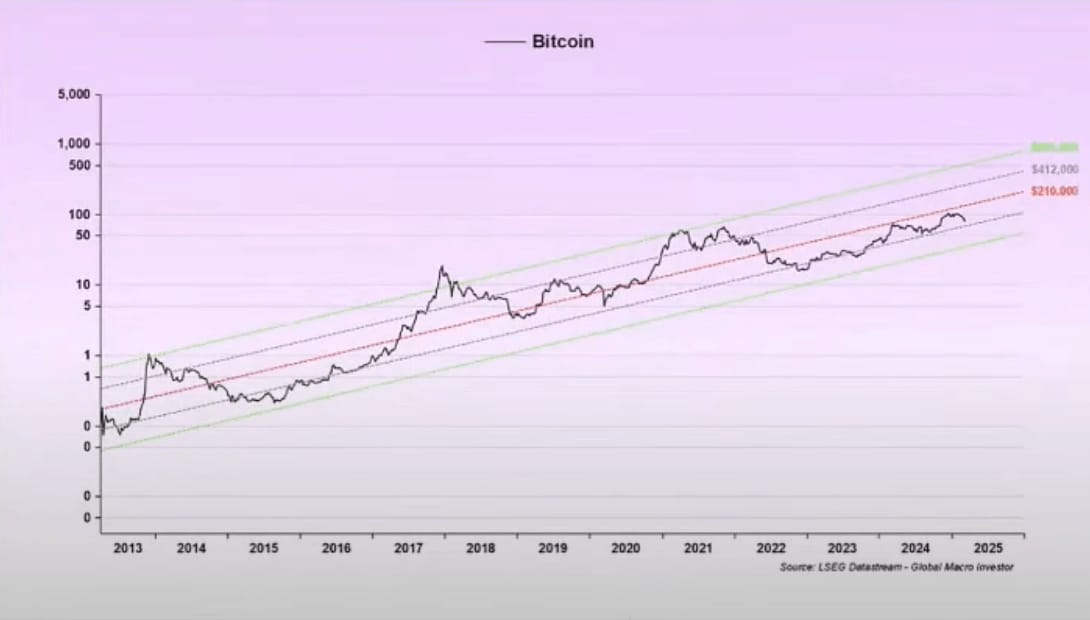

Raoul then moved on to this chart:

It lays out Raoul’s 3 rough contextual targets for Bitcoin:

$210K = most likely

$412K = possible

$800K = moonshot

But Raoul made clear, these are not predictions:

“These aren’t predictions. It’s contextualization based on macro.”

Raoul’s overal takeaway?

Stop freaking out.

Zoom out.

Follow the macro.

“This is the greatest macro opportunity of our lifetime. If you understand it, it will change your life.”

ANOTHER ALL-TIME HIGH 💪

It’s time for another look at Ethereum’s supply side dynamics.

Today we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

As of today, 59,262,509 ETH is staked.

That’s an increase of 970,717 ETH in just the past two weeks. (~$1.96 billion at today’s prices)

And yes, this marks yet another all-time high. (As we say, this metric literally sets a new record daily.)

Putting that figure into context:

Staked ETH now makes up 49.09% of the total circulating supply.

That’s nearly half of all Ethereum locked up by long-term holders - investors who clearly aren’t in a rush to sell.

Despite relatively weak price action, these holders remain locked in. 💪

Conviction is high. Supply is tightening.

Setting the stage for a potential supply squeeze.

CRACKING CRYPTO 🥜

SEC to host 4 additional crypto roundtables to tackle topics including trading, custody, DeFi. Commissioner Hester Peirce emphasizes the SEC's commitment to regulatory clarity through planned expert-led crypto roundtables.

BlackRock ‘BUIDL’ tokenized fund triples in 3 weeks as Bitcoin stalls. Bitcoin’s lack of momentum may drive further interest in safer investments, such as tokenized RWAs, which are approaching the $20 billion record milestone.

Trump-Tied World Liberty Financial Pitches Its Stablecoin in Washington With Don Jr. The president's son, Donald Trump Jr., connected to a Washington crypto event via video to talk up crypto and to back the family's link to World Liberty.

Tariffs set to 'liven up' crypto markets again as eyes turn toward Trump's 'Liberation Day'. If Trump softens his stance, markets could rise, but if he’s vague, volatility may increase, and a tough approach may lead to a sharp decline, the analysts said.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is "mining" in Bitcoin?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: The process of confirming transactions and adding them to the blockchain 🥳

Bitcoin mining is the process of adding new groups of transactions (known as blocks) to the shared transaction record (known as the blockchain)

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.