Today’s edition is brought to you by Incogni.

Stop scam calls at the source by removing your data from broker lists, use code cryptonutshell for 55% off.

GM to all of you nutcases. It’s Crypto Nutshell #763 dodgin’ bombs… 💣🥜

We’re the crypto newsletter that’s more mysterious than a magician who blurs the line between illusion and reality… 🎩🪄

What we’ve cooked up for you today…

📈 The bounce back

💊 How long to recover?

💪 Stronger

💰 And more…

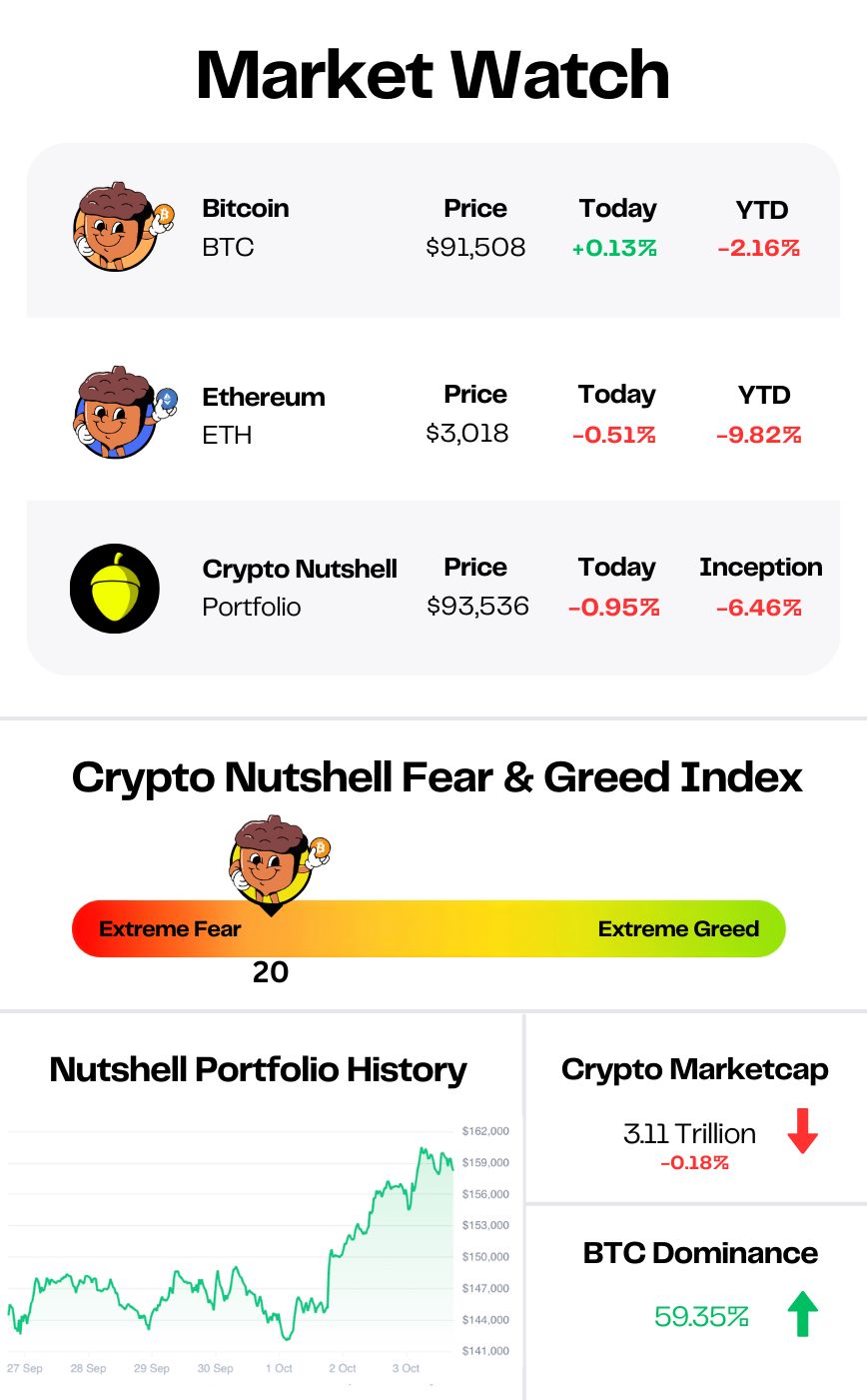

Prices as at 2:30am ET

THE BOUNCE BACK 📈

BREAKING: Bitcoin rebounds above $91,000 as December rate cut odds rise

Bitcoin just clawed back above $90K, and for once the story is simple.

Rate cuts and big buyers.

Macro flipped first

A week ago, markets were freaking out about the Fed going on pause.

Now, traders have swung hard the other way.

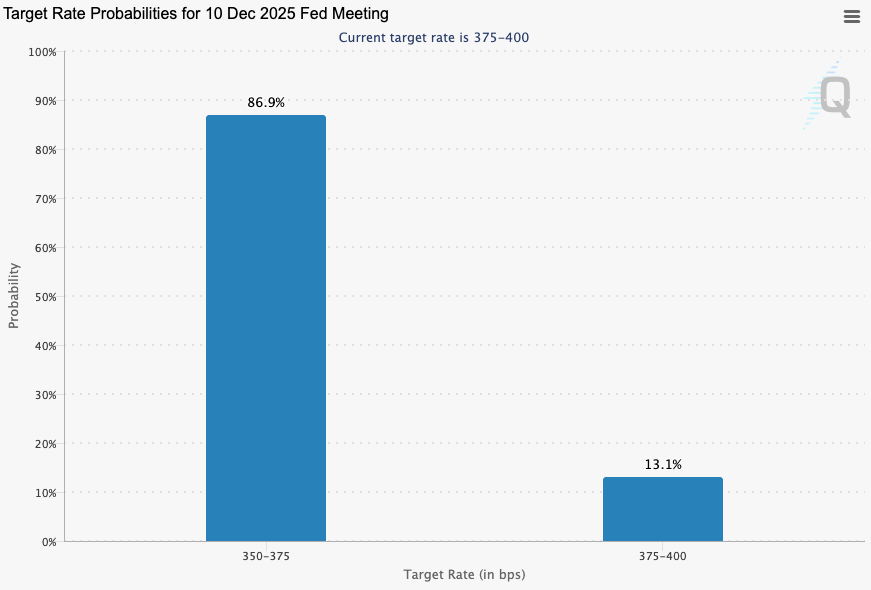

CME FedWatch and prediction markets are putting the odds of a December cut at around 87%.

Last week it was at 39%… Risk assets are back in “maybe this is fine” mode.

As Kronos Research put it, the move above 90K looks like a “classic oversold snapback” helped by rising cut expectations.

So the backdrop has shifted from “no more liquidity” to “a cut is the base case again.”

Whales and ETFs defended the 80K zone

On-chain, the message is clear. After months of selling above $100K, big holders are finally back on the bid.

Glassnode’s data shows:

Wallets holding 10,000+ BTC have flipped to strong accumulation for the first time since August

1,000–10,000 BTC holders have turned positive again

100–1,000 BTC wallets never really stopped buying the dip

Sub 1 BTC retail is now stacking at its highest pace since July

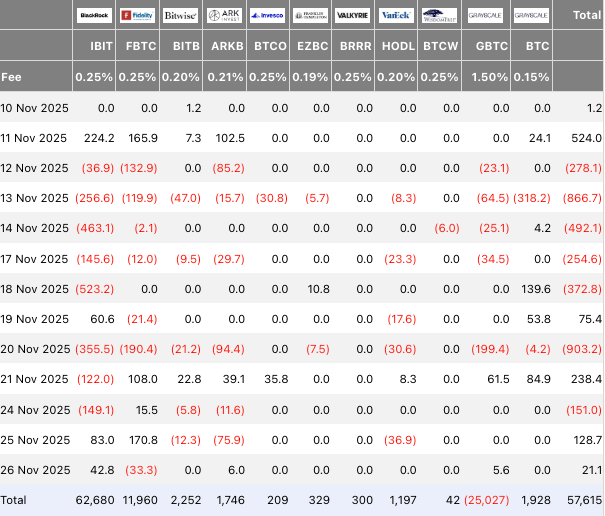

At the same time, the ETF crowd is breathing again.

BlackRock’s IBIT holders are back in profit, with roughly $3.2 billion dollars in unrealised gains.

Across all spot Bitcoin ETFs, price has reclaimed the key flow weighted cost basis near 89–90K.

Outflows have cooled and we just saw the first back to back inflow days in two weeks.

Bitcoin ETF Flows

When ETFs were underwater, they were a constant source of sell-side pressure. At breakeven or better, that pressure fades.

So are we back?

For now it’s still too early for a definitive answer.

But macro is turning more supportive and whales are accumulating hard.

That points to a mid cycle recovery, not a cycle top.

And in the next section we’ll break down how long this recovery could last.

Unknown number calling? It’s probably not random.

The BBC recently filmed scam call center workers on hidden cameras, laughing at the people they were ripping off.

One bragged about making $250k from victims.

Here’s the part most people miss:

Scammers do not guess your number. They buy your data from brokers who already have your name, phone, email, and more.

Once that data is out, it doesn’t stop at annoying calls.

It turns into phishing, impersonation, and full-blown identity theft.

That’s why we recommend Incogni.

They contact data brokers on your behalf, demand removal, monitor for new listings, and keep following up so your information gets wiped again and again.

HOW LONG TO RECOVER? 💊

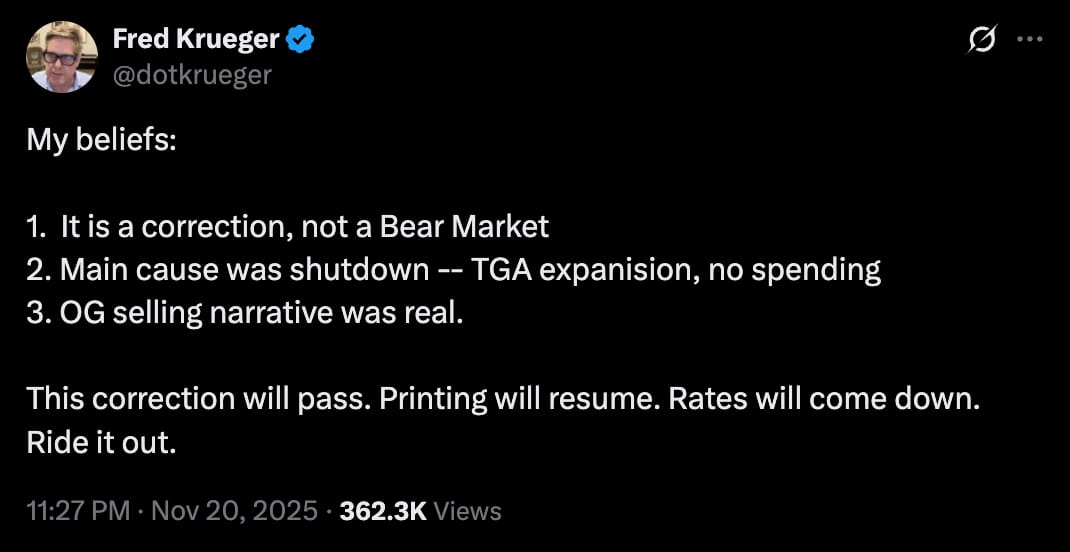

This week, Mathematician Fred Krueger - founder, quant, entrepreneur, and one of the sharpest probability-based thinkers in crypto - weighed in on this week’s chaos.

His message?

Relax. This isn’t a bear market.

Here’s exactly what he posted:

According to Fred, crypto bull markets only have two types of corrections:

• Fast ones → ~3 weeks

• Slow ones → 3–4 months

And his read this time?

So while everyone else is screaming, doomposting, and calling tops…

The guy who literally models probability distributions for fun is saying:

This is noise.

The macro didn’t break.

The cycle didn’t end.

Ride it out. ⚡️

STRONGER 💪

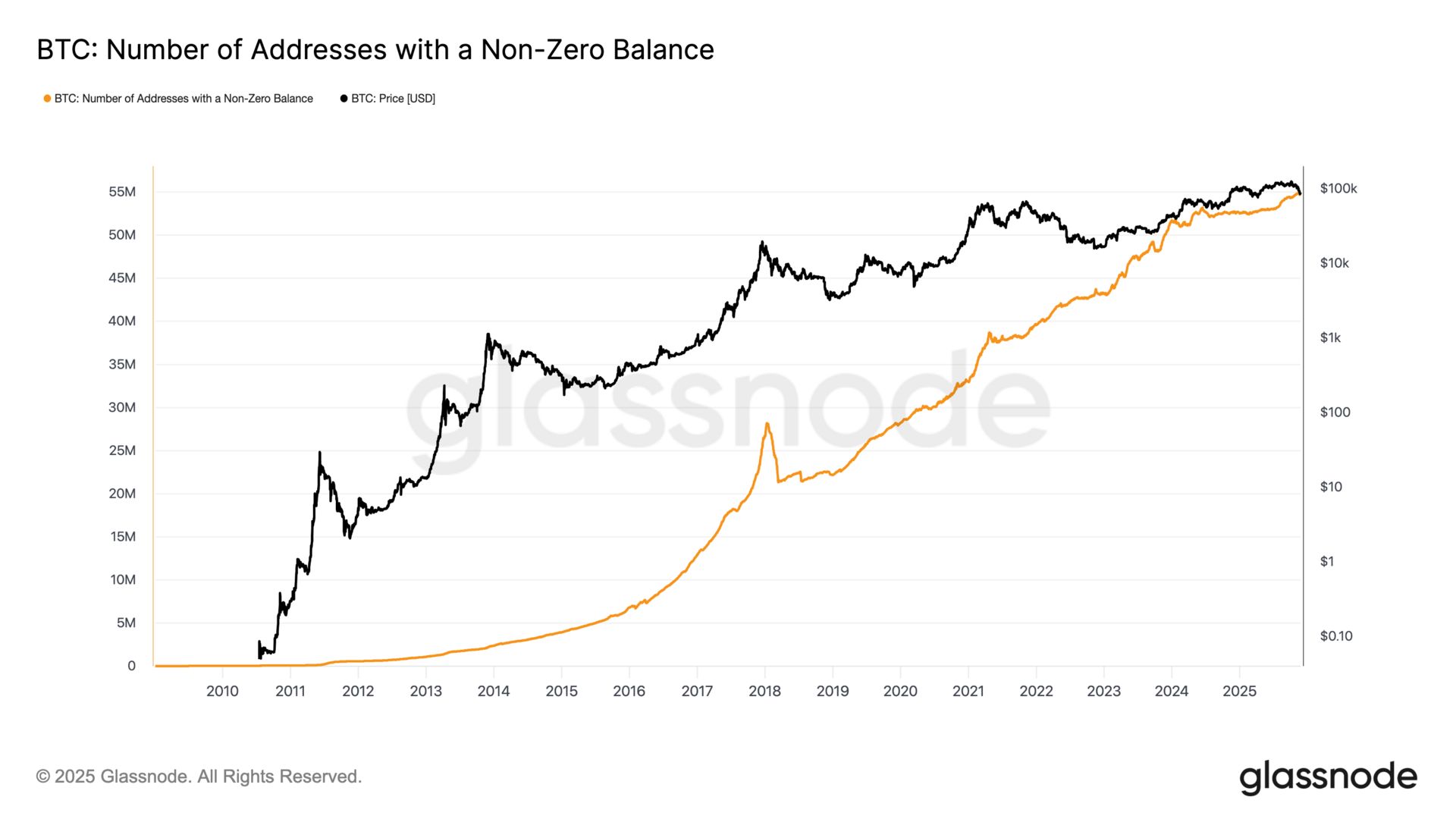

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

There are now 54,744,426 wallets holding Bitcoin.

That’s 121,511 fewer than just two weeks ago, clear evidence that this correction has shaken some people out.

But if we zoom out…

In 2025 alone, this number is still up by 2,220,889 wallets.

The message is clear: adoption isn’t slowing - it’s accelerating.

More holders. More conviction. More resilience through every swing.

Prices fluctuate. The network keeps getting stronger. 💪

CRACKING CRYPTO 🥜

How long can miners hold out as revenue hits record lows while Bitcoin’s security is at record highs? Despite record computing power, Bitcoin miners face revenue collapse amid rising energy costs and market liquidation.

Tom Lee cools on $250K Bitcoin call, year-end ATH now just a ‘maybe’. BitMine chair Tom Lee has seemingly walked back his $250,000 end-of-year target for Bitcoin, now saying that it "maybe" can surpass its all-time high.

Avalanche ETF Race Heats Up as Bitwise Becomes First to Add Staking. Bitwise moves its Avalanche ETF closer to market with updated SEC filing and becomes first issuer to include staking.

'A rainy island with a hostile tax system is a hard sell': Crypto industry reacts to UK Chancellor's budget statement. Crypto industry figures welcomed pro-entrepreneur measures but warned that wider tax and regulatory pressures could hurt UK competitiveness.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

The weekly Crypto Nutshell quiz is back!

5 questions. All from this week’s issues. If you’ve been paying attention, you’ll crush it. If you’ve been skimming, it’ll show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.