GM to all of you nutcases. It’s Crypto Nutshell #767 stayin’ alive… ⛑️🥜

We’re the crypto newsletter that’s more unbreakable than a hero discovering he was built for something far bigger than himself… 💪🕶️

What we’ve cooked up for you today…

📈 Wall Street turns up the heat

🏹 Robinhood considering Bitcoin

💪 Not going up

💰 And more…

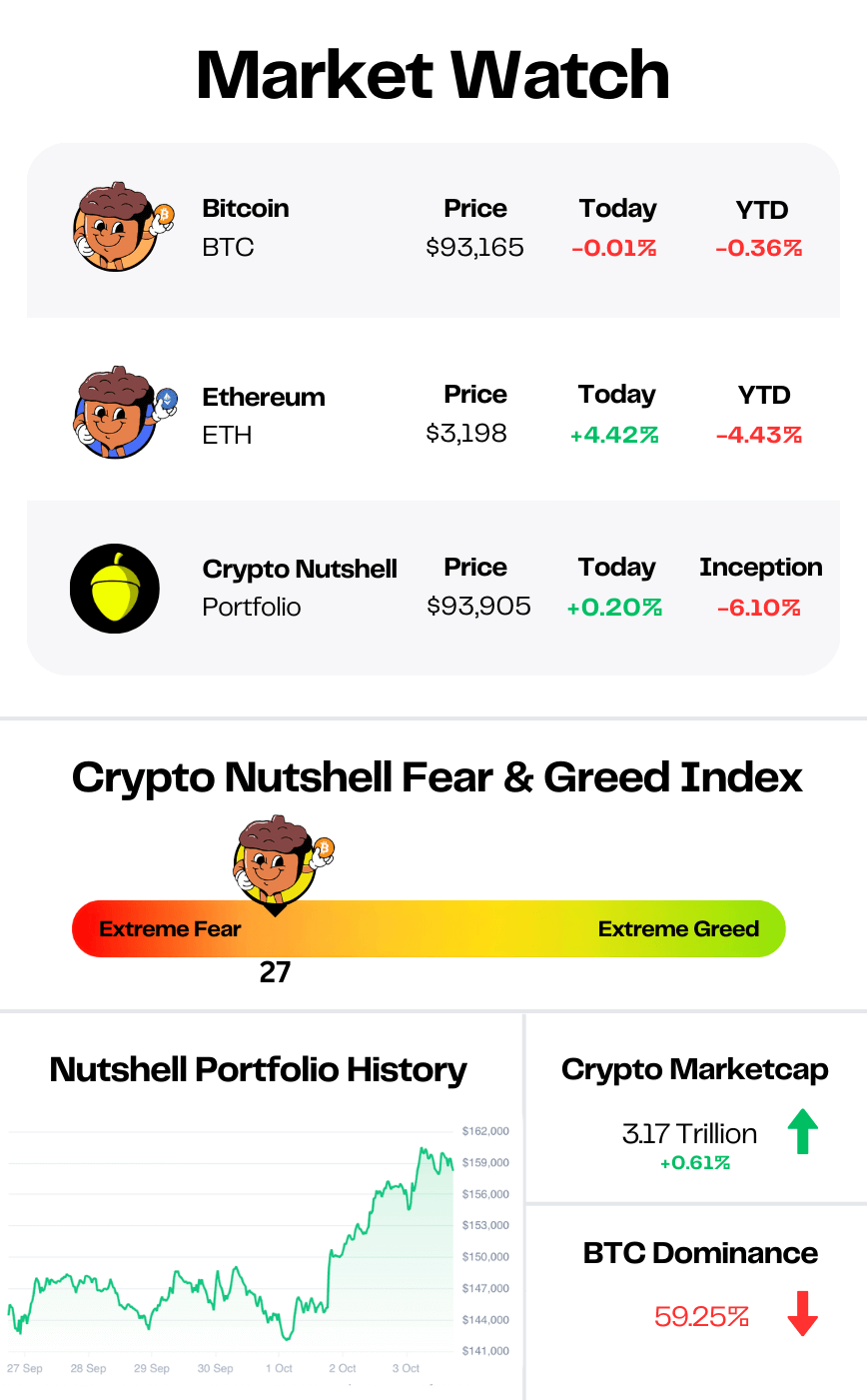

Prices as at 2:30am ET

WALL STREET TURNS UP THE HEAT 🔥

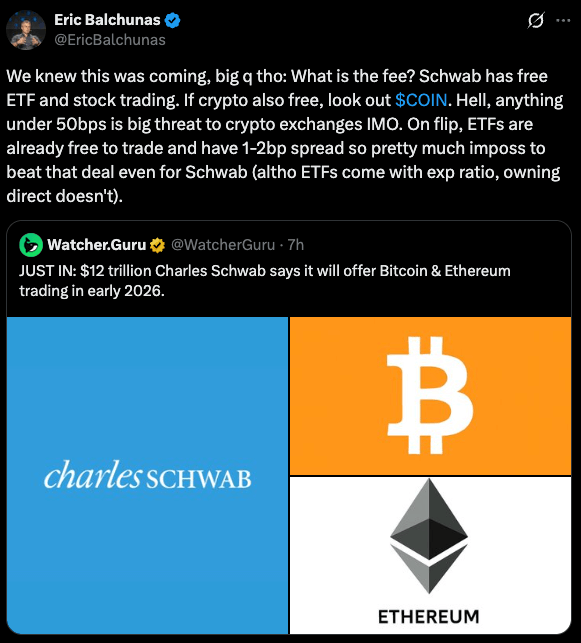

BREAKING: $12 Trillion Charles Schwab Crypto Entry Could Threaten US Crypto Exchanges

We’re not going to get into conspiracy theory territory…

But it does feel a little suspicious that after the market dumped, Vanguard, Bank of America and now Charles Schwab all roll out crypto products to their clients. (In the same week as well)

Schwab, which oversees more than $12 trillion in client assets, plans to roll out spot Bitcoin and Ethereum trading across its platforms in early 2026.

That puts BTC and ETH in the same app as stocks, bonds, ETFs and retirement accounts for millions of mainstream investors.

No extra exchange account. No separate login. No wiring money to a crypto platform.

Just another tab inside a brokerage account people have already used for decades.

Schwab already has the distribution. The moment it flicks the switch, a massive chunk of US households can own spot crypto without ever downloading a crypto exchange app.

And it’s also a direct shot at Coinbase, Kraken and the rest.

Schwab is famous for zero commission stock and ETF trading. If it applies the same low fee mindset to crypto, that makes life difficult for the classic exchanges.

Retail traders on Coinbase are still paying fees north of 1% in many cases. Even “advanced” trading sits around 0.60%. The business model depends on that spread.

Schwab does not need that. It earns from interest on cash, advisory fees, order flow, margin and a full suite of traditional products. Crypto can just be a low margin feature that helps retain clients and consolidate assets under one roof.

On top of that, Schwab operates inside long standing SEC and FDIC frameworks. For older or more cautious investors, that level of perceived safety matters.

Given the history of exchange hacks and blow ups, “I can just buy it at Schwab” is a powerful message.

Right now, Schwab customers can already buy Bitcoin ETFs with zero commission. Those ETFs trade with razor thin spreads, often just 1 to 2 basis points.

For Schwab to justify spot trading at all, it has to keep direct crypto fees low enough to compete with those nearly free wrappers.

Vanguard opens its platform to crypto ETFs. Bank of America tells wealth clients that a 1% - 4% allocation is “appropriate.”

Now Schwab is preparing to plug spot Bitcoin and Ethereum directly into accounts that already hold US retirement savings.

The institutions are here…

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

ROBINHOOD CONSIDERING BITCOIN? 🏹

At Robinhood’s latest shareholder meeting, 1 question cut straight to the point:

Will they add Bitcoin to their corporate treasury?

For context - Robinhood is a $111B company, one of the largest retail trading platforms in the world, with tens of millions of users trading stocks, options, and crypto every day.

The answer came from Shiv Verma, Senior VP of Finance & Strategy and Treasurer at Robinhood.

Here’s what he said, verbatim:

“We like alignment with the community. We are a big player in crypto… But it [Bitcoin] does take up capital. Our shareholders can also go and buy Bitcoin directly on Robinhood… So are we making that decision for them? And is it the best use of our capital?”

Translation:

They like Bitcoin.

They’re deeply involved in crypto.

They just haven’t pulled the trigger on holding it themselves… yet.

And the key line?

“We’re still thinking about it… and it’s one that we’re going to keep actively looking at.”

This isn’t a rejection.

This is a $111B financial platform openly debating Bitcoin at the balance-sheet level.

One by one… 🐜

NOT GOING UP 💪

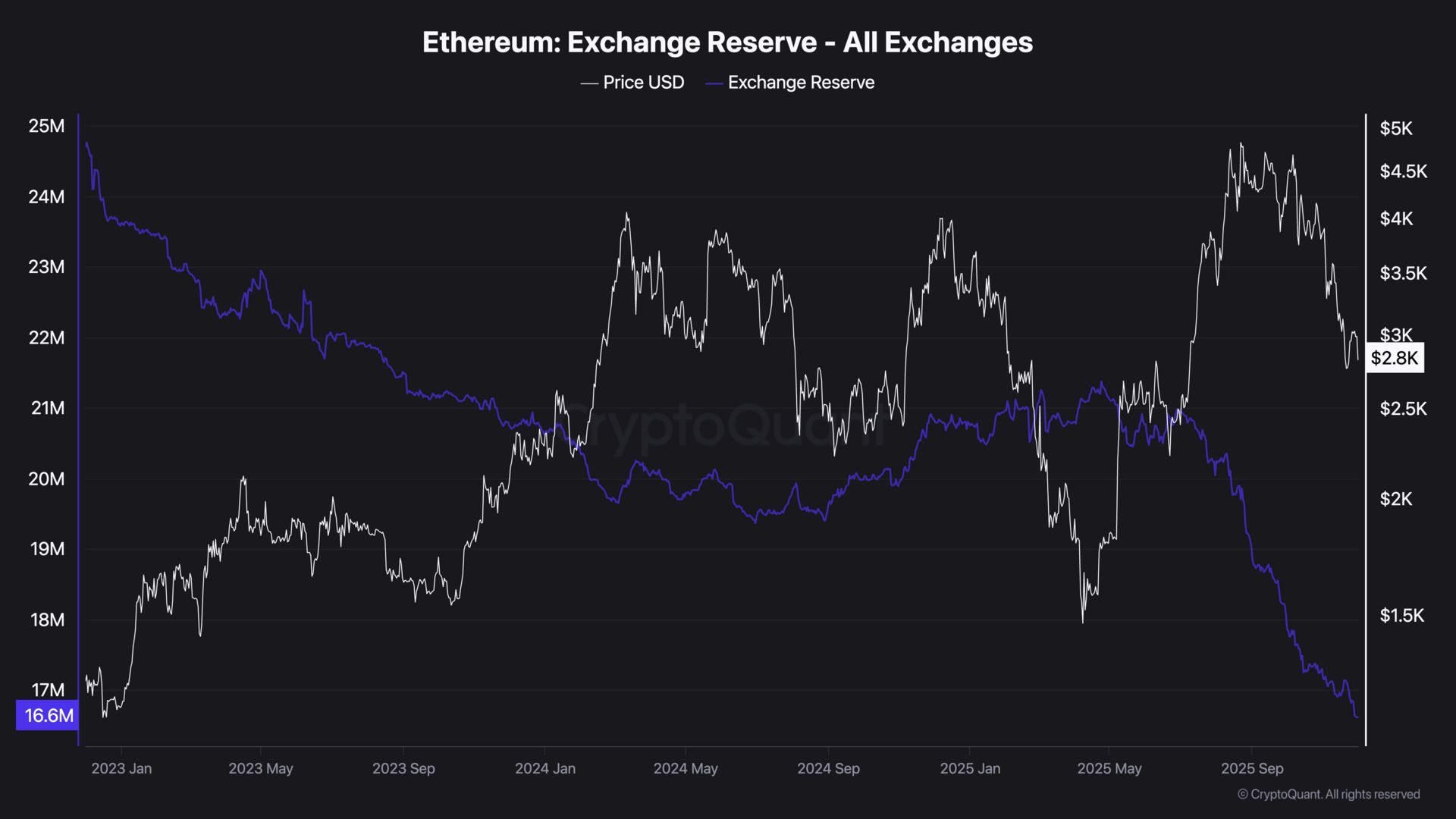

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 16.61 million ETH are left on exchanges.

That’s just 13.76% of the entire supply.

And since January, another 4.14 million ETH has been pulled off exchanges.

Read that again…

This is what a supply squeeze looks like before the market wakes up. Even with ETH selling off alongside the rest of crypto, exchange balances are still not climbing.

That tells you a lot. This is not panic. It is not forced capitulation.

It is experienced holders taking some profits while the long-term supply base keeps tightening.

The whales are not exiting.

They are reloading and positioning. 🐳

CRACKING CRYPTO 🥜

Bitcoin just ripped 11% after the Fed quietly restarted a $38 billion money printer mechanism. Bitcoin reverted from Dec. 1 lows below $84,000 to break above $91,000 again.

BlackRock’s Fink calls Bitcoin an ‘asset of fear’, softens crypto stance. Larry Fink described how he has softened his stance on crypto since calling Bitcoin an “index of money laundering” in 2017, moving to launch a spot BTC exchange-traded fund.

Ethereum Activates Fusaka Upgrade, Aiming to Cut Node Costs, Speed Layer-2 Settlements. At the center of the upgrade is PeerDAS, a system that lets validators check slices of data rather than entire “blobs,” reducing costs and computational load.

CryptoQuant says Strategy prepares for a bitcoin bear market as it sets up US dollar reserve. CQ’s Julio Moreno told The Block that if the bear market continues, bitcoin could trade between $70,000 and $55,000 next year.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When Bitcoin dominance is falling while total crypto market cap is rising, what does this usually signal?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Altseason, with capital rotating into altcoins 🥳

A falling BTC dominance during an overall market uptrend typically means money is flowing from Bitcoin into altcoins, a classic altseason signal. 🌈📊

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.