GM to all of you nutcases. It’s Crypto Nutshell #704 huntin’ for cheese… 🪤🥜

We're the crypto newsletter that's more gripping than a man surviving 127 hours trapped by a boulder... 🏞️⏱️

What we’ve cooked up for you today…

🏦 Here come the altcoin ETFs

🩸 Scared of red September?

🤑 Are long-term holders taking profit?

💰 And more…

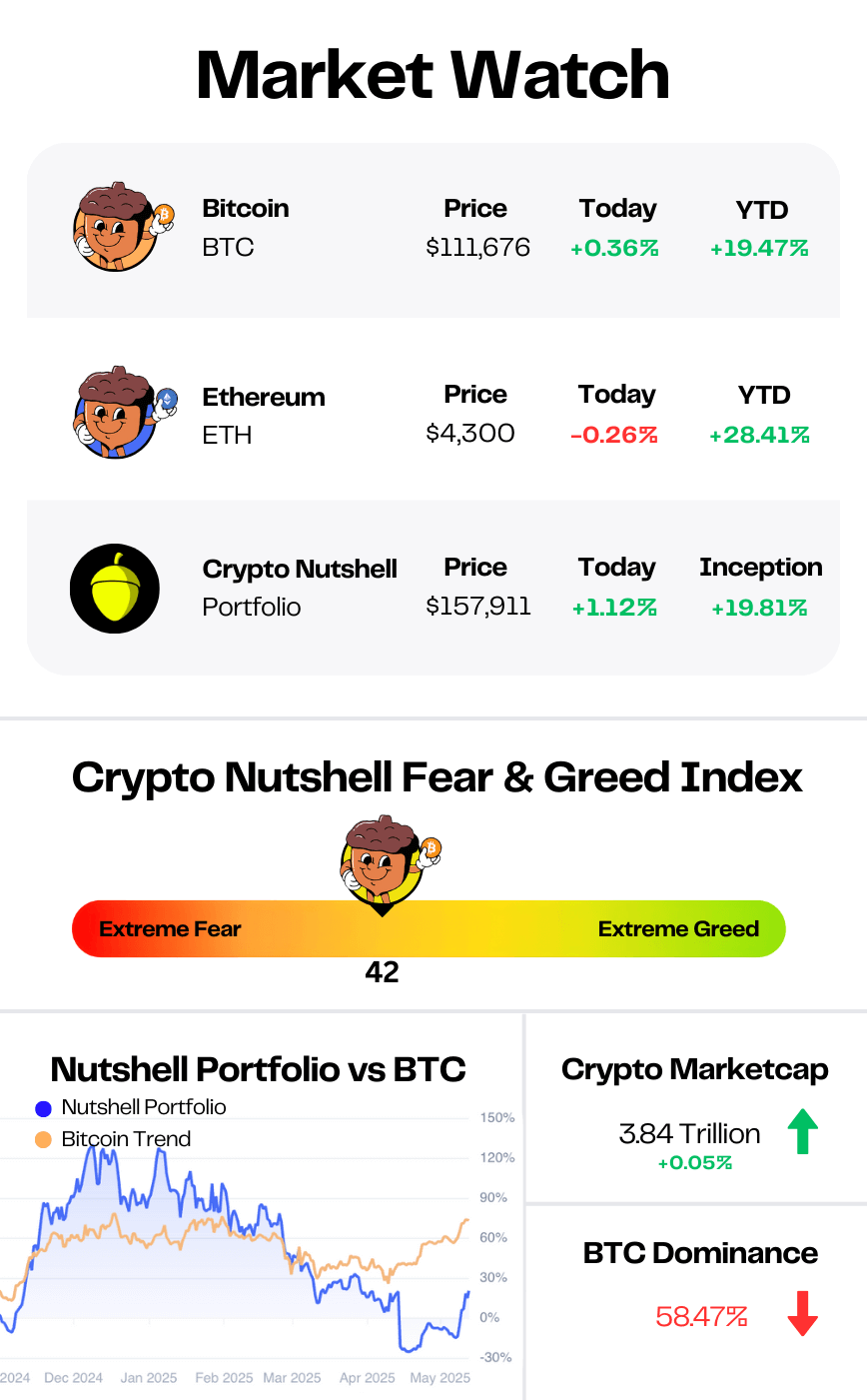

Prices as at 4:35am ET

HERE COME THE ALTCOIN ETFs 🏦

BREAKING: First Dogecoin ETF May Debut in the US This Week

The meme coin that started as a joke is about to make Wall Street history…

Bloomberg’s Eric Balchunas says REX Shares could launch the first-ever U.S. Dogecoin ETF as early as this week.

The filing uses the faster “40 Act” structure - the same backdoor REX used to get its Solana staking ETF across the line.

That matters.

Unlike traditional spot ETFs bogged down in endless SEC delays, the 40 Act is a regulatory end-around.

It cuts through the red tape, clearing the way for DOGE to hit mainstream portfolios sooner than expected.

Why it matters

Dogecoin may be trading at just $0.21 - well off its December 2024 high of $0.46 - but it’s still up 116% over the past year.

Pair that rebound with unmatched cultural pull, and suddenly institutions are circling a coin that Elon Musk once called “a hustle” on live TV. (Yes… we’re seriously putting “institutions” and “Dogecoin” in the same sentence…)

Other issuers like 21Shares, Bitwise, and Grayscale have filings in the queue, but REX looks ready to strike first.

The firm has even filed for a Trump token ETF - proof that the net for altcoin products is widening fast.

Zoom out and the backdrop gets even bigger.

The SEC is reviewing 92 crypto ETF applications - including Solana, XRP, and Litecoin - with final calls due in October.

The bottom line: DOGE may be a meme, but ETFs are about access.

And with Wall Street about to hand Dogecoin its own ticker, a new wave of capital could be about to flood the altcoin market. 🚀

Practical AI for Business Leaders

The AI Report is the #1 daily read for professionals who want to lead with AI, not get left behind.

You’ll get clear, jargon-free insights you can apply across your business—without needing to be technical.

400,000+ leaders are already subscribed.

👉 Join now and work smarter with AI.

SCARED OF RED SEPTEMBER?🩸

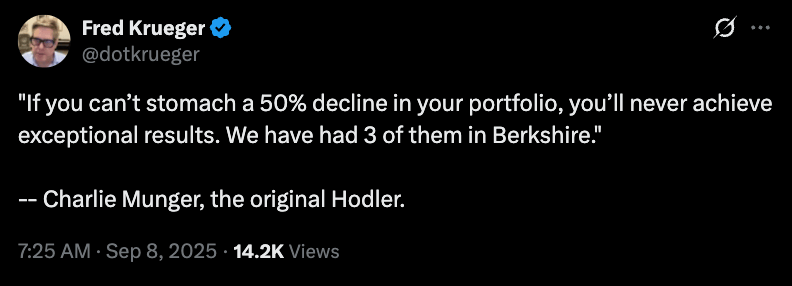

Fred Krueger - mathematician, ex–hedge fund manager, and diehard Bitcoiner -dropped a timely reminder today with a Charlie Munger classic.

If you can’t handle the volatility, you don’t deserve the outperformance.

Here’s Fred’s reminder:

It’s the original hodler mindset.

And it’s worth remembering right now…

September is historically the worst month of the year for Bitcoin, Ethereum, and crypto as a whole.

We don’t call it ‘Red September’ for nothing…

It’s not just crypto either - equities and traditional markets have long shown the same seasonal weakness.

This year? We haven’t really seen much of a dip yet. But history suggests you should keep your guard up.

Because you don’t get outsized returns without outsized volatility.

The only question: can you stomach it? 👀

LONG-TERM HOLDERS TAKING PROFIT? 🤑

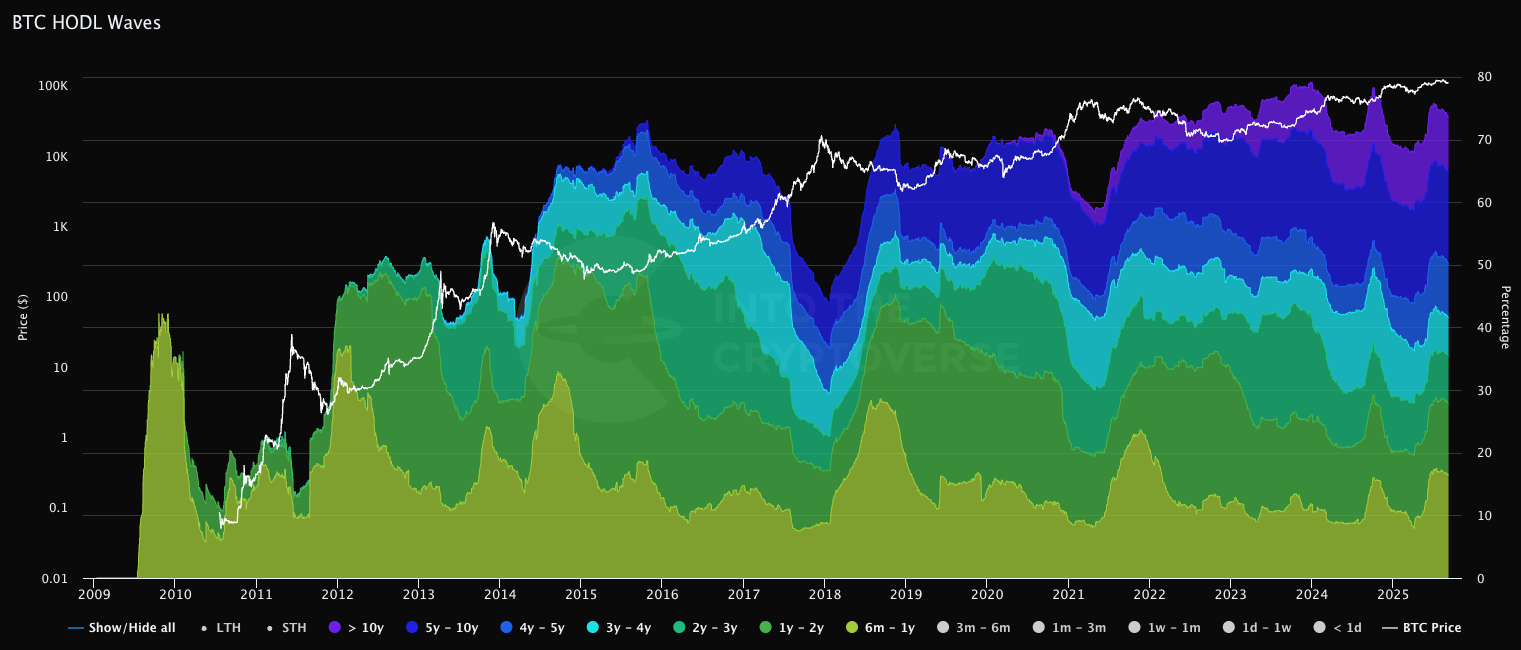

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 16.37% (down from 16.62%)

1y - 2y: 11.41% (down from 11.58%)

2y - 3y: 7.64% (up from 7.57%)

3y - 4y: 6.11% (down from 6.17%)

4y - 5y: 8.55% (down from 8.77%)

5y - 10y: 14.48% (down from 14.50%)

>10y: 8.98% (up from 8.93%)

TL;DR: 73.54% of all Bitcoin hasn’t moved in over six months 🔒

That’s a 0.6% drop from two weeks ago.

The latest shifts tell a clear story:

The shorter bands - 6–12 months and 1–2 years - thinned out, suggesting some newer holders took chips off the table.

But look further out, and the conviction only deepens.

Both the 2–3 year and 10+ year cohorts ticked higher, showing coins continue to migrate into stronger hands.

The small pullbacks in the 3–4, 4–5, and 5–10 year ranges? That’s selective profit-taking, not broad selling.

The bigger takeaway: even with Bitcoin hovering near record highs, the long-term holder base remains rock solid.

CRACKING CRYPTO 🥜

If selling $2 billion crashes the BTC price, why doesn't buying $83B send it to space? Why does a $2 billion BTC sale crash the BTC price, but $83B of steady buying in 2025 barely move the dial?

Stablecoin Retail Transfers Hit Record Level as BSC, Ethereum Gains Ground, Tron Slips. Retail transfers under $250 are at all-time highs, with BSC and Ethereum gaining ground as Tron falls, according to a fresh report by CEX.io.

El Salvador celebrates Bitcoin anniversary amid mixed results 4 years on. El Salvador's Bitcoin Office celebrates the four-year anniversary of adopting Bitcoin on a national level, but the results of the policies remain a mixed bag.

Senate market structure bill draft proposes SEC–CFTC joint committee to end crypto turf wars. The bill's latest draft also addresses the regulatory treatment of airdrops, protections for developers, a DePIN carve-out, and more.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What was the message embedded in the Genesis Block of Bitcoin?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: “Chancellor on brink of second bailout for banks” 🥳

Satoshi included a UK Times headline from Jan 3, 2009, anchoring Bitcoin’s birth to the financial crisis. 📰

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.