GM to all 64,612 of you. Crypto Nutshell #323 puttin’ out fires... 🧯🥜

The crypto newsletter more enthralling than a group of treasure hunters on a quest for lost gold... 🏴☠️💰

What we’ve cooked up for you today…

🦈 Shark is angry

💸 It really is this simple

📉 Ethereum fees declining

💰 And more…

MARKET WATCH ⚖️

Prices as at 5:35am ET

Only the top 20 coins measured by market cap feature in this section

SHARK IS ANGRY 🦈

BREAKING: Shark Tank star and billionaire Mark Cuban warns Gensler's SEC crypto policies could cost Biden the election

Billionaire investor Mark Cuban has slammed the Biden administrations handling of crypto.

Cuban even believes that Gary Gensler and the SEC will be one of the main reasons that Biden will lose the upcoming election.

Cuban on Gensler:

“Gensler HAS NOT PROTECTED A SINGLE INVESTOR AGAINST FRAUD. All he has done is make it nearly impossible for legitimate crypto companies to operate, killing who knows how many businesses and ruining who knows how many entrepreneurs.”

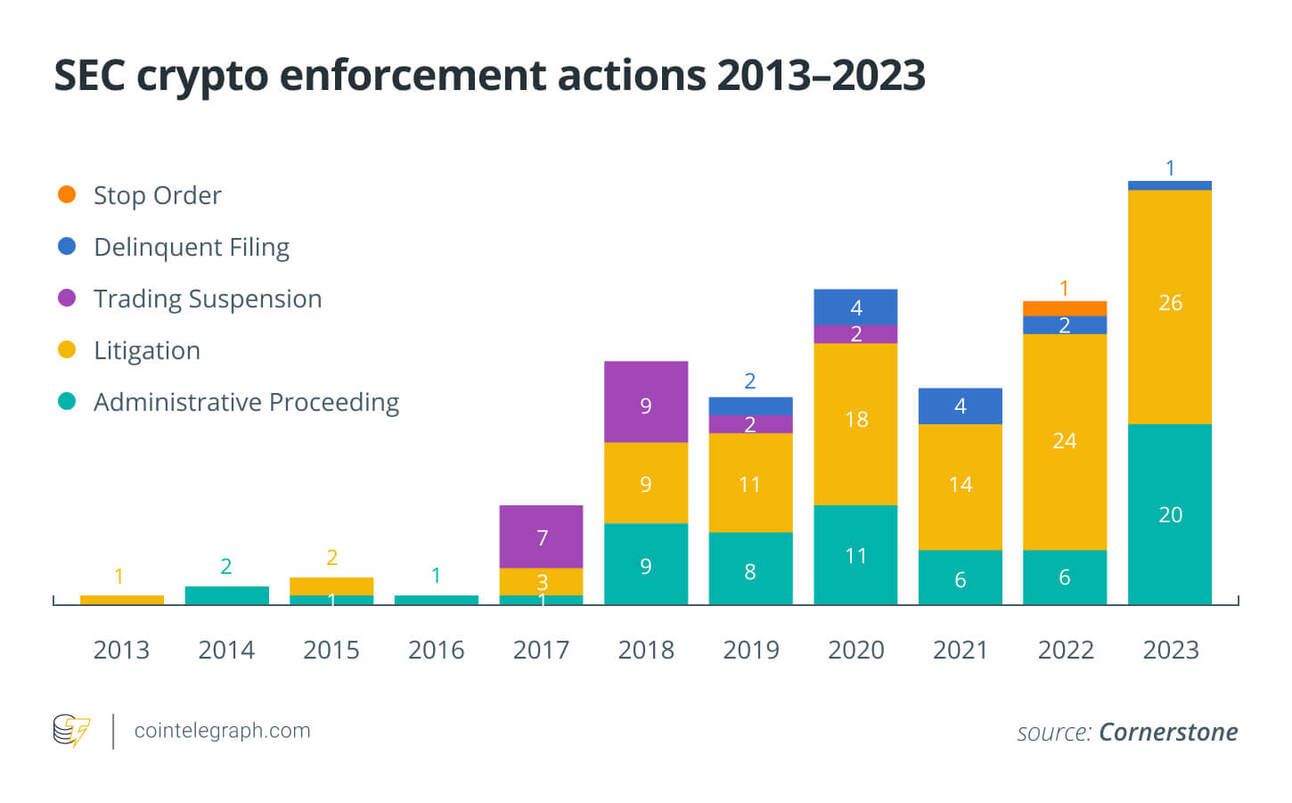

Quick reminder, the SEC is currently undertaking legal action against Kraken, Coinbase, Uniswap, Metamask and Robinhood.

The thing is though, all of these companies have previously sought out regulatory clarity from the SEC.

But the SEC continues to pursue legal action…

Continuing on, Cuban explained:

“This is also a warning to Congress. Crypto voters will be heard this election. You could solve this problem for Biden by passing legislation that defines registration that is specific to the crypto industry just as other industries have registration that is defined for them,”

Cuban also suggested assigning all crypto regulation to the Commodity Futures Trading Commission (CFTC).

Because “they actually know what they are doing”…

TOGETHER WITH BULLSEYE TRADES 🎯

Tiny Bitcoin Miner Set to Rival Industry Giants

The name of the game in bitcoin mining?

Lowering costs.

This small stock has found a way to produce bitcoin for up up to 28% LESS* than the biggest players in the space!

And get this…

It’s 100% renewable energy…

Read Bullseye Trade to learn more.

IT REALLY IS THIS SIMPLE 💸

Raoul Pal just posted two charts to Twitter, going so far as to call them “the MOST important charts in all of macro/crypto”

Let’s break them down.

Chart 1

Chart 1 is a comparison between Fed Net Liquidity and US government debt as a % of GDP.

⚫ Fed Net Liquidity: the money the Federal Reserve makes available in the economy. More liquidity means more money flowing through the economy

🔴 US Government Deb as a % of GDP: shows how much debt the government has relative to the country’s total economic output

As you can see, these two measures are clearly correlated.

As the debt relative to GDP increases, the fed increases liquidity to help service this debt (money printing).

Chart 2

Chart 2 is a comparison between the Labor Force Participation Rate and government debt.

⚫ Labor Force Participation Rate: percentage of working age people who are either employed or actively seeking employment. A declining rate suggests an ageing population

🔴 US Government Deb as a % of GDP (inverted)

From the chart below, it’s clear that a declining labor force participation rate is linked to an increase in government debt.

As fewer people work, there’s less economic output and tax revenue. Which results in the government having to borrow more.

So what’s Raoul getting at here?

Aging population = lower GDP growth

Lower GDP = higher debt to service the ageing population

With high debt and low GDP growth, the fed needs to create liquidity to service this debt.

This means money printing and currency debasement.

Currency debasement = number go up (assets increase in value)

“It really is that simple with a longer-term time horizon.”

ETHEREUM FEES DECLINING 📉

Ethereum’s transaction fees continue to decline.

According to Ultrasound money, the average gas fee has dropped to 5.07 Gwei - the lowest since the merge in 2022.

And since a portion of Ethereum’s gas fees are “burnt” (permanently removed from the supply), this has resulted in Ethereum once again becoming inflationary.

Over the last 30 days, the supply of Ethereum has been inflating at a rate of 0.4% per year.

Basically:

Lower transaction fees means less Ethereum burnt. Less Ethereum burnt leads to an increase in the supply.

And while this initially sounds bearish for Ethereum…

The reason why is promising.

For years Ethereum has been working on improving the functionality of Layer 2 networks. (networks built on top of Ethereum with the goal of speeding up transaction speeds and keeping fees low)

Earlier this year, Ethereum released their Dencun upgrade which reduced Layer 2 transaction fees by over 10x.

The chart below shows the clear transition from the Ethereum mainnet to Layer 2 networks:

🟨 Ethereum Layer 2 networks

🟧 Ethereum Mainnet

Currently, the top 3 Layer 2 networks (Arbitrum, Optimism and Base) account for over 82% of all Ethereum transactions.

And since the release of the Dencun upgrade, Ethereum mainnet transactions have fallen by 10%.

With less transactions taking place on the mainnet, less ETH is being burnt. Which results in Ethereum becoming inflationary.

And while this may be bearish (in the short-term) for Ethereum, the ecosystem is growing. And we’re seeing more and more applications being built on these Layer 2 networks.

In the long-run this is massively bullish for Ethereum.

CRACKING CRYPTO 🥜

IMF backs crypto to solve Nigeria’s forex issues despite local crackdown. IMF recommends Nigeria embrace crypto adoption by licensing exchanges and creating a robust regulatory framework for the industry.

Bitcoin repeats '2016 history perfectly' amid $350K price prediction. The Bitcoin price chart is playing out like it did in 2016 "perfectly" according to crypto traders.

Dogecoin Appears Headed for a 'Golden Cross'. A DOGE price pattern that presaged the early 2021 surge looks set to recur.

'Asia's MicroStrategy' Metaplanet Tops up Bitcoin Portfolio in Latest Purchase. Metaplanet Inc., a renowned Japanese company, invests $1.25 million into Bitcoin.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

In order to comply regulations, crypto exchanges must gather specific information about their customers. This process is typically known as:

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) KYC 🥳

KYC stands for Know Your Customer.

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.