Today’s edition is brought to you by Coinbase - the easiest way to purchase crypto.

GM to all of you nutcases. It’s Crypto Nutshell #813 tryin’ not to cry… 🧅🥜

We’re the crypto newsletter that’s more relentless than a cop chasing a killer who refuses to play by the rules… 🚓🔪

What we’ve cooked up for you today…

🏦 The pain doesn’t stop

🧩 Hard but simple

📈 Always expanding

💰 And more…

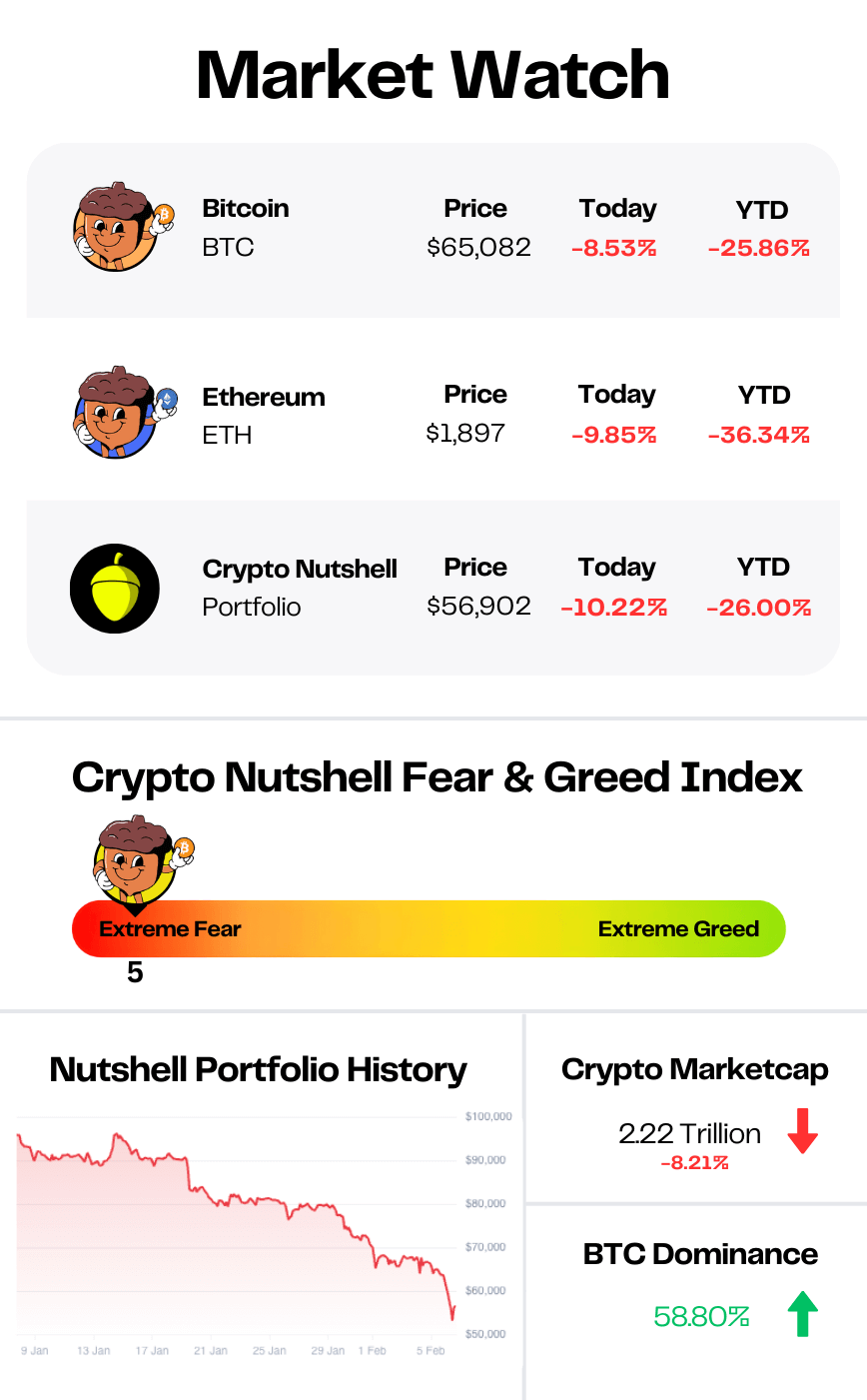

Prices as at 2:25am ET

THE PAIN DOESN’T STOP 🏦

BREAKING: Bitcoin Flash Crashes to $60K in Worst Day Since FTX as Strategy and BitMine Losses Top $17 Billion

Bitcoin just had its worst day since FTX collapsed…

BTC flash crashed to $60,000 on Thursday night - its lowest level since September 2024.

It's since bounced to around $65k but the damage is severe. Bitcoin is now down 50% from October's all-time high of $126,000.

Over $2.67 billion in positions were liquidated in 24 hours. $2.31 billion of that came from longs.

"Traders are no longer trying to catch falling knives," said BTC Markets analyst Rachael Lucas. "They're prioritizing capital preservation."

Strategy posts $12.4 billion loss

Bitcoin's biggest corporate holder is deep in the red.

Strategy reported a $12.4 billion loss in Q4 2025 as Bitcoin fell from $120,000 to $89,000 over the quarter. Things have only gotten worse since.

The company now holds 713,502 BTC at an average cost of $76,052. With Bitcoin trading around $64,000, that's $9.2 billion in paper losses - down 17.5% on its entire position.

But executives say there's no reason to panic.

Strategy has $2.25 billion in cash - enough to cover 30 months of dividends. No major debt matures until 2027.

"I'm not worried, we're not worried, and no, we're not having issues," CEO Phong Le told investors.

BitMine's losses top $8 billion

Ethereum treasury giant BitMine is in even worse shape.

The firm holds 4.28 million ETH at an average cost of $3,883. With ETH crashing 34% this week to around $1,867, BitMine is now sitting on $8.4 billion in unrealized losses.

Combined, Strategy and BitMine are down over $17 billion on paper.

IBIT sets volume record

BlackRock's spot Bitcoin ETF had its busiest day ever on Thursday - but not for good reasons.

IBIT traded $10 billion in volume, crushing its previous record. The fund dropped 13%, its second-worst daily decline since launch.

But here's the surprising part: ETF investors aren't panic selling.

Despite Bitcoin dropping 40%+ from highs, only 6.6% of ETF assets have exited, according to Bloomberg's Eric Balchunas.

"For now, the ETF boomers have really come through," he said. "A selloff doesn't mean the end. It just means it's a selloff."

Where's the bottom?

Analysts point to the $58,000-$60,000 range as key support.

That's where Bitcoin's 200-week moving average sits - and where heavy buying interest has clustered historically.

For now, conviction is being tested like never before. 🚀

CRYPTO MADE SIMPLE 🤑

Buying crypto can be easy.

Knowing which exchange to trust? That’s where it gets complicated.

That’s why over 100 million users have started their journey with Coinbase - the most recognised crypto exchange in the U.S.

Here’s what makes Coinbase stand out:

A beginner-friendly platform with a clean interface, helpful tips, and easy access to 250+ cryptocurrencies 💰

Coinbase Advanced for pro-level trading tools - no separate account needed 📈

Staking made simple: earn rewards on ETH, SOL, ADA, and more, all without leaving the app 🥩

You’ll also get access to learning rewards (yes, free crypto), recurring buys, and a sleek mobile app - all backed by a publicly traded company with transparent financials and industry-leading security.

Whether you’re stacking Bitcoin weekly or diving into deep altcoin research…

HARD BUT SIMPLE 🧩

Hunter Horsley just summed up the market in one sentence.

If you’re newer here, Horsley is the CEO of Bitwise, one of the largest crypto asset managers on Earth, overseeing billions for institutions.

His job is literally to study capital flows and position ahead of them.

So when he points something out, it’s usually worth pausing.

This week he tweeted:

“People watching gold, wishing they'd bought it when it was cheap. Meanwhile, Bitcoin, which historically follows gold with a few month lag, sitting cheap. Hard but simple.”

Zoom out and you can see exactly what he means.

Gold & silver have been ripping.

New highs. Constant inflows. Institutional demand everywhere.

Now think back to every cycle.

Gold tends to move first.

Bitcoin tends to follow.

Not instantly. But violently once it starts.

The problem?

Buying strength feels safe. Buying Bitcoin while sentiment is shaky is uncomfortable.

That’s why Horsley called it hard.

But the framework is simple.

By the time it feels obvious… it usually isn’t cheap anymore. 🧩

ALWAYS EXPANDING 📈

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

There are now 58 million wallets holding Bitcoin.

That's another 150,000 wallets in just two weeks.

Bitcoin's down from its highs. Fear's elevated. The macro backdrop is messy.

And yet adoption keeps accelerating.

More wallets. More distribution. More resilience.

The network keeps expanding. 💪

CRACKING CRYPTO 🥜

Tom Lee's BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion. Shares in publicly traded Ethereum treasury firm BitMine Immersion Technologies have fallen to a seven-month low as unrealized losses mount.

Polygon to Migrate Prediction Market Settlement to Circle-Issued USDC. Polymarket will replace bridged USDC on Polygon with Circle-issued native USDC, shifting its prediction market settlement infrastructure away from cross-chain bridges.

U.S. Treasury's Bessent calls out crypto 'nihilists' resisting market structure bill. Treasury Secretary Bessent said market participants who don't want strong regulation should "move to El Salvador."

JPMorgan says bitcoin could reach $266,000 'long term' as it looks more attractive than gold. That target is “unrealistic” this year, but possible “over the long term” once negative sentiment reverses, according to the analysts.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Satoshi 🥳

Satoshi (or "sat") is the smallest divisible unit of Bitcoin, named after its creator Satoshi Nakamoto. One Bitcoin equals 100 million satoshis.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.