Today’s edition is brought to you by Coinbase - the easiest way to purchase crypto.

GM to all of you nutcases. It’s Crypto Nutshell #663 findin’ the way… 🧭 🥜

We're the crypto newsletter that's more gripping than a man stuck in a time loop trying to solve his own murder... 🔁🕵️

What we’ve cooked up for you today…

🏦 New record

🧗♂️ Still early in the run

🤯 Sell-off?

💰 And more…

Prices as at 7:05am ET

NEW RECORD 🏦

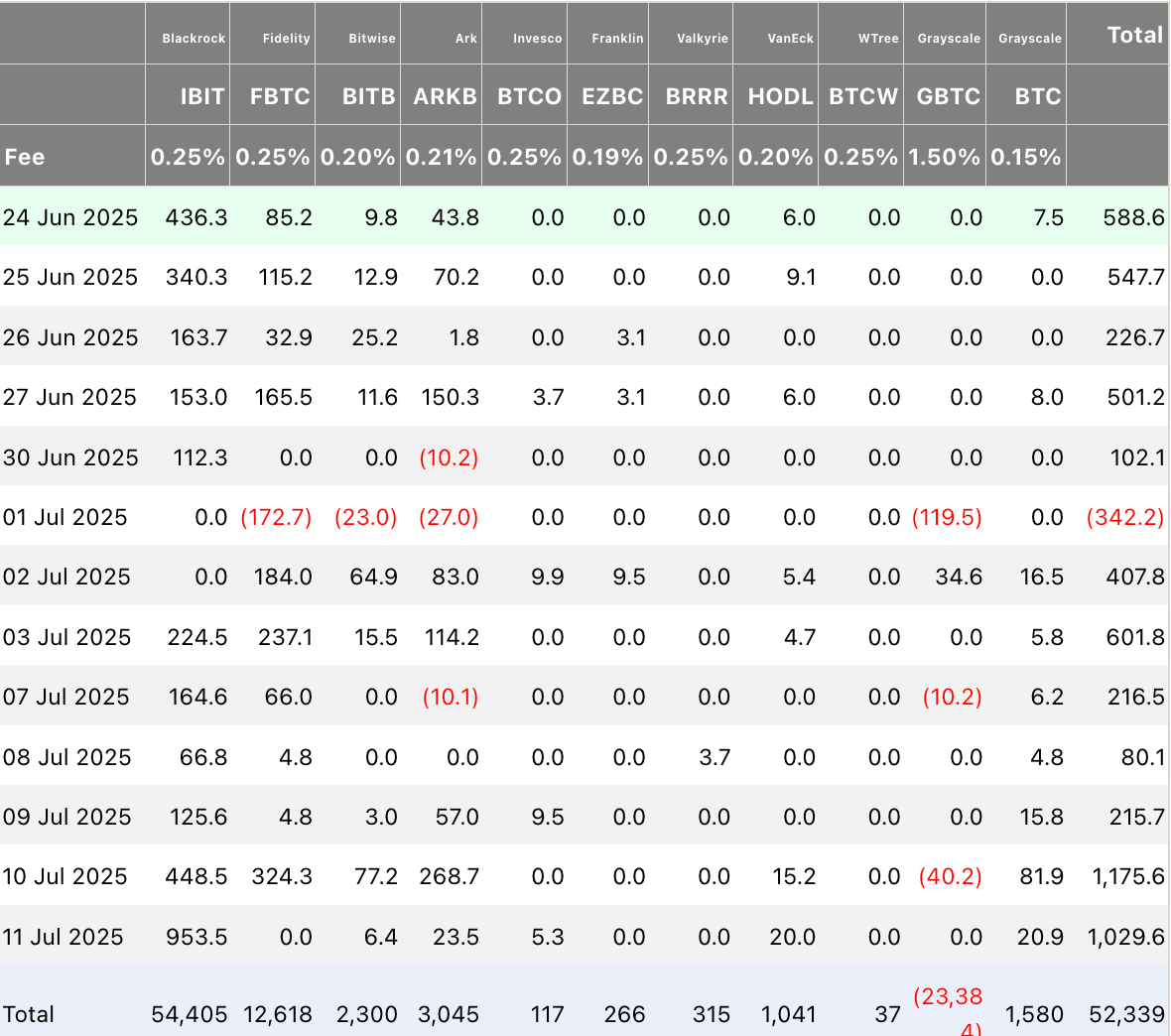

BREAKING: Two straight billion-dollar inflow days bring spot Bitcoin ETFs to $158 billion in total net assets

Bitcoin just set ANOTHER all-time high over $123,000! 🥳

But the real story is under the surface…

And it’s all about the ETFs.

BlackRock’s Bitcoin ETF (IBIT) just became the fastest ETF in history to hit $80 billion in AUM.

It did it in just 374 days - five times faster than the previous record-holder, Vanguard’s S&P 500 ETF, which took over 1,800 days.

On Friday alone, IBIT absorbed $953.5 million in inflows - accounting for 95% of all spot BTC ETF inflows that day.

And that was no fluke.

Bitcoin ETFs saw back-to-back billion-dollar days, with $1.18B on Thursday and $1.03B on Friday - the largest 48-hour inflow stretch since launch.

Total spot BTC ETF assets now sit at a record-breaking $158 billion.

BTC ETF Flows

Meanwhile, Ethereum ETFs are quietly gaining steam.

Over the last six trading days, ETH ETFs brought in over $1.05 billion in inflows, pushing cumulative net inflows to a new high of $5.31 billion.

BlackRock’s ETHA fund leads the pack with $6.14 billion in AUM - already larger than Grayscale’s ETHE and ETH combined.

ETH ETF Flows

The message is clear: institutional demand isn’t slowing down.

Bitcoin has broken out, and Ethereum is quietly coiling beneath the surface.

With ETH still lagging and its ETFs gaining traction, the setup feels eerily similar to Bitcoin in early 2024 - just one step behind in the rotation.

The next phase of the cycle is coming. 😎

CRYPTO MADE SIMPLE 🤑

Buying crypto can be easy.

Knowing which exchange to trust? That’s where it gets complicated.

That’s why over 100 million users have started their journey with Coinbase - the most recognised crypto exchange in the U.S.

Here’s what makes Coinbase stand out:

A beginner-friendly platform with a clean interface, helpful tips, and easy access to 250+ cryptocurrencies 💰

Coinbase Advanced for pro-level trading tools - no separate account needed 📈

Staking made simple: earn rewards on ETH, SOL, ADA, and more, all without leaving the app 🥩

You’ll also get access to learning rewards (yes, free crypto), recurring buys, and a sleek mobile app - all backed by a publicly traded company with transparent financials and industry-leading security.

Whether you’re stacking Bitcoin weekly or diving into deep altcoin research…

STILL EARLY IN THE RUN 🧗♂️

Willy Woo just dropped an update on where we are in the cycle.

In a nutshell?

This move is just getting started.

Who’s Willy Woo?

He’s one of the most respected on-chain analysts in the game.

His specialty?

Reading blockchain data to figure out exactly what’s happening behind the scenes.

This week, he shared a new model that tracks investor behaviour and speculation pressure.

And the verdict?

We’re nowhere near overheated.

Here’s the breakdown:

Speculation is still low 📉

That means there’s not a ton of risky, short-term gambling happening yet.

Price hasn’t been driven by hype - which is bullish.Investor buying is far from stretched 📊

Woo tracks the average price investors bought Bitcoin at.

Right now, price hasn’t run too far above that average.

Translation? Investors aren’t euphoric - yet.That last breakout? It wasn’t greed-driven. 💥

Woo says the move to new highs was caused by short sellers getting liquidated.

Not bullish FOMO - just bears getting wiped out.

Investors are stepping back in. Sentiment is turning. And this run still has room to fly - once we get a short breather.

“This run has plenty of legs left in it (but needs consolidation right now).”

If you missed the move to $117K?

This might be your second chance. 👀

SELL-OFF? 🤯

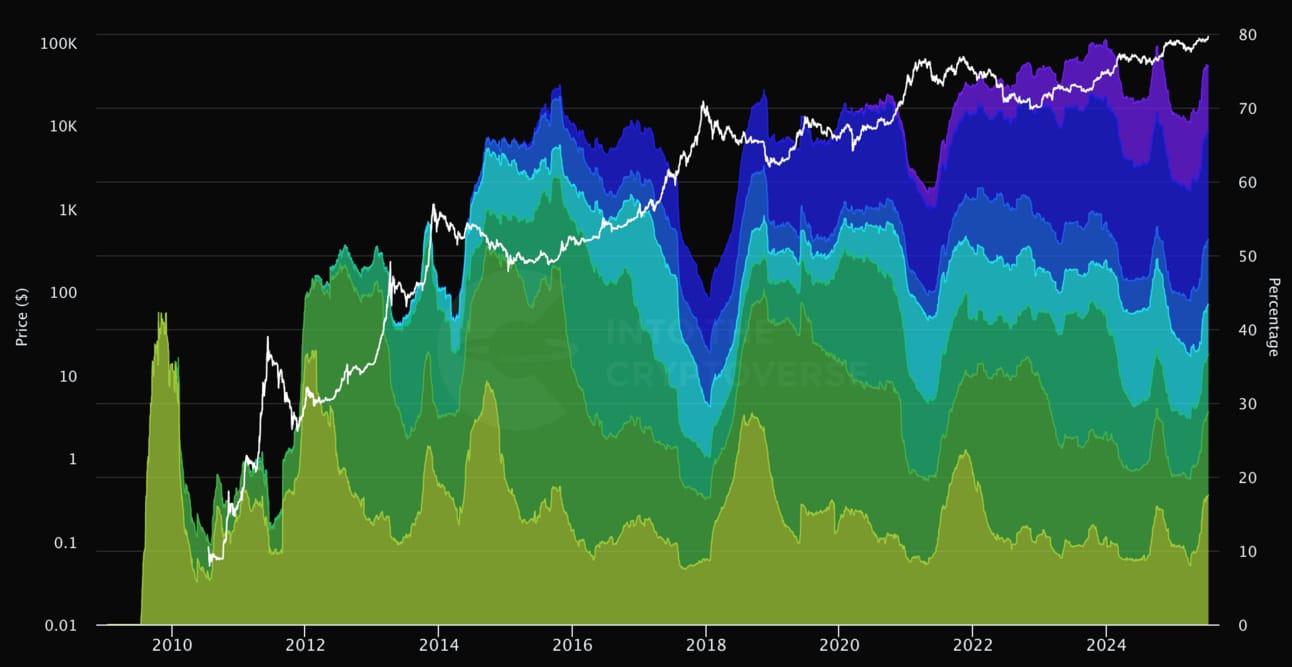

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 17.49% (up from 16.54%)

1y - 2y: 11.21% (up from 11.06%)

2y - 3y: 7.80% (down from 7.89%)

3y - 4y: 6.32% (down from 6.80%)

4y - 5y: 8.70% (down from 8.77%)

5y - 10y: 14.63% (down from 14.80%)

>10y: thanks 8.88% (down from 9.31%)

TL;DR: 75.03% of all Bitcoin hasn’t moved in over six months. 🔒

What stands out?

The 6–12 month band saw the biggest jump, as short-term holders continue aging into longer-term conviction.

At the same time, slight dips in the 2–10 year cohorts likely reflect some profit-taking - totally natural behaviour as Bitcoin just set a new all-time high.

But zoom out…

Long-term holders are still sitting tight

Liquid supply keeps drying up

Conviction remains strong

This is not a sign of weakness.

It’s a sign of a maturing, locked-up supply base - right as demand heats up.

And when you combine that with all-time highs and ETF flows?

You don’t get a top.

You get a fuse. 🔥

CRACKING CRYPTO 🥜

DOJ prosecutor used misattributed quote to show Tornado Cash team's 'consciousness of guilt'. Prosecutors claimed a Tornado Cash developer asked about laundering $600 million, but he had merely forwarded a message from a reporter.

Pump.fun Swiftly Raises $500M in Public Sale at $4B Fully Diluted Valuation. All 125B tokens sold at $0.004 each, giving PUMP a $4B fully diluted valuation; post-sale tokens stay initially frozen for up to 72 hours.

Bitcoin gains ground in gold vs. crypto debate. Lyn Alden and Vijay Boyapati urge gold maximalists to hedge risk by allocating 5% of their metals portfolio to Bitcoin.

Who owns the most Bitcoin in 2025? The rich list revealed. Explore the top Bitcoin holders in 2025, including the largest BTC wallets, institutional reserves and crypto billionaires.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the minimum amount of Bitcoin that can be sent in a transaction?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 1 satoshi 🥳

The smallest unit of Bitcoin is called a satoshi, named after Satoshi Nakamoto. 1 sat = 0.00000001 BTC - perfect for microtransactions. 🧮⚡

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.