GM to all of you nutcases. It’s Crypto Nutshell #620 checkin’ in… 📍🥜

We're the crypto newsletter that's more intense than a teenager escaping a monster-infested labyrinth with no way out... 🧩🏃♂️

What we’ve cooked up for you today…

❄ Inflation cools

⚡ Supply shock

💪 The strongest hands

💰 And more…

Prices as at 3:40am ET

INFLATION COOLS ❄

BREAKING: U.S. CPI Rose Less Than Expected 0.2% in April; Annual Pace Slips to Four-Year Low

US inflation cooled for the third straight month in April.

And that’s with some of President Donald Trump’s tariffs taking effect…

Here’s the April CPI snapshot:

+0.2 % MoM headline (vs. +0.3 % estimated)

2.3 % YoY headline — softest since Feb 2021

Core CPI +0.2 % MoM, stuck at 2.8 % YoY

Bitcoin reacted positively to this news, hitting a high of ~$105,000 shortly after the data was released.

But despite inflation cooling…

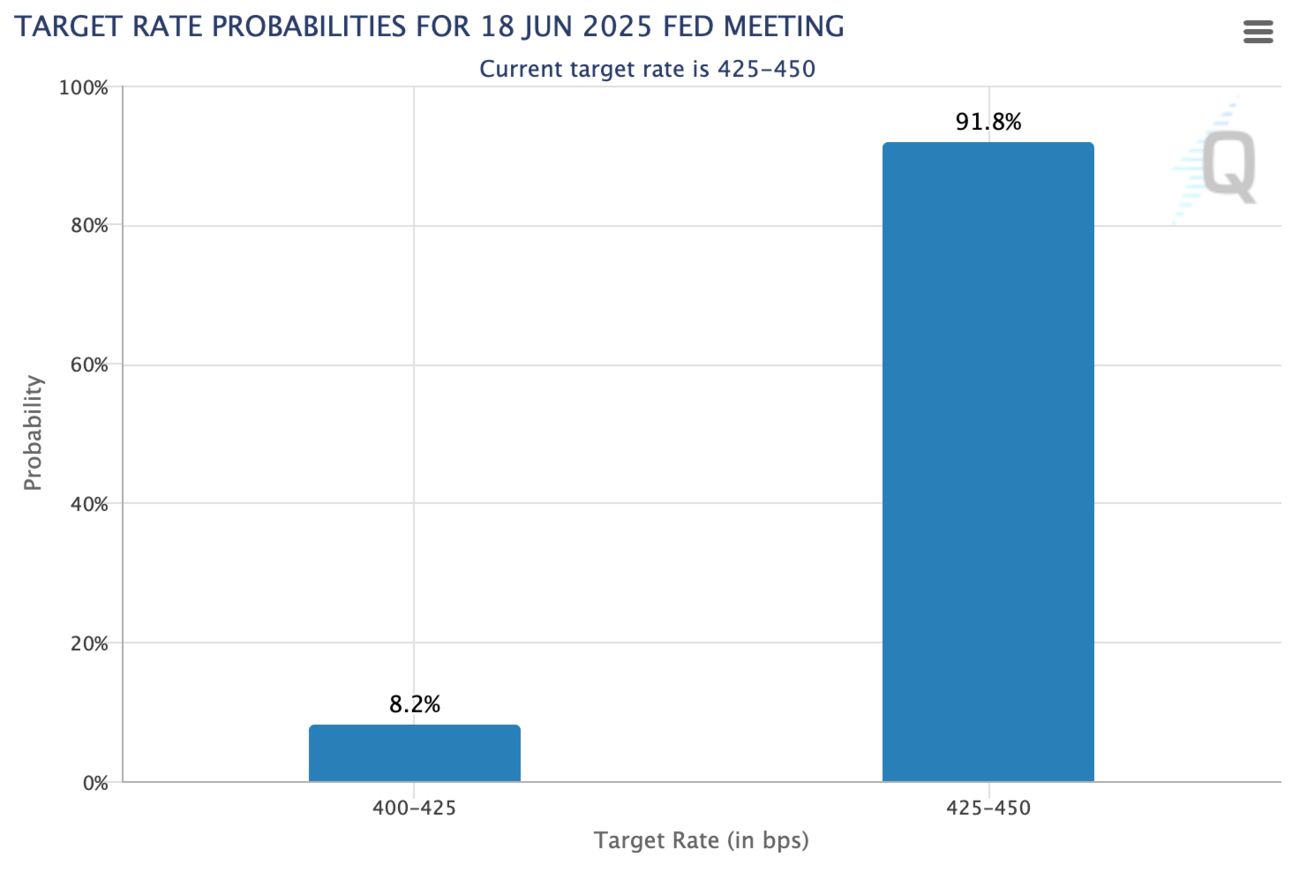

The Fed held rates steady at 4.25 – 4.50 % for a fourth straight meeting last Wednesday.

Chair Jerome Powell refused to buckle under political pressure:

“We’re always going to do the same thing… use our tools to foster maximum employment and price stability.”

Powell also flagged tariff uncertainty:

“The tariff increases announced so far have been significantly larger than anticipated… their effects on the economy remain highly uncertain.”

And traders are with him.

CME FedWatch now shows just 8.2% odds of a June cut.

July sits at 38%.

The first real shot at easing is September, with odds near 72.7%.

It’s looking like “Higher for longer” is now the base case.

Macro winds, however, keep shifting in crypto’s favour.

A 90-day U.S.–China tariff truce sparked the best equity day in a month and helped Bitcoin briefly eclipse $105K.

Risk appetite is rebuilding as headline fears fade.

In our opinion, Bitcoins long-term outlook is the strongest it has ever been. 💪

Know Exactly Where We Are In The Cycle

Everyone is asking the same questions:

“Is now the time to buy?”

“Are altcoins about to run?”

“When is it time to sell?”

Crypto Nutshell Pro gives you the answer — every single week.

Our team of full-time on-chain analysts track 10+ critical indicators across:

📈 On-chain metrics

📉 Technical signals

📊 Liquidity flows

🧠 Social sentiment shifts

🌍 Macro trends

So you’ll know exactly when to buy.

But more importantly, when to sell.

Here’s what we told members when Bitcoin dipped to $75K last month:

“We’re at or very close to the bottom. This is what the reversal looks like.”

Bitcoin then rebounded to $104K…

In the next 24 hours, we’ll be opening 25 new spots to Crypto Nutshell Pro.

👇 Click below to join the waitlist.

First in, first served. (Crypto Nutshell has 95,000+ daily readers — you do the math.)

SUPPLY SHOCK ⚡

Matt Hougan — Chief Investment Officer at Bitwise — just posted the latest Bitcoin supply vs demand breakdown.

All the raw numbers.

And if you’re still wondering if Bitcoin could go vertical from here — this answers it.

Year-to-Date Supply vs. Demand

If that’s confusing, here’s the takeaway:

Demand is outpacing new supply by 4 to 1.

And that’s not even counting retail.

Why It Matters

Since the halving last year, Bitcoin supply has been cut in half.

Yet demand is accelerating — from some of the biggest buyers on the planet.

Yes, some sellers are happy to cash out above $100K.

But they won’t last forever.

Eventually, the sell-side dries up.

And when that happens?

Buyers don’t disappear.

They bid higher. Fast.

This is how it starts:

Hard capped supply.

Slowing issuance.

Relentless demand.

The conditions are in place.

The pressure is building.

The supply shock isn’t coming — it’s already begun. ⚡

THE STRONGEST HANDS 💪

Let’s check in on one of our favourite metrics: Bitcoin’s supply last active 1+ years ago.

It’s a simple but powerful signal - tracking how much BTC has remained untouched as a percentage of total circulating supply.

Here’s the logic:

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

So what’s really happening with the supply of Bitcoin? 🧐

Short answer: Conviction is still rock solid.

Here’s the latest supply breakdown vs. two weeks ago:

🔴 Supply last active 1+ years ago: 62.82% (down from 63.25%)

🟠 Supply last active 2+ years ago: 52.25% (down from 52.66%)

🟢 Supply last active 3+ years ago: 45.12% (down from 45.44%)

🔵 Supply last active 5+ years ago: 30.61% (up from 30.58%)

At first glance, yeah the 1–3 year bands dipped slightly…

But zoom in on the real signal:

5+ year holders are still growing.

That’s the most hardened cohort — this isn’t their first cycle, they’ve survived multiple drawdowns and never flinched.

And here’s the big picture:

Nearly two-thirds of all Bitcoin hasn’t moved in over a year.

That’s not noise - that’s serious conviction.

Even with new highs in sight and price ripping upward…

The strongest hands aren’t selling.

Meanwhile, demand is ramping up fast as we explained earlier.

You don’t need a PhD to see what comes next:

Shrinking supply + rising demand = 🚀

CRACKING CRYPTO 🥜

Coinbase makes history with S&P 500 induction, reinforcing crypto's arrival in mainstream finance. Now part of the financial elite, Coinbase’s S&P 500 debut signifies enduring crypto acceptance and expanded market reach.

$1B Bitcoin exits Coinbase in a day as analysts warn of supply shock. Coinbase saw its highest daily Bitcoin outflows this year, signaling growing BTC investments among institutional investors and corporations.

Cantor Equity Partners Discloses $458M Bitcoin Acquisition. The bitcoin treasury company made the purchase via Tether at an average price of $95,320 per BTC.

London-based asset manager buys nearly $500 million worth of Ethereum in six days. Lookonchain also noted that Abraxas Capital borrowed 240 million in USDT from Aave before depositing it on Binance.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which asset manager saw the largest inflows in the first week of U.S. spot Bitcoin ETF trading in 2024?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: BlackRock 🥳

BlackRock’s iShares Bitcoin Trust (IBIT) dominated launch week — raking in billions and instantly becoming a heavyweight in the crypto ETF arena. 💼🪙

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.