GM to all of you nutcases. It’s Crypto Nutshell #600 keepin’ it easy… 🏖️🥜

We're the crypto newsletter that's more legendary than forging a fellowship to destroy the most powerful ring in existence... 💍🔥

What we’ve cooked up for you today…

😎 Never enough

🇺🇸 Buying Bitcoin with tariffs

💪 Patience is building

💰 And more…

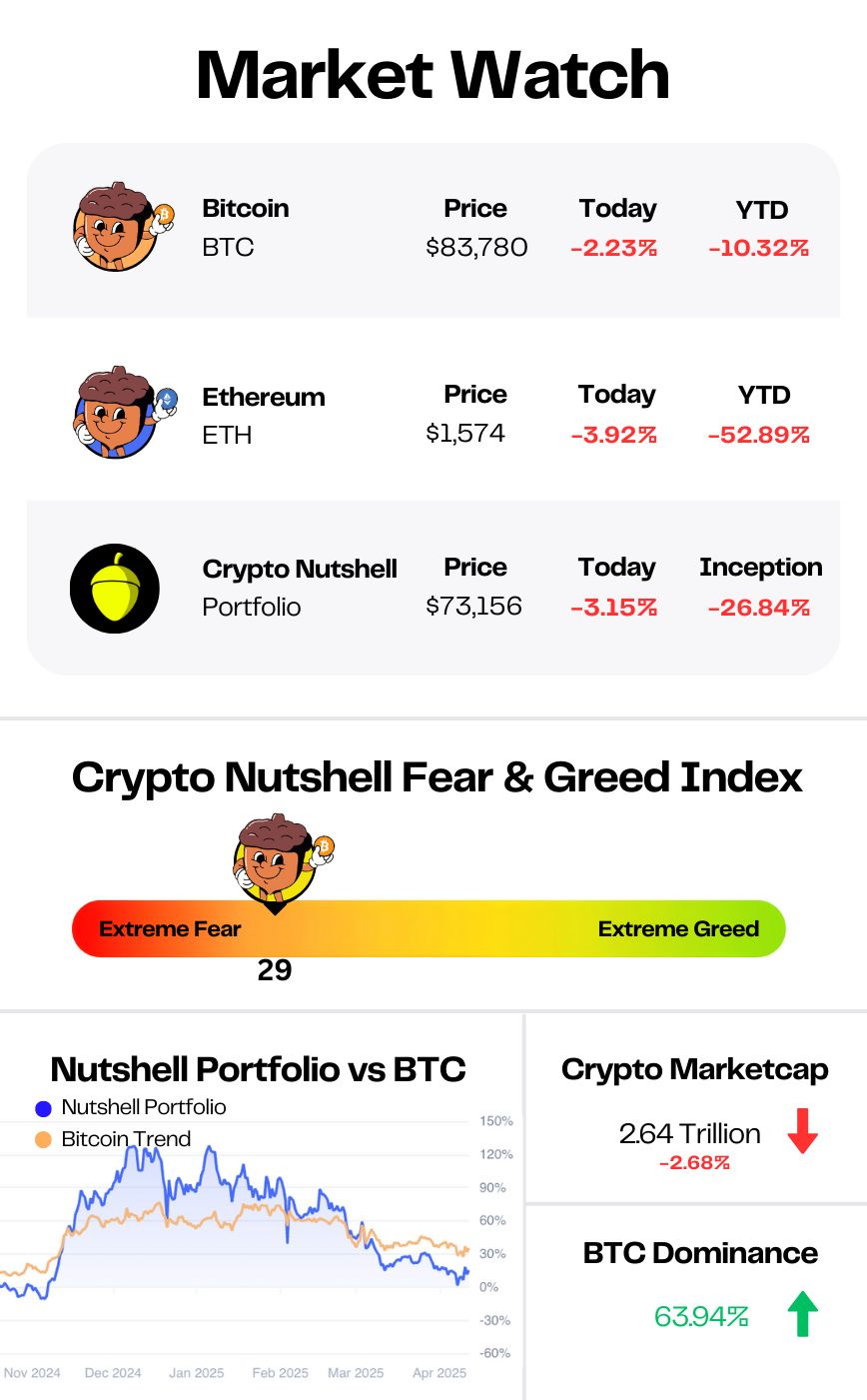

Prices as at 5:45am ET

NEVER ENOUGH 😎

BREAKING: Semler Scientific files $500 million offering to buy more bitcoin

As we mentioned yesterday, the corporate Bitcoin wave is just getting started.

The latest to up the ante?

Semler Scientific, a Nasdaq-listed healthcare tech firm, has filed to raise $500 million - with plans to use part of it to buy more Bitcoin.

This isn’t their first rodeo either.

Semler already holds 3,192 BTC (worth ~$266 million), making it the 12th largest corporate holder of Bitcoin globally.

And they’re not slowing down:

“We view our Bitcoin holdings as long-term and expect to continue to accumulate Bitcoin… We have not set any specific target for the amount of bitcoin we seek to hold, and we will continue to monitor market conditions in determining whether to engage in additional bitcoin purchases.”

This isn’t a one-off trend.

According to Bitwise, public companies added 95,431 BTC in Q1 2025 alone - pushing total corporate holdings to 688,000 BTC, worth over $57 billion.

And the adoption news doesn’t stop there...

Strive Asset Management, founded by Vivek Ramaswamy, is now pushing Intuit to add Bitcoin to its balance sheet.

(Quite note: Intuit is the $170 billion fintech giant behind TurboTax and QuickBooks)

Their pitch? Brutally direct:

“We believe that TurboTax, Intuit’s flagship product, has a high risk of being automated away by AI. While we appreciate Intuit’s own investments and internal implementation of AI, we believe an additional hedge is warranted, and that a Bitcoin war chest is the best option available.”

Why does this pitch from Strive matter?

Because Strive sent a similar letter to GameStop back in February.

Two months later GameStop raised $1.5 billion - and announced it would use the proceeds to buy Bitcoin.

Strive Asset Management letter to Intuit

Is Intuit next? 👀

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

BUYING BITCOIN WITH TARIFFS 🇺🇸

President Trump’s Executive Director on Digital Assets just dropped another bombshell.

Not only does the U.S. want to buy more Bitcoin - they’re now floating new ways to fund it.

One of them?

Tariffs. 👀

If you don’t know who Trump’s Executive Director on Digital Assets is, his name is Bo Hines:

Former college football star 🏈

Ran for Congress in 2022 🎤

Big advocate of economic policy, digital assets, & national strength 🇺🇸

In his latest interview with Anthony Pompliano, Bo Hines doubled down:

“We want as much [Bitcoin] as we can get. And we’re going to find budget-neutral ways to make that happen.”

This isn’t theoretical.

Bo confirmed there are high-IQ teams at work, spread across the Treasury, Commerce, & beyond.

Their mission?

Find creative ways to stack Bitcoin - without costing taxpayers a dime.

Here’s what is currently being suggested:

💰 Selling gold to unlock capital

💼 Reshuffling existing federal assets

🌍 And now? Using external revenue like tariffs to buy Bitcoin

“There are countless ways to do this… and we’re looking at every single one.”

Bo made it crystal clear:

“We want as much as we can get.”

And it turns out, they’re willing to get creative to make it happen.

Who on earth would bet against Bitcoin right now? 🎰

PATIENCE IS BUILDING 💪

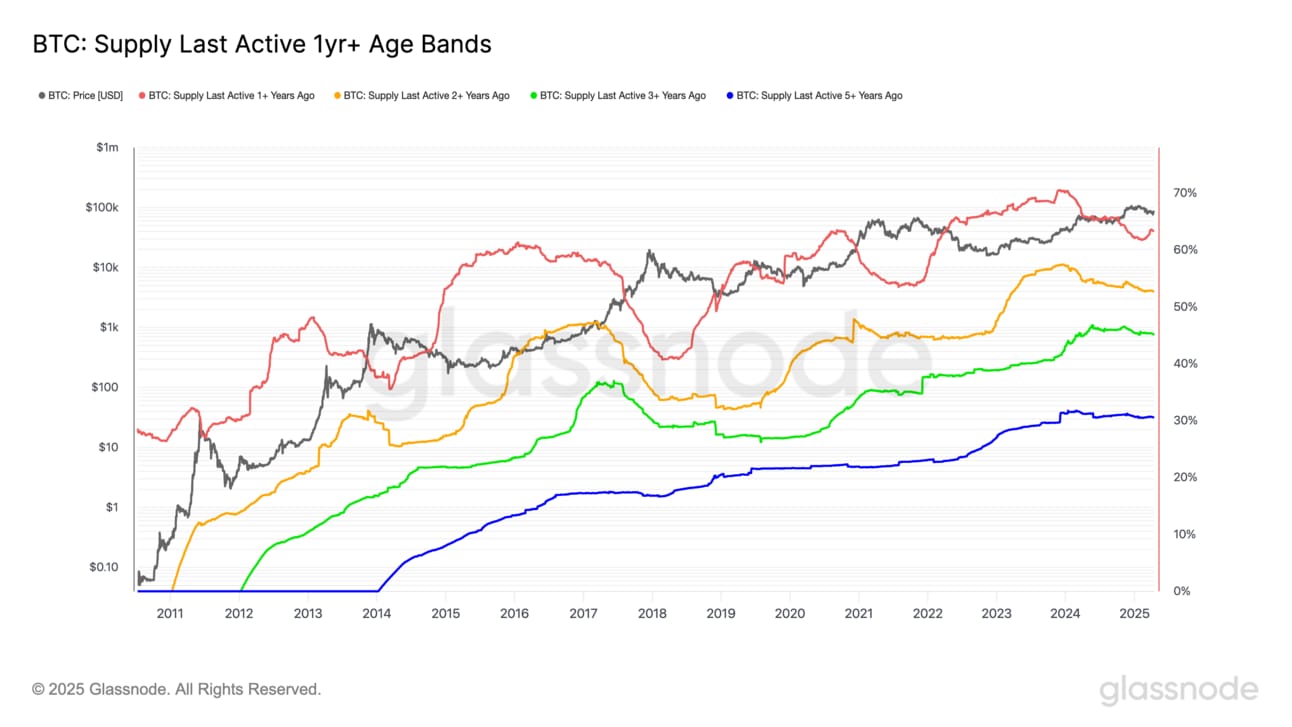

Let’s check in on one of our favourite metrics: Bitcoin’s supply last active 1+ years ago.

It’s a simple but powerful signal - tracking how much BTC has remained untouched as a percentage of total circulating supply.

Here’s the logic:

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

So what’s happening right now? 🤔

Simply put: Long-term conviction is holding strong.

Here’s the latest breakdown (vs. two weeks ago):

🔴 Supply last active 1+ years ago: 63.32% (down from 63.49%)

🟠 Supply last active 2+ years ago: 52.71% (down from 52.89%)

🟢 Supply last active 3+ years ago: 45.18% (down from 45.36%)

🔵 Supply last active 5+ years ago: 30.59% (down from 30.66%)

Yes, there’s been a tiny dip across the board - that’s totally normal during periods of volatility.

But the big picture?

Nearly two-thirds of all Bitcoin hasn’t moved in over a year.

That’s not fear. That’s patience.

Bitcoin is sitting in strong hands - and the supply is quietly tightening beneath the surface.

Historically, this kind of HODL behaviour has always set the stage for explosive rallies.

Because when supply locks up and demand returns?

Price doesn’t stay low for long. 🚀

CRACKING CRYPTO 🥜

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the name of the NFT artwork that sold for $69 million at a Christie’s auction in 2021?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Everydays: The First 5000 Days 🥳

Created by digital artist Beeple, this sale put NFTs on the global map overnight.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.