GM to all 34,152 of you. Crypto Nutshell #196 trottin’ by. 🦄 🥜

We’re the crypto newsletter that's more thrilling than waking up with superpowers after a radioactive spider bite... 🕷️💥

What we’ve cooked up for you today…

😁 It’s finally happening?

📈 The Bitcoin ETF is not priced in

⚖️ Bitcoin exchange balance

💰 And more…

MARKET WATCH ⚖️

Prices as at 5:05am ET

Only the top 20 coins measured by market cap feature in this section

IT’S FINALLY HAPPENING? 😁

BREAKING: Multiple spot Bitcoin ETFs will be approved today

After writing about them for the past 6 months, the day we’ve all been waiting for has finally (maybe?) arrived.

According to TechCrunch senior reporter, Jacquelyn Melinek, we can expect something to happen today.

“[I have] heard from sources extremely close to the matter that the bitcoin spot ETF is going to be approved by the SEC for multiple firms' applications… Expecting something tomorrow (Friday)”

Jacquelyn Melinek isn’t the only person who thinks we’re about to see an approval.

Earlier in the week, sources from Fox Business reported that the SEC would announce approvals on Friday, January 5.

Some cryptic tweets also began appearing today potentially indicating the ETFs have been approved… 🤔

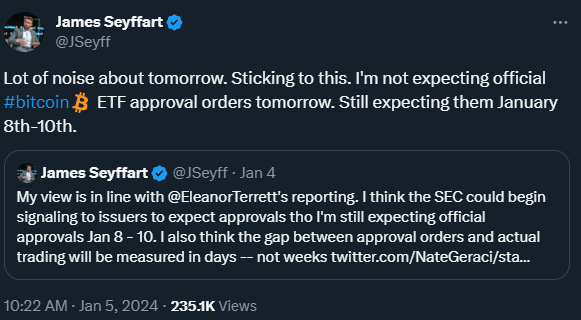

Regardless of all this buzz, ETF analyst James Seyffart is sticking with his initial prediction. Based off of this, we can expect approvals between January 8 - 10.

Who really knows when they’ll be approved.

All we can say is that it sounds like a done deal to us.

BUT It could be exciting start to the weekend…

Is it time?

TOGETHER WITH STOCK MARKET RUNDOWN🤑

Do you want to sound smart in front of your boss? 🧠

How about stunning your friends with your business knowledge?

There’s an easy way to do it: the Stock Market Rundown.

It’s a daily 3-minute read that keeps you covered on the stock market and all things business.

We enjoy reading Stock Market Rundown because they make keeping up with the latest business news amusing and actually kind of fun.

The best part? They’re 100% free.

Whack that subscribe button to get smarter on business today. 😎

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

THE BITCOIN ETF IS NOT PRICED IN 📈

The spot Bitcoin ETF is coming within the next 5 days.

We know this with 99% certainty.

But the Bitcoin ETF is not priced in.

That’s the message out from on-chain Bitcoin analyst, Dylan LeClair.

Today, a report was released from Chief Investment Officer of Bitwise, Matt Hougan.

It was a survey on 400+ financial advisors and their expectations surrounding Bitcoin. The survey was conducted in November & December of last year.

The results were shocking:

First off, only 39% of financial advisors expect an ETF approval in 2024.

Dylan LeClair pointed out some even more shocking statistics:

1. 88% of advisors are waiting to purchase Bitcoin after a spot ETF is approved.

2. Only 19% of advisors said they were able to currently buy Bitcoin

If you are reading this, you are more informed on Bitcoin than the majority of financial advisors.

We know with near certainty we are on the cusp of approval. Yet only 39% of advisors believe approval is coming.

The Bitcoin ETF is not priced in. 📈

BITCOIN EXCHANGE BALANCE ⚖️

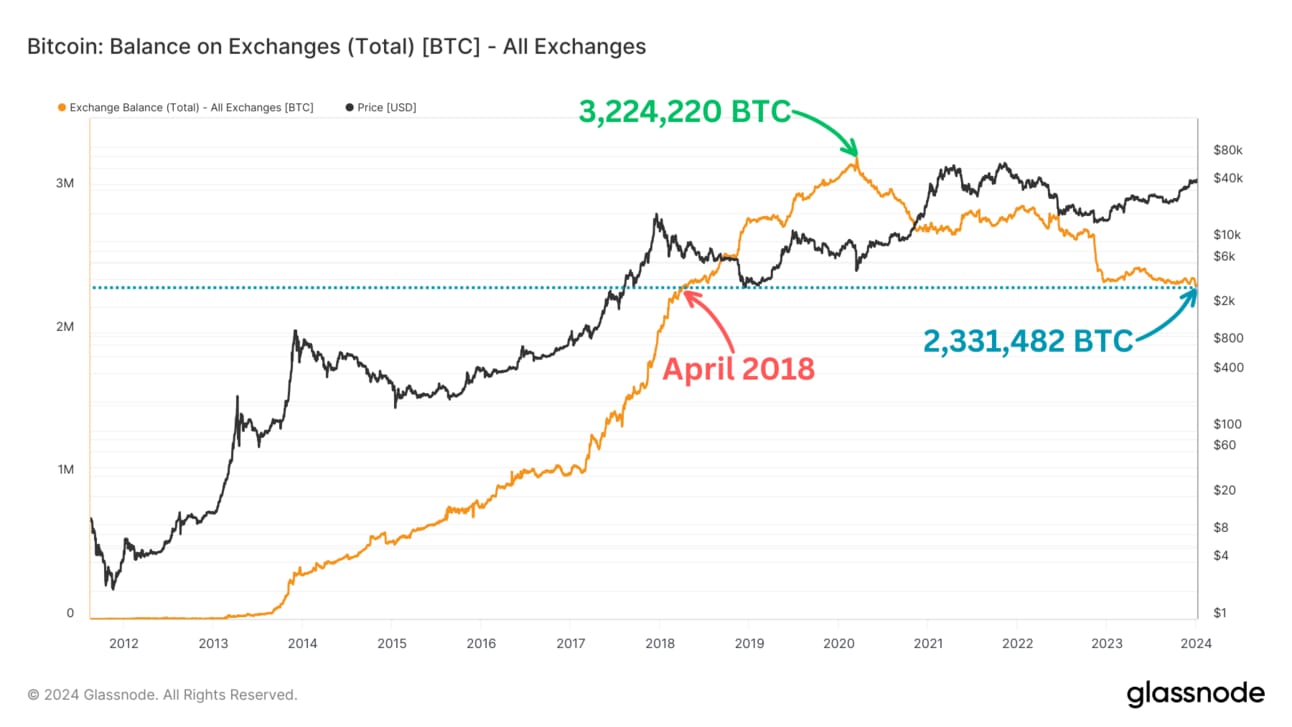

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

A decline in this metric is a bullish indicator as it signifies a shift towards long-term holding. (also decreased selling pressure)

Put simply, Bitcoin can’t really be sold if it’s not on an exchange…

Currently there is only 2,331,482 BTC available for sale on exchanges.

That’s ~11.90% of the entire circulating supply.

We haven’t seen numbers this low since April 2018…

This metric peaked back in March 2020 at 3,224,220 Bitcoin. Since then it’s dropped by 892,738 BTC.

Convert that to dollars and you get $38.99 billion at today’s prices…

So since March 2020, 892,738 Bitcoin have been withdrawn from exchanges and moved into long-term storage.

That is insane.

Clearly a growing trend towards self-custody (the smart play).

Just what you want to see heading into two MASSIVE catalysts… 😎

(ETF approval & Halving)

CRACKING CRYPTO 🥜

Bitcoin ETF decision may be ‘imminent’ as VanEck, Grayscale file exchange registration form: Bloomberg Analyst. Three hopeful ETF candidates, Grayscale and Fidelity, and VanEck have now filed their form 8-A with the U.S.

South Korea proposes ban on credit card payments for cryptocurrencies. South Korea’s Financial Services Commission wants to ban local citizens from purchasing cryptocurrencies with credit cards.

SEC wants court to consider Terraform ruling in Binance case. The SEC, in a Wednesday filing, said the recent Terraform ruling is relevant in its case against Binance.

Bitcoin ETFs Could Spark Huge BTC Trading. The Market Appears Up to the Task. Market makers, like trading firm DRW, have been preparing for months to be able to provide the necessary liquidity to ensure sufficient liquidity should the SEC approve bitcoin exchange-traded funds in the U.S.

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

Sponsored

Market Twists & Turns

Market Twists & Turns: Buy and Sell Opportunities You Can’t Afford to Miss

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

How often is Bitcoin's mining difficulty adjusted?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) Every two weeks 🥳

Bitcoin’s mining difficulty is automatically adjusted roughly every two weeks in order to keep the total block time at 10 minutes.

GET IN FRONT OF 34,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.