GM to all 11,118 of you. Crypto Nutshell checkin’ in. 🥜🫡

The crypto newsletter that's as thrilling as a team of archaeologists searching for ancient artifacts... 🏺🌍

Today, we’ll be going over:

🧑🔬 The Bitcoin lab leak hypothesis

😱 Why you should stay optimistic on BTC

📈 Accumulation continues

💰 And more…

MARKET WATCH ⚖️

Only the top 20 coins measured by market cap feature in this section

THE BITCOIN LAB LEAK HYPOTHESIS 🤔

Have you heard of the theory that the National Security Agency (NSA) created Bitcoin? 🤔

This tweet revived the old theory after screenshots were posted of a 1996 report titled “How to Make A Mint: The Cryptography of Anonymous Electronic Cash”

This research paper is one of the first known discussions on a Bitcoin like system which would allow users to make anonymous payments…

Footer notes in the report state “prepared by NSA employees” and sources include cryptography expert Tatsuaki Okamoto… sounds awfully similar to Satoshi Nakamoto (identity behind Bitcoin)…

Twitter user Nic Carter recently added to this theory stating:

“I call it the ‘Bitcoin lab leak hypothesis.’ I think it was a shuttered internal R&D project, which one researcher thought was too good to lay fallow on the shelf and chose to secretly release…In my version of this made-up idea, the researcher did it without permission of the NSA and chose to leave the coins behind so as to preserve his anonymity.”

Many people believe that the US government was secretly behind the creation of Bitcoin, but Raoul Pal believes they had a little help…

“I think the U.S. government and the U.K. government invented it... which is the NSA and the GCHQ in the U.K., who are the two world centers of cryptography.”

Now this theory may well be true but we have no concrete evidence to back it up just yet…

Nobody knows who’s truly behind Bitcoin. It’s fun to speculate but in reality we may never know who Satoshi Nakamoto really is / was. 😥

TOGETHER WITH NEVER NOT WEALTHY 🤑

Do you want to get rich?

Let’s be real for a second.

If you’re interested in Bitcoin or crypto, there’s a good chance you want to be wealthy.

We do too.

Money doesn’t buy happiness… but it can set you free. (we’d argue that freedom is a pre-requisite to happiness, but that’s for another day)

That’s where Never Not Wealthy comes in. They’re a quick, 3-min weekly read that sends you:

Science based productivity tips to get more stuff done 🧪

Personal development hacks like how to improve your sleep 😴

How to find & align your life to your purpose 🌄

All with one goal: To make you more wealthy.

As always, they’re completely free.

Destroy that subscribe button and it’ll automatically add you to their list.

Future you will thank you. ❤️

US DEBT IS OUT OF CONTROL 😱

With Bitcoin being down ~70% from its 2021 highs, it’s sometimes hard to remain optimistic about crypto.

If you’re feeling down, today’s expert, Will Clemente, broke down exactly why you should remain optimistic.

Here’s his analysis in a nutshell:

In the 15 years since the 2008 financial crisis, U.S debt has increased from 60% of GDP to 120% of GDP. 😲

There’s two reasons why this trend will inevitably continue:

Political incentives to be liked & elected. Meaning no elected presidents will prioritise reducing debt.

Baby boomers are starting to retire. Social security programs must be supported by younger generations. This puts pressure on more spending.

the trend is pretty clear to see…

So debt is out of control, growing faster than the economy.

Which leaves the question: How will the U.S ever service it’s debt?

There’s only one answer: monetary debasement.

The U.S is the global reserve currency, so they can just print more money to pay back their debt. It’s like a magic trick: pay back the debt in nominal terms, but not in real terms. The money is worth less than when it was created. 🪄

Problem solved - right?!

One problem.... this erodes away at everyone’s quality of life as prices rise. House prices go up, grocery bills increase and you end up feeling poorer & poorer each year.

According to Pew Research, public trust in government is close to record lows. It’s down from 79% in 1960 to only 16% today. 🤯

So here’s the situation:

Inevitable monetary debasement 💸

Falling quality of life 📉

Public trust in government at record lows 🏦

Combine them and what do you get?

A large part of the population feels left behind & dissatisfied. This leads to dissatisfaction of the current system & the seeking of alternatives.

The most successful & decentralized alternative monetary system right now?

Bitcoin. 😎

Bottom Line: On a long enough time horizon, all trends point towards Bitcoin going up. Ignore any short term noise & fluctuations.

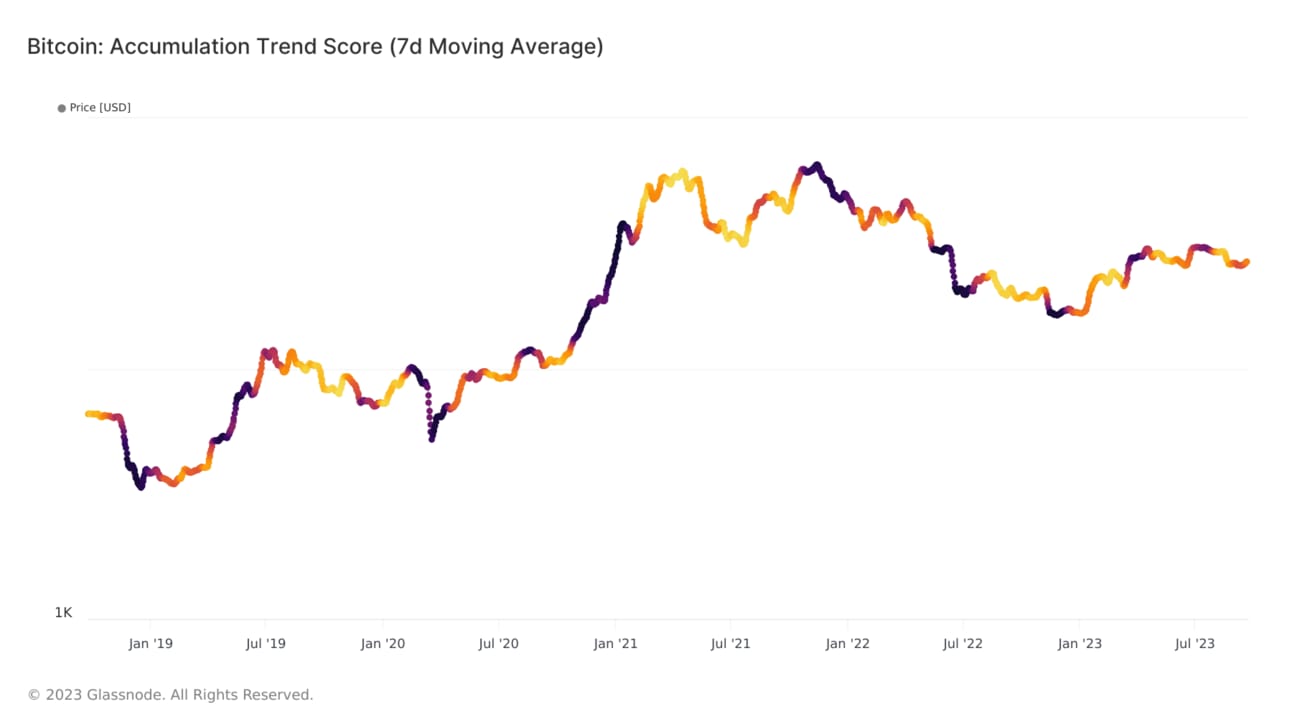

ACCUMULATION CONTINUES 📈

Today we’ll be looking at the Bitcoin Accumulation Trend Score. This metric tracks all the different wallets on chain excluding exchanges and miners and determines whether they have increased or decreased their holdings.

We like it as it’s a quick visual cue for current market sentiment.

Purple zones: lots of investors are increasing their holdings

Yellow zones: lots of investors are decreasing their holdings

You’ll notice that purple zones appear at every market bottom. People heavily acquire coins on these dips and this is how market floors are created.

People also FOMO in as seen by heavy accumulation on the way to market tops.

2023 started with a period of heavy accumulation which put in the market floor of ~$16,000.

Since then the price has been trading sideways and accumulation has been hovering around the middle zone (orange).

Interestingly during this accumulation period we saw small blips of purple as the price was approaching $31,000. This just goes to show that even HODLers still experience some levels of FOMO, as investor greed kicked in (yesterday we broke down why we’re in a HODLer driven market).

Bottom line: Right now we’re right in the middle of the accumulation trend score. This can only last so long as long-term, high conviction holders own more & more of the supply. ⏰

CRACKING CRYPTO 🥜

WHAT WE’RE READING? ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

Sponsored

The Next Big Rush

⛏ Let's Explore the Wealth Beneath the Surface!

CAN YOU CRACK THIS NUT? ✍️

Who wrote Ethereum's whitepaper?

A) Vitalik Buterin

B) Satoshi Nakamoto

C) Michael Saylor

D) Charles Hoskinson

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) Vitalik Buterin 🥳

Vitalik Buterin published the Ethereum whitepaper in 2014 before Ethereum’s launch in 2015.

GET IN FRONT OF 11,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.