GM. Crypto Nutshell comin’ at ya! 🫶 🥜

We’re the crypto newsletter more gripping than being stuck in a realm where winter lasts for years... ❄️🐺

Today, we’ll discuss:

Hong Kong to become global crypto hub 🌎

Bitcoin ETF conspiracy theory 🕵♂️

Exchanges are bleeding Bitcoin 🩸

And more…

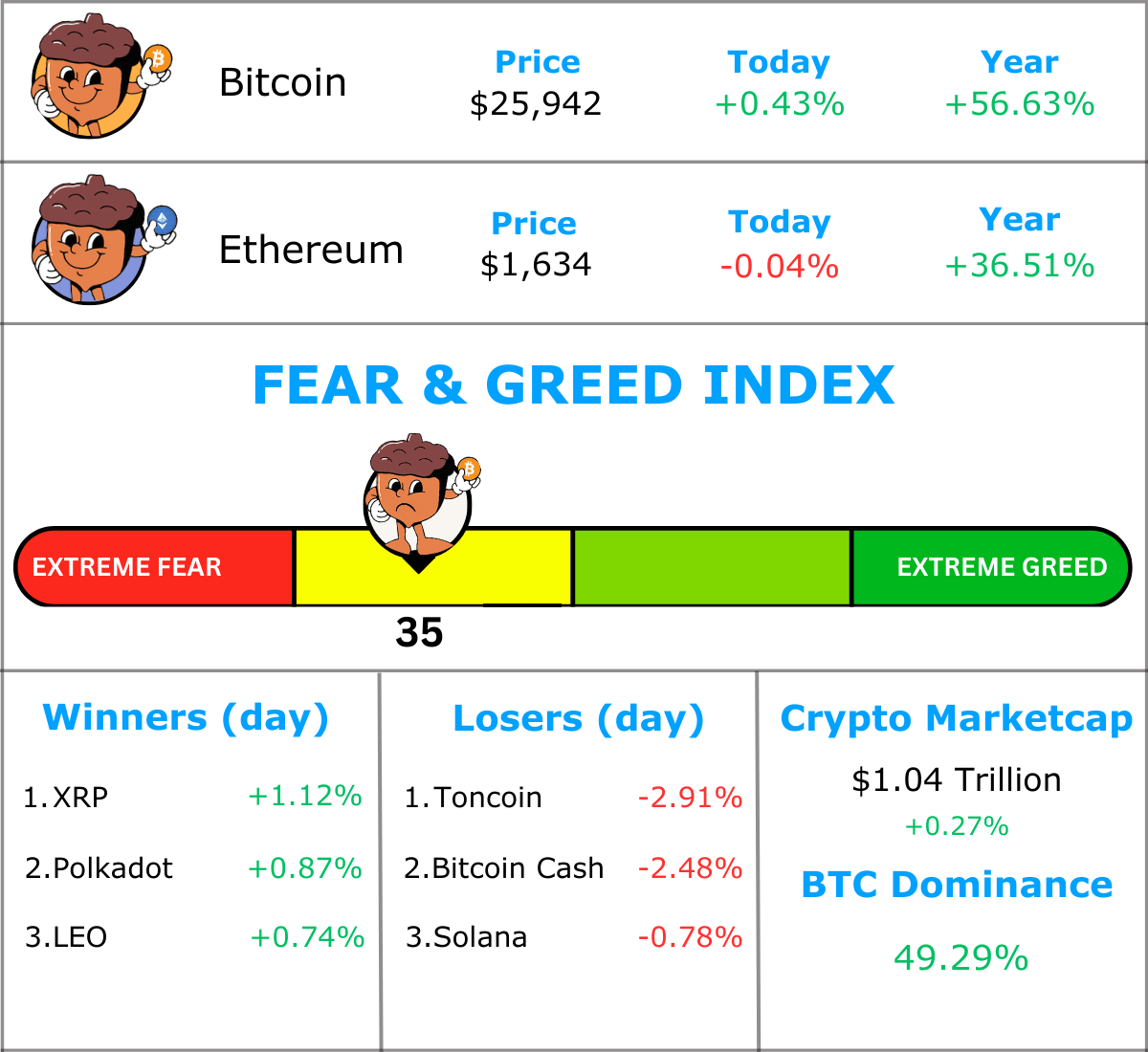

MARKET WATCH ⚖️

Prices as at 8:10am ET

Only the top 20 coins measured by market cap feature in this section

HONG KONG GLOBAL CRYPTO HUB 🌎

JUST IN: China court declares virtual assets legal properties protected by law

A top court in China just released a report declaring crypto as “legal property and protected by law”.

“Virtual currency is not classified as an illegal item. Therefore, under the current legal policy framework, the virtual currency held by relevant entities in our country is still legal property and protected by law,"

This is BIG news. Back in 2021 China cracked down on crypto, banning all crypto companies and Bitcoin miners. Is China flipping on this decision?

There’s growing speculation that Hong Kong is set to become a global crypto hub. Not long ago licences were issued to HashKey and OSL to offer crypto trading to the public. 👀

"Hong Kong is clearly looking to establish itself as a very significant center for digital assets markets and stablecoins and we are paying very close attention to that," says Jeremy Allaire who oversees the $28 billion USDC stablecoin.

Another case of governments vs Bitcoin. Seems to be the common theme for this year.

One thing is clear - Bitcoin is winning all over the globe.

For the full article click here.

EXPERT OF THE DAY 💰

Mark Yusko believes that BlackRock is playing the oldest trick in the book. 🪄

If you don’t know Yusko, he’s the CEO & Founder of Morgan Creek Capital. They have over a billion dollars under management. (He knows his stuff)

In his latest interview, Yusko pointed something out.

The fiasco of a futures ETF being approved before a spot ETF? We’ve seen it all before. 🧐

The price of gold was dead flat up until November 2004. Then a spot gold ETF was listed and the price of gold increased by ~400% in 12 years.

Yusko believes it’s no coincidence that the price of gold was dead flat for decades up until November 2004. The futures ETF was used to manipulate and suppress the price of gold.

“This is the oldest trick in the book. When George Soros used to want to buy copper, he didn't go out and start buying copper. He went short copper and he spread rumours that copper was the worst thing in the world to push the price down. Then he would go buy a lot of it. That's how it works. People have been doing that forever.”

Now the same thing is happening with Bitcoin. Mark believes it’s no coincidence that the exact peak of BTC in the last cycle was the exact same day a futures ETF was approved.

Here’s what’s Mark believes is going on: Big institutions like BlackRock are shorting an asset and suppressing it's price as much as they can. Then they accumulate at low prices.

This can’t last forever.

Mark’s advice? Don’t be fooled. If you sell, you just fell for the oldest trick in the book. 🤦♂️

Nutty’s takeaway: Whether you believe Yusko’s theory or not, one thing is true. We have seen this playbook done again and again throughout history. Let us know what you think in today’s poll at the bottom of today’s newsletter 👇

ON CHAIN DATA DIVE 📊

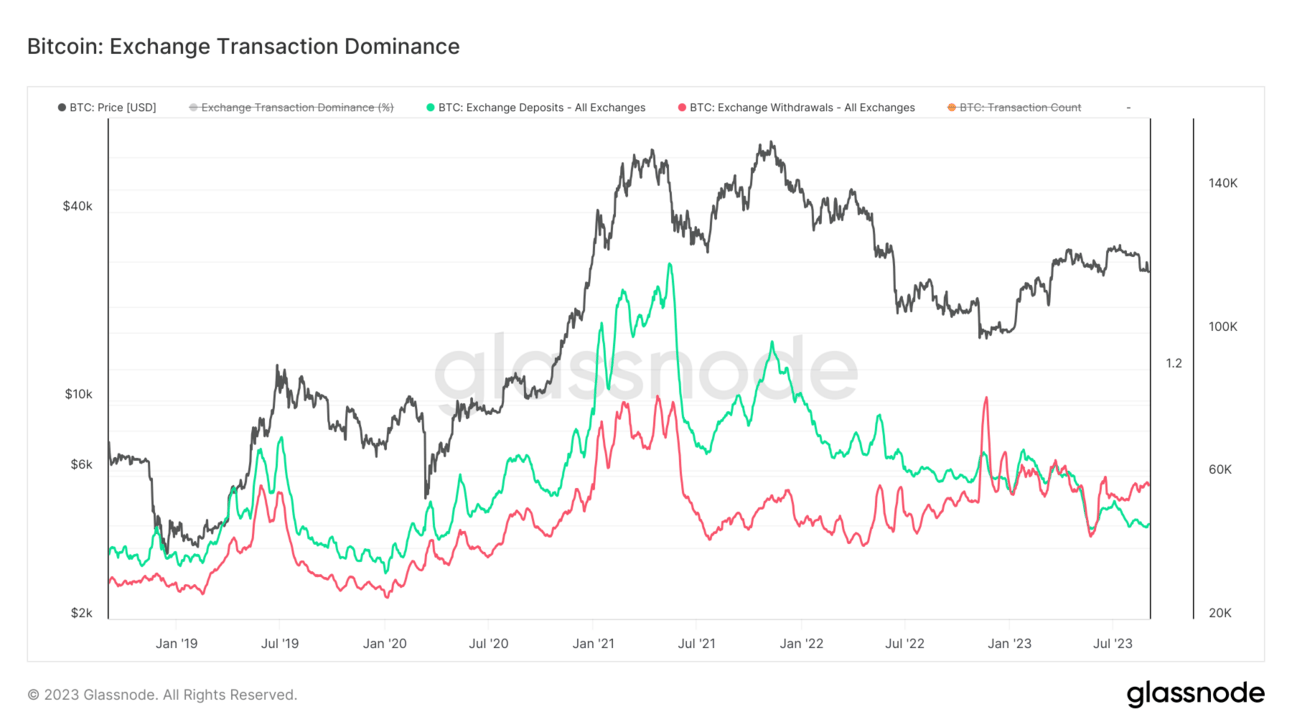

Bitcoin Exchange Transaction Dominance

This chart is super simple to understand but provides us with some powerful insights. It simply tracks the total amount of Bitcoin being deposited onto exchanges and the total amount of Bitcoin being withdrawn from exchanges.

Exchange withdrawals 🔴 have surpassed deposits 🟢 for 3 consecutive months. The first time in Bitcoin's history. Wow. Today these numbers are at:

Withdrawals: ~57,619 Bitcoin

Deposits: ~46,568 Bitcoin

Takeaway: what does all of this mean? lets break it down:

Investors are deciding to hodl their coins rather than trading or selling

Less trust in crypto exchanges, bitcoin being moved to cold storage

Reduced selling pressure on market as less and less Bitcoin is available for sale

Increased amount of long-term holders (more on this in the next chart)

All things considered this is a bullish indicator for Bitcoin in the long-term. 🐂

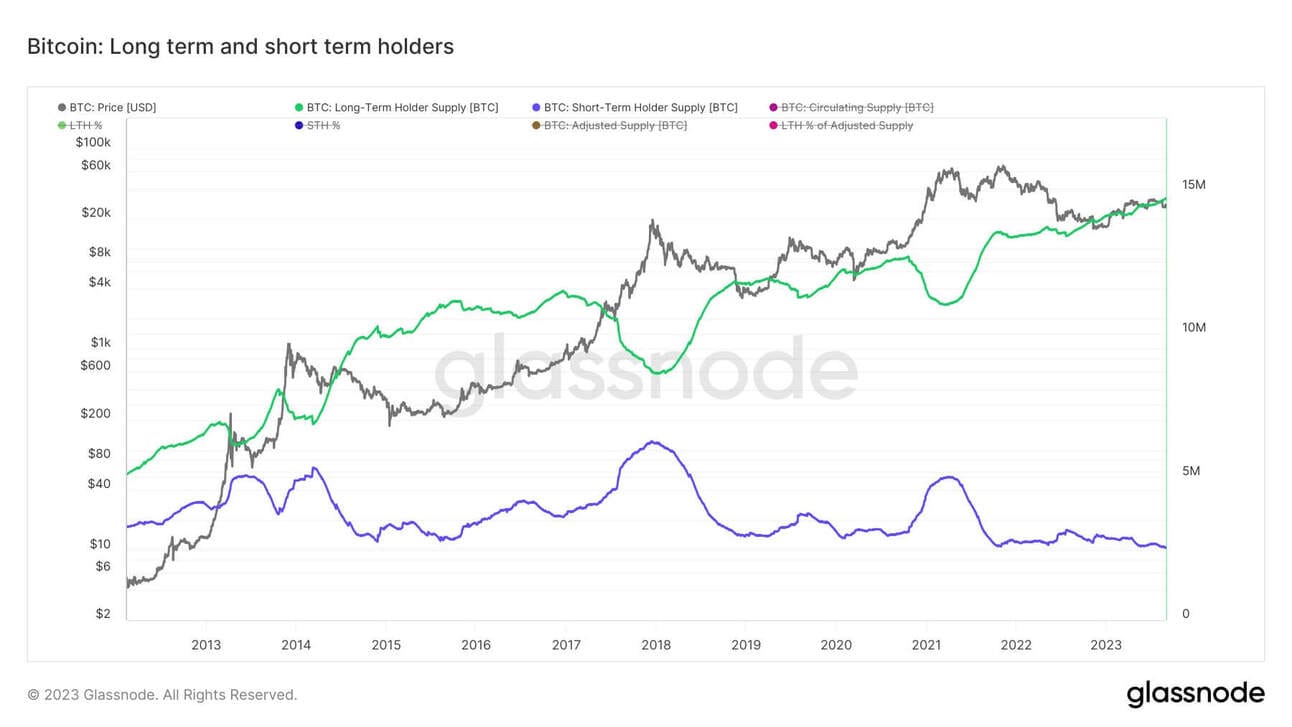

Bitcoin: Realized HODL Ratio

The chart below shows us the amount of Bitcoin held by long and short term holders. Short-term holders become long-term holders when they’ve held their coins for longer than 155 days.

Interestingly these metrics can be used to identify market tops and bottoms. When Bitcoin reaches a new high, the amount of long-term holders begins to decrease and the amount of short-term holders rockets up.

Takeaway: The supply held by long-term holders continues to reach all time highs while the short-term supply continues to dip to new lows. Gradual accumulation by long-term holders has often been a bearish indicator.

BUT… this is normal. Long periods of accumulation have always preceded massive upwards price movements. Just take a look at the chart below. It happens every cycle. 🚀

WHAT WE’RE READING 📚

Want to get even smarter in Crypto before the bull run? Subscribe to deez

p.s. all completely free

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

Sponsored

Black Swan Street

A Weekly Newsletter That Provides A Sobering Look Into Capital Markets & Economic Trends. Stay Informed Without The Noise.

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

In September 2021, which Central American country became the first nation in the world to make bitcoin legal tender?

A) Costa Rica

B) Honduras

C) Panama

D) El Savador

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) El Savador 🥳

Laszlo Hanyecz, a programmer and early Bitcoin miner, bought the pizza for 10,000 BTC. This would have been worth $690 million at Bitcoin’s all time high.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.