GM to all of you nutcases. It’s Crypto Nutshell #762 cleanin’ up mess… 🧤🥜

We’re the crypto newsletter that’s more intense than a soldier reliving the same battle until he learns how to win… ⚔️🔁

What we’ve cooked up for you today…

📉 Tether downgraded

🚢 The bottom is in

🔒 Locked up

💰 And more…

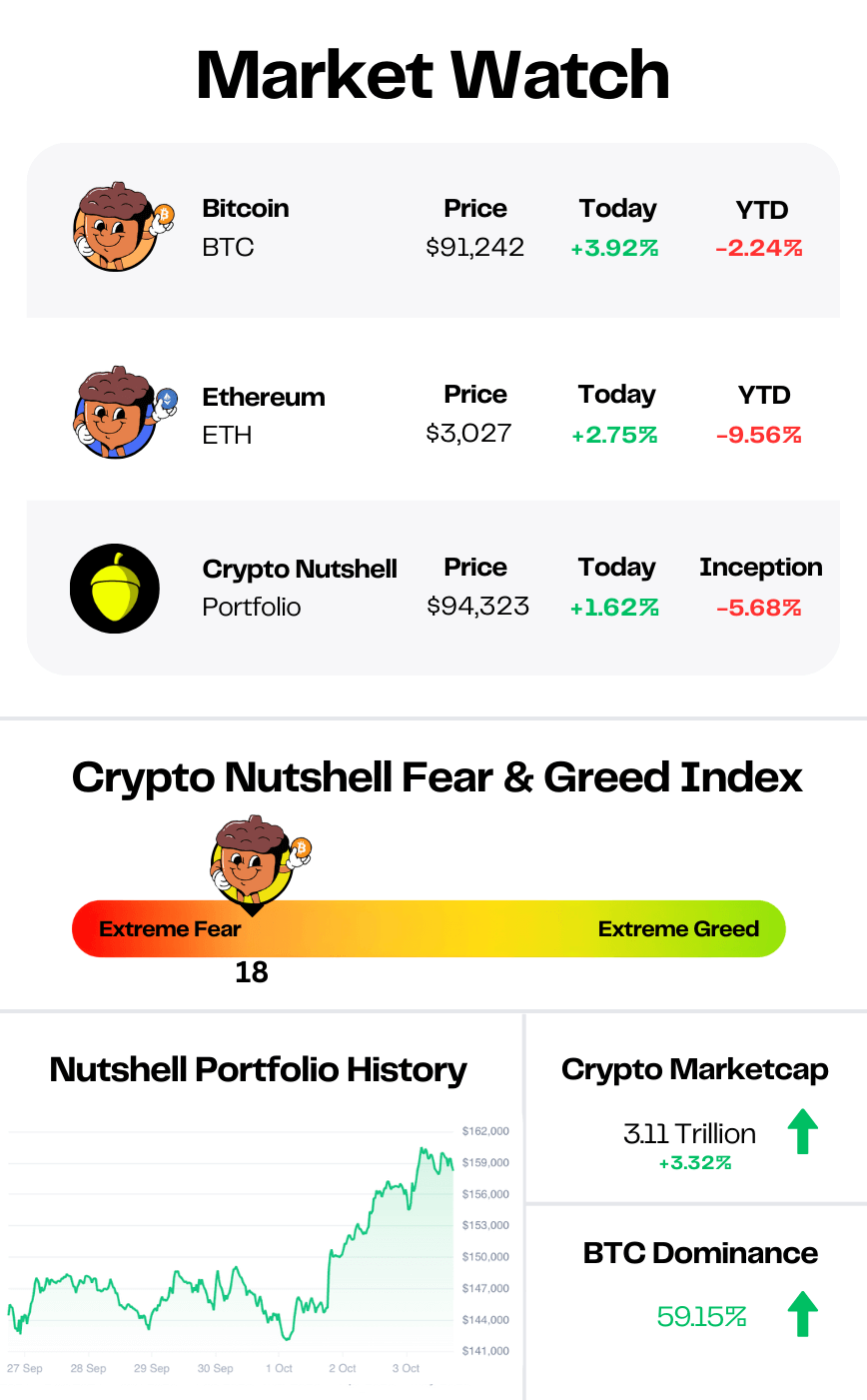

Prices as at 2:00am ET

TETHER DOWNGRADED 📉

BREAKING: Tether’s USDT stability score cut to 'weak' level as S&P says reserves can’t absorb bitcoin drop

Here comes the Tether FUD again.

S&P Global Ratings has cut Tether’s USDT to the lowest score on its stability scale.

They now call its dollar peg “weak” and say the reserves are taking on more risk than before.

Here is what they are worried about:

More risk than buffer

Bitcoin now makes up about 5.6% of the assets backing USDT.

Tether’s own report shows about 3.9% extra reserves as a cushion.

S&P’s point is simple: if Bitcoin and other risky assets drop at the same time, USDT could become undercollateralized. In plain English, there might not be enough safe assets to fully back every token.

Higher-risk reserve mix

About 24% of total reserves are now in bitcoin, gold, loans, corporate bonds and other volatile assets. A year ago, that number was 17%.

The rest is mostly short term US Treasuries and cash-like assets, which S&P still sees as low risk.

Disclosure and structure gaps

S&P also flags how Tether is set up.

They say there is still no full audit, no detailed proof-of-reserves breakdown, and not enough clarity on which banks and custodians are holding the assets.

Tether is regulated in El Salvador under CNAD, which S&P says has looser reserve rules than the new US stablecoin laws.

As you’d expect, Tether is pushing back hard

CEO Paolo Ardoino called the report “misleading” and said old-school rating models do not understand “digitally native money.”

He also points to the scale of Tether’s balance sheet:

Tether holds over $112B in US Treasuries, making it the 17th-largest holder in the world.

It has accumulated 116 tons of gold, on top of its dollar assets.

USDT has maintained its peg through banking crises, exchange failures and multiple crypto drawdowns, and Tether says it has “never refused a redemption request from a verified user.”

So the picture is split:

On one side, S&P sees a key dollar rail for crypto that is taking more risk and does not have the same protections as a regulated money market fund.

On the other side, Tether now looks a lot like a shadow central bank for crypto: huge Treasury and gold holdings, big profits, and a stablecoin that still dominates the market.

Both views can be true at the same time.

The risk profile is rising. The system is also bigger and more important than ever.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

THE BOTTOM IS IN 🚢

For the last month, crypto has been chaos.

Bitcoin nuked ⚠️

Ethereum flushed 💧

MicroStrategy cratered 65% in 3 months 📉

But Tom Lee just went on CNBC - and delivered what the host literally called one of the most important interviews of the year:

“This is one of, if not the most important interviews I’ve done this year, and that’s respectfully to every other guest we’ve had on this fine network and fine show.”

And Tom Lee delivered.

He thinks we’re basically at the bottom.

Here’s his exact line:

“That’s the low and Ethereum bottoms at 2500. The recovery from there to all-time highs will be faster than the decline.”

Why?

Because every crypto crash ends the same way:

panic sellers puke

forced sellers get cleared

patient buyers wait

then price rockets back

And the real tell? MicroStrategy.

Lee says Strategy (formerly MicroStrategy) is the most important chart in crypto:

“MicroStrategy is probably the most important stock to watch right now because that is the Bitcoin proxy.”

He explains the entire selloff has been amplified by hedging behavior:

“When in the crypto world, when they're trying to hedge their longs in Bitcoin and Ethereum, they can't find any other way to hedge it except shorting the liquid stocks that are the proxy. So that's the MicroStrategy.”

But here’s where it gets interesting:

“Actually, MicroStrategy at this level here probably is when you want to ratchet into the longs.”

And on Bitcoin itself:

“Bitcoin maybe just a few thousand dollars lower. I think we're there. We might be at the bottom for Strategy.”

The takeaway:

Tom Lee rarely panics - and never without reason.

If this is the interview he’s openly saying Bitcoin and Strategy are bottoming…

You might want to listen.

He’s seen every cycle.

He’s watched every forced seller get wiped out.

And he’s telling you the rebound will be faster than the decline.

According to Tom, the bottom is close - maybe already in. 🚀

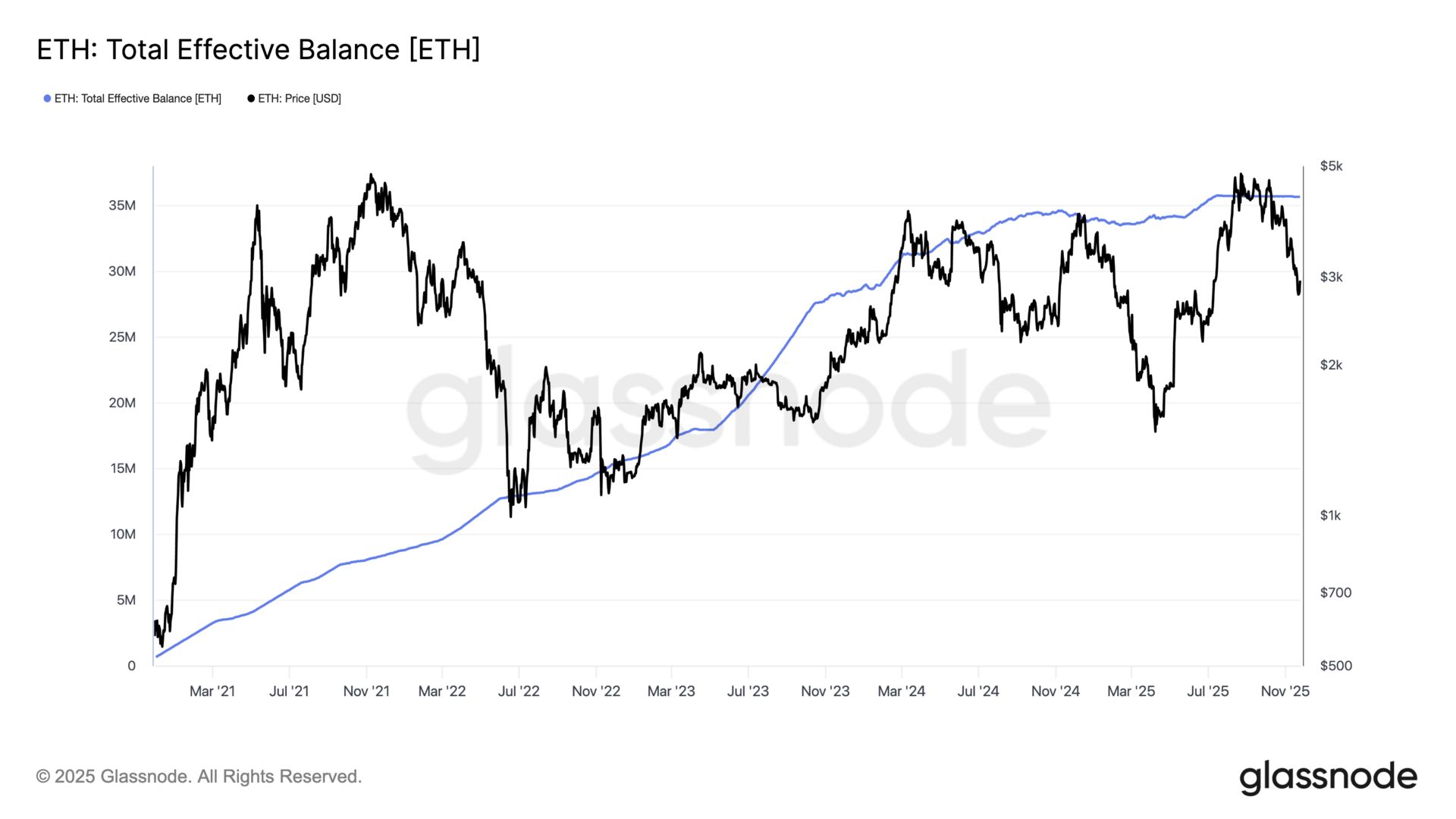

LOCKED UP 🔒

Time for check in on Ethereum’s supply side dynamics.

To do that we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

35.68 million ETH is now staked, up another 1.68 million ETH this year alone.

That is 29.41% of the entire supply, almost one third of Ethereum effectively pulled out of day-to-day circulation.

This is not a side statistic. It is a slow, grinding supply squeeze.

Week after week, more ETH disappears into staking contracts while the liquid float shrinks.

When real demand eventually slams into that kind of scarcity…

ETH does not just drift higher. It explodes. 🚀

CRACKING CRYPTO 🥜

Why Wall Street is blocking Strategy’s S&P 500 entry — even with its $56B Bitcoin empire. Strategy reshapes its corporate identity with Bitcoin-led ambitions, balancing asset coverage and equity volatility.

Crypto Bottoming Signs? FT Drops Trifecta of Bitcoin Gloom on Wednesday. As British taxes have been hiked once again, the U.K.-based publication took a victory lap on bitcoin's recent struggles.

CryptoQuant says big bitcoin holders increased deposits to exchanges as prices fell. The firm noted that exchange activity in ETH and altcoins also remained elevated, putting further downward pressure on prices.

Bolivia to integrate crypto, stablecoins into the financial system. The government of Bolivia wants to integrate crypto into the financial system to modernize the country's payments system and economy.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What makes Solana’s Proof of History mechanism unique?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: It timestamps events to speed up ordering of transactions 🥳

Proof of History creates a cryptographic timeline, helping Solana achieve extremely high throughput. ⚡

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.