Today’s edition is brought to you by Coinbase - the easiest way to purchase crypto.

GM to all of you nutcases. It’s Crypto Nutshell #789 dodgin’ fireworks… 🎆🥜

We’re the crypto newsletter that’s more volatile than a trade that turns disaster into genius in seconds… 📉💥

What we’ve cooked up for you today…

🏦 The new playbook

🎯 The contrarian bet

📈 Ageing up

💰 And more…

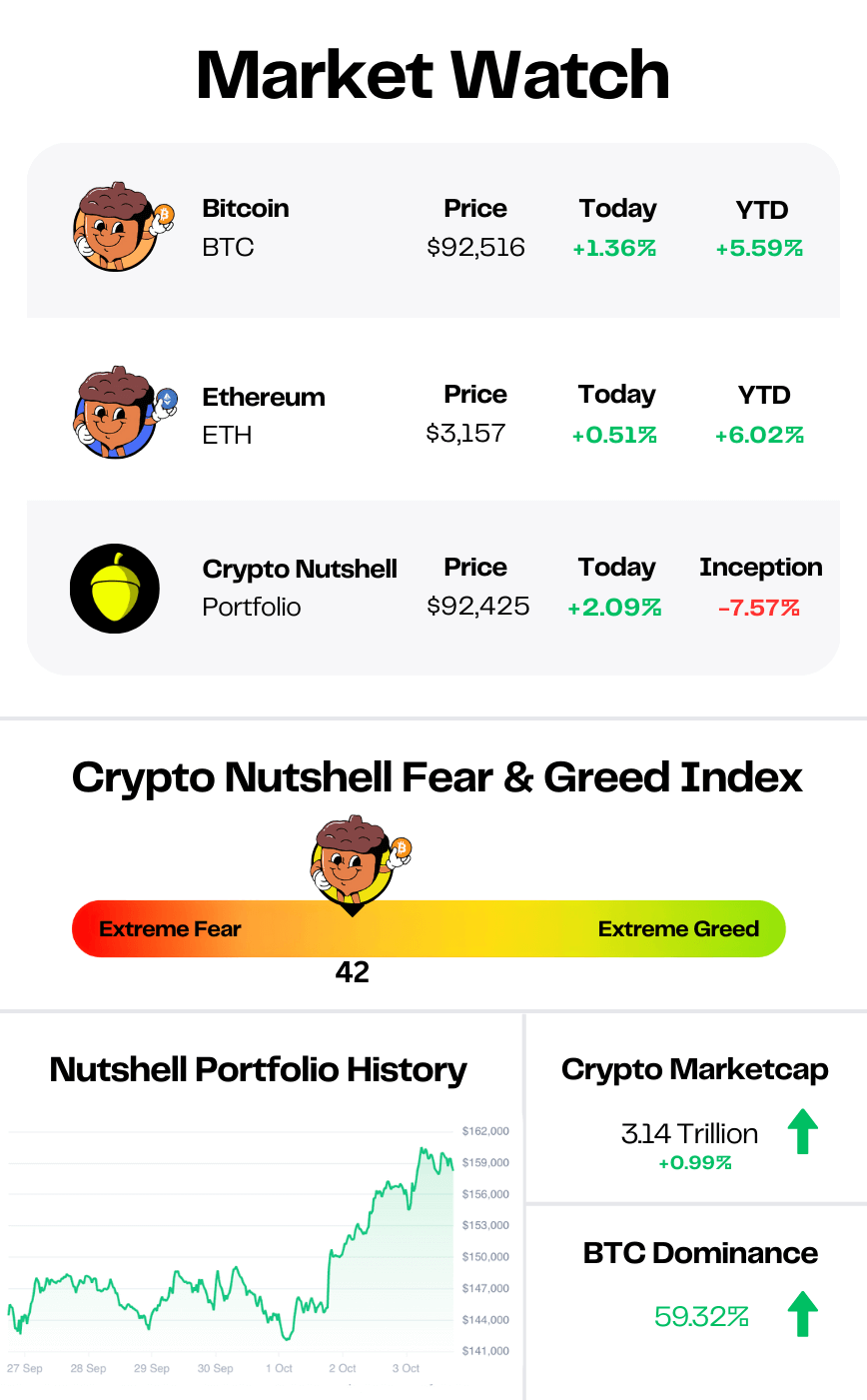

Prices as at 2:05am ET

THE NEW PLAYBOOK 🏦

BREAKING: BitMine stakes $259M more ETH, pushing validator entry queue near 1M Ether

BitMine just staked another 82,560 ETH - worth roughly $260 million.

That brings BitMine's total staked ETH to 544,064 - valued at approximately $1.62 billion.

And it's creating congestion…

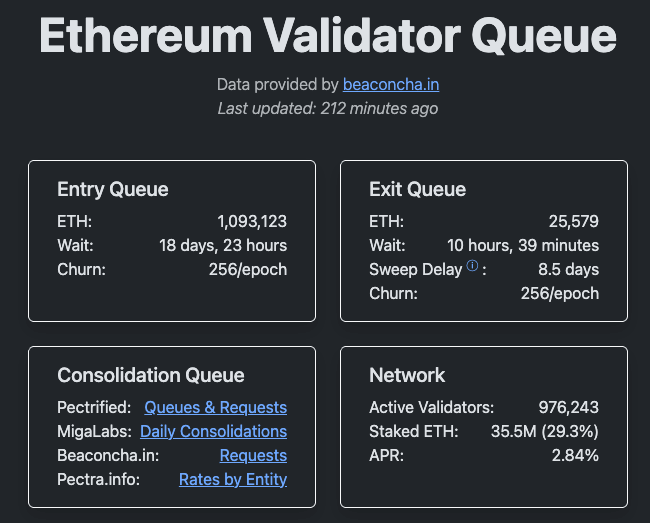

Ethereum's validator entry queue has climbed to roughly 1.09 million ETH, with an estimated wait time of nearly 19 days for new validators to become active.

Exit activity remains light by comparison - with 25,579 ETH waiting to withdraw.

BitMine started staking on December 26, depositing $219 million worth of ETH into staking contracts. The company plans to expand through its Made-in-America Validator Network (MAVAN), launching in Q1 2026.

Why this matters

More than 35.5 million ETH - roughly 29% of total supply - is now staked. The annualized staking yield sits near 2.54%.

The last time Ethereum's entry and exit queues flipped was June. ETH doubled in price shortly after.

The share expansion push

Meanwhile, BitMine chairman Tom Lee is urging shareholders to approve a massive share count increase to 50 billion.

His argument: if ETH hits $250,000 - which he models as possible if Bitcoin reaches $1 million - BitMine's share price would become too expensive for most retail investors without stock splits.

The proposed expansion would give BitMine flexibility to split shares and maintain accessibility.

The setup

BitMine holds over 4 million ETH total. Now it's aggressively staking that treasury for yield.

The validator queue is building. Supply continues tightening. Nearly 30% of ETH is locked in staking.

And institutional demand for yield isn't slowing. 🚀

CRYPTO MADE SIMPLE 🤑

Buying crypto can be easy.

Knowing which exchange to trust? That’s where it gets complicated.

That’s why over 100 million users have started their journey with Coinbase - the most recognised crypto exchange in the U.S.

Here’s what makes Coinbase stand out:

A beginner-friendly platform with a clean interface, helpful tips, and easy access to 250+ cryptocurrencies 💰

Coinbase Advanced for pro-level trading tools - no separate account needed 📈

Staking made simple: earn rewards on ETH, SOL, ADA, and more, all without leaving the app 🥩

You’ll also get access to learning rewards (yes, free crypto), recurring buys, and a sleek mobile app - all backed by a publicly traded company with transparent financials and industry-leading security.

Whether you’re stacking Bitcoin weekly or diving into deep altcoin research…

THE CONTRARIAN BET - NEW HIGHS IN 2026 🎯

Most people think 2026 is supposed to be a down year.

Tom Lee is betting big on the opposite.

In his latest CNBC interview, Lee laid out why he thinks new all-time highs come early in 2026, not later - and why the macro setup for crypto has flipped bullish.

Tom Lee on CNBC

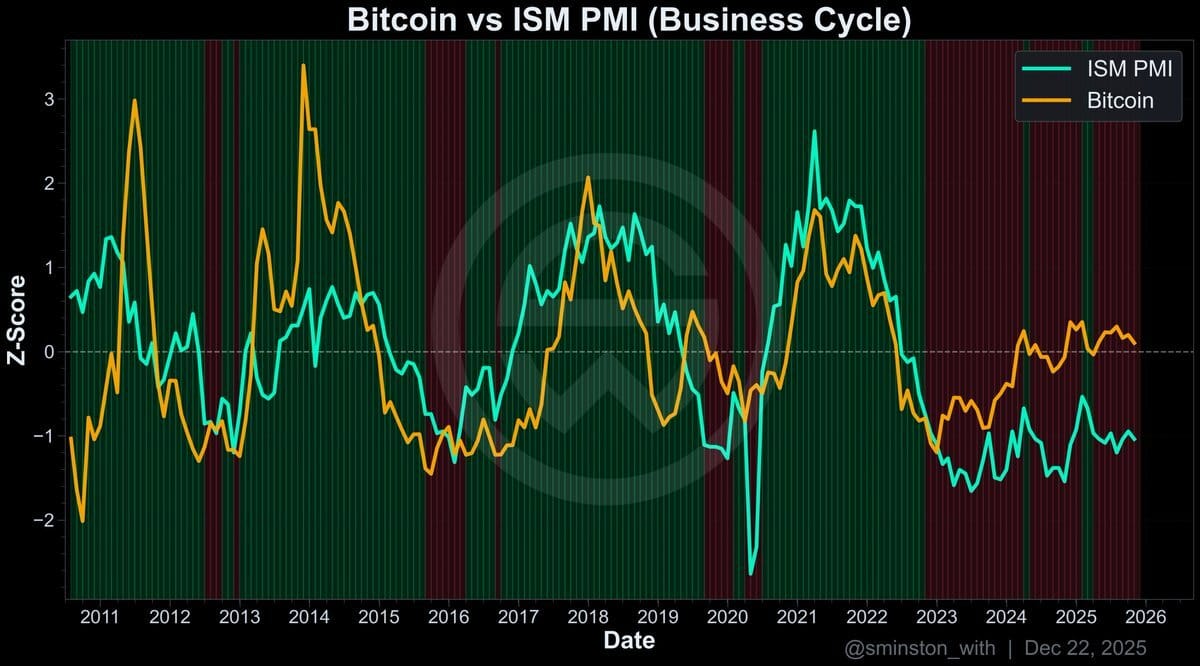

Tom Lee’s bet entirely revolves around the business cycle:

“Crypto prices are really sensitive to the ISM.”

The ISM is a manufacturing index that tells you whether the economy is expanding or contracting.

Below 50 is contraction. Above 50 is expansion.

Here’s the key part:

“ISM moving back above 50 has historically been associated with super-cycle moves in Bitcoin and Ethereum.”

Right now, the ISM has been below 50 for more than 3 years - one of the longest stretches on record.

That’s why we got muted crypto prices in 2025. You can see how close Bitcoin tracks the ISM here:

Watch for the ISM to move higher in 2026

Lee’s view is that this is about to change.

A new Fed.

Potential banking deregulation.

An economy moving from contraction back into expansion.

And when that flip happens, Lee says crypto reacts fast.

“Bitcoin acts a lot more like it’s sensitive to monetary policy and the business cycle… and both are about to turn up.”

That’s why he directly pushes back on the idea that the four-year cycle means 2026 has to be weak.

“Anybody who thinks the Bitcoin four-year cycle means crypto prices are down next year - we’re betting against that.”

That’s the contrarian bet.

If the economy moves back into expansion and liquidity improves, Bitcoin and Ethereum won’t wait around for some pre-ordained cycle.

They’ll move. Fast.

And if Lee’s right, new highs come earlier than most people are positioned for. 🎯

AGEING UP📈

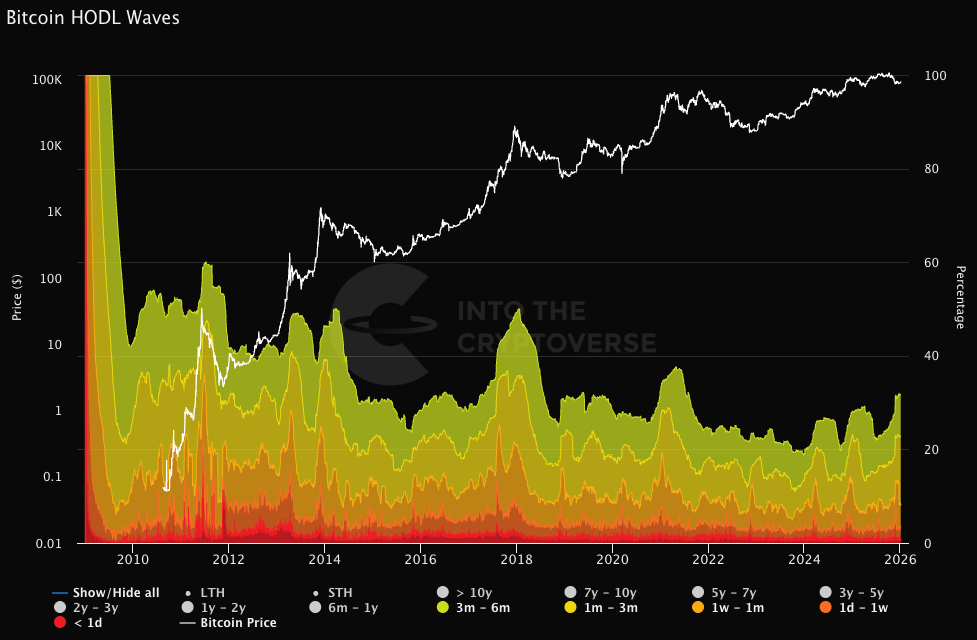

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The warmer the colour, the younger the coins - with red showing Bitcoin that has been held for less than one day.

Today, we’re focusing on short-term holders (STHs) - defined as coins held for less than six months.

Here’s how the Bitcoin supply breakdown looks today:

<1 day: 0.49% (down from 1.63%)

1d - 1w: 3.02% (up from 1.76%)

1w - 1m: 4.71% (down from 10.80%)

1m - 3m: 14.45% (up from 11.37%)

3m -6m: 9.10% (down from 9.52%)

TL;DR: 31.77% of all Bitcoin is in the hands of short-term holders. 🔒

That's down from 35.08% two weeks ago.

The youngest cohort (<1 day) dropped sharply as fresh buying slowed. The 1 day to 1 week band expanded as those coins aged out.

The big move? The 1 week to 1 month band collapsed from 10.80% to 4.71%.

But not all of those coins hit exchanges - they aged into the 1-3 month range, which jumped over 3 percentage points.

Translation: recent buyers are holding.

Short-term holders are still more sensitive to headlines, more prone to panic on volatility.

But the overall share is contracting, not expanding.

As long as the long-term base stays dominant - and it does at 68% - this isn't a structural problem.

If these coins survive the chop and age into the 6+ month bands, this will look like what it usually is: a transfer from weak hands to patient ones. 💎

CRACKING CRYPTO 🥜

Hundreds of MetaMask wallets drained: What to check before you 'update'. ZachXBT tracked $107,000 drained from hundreds of wallets through fake MetaMask emails.

Bitcoin And Ether ETFs Pull In $646M Inflows On First Trading Day Of 2026. US spot Bitcoin and Ether ETFs kicked off the new year with strong net inflows of $471.3 million and $174.5 million, respectively.

Neobanks will fuel Ethereum's 2026 growth, says ether.fi CEO. Ethereum's next phase will be defined by financial products that feel familiar to everyday users, Mike Silagadze said.

Top crypto VCs share 2026 funding and token sales outlook. Crypto VCs told The Block they expect disciplined activity to persist in 2026, with a higher bar for new investments.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What's the closest Ethereum has ever come to flipping Bitcoin by market cap?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Around 85% 🥳

In May 2017, Ethereum's market cap reached roughly 85% of Bitcoin's, getting close to "The Flippening." ETH was around $400 while BTC sat near $2,800.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.