GM to all of you nutcases. It’s Crypto Nutshell #759 puttin’ out flames… 🧯🥜

We’re the crypto newsletter that’s more explosive than a cop trapped in a skyscraper full of terrorists on Christmas Eve… 🎄💣

What we’ve cooked up for you today…

🏦 Bitcoin vs TradFi

🍦 Who’s buying the dip?

💪 Holding on

💰 And more…

Prices as at 3:40am ET

BITCOIN VS TRADFI 🏦

BREAKING: Strategy's $55 Billion Bitcoin Bet Undeterred by Index Delisting Concerns, Says Michael Saylor

Over the weekend we got an interesting development around Digital Asset Treasury (DAT) companies.

And at the center of it all is Strategy.

MSCI is consulting on whether to kick out digital asset treasuries whose balance sheets are more than 50% crypto, or whose capital raising is mainly used to buy Bitcoin and other coins.

That puts names like Strategy, Metaplanet and several miners directly in the crosshairs.

If MSCI goes ahead, every fund that tracks those indices would have to sell.

JPMorgan estimates Strategy alone could see $2.8B in outflows from MSCI related products.

If other index providers follow, they put the total risk closer to $11.6B.

That is why Strategy’s share price has been smashed harder than Bitcoin.

MSTR is down over 40% in a month, trading near a 13 month low.

Its market cap has slipped below the value of its Bitcoin stack, making new equity raises more painful.

Bitcoin is down heavily too, but the stock has clearly underperformed the asset it holds.

And the backlash from the Bitcoin community has been fierce.

Bitcoin maxis and Strategy supporters are now pushing a “boycott JPMorgan” narrative, blaming the bank for amplifying the MSCI risk.

High profile voices like Grant Cardone and Max Keiser are telling followers to pull deposits from JP Morgan and buy BTC and Strategy instead.

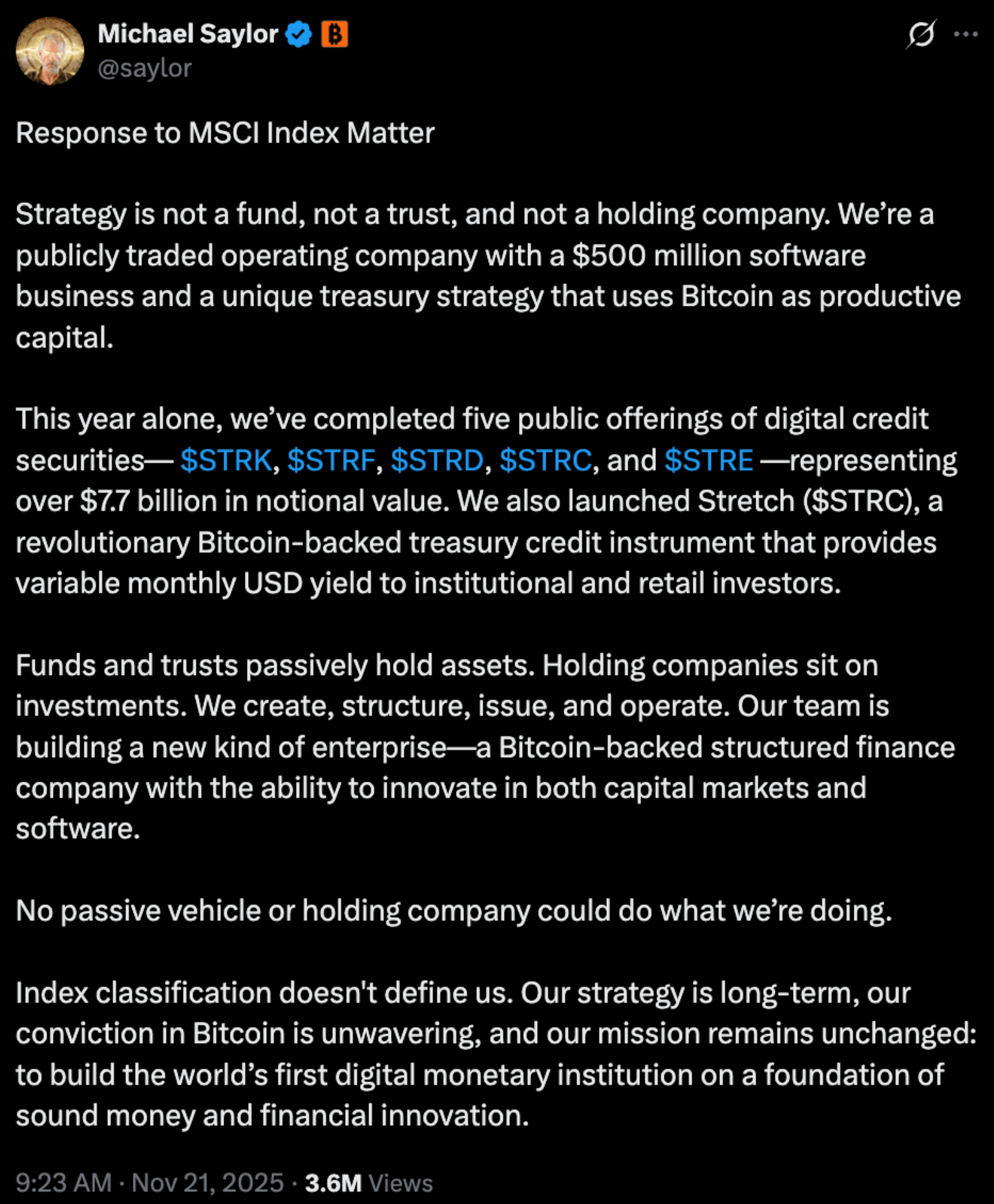

Saylor, as usual, is not backing down.

He is pitching Strategy as a Bitcoin backed structured finance company, not a passive ETF in disguise.

He also says index classification does not define the business, and that their “conviction in Bitcoin is unwavering.”

So what does this actually mean for us?

Short term, this index fight is another source of forced selling and volatility around Strategy and other DAT names.

If those treasuries ever choose to sell coins to stay inside the indices, it could briefly add pressure to Bitcoin itself.

But structurally, this is about TradFi deciding how to treat corporate Bitcoin balance sheets.

Clearer rules might hurt some stocks in the near term, yet they also give future treasuries a cleaner playbook.

MSCI’s decision lands on January 15, 2026.

The reaction after that will tell us how serious Wall Street really is about Bitcoin on corporate balance sheets…

The Vault Just Opened on a $2T Market Opportunity

Elf Labs owns 100+ priceless trademarks for icons like Cinderella & Snow White. They’ve already earned $15M+ in royalties, and are now using AI to turn these legends into living, interactive worlds for the next generation. With patented tech & a $2T market opportunity ahead, the next chapter of entertainment is being written in real time.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

WHO’S BUYING THE DIP? 🍦

Over the past week, crypto got hammered.

Bitcoin bleeding. Sentiment collapsing. Retail doing what retail does - freaking out.

But not Grant Cardone.

While everyone else was panicking, the real-estate mogul just posted this:

He bought the fear in size.

And this comes right after Grant revealed on his most recent podcast with Michael Saylor how Saylor personally convinced him to buy 1,000 BTC:

“If you really want to get wealthy, figure out how to add Bitcoin to your real estate.”

Grant listened.

Now he’s doubling down while the market’s scared.

Here’s the takeaway:

When billionaires who’ve made their fortune in tangible, old-world assets start shifting their playbook toward Bitcoin…

It tells you exactly where the future is heading.

While retail hesitates, the big dogs are scooping up supply.

Don’t ignore who’s buying your fear. 🐳

HOLDING ON 💪

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): Coins held for less than 155 days

🔵 Long-Term Holders (LTHs): Coins held for more than 155 days

🟥 Short-Term Holder Cost Basis: All coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: All coins purchased in this price range are LTHs

This metric is powerful because it shows exactly what price range long and short term holders bought their Bitcoin at. 🔍

The new key cutoff date is June 21, 2025 - when Bitcoin was trading at around $102K.

Anything bought before that? Long-term (LTH).

After? Short-term (STH).

Here’s the breakdown:

LTHs: 14.34M BTC → 71.87% of supply

STHs: 2.70M BTC → 13.56% of supply

Over the last three months, long-term holders have sold 199,246 BTC - roughly $17.48 billion at today’s prices.

Sounds heavy…

But zoom out.

More than 70% of all Bitcoin is still locked with long-term holders.

That is not a weak market. That is a conviction wall.

Supply is tight. Willing sellers are thinning out. 💥

CRACKING CRYPTO 🥜

Coinbase’s latest acquisition caused controversial 10X token boom - Who knew? Coinbase folds Vector tech into its app while Tensor Foundation keeps the marketplace and TNSR, stoking questions about pre-announcement buying.

Tiny Hashrate Miner Nets $265,000 in Rare BTC Block. The winning miner controls just 0.0000007% of Bitcoin’s total network hashpower, which recently hit a record 855.7 exahashes per second.

Strategy and Bitcoin supporters call for 'boycott' of JP Morgan. Supporters of Bitcoin treasury company Strategy called for a boycott of the financial services company JP Morgan as the backlash against it grew.

Hoskinson involves FBI after developer's 'careless' experiment splits Cardano blockchain. An IOG employee resigned after Hoskinson involved the FBI to investigate the incident, concerned that development mistakes could lead to legal consequences.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What main advantage does the Lightning Network provide?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Instant, low-fee payments off-chain 🥳

Lightning moves transactions off-chain, enabling extremely fast and cheap micropayments. ⚡

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.