GM to all of you nutcases. It’s Crypto Nutshell #795 hodlin’ the door… 🚪🥜

We’re the crypto newsletter that’s more paranoid than a trader who realizes the system is rigged against him… 👁️📉

What we’ve cooked up for you today…

🏦 The year of Ethereum

🚦 3 Checkpoints to new highs

📉 Outflows return

💰 And more…

Prices as at 2:05am ET

THE YEAR OF ETHEREUM 🏦

BREAKING: Standard Chartered says '2026 will be the year of Ethereum' as bank backs ETH outperformance

Standard Chartered just made a bold call.

"2026 will be the year of Ethereum, much like 2021 was."

The bank expects ETH to outperform Bitcoin despite cutting near-term price targets across the board.

The targets

Standard Chartered lowered its medium-term forecasts:

2026: $7,500 (down from $12,000)

2027: $15,000 (down from $18,000)

2028: $22,000 (down from $25,000)

But raised long-term targets:

2029: $30,000 (up from $25,000)

2030: $40,000 (new target)

"Weaker-than-expected Bitcoin performance has dampened prospects for all digital assets against the USD given Bitcoin's continued dominance."

But relative to Bitcoin, Ethereum's drivers have strengthened.

Why ETH outperforms

Standard Chartered expects the ETH-BTC ratio to gradually return toward 2021 highs around 0.08.

The bank cited four structural advantages:

1. Stablecoin dominance: More than half of all stablecoins sit on Ethereum. The bank forecasts stablecoin market cap hitting $2 trillion by 2028, with the majority settling on Ethereum.

2. Tokenized real-world assets: Over 50% of tokenized RWAs are on Ethereum. Standard Chartered sees RWA market reaching $2 trillion by 2028.

3. DeFi leadership: Ethereum remains the dominant platform for decentralized finance.

4. Network scaling: Ethereum transaction count hit fresh all-time highs recently, driven by stablecoin activity (35-40% of transactions). The Fusaka upgrade in December increased Layer 1 throughput - and higher throughput historically translates to higher market cap.

BitMine keeps buying

ETF and corporate treasury flows have slowed across crypto. But they remain more supportive for Ethereum than Bitcoin.

BitMine Immersion - the largest Ethereum treasury company - now holds 3.4% of ETH in circulation and remains on track for its 5% target.

Whales accumulated $16.5 million in ETH last week across 324 wallets, doubling their rate from the prior week.

Regulatory catalyst

Kendrick said passage of the CLARITY Act in Q1 would "boost digital assets, particularly ETH, if it unlocks the next steps for DeFi."

The Senate is targeting a key committee vote later this week.

The crypto brokerage

Meanwhile, Standard Chartered is reportedly developing a crypto prime brokerage platform under its venture arm, SC Ventures, according to Bloomberg.

No timeline confirmed. But it signals the bank is expanding crypto services even as it cuts near-term price targets.

Bank of America just approved four spot Bitcoin ETFs for adviser recommendations. Morgan Stanley filed for an Ether ETF last week.

Traditional finance isn't retreating. It's building infrastructure. 🚀

So what's your take?

Let us know your thoughts in the poll below. 👇

Which asset will outperform in 2026?

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

3 CHECKPOINTS TO NEW HIGHS🚦

Matt Hougan is the CIO of Bitwise.

That means he sits in the rooms where ETFs, pensions, RIAs, & institutions decide how much capital goes into crypto.

When he writes, it is not for Twitter. It is for people moving billions.

In his first CIO memo of 2026, he laid out something refreshingly simple:

If just 3 things go right, crypto is going to rally HARD in 2026.

And one already has. 👀

Checkpoint #1: The October crash is behind us

Hougan points back to October 10, 2025.

The biggest liquidation event in crypto history. $19 billion wiped out in one day.

For months after that, the market was haunted by a simple fear:

What if some giant fund or market maker still had to unwind and dump into the market?

That is why Q4 felt so heavy.

But Hougan makes a blunt point. If forced sellers were still out there, we would have seen it by now.

“If it were going to happen, it probably would have happened by now.”

That overhang is now gone.

Status: Green light.

Checkpoint #2: U.S. crypto law finally gets written

The CLARITY Act is moving through Congress right now.

This is the bill that defines how crypto is regulated in the United States.

Hougan calls this one of the most important gates for long-term adoption because without it, everything depends on which political party is in charge.

White House crypto czar David Sacks recently said:

“We are closer than ever.”

Prediction markets say the odds of passage this year are over 80%.

That is not guaranteed yet, but it is no longer a fantasy either.

Status: Yellow light.

Checkpoint #3: Stocks do not implode

Crypto does not need stocks to go vertical. But it does need them not to crash.

Hougan is clear here. A 20%+ equity drawdown would drag everything down in the short term. But so far, markets are not pricing in a recession.

Prediction markets show roughly an 80% chance the S&P 500 is higher this year.

Not explosive. Just stable enough.

Status: Yellow light.

Put it all together and you get Hougan’s base case.

Institutions are still coming.

Stablecoins and tokenization are still growing.

Regulators are finally moving in the right direction.

And now the biggest technical risk from 2025 is off the table.

If the other 2 checkpoints clear, a 2026 crypto rally is not a bounce.

It is the next leg much, much higher. 🚀

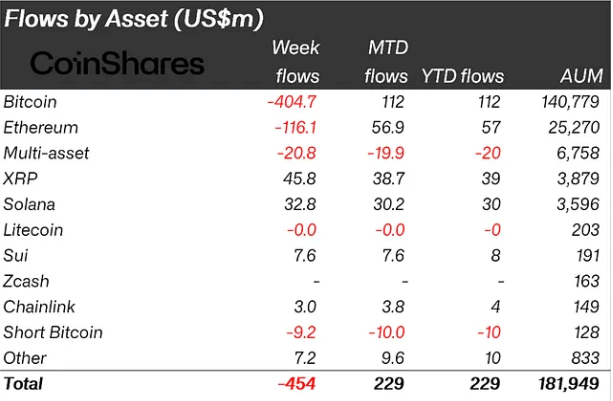

OUTFLOWS RETURN 📉

Well that didn’t take long…

After an impressive first week of the year, digital asset funds saw outflows of $454 million last week.

Let’s break it down.

The outflows were concentrated on Bitcoin last week which saw $404.7 million exit.

Ethereum followed with $116.1 million in outflows.

Whilst XRP and Solana saw inflows of $45.8 and $32.8 million.

From a regional perspective, the US saw the majority of the outflows with $568.9 million leaving.

Germany and Canada saw inflows of $58.9m and $24.5m respectively.

According to CoinShares, this turnaround in sentiment likely stems from the macro uncertainty surrounding rate cuts in 2026.

And with Trump now threatening the Federal Reserve with legal action…

Things just got a lot spicier. 🌶

CRACKING CRYPTO 🥜

Trump-Backed World Liberty Financial Launches Crypto Lending Platform. World Liberty Financial launched a new borrowing and lending protocol, bolstering the utility of its USD1 stablecoin.

New CFTC chief uses crypto-heavy CEO panel as core to start innovation advisory squad. Mike Selig, chairman of the Commodity Futures Trading Commission, is settling in with the revamping of a new innovation panel with many crypto names.

SEC Chair: ‘Remains to be seen‘ Whether US will Seize Venezuela‘s Bitcoin. SEC Chair Paul Atkins deferred to the White House on whether there were any US government plans to seize crypto from Venezuela, rumored to hold $60 billion in Bitcoin.

Tom Lee's BitMine adds another 24,266 ether as holdings approach 4.2 million ETH and staked assets nearly double. BitMine's total crypto and cash holdings currently stand at $14 billion, and the company owns 3.45% of Ethereum's circulating supply.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When Tether launched in 2014, it was originally called something else. What was its first name?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Realcoin 🥳

Tether was originally launched as "Realcoin" in July 2014 before rebranding to Tether just a few months later in November 2014. It started on the Bitcoin blockchain using the Omni Layer protocol before expanding to Ethereum, Tron, and other chains.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.