Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all 64,612 of you. Crypto Nutshell #324 keepin’ it calm... 🧘 🥜

We’re the crypto newsletter that’s more thrilling than a theme park filled with resurrected dinosaurs... 🦖🌴

What we’ve cooked up for you today…

🤑 This is how it’s done

🏦 They’re coming

💪 HODLer breakdown

💰 And more…

MARKET WATCH ⚖️

Prices as at 7:35am ET

Only the top 20 coins measured by market cap feature in this section

THIS IS HOW IT’S DONE 🤑

BREAKING: El Salvador launches transparent Bitcoin investment data platform

El Salvador has just launched its own proof of reserve website!

This website provides real-time data on the nations Bitcoin reserves.

Never before have we seen this level of government transparency.

From the website we can see that El Salvador currently holds 5,748.76 Bitcoin. (worth ~ $362 million)

And over the last 30 days they’ve added a total of 31 BTC.

This comes as president Bukele announced that El Salvador would be purchasing one Bitcoin every single day.

Checkout the date of that tweet by the way…

El Salvador made this decision in the depths of the bear market.

From the website we can see their Bitcoin balance increasing by at least 1 BTC every day.

El Salvador was the first country to adopt Bitcoin as legal tender back in 2021.

And although this decision initially received criticism from many, El Salvador is currently sitting on an unrealised profit of ~$58 million.

Sounds like it’s working to us… 😎

TOGETHER WITH CRYPTO.COM 💳

Stop right there.

You still don’t have a crypto card?

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Earn up to 5% back in CRO rewards on every transaction. 💳

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.

P.S - We heard your feedback. The crypto.com Visa card is available in the U.S, Canada, U.K, Australia and many more!

Disclaimer: Terms and conditions apply. Offer valid for new users. Crypto investments involve risks; please do your research.

THEY’RE COMING… 🏦

Large corporations are coming for Bitcoin.

It’s only a matter of time.

That’s the latest message out from Michael Saylor.

In his latest interview, Saylor was asked will MicroStrategy continue purchasing Bitcoin?

And in case there was any doubt, here’s what he had to say:

“We’ll keep adding Bitcoin… MicroStrategy is going to keep developing it’s Bitcoin position. But it’s going to get exponentially harder.”

MicroStrategy currently holds 214,400 BTC. That’s 1.02% of the total maximum supply.

Saylor expects increasing demand for Bitcoin, particularly by:

Bitcoin miners

Crypto exchanges

Corporations - Block announced they will be buying BTC monthly

Bitcoin ETFs

“Now we’re up to 22 spot ETFs in the world. And they’re all in a marketing war with each other. At some point you’re going to see other Russel 1000 companies… Which one of them wants to crawl out of their zombie state? When they do that, they drive up the price of Bitcoin.”

(The Russell 1000 is a market index that tracks the top 1000 companies by market cap in the United States)

And just look at MicroStrategy’s stock performance since adopting its Bitcoin strategy…

MicroStrategy stock was basically trading sideways for 20 years before it embraced Bitcoin.

When will other companies follow?

Saylor is predicting that from mid-2024 onwards we’ll begin to see more and more large corporations adopt Bitcoin as a treasury asset.

And most recently, Japanese company Metaplanet adopted Bitcoin as a treasury asset.

“Metaplanet has adopted bitcoin as its strategic reserve asset. The move is a direct response to sustained economic pressures in Japan, notably high government debt levels, prolonged periods of negative real interest rates, and the consequently weak yen,”

Slowly, then all at once.

They’re coming…

HODLER BREAKDOWN 💪

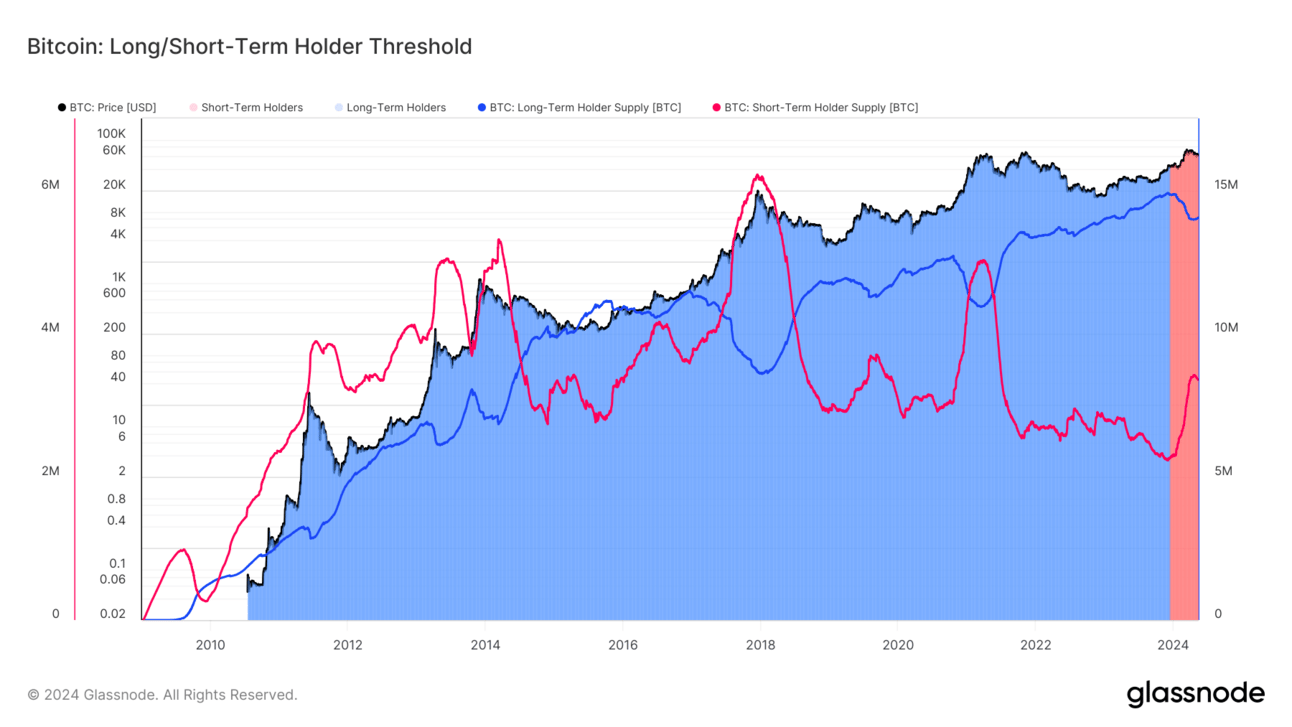

Today we’ll be taking a look at the Long / Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): coins that have been held for less than 155 days

🔵 Long-Term Holders (LTHs): coins that have been held for more than 155 days

🟥 Short-Term Holder Cost Basis: all coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: all coins purchased in this price range are LTHs

This metric is extremely powerful as we can see exactly what price STHs and LTHs purchased Bitcoin at. 🔎

The LTH / STH threshold is currently at 10th December 2023, back when Bitcoin was ~$41,500.

All coins purchased before this date are classified as LTHs.

All coins purchased after this date are classified as STHs.

Today there is currently 14,036,344 Bitcoin in the hands of LTHs. (71.26% of the circulating supply) 💪

Whereas the amount of coins held by STHs is only 3,349,707. (17.01% of the circulating supply)

(Quick note, exchange balances aren’t counted in this metric)

During Bitcoin’s run up to $73,000, the amount of LTH’s experienced a significant decline. That’s typical of bull markets.

As the price increases, long-term holders begin to lock in profits. As a result, the amount of short-term holders also increases.

BUT, recently the amount of long-term holders has begun to increase…

Perhaps due to Bitcoin’s sideways price action, every LTH that was set on taking profits already has.

Which means LTH’s have slowed down their selling.

Looks like everyone is waiting for the bull market to once again pickup.

(fingers crossed that happens soon 🤞)

CRACKING CRYPTO 🥜

Ordinals sales elevate Magic Eden to top NFT marketplace surpassing Blur by $108 million. Magic Eden has surpassed Blur to become the top NFT marketplace in terms of trading volume.

Bitcoin whale wallets move $61M in BTC after a decade of dormancy. Two Bitcoin wallets, which received 500 Bitcoin each in September 2013, have made outward transfers at a combined market value of $61 million.

Franklin Templeton CEO says all ETFs and mutual funds will be on blockchain. Franklin Templeton’s CEO and President, Jenny Johnson, believes blockchain is the future of the financial industry.

Bitcoin Just Got a Big New Buyer. Should You Follow Its Lead? This billionaire's Bitcoin investment plan follows a solid fundamental approach to buying volatile assets.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

The data in a blockchain gets stored in ________ .

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Blocks 🥳

In a blockchain, data is stored in a decentralized manner across a network of computers or nodes where blocks are chained together.

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.