GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that's less tragic than waking up to the realization that you must save your kingdom from your wicked uncle... 🏰🦁

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Bitcoin: Things could get ugly… 📉

How does the Bitcoin halving impact price? 🤔

And more…

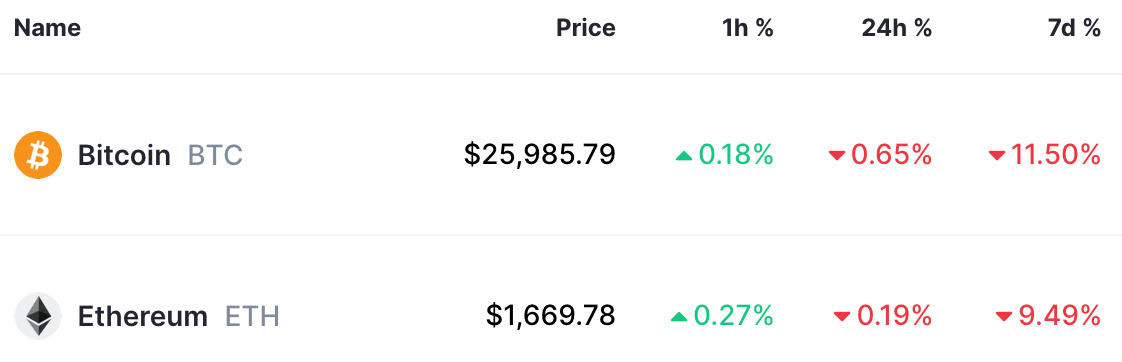

MARKET WATCH ⚖️

BTC Dominance is currently at 48.99% and the current crypto market cap is $1.06T ▼0.86%

Biggest Winners of The Day 🤑

Litecoin (LTC) ▲0.78%

Only one winner for today? Yep that’s right… 😭

Biggest Losers of The Day 😭

XRP (XRP) ▼3.84%

Shiba Inu (SHIB) ▼3.44%

Solana (SOL) ▼3.30%

Only the top 20 coins measured by market cap feature in this section

All price data as of 7:55am ET

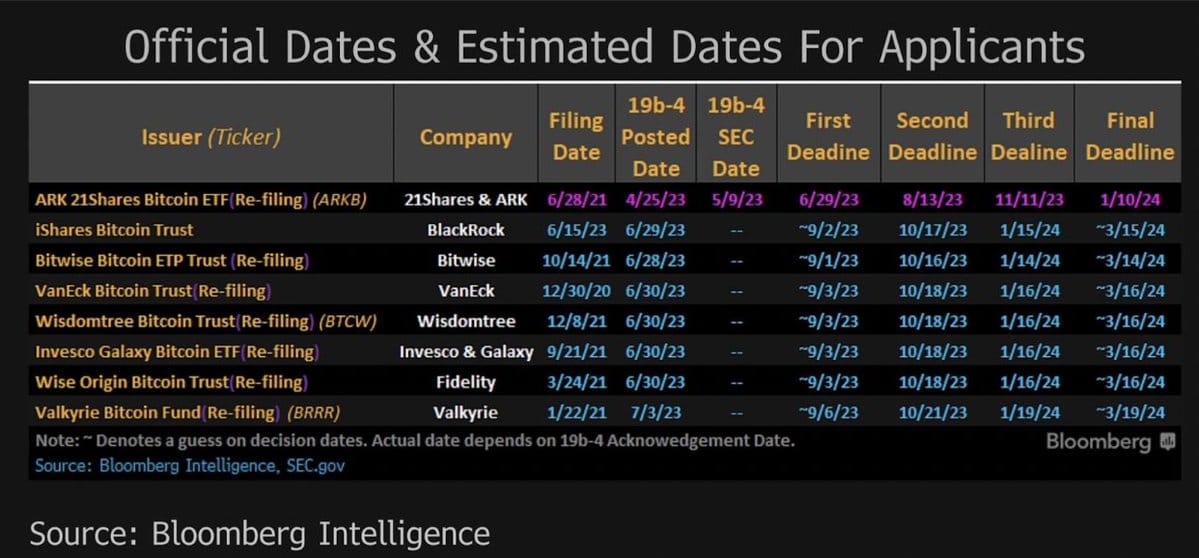

BITCOIN ETF IMPORTANT DATES 📅

The race for the first spot Bitcoin ETF is still underway, here are some important dates to keep in mind:

2nd September 2023 BlackRock/Fidelity first deadline

5th October 2023 Grayscale vs SEC case final deadline

10th January 2024 Ark Invest ETF final deadline

15th March 2024 BlackRock Fidelity final deadline

Although all of these Bitcoin ETF application’s have different deadline dates, a couple of weeks ago Ark Invests Cathie Wood had this to say:

“I think the SEC, if it’s going to approve a Bitcoin ETF, will approve more than one at once.”

Even though Ark Invest is first in line for approval this is an interesting take… Will they all be approved on the same date? 🤔

EXPERT OF THE DAY 💰

This Crypto expert believes that things could get “pretty ugly” and is telling investors what price levels to keep a keen eye on. 👀

Today’s expert of the day is @pentosh1 - an anonymous technical analyst that regularly posts his charts, trades & theses on twitter.

If you haven’t heard of Pentoshi before, he’s amassed a following of over 700,000 investors for three reasons:

His brilliant technical analysis

His stunningly accurate calls

His anonymous avatar is a penguin 🐧

Even though we aren’t huge fans of technical analysis (if you have enough money you can make the charts do whatever you want) we can vouch for his accuracy. 🎯

Not only did he call the Bitcoin & Ethereum top at the end of 2021, but he’s also been blisteringly accurate all the way down.

Today he released his latest update on what’s going on with Bitcoin.

Here’s the key areas he's eyeing:

If Bitcoin breaks below $25,000, things could get pretty ugly. If this were to play out, he’d be looking at buying in the $19,000 - $22,000 area.

If Bitcoin reverses and reclaims $29,000, the key area of resistance it will need to break is at $32,000. If this were to play out, it’s blue skies all the way up to $40,000. 😎

Here’s a chart in which he has highlighted all the key areas.

Given the positive price catalysts on the horizon - the spot Bitcoin ETF, the Bitcoin halving - we actually hope the first scenario plays out.

More time to stack more sats at lower prices. 🥂😉

Nutty’s takeaway: Although dollar cost averaging (DCA) is the least stressful way to get into Bitcoin / crypto, there is some merit to technical analysis when it comes to when to buy.

If Bitcoin does get down the $19,000 - $22,000 and nothing has fundamentally changed… I’ll be buying. 💰

ON CHAIN DATA DIVE 📊

Bitcoin has an one important pre-programmed feature:

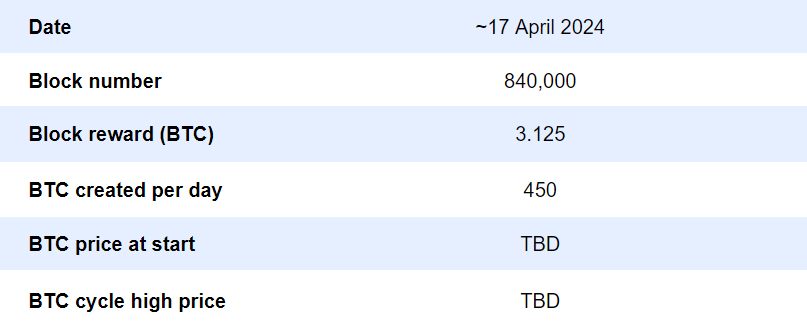

The reward miners receive for successfully mining and verifying blocks is halved every 210,000 blocks. This is known as the “Bitcoin Halving” and happens roughly every four years. The next halving is due to happen in April 2024. 🔪

The amount of Bitcoin miners receive as rewards:

2009: 50 BTC

2012: 25 BTC

2016: 12.5 BTC

2020: 6.25 BTC

2024: 3.125 BTC

and so on…

This 4 year cycle will continue 33 times in total, until the mining rewards are essentially zero.

Three halving’s have already taken place. Let’s jump in and see how the halving impacts Bitcoin’s price and supply dynamics.

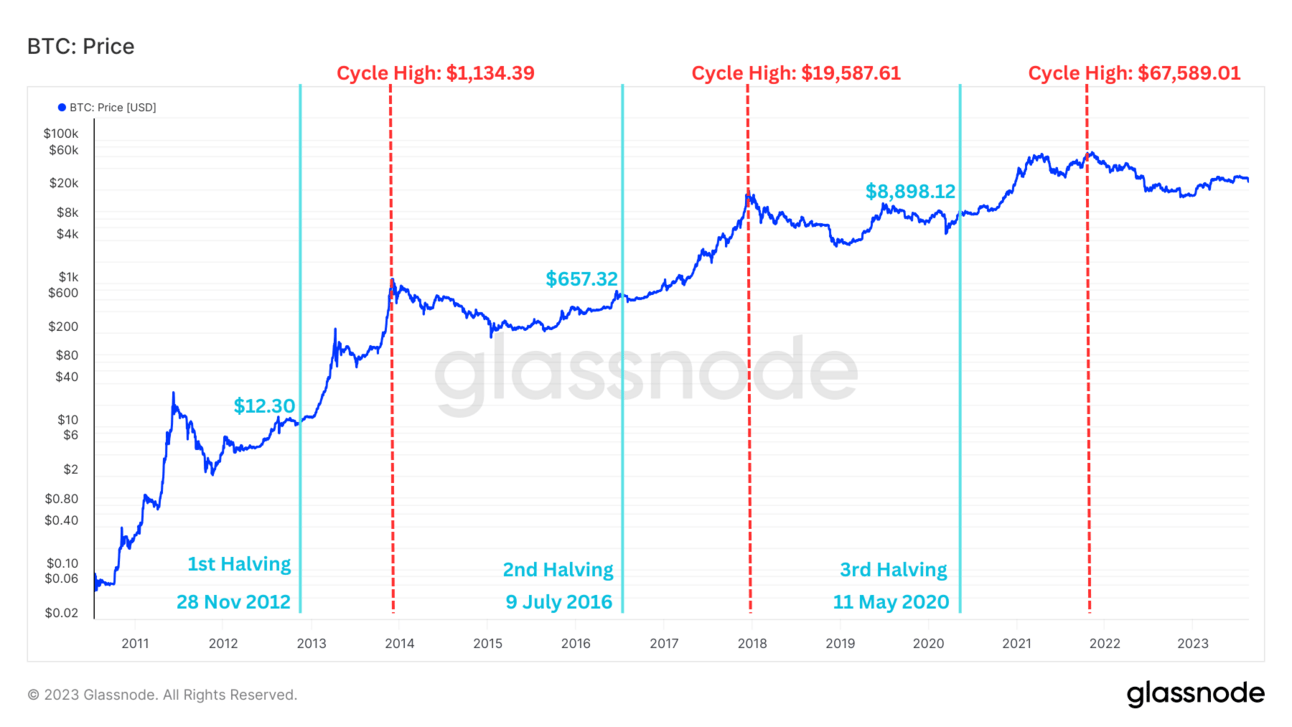

In the chart below we’ve outlined the start date of each halving (light blue vertical lines) and the cycle high’s (red vertical lines).

After each halving we’ve seen explosive growth in the price of Bitcoin.

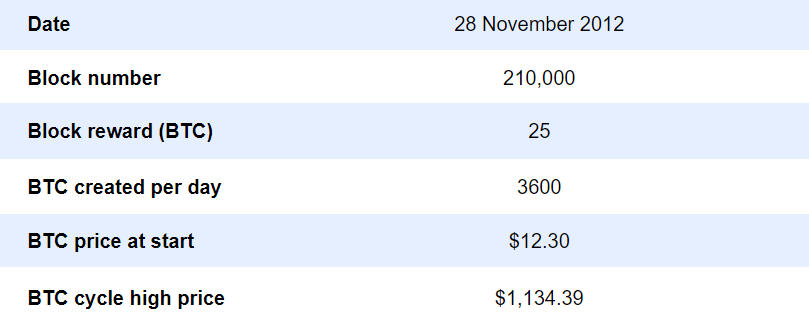

The first halving saw the price of Bitcoin explode from $12.30 all the way up to a high of $1,134.39

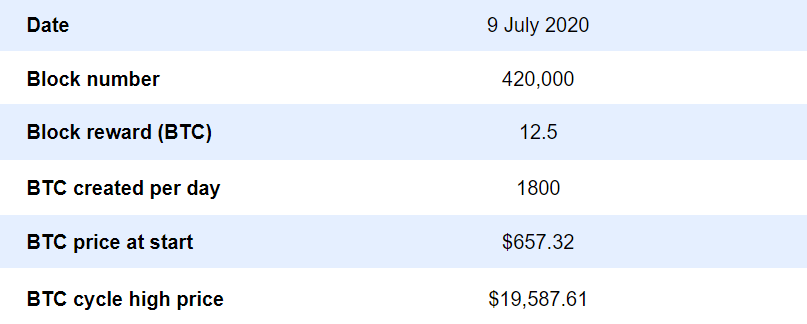

During the second halving Bitcoin grew from $657.32 up to a high of $19,587.61

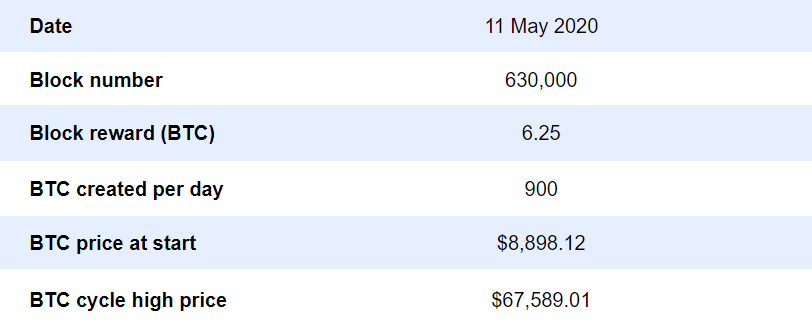

The most recent halving had Bitcoin blow up from $8,898.12 to a high of $67,589.01

We’ve broken down the stats of each halving cycle to help you get a better understanding of what’s going on.

Bitcoin 2012 Halving

Bitcoin 2016 Halving

Bitcoin 2020 Halving

Bitcoin 2024 Halving

Nutty’s Takeaway: Summing all of this up, the Bitcoin halving reduces the supply of Bitcoin entering the market. We’ve also seen that in the past that it leads to insane price growth. 🤑

However… History is no indicator of future performance… but if it’s happened 3 times in the past who’s to say it won’t happen again?

We’re super excited for the halving and we’re sure you are too. Let us know your thoughts on the 2024 Bitcoin halving in the poll at the bottom of today’s newsletter. 👇

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

A __________ is an automated computer program that are hosted and executed on a blockchain.

A) Cryptocurrency

B) Smart Contract

C) Smart Phone

D) Smart Ledger

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Smart Contract 🎉

Smart contracts are automated computer programs that are hosted and executed on a blockchain.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.