Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all 62,645 of you. Crypto Nutshell #290 swingin’ in... 🐒 🥜

We’re the crypto newsletter that's as enthralling as a team of elite agents battling against supernatural threats to protect humanity... 🧛♂️ 🔫

What we’ve cooked up for you today…

🤑 Longest active inflow streak

🏦 This changed their mind

📉 Huge Coinbase outflow

💰 And more…

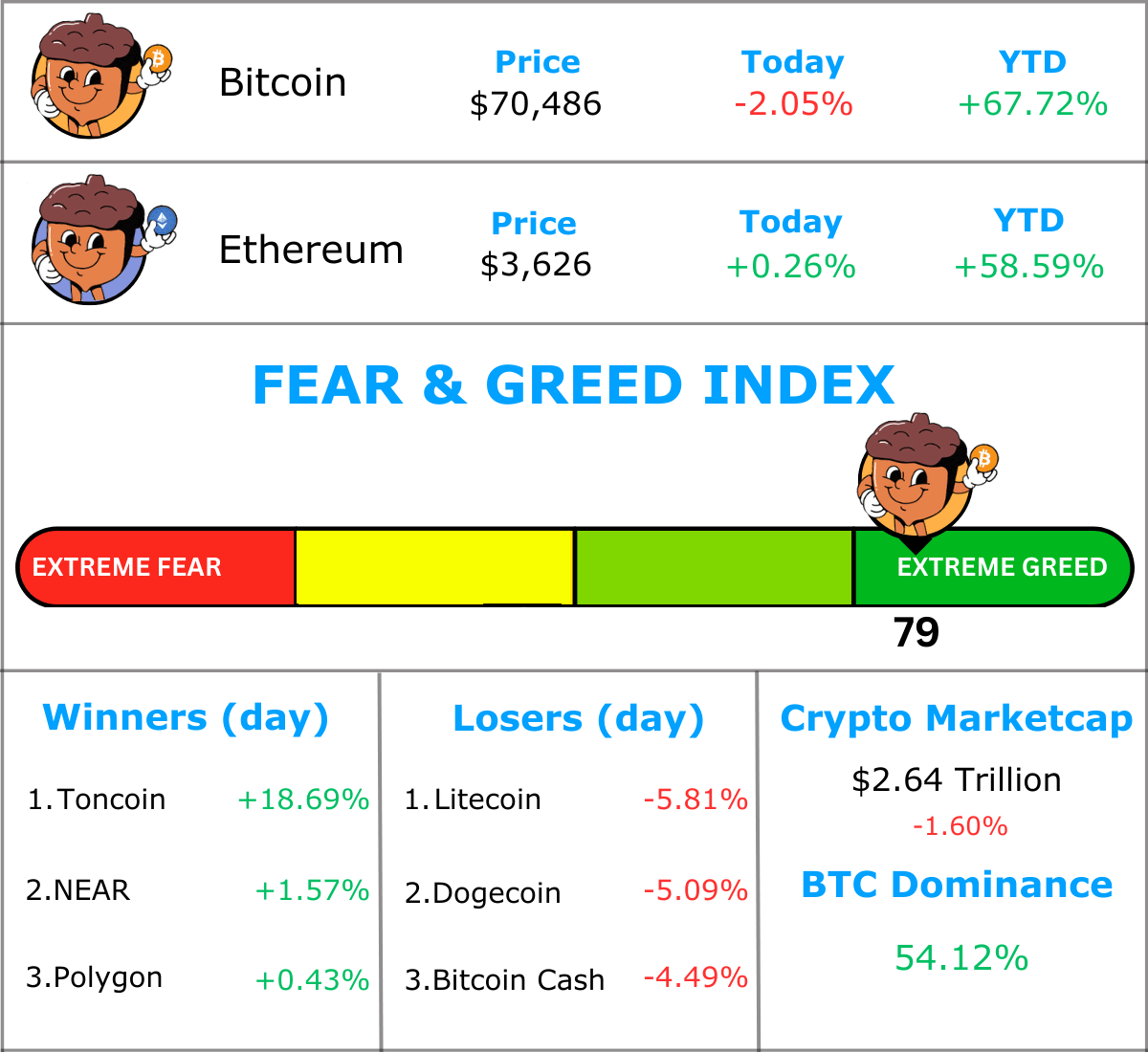

MARKET WATCH ⚖️

Prices as at 6:25am ET

Only the top 20 coins measured by market cap feature in this section

LONGEST ACTIVE INFLOW STREAK 🤑

BREAKING: BlackRock and Fidelity’s Bitcoin ETFs make history with record streak of inflows

BlackRock and Fidelity have recorded inflows every single day since launch.

That’s 59 days straight…

An absolutely incredible achievement.

To put that into perspective. It’s currently the longest active inflow streak for an ETF.

And the 18th longest inflow streak of all time.

ETF analyst Eric Balchunas stated that this is unheard of for a newly launched ETF.

The sheer amount of records the Bitcoin ETFs have broken is getting ridiculous…

In other ETF news, Grayscale’s outflows are once again increasing.

Yesterday, Grayscale experienced net outflows of $303.3 million.

As all other ETFs (besides Bitwise) had a relatively “poor” days, this resulted in overall outflows of $223.8 million.

Here’s the breakdown:

Bitwise BITB: $40.3 million 🥇

BlackRock IBIT: $21.3 million 🥈

ARK Invest ARKB: $9.3 million 🥉

Surprisingly, Bitcoin completely shrugged off this huge outflow as it’s currently trading just shy of it’s all time high…

Incredible strength. 💪

TOGETHER WITH CRYPTO.COM 💳

Stop right there.

You still don’t have a crypto card?

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Earn up to 5% back in CRO rewards on every transaction. 💳

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.

P.S - We heard your feedback. The crypto.com Visa card is available in the U.S, Canada, U.K, Australia and many more!

Disclaimer: Terms and conditions apply. Offer valid for new users. Crypto investments involve risks; please do your research.

THIS CHANGED THEIR MIND 🏦

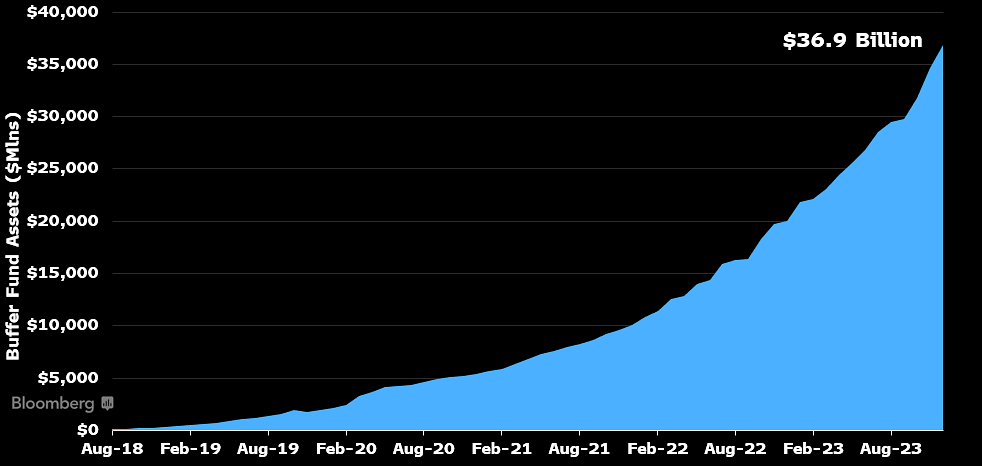

$12 billion in ETF flows is only just the beginning.

We’ve got a long way to go.

That’s the latest out from Matt Hougan.

Matt Hougan is the Chief Investment Officer at Bitwise, the 4th largest Bitcoin ETF issuer.

He knows what he’s talking about when it comes to ETFs.

Speaking at Bitcoin Investor Day, Matt was asked the following question:

What changed TradFi’s opinion on Bitcoin? Was it just that the ETFs were approved or did other factors like price movement play a part?

This was his answer:

“It’s just ‘ETF gets approved’. That’s a huge deal. It’s ETF gets approved, it’s BlackRock’s in the market. This is not the Bitcoin of yesteryear, this is now considered an institutional asset.”

Continuing on, Matt added:

“I also think ETFs being approved and BlackRock coming in means that it’s not going to zero. Which is a material difference for these advisors. They are worried about looking foolish to their clients.”

Matt also explained what typically happens when a new ETF launches.

“What happens is there's a lot of excitement and flows initially. And then it actually just builds over time.”

Using GLD (first US gold ETF) as an example:

When GLD launched, it experienced record breaking inflows of $1 billion in the first week.

However as the years went on, assets continued to grow faster and faster.

With it’s largest inflow year being year 16 (2020).

When the Bitcoin ETFs were approved, retail investors, RIA’s and independent financial advisors finally had access to Bitcoin.

However, they have yet to be approved platform wide on Morgan Stanley, Wells Fargo etc.

Matt explained that old firms like these take time to approve new investment categories.

(Think of the amount of compliance meetings they’d have to go through… 🥱)

That’s why flows build over time.

Matt also commented on the great success of the ETFs and whats to come:

“We’re off to a great start, we’ve pulled in $12 billion in flows. But the US wealth management industry is $45 trillion…”

$12 billion out of $45 trillion…

That’s a ridiculously small percentage. (0.0267%)

But according to Matt, these ETF flows are only just getting started.

HUGE COINBASE OUTFLOW 📉

Today we’ll be taking a look at Coinbase’s Bitcoin balance.

As always, here’s how to interpret the chart:

Decreasing exchange balance: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balance: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Over the last 30 days, 85,000 Bitcoin have been withdrawn from Coinbase.

That’s over $6.07 billion at todays prices.

And it marks the second largest outflow ever for Coinbase over a 30-day period.

The largest being 86,000 Bitcoin withdrawn back in March 2021.

Since March 2020, Coinbase’s Bitcoin balance has been in free fall.

And since the launch of the ETFs, Coinbase experienced additional withdrawals of 120,000 BTC. (across February & March)

This brings their current balance to 294,000 BTC. Which is a significant drop from the 1 million BTC they held back in December 2020.

Clearly a majority of investors are looking to hold their Bitcoin for the long-term.

With this trend continuing, there simply isn’t that much Bitcoin available for sale.

And with the halving fast approaching, a supply shock is on the way.⚡

CRACKING CRYPTO 🥜

BlackRock and Fidelity's Bitcoin ETFs make history with record streak of inflows. Bloomberg ETF analyst Eric Balchunas observed on April 8 that two spot Bitcoin ETFs are among the 20 ETFs with the longest inflows.

SEC defers decision on Bitwise, Grayscale Bitcoin ETF options. The SEC has delayed its decision on whether to approve options trading of spot Bitcoin ETFs on the New York Stock Exchange.

What analysts say the bitcoin halving is set to do for MicroStrategy stock. One analyst nearly doubled his price target for MicroStrategy stock on Monday as industry watchers anticipate upward price action.

Crypto Market Cap to Double to $5 Trillion by Year-End. Brad Garlinghouse highlighted several macroeconomic factors behind the potential growth of the total crypto market value.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

How much did Beeple's record breaking NFT sell for?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) $69 million 🥳

In March 2021, Christie's opened bidding on Everydays at $100. A fortnight later, the sale closed at $69,346,250, shattering the world record price for an NFT.

GET IN FRONT OF 62,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.