Today’s edition is brought to you by Kalshi - the first regulated and largest prediction market where you can trade on crypto prices, elections, inflation, and more.

Get a $20 bonus when you sign up today!

GM to all of you nutcases. It’s Crypto Nutshell #817 pluggin’ in… 🔌🥜

We’re the crypto newsletter that’s more relentless than a lone enforcer cleaning up a city that’s already broken… 🚔🔥

What we’ve cooked up for you today…

🏦 This is historic

🧱 This is normal

📉 It keeps falling

💰 And more…

Prices as at 3:15am ET

THIS IS HISTORIC 🏦

BREAKING: BlackRock Makes Historic DeFi Move - Buys UNI and Lists $2.1B Treasury Fund on Uniswap

BlackRock just stepped into decentralized finance for the first time.

The world's largest asset manager announced Wednesday that it will list its $2.1 billion tokenized Treasury fund, BUIDL, on Uniswap - the biggest decentralized exchange in crypto.

Even bigger: BlackRock bought UNI tokens as part of the deal.

That makes Uniswap's governance token the first DeFi asset on BlackRock's balance sheet.

As you’d expect, UNI jumped 25% on the news.

But unfortunately it has since largely retraced that entire move…

Why this matters

This isn't just another partnership announcement.

BlackRock manages over $10 trillion in assets. For years, traditional finance kept DeFi at arm's length - too risky, too unregulated, too wild.

Now the biggest player in the room is buying in.

"This collaboration is a notable step in the convergence of tokenized assets with decentralized finance."

What's actually happening

BUIDL is BlackRock's tokenized money market fund - backed 100% by U.S. Treasuries and cash.

It pays yield on-chain and is the largest product of its kind.

Through Uniswap, qualified investors can now trade BUIDL around the clock using stablecoins. No traditional intermediary required.

Trading will be handled through UniswapX, with Securitize managing compliance. Only pre-approved, whitelisted investors can participate - so it's not a free-for-all.

But the infrastructure is DeFi-native.

The bigger picture

As you know, BlackRock has been pushing deeper into crypto for years.

It launched the spot Bitcoin ETF that became the fastest-growing ETF in history. It's expanded BUIDL across Ethereum, Solana, and BNB Chain.

But this is different.

Buying a DeFi token and using decentralized infrastructure to trade a regulated product?

That's a line crossed.

Wall Street isn't just watching DeFi anymore. It's building on it. 🚀

WE WANT TO GIVE YOU $20 🤑

Seriously.

Kalshi is giving Crypto Nutshell readers a $20 bonus when you sign up today.

Just deposit $10 or more and the bonus is yours.

Kalshi is the first CFTC-regulated and largest prediction market that lets you trade on real-world events like crypto prices, inflation, elections, and major economic headlines.

If you already have opinions on where markets are headed, Kalshi gives you a way to act on them.

Claim your $20 in 3 simple steps:

Deposit $10+

Receive your $20

That’s it.

THIS IS NORMAL 🧱

When Bitcoin crashes, most people panic.

Phong Le doesn’t.

For newer readers, Phong Le is the CEO of Strategy, the company that holds more Bitcoin than any other corporation on the planet.

When you’re responsible for tens of billions in BTC exposure, you tend to understand volatility a little differently.

After the latest crypto selloff, he gave one of the clearest reminders of what this asset actually is.

Here’s what he said:

“7 years from now, when Bitcoin is at $1M and it drops to $750K, that’s a 25% drawdown.”

Read that again.

Not if Bitcoin hits $1M.

When.

And what happens next?

“Everyone will think it’s the end of Bitcoin, and I’ll say ‘hold on’ then too.”

That’s the mindset of someone playing a completely different time horizon.

Because here’s the reality most investors never internalize:

Bitcoin doesn’t move in straight lines. It reprices violently.

Then it keeps going.

Every cycle feels catastrophic while you’re inside it.

What looks like collapse today often looks like noise a few years later.

Le isn’t dismissing volatility.

He’s reframing it.

If Bitcoin truly is heading into seven-figure territory, then corrections aren’t a bug…

They’re the admission price.

The question isn’t whether drawdowns happen.

It’s whether you understand what you own when they do. 🎢

IT KEEPS FALLING 📉

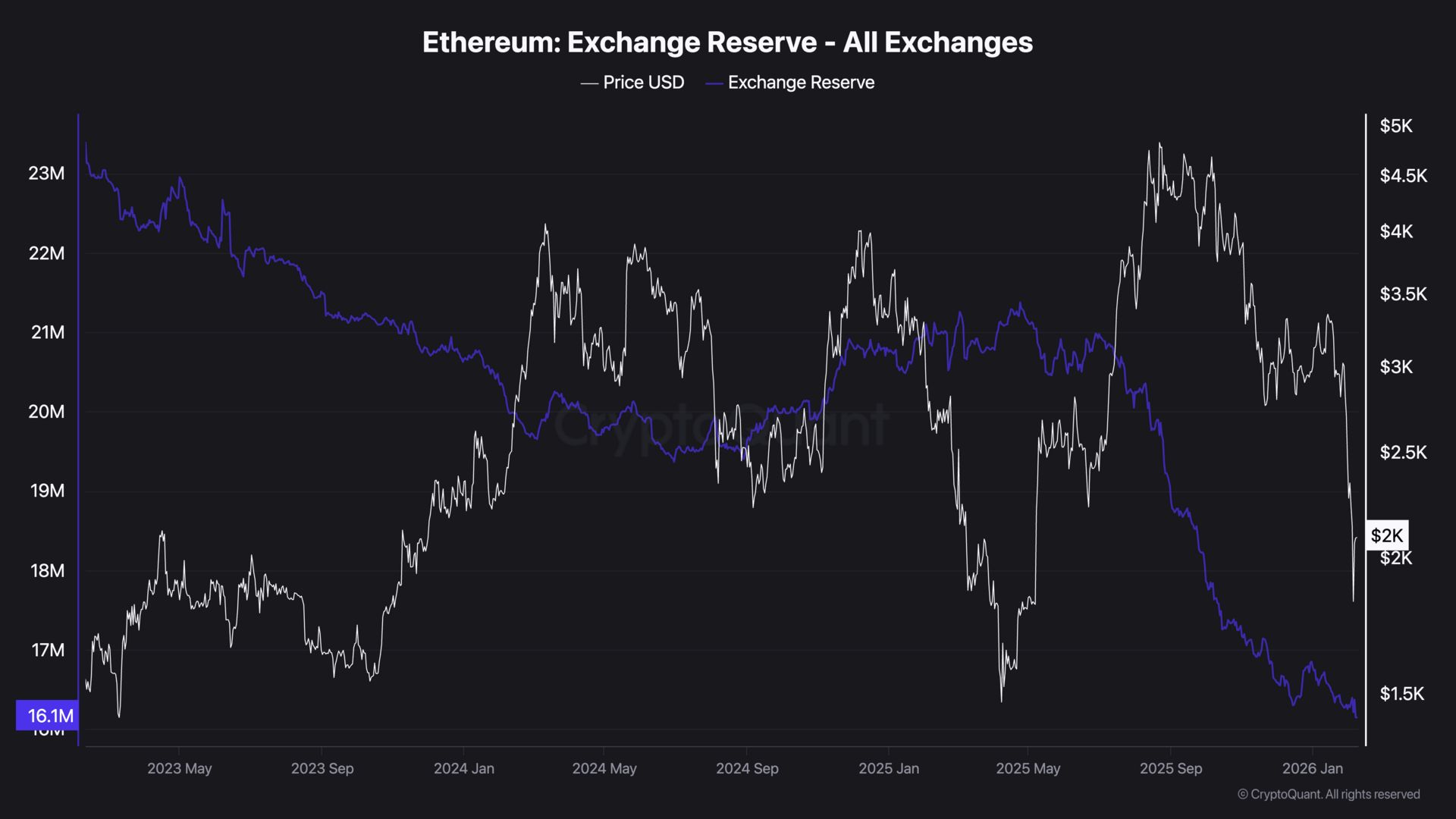

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 16.15 million ETH are left on exchanges.

That's just 13.38% of the entire supply.

Since the start of 2026, another 637,442 ETH has been pulled off exchanges.

ETH's been bleeding. Sentiment's still in the gutter. Fear's everywhere.

Yet exchange balances keep falling.

Retail's shaken. Weak hands are folding.

But the veterans? They're accumulating. 💎

CRACKING CRYPTO 🥜

Danske Bank Offers Bitcoin, Ethereum ETPs to Investors, Ending Eight-Year Crypto 'Ban'. Denmark’s largest bank is ending an eight-year ‘ban’ on crypto services in response to growing customer demand and improved regulation.

Spot Bitcoin ETFs Post $166M Inflows Despite Market Dip. Spot Bitcoin ETFs posted $166.6 million in inflows on Tuesday, while Goldman Sachs reported trimming Bitcoin and Ether ETF exposure and adding XRP and Solana ETFs.

JPMorgan bullish on crypto for rest of year as institutional flows set to drive recovery. After bitcoin fell below its estimated production cost, the bank said stronger fundamentals and rising institutional inflows could lift crypto in 2026.

Coinbase rolls out AI tool to 'give any agent a wallet'. AI bots will now be able to independently hold funds, send payments, trade tokens, earn yield, and transact onchain.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When BlockFi filed for bankruptcy in November 2022, approximately how much did it owe creditors?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: $1 billion 🥳

BlockFi filed for Chapter 11 bankruptcy with over $1 billion in liabilities, listing more than 100,000 creditors. The crypto lender had significant exposure to FTX and Alameda Research, with $355 million locked on the FTX platform when it collapsed. BlockFi had been a major player in crypto lending before the 2022 contagion wiped it out.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.