GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that's more stable than waking up to find your toy cowboy and space ranger dolls are alive. 🤠🚀

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Brian D Evans: Why Bitcoin will outperform every other asset 🌊

Short-term holders vs long-term holders 💰

And more…

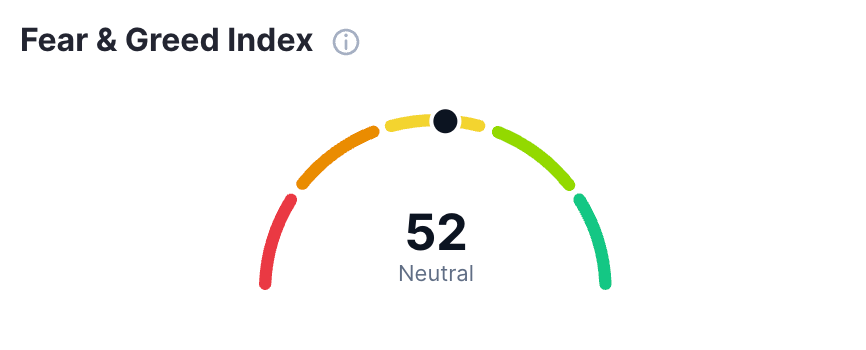

MARKET WATCH ⚖️

BTC Dominance is currently at 49.95% and the current crypto market cap is $1.19T ▲1.35%

Biggest Winners of The Day 🤑

Stellar (XLM) ▲14.34%

Solana (SOL) ▲6.34%

Bitcoin Cash (BCH) ▲4.40%

Biggest Losers of The Day 😭

Toncoin (TON) ▼2.57%

Only the top 20 coins measured by market cap feature in this section

BREAKING: Robert F. Kennedy doubles down and purchases 14 Bitcoin for his 7 children “I’m going to put my money where my mouth is”.

This comes from a Twitter space on July 26, where Kennedy was criticised for promoting a “volatile asset” while having no stake himself.

“Right after that Bitcoin conference I got a big check and I said, okay, you know, I'm going to put my money where my mouth is and so I bought two Bitcoin for every one of my seven children.”

This marks the first time that Kennedy has admitted to owning Bitcoin. 💰

Pretty wild to see US presidential candidates talking about and using cryptocurrency as part of their campaigns, what do you guys think about this?

Take a listen to what this US congressman had to say about Bitcoin. Clearly this man has no idea what he’s talking about 🤣

“Saratoshi Nagamoto was not innovative” 🤡

Someone get him The Crypto Nutshell ASAP 🥜

All price data as of 7:55am ET

EXPERT OF THE DAY - BRIAN D EVANS 💸

This expert thinks that Bitcoin is going to DOMINATE whilst other cryptos bleed.

Brian D Evans believes that investors are making a mistake if their focus is on any other digital asset that’s not Bitcoin.

For those who don’t know Brian, he is:

An award-winning serial entrepreneur

A wildly successful online marketer

Current CEO and founder of BDE Ventures, a venture fund that specialises in Web3

In his latest interview, he argues that Bitcoin is going to out-perform other digitals, including Ethereum, for the foreseeable future.

His main arguments include:

Historically leading into the Bitcoin halving, Bitcoin out-performs

The Bitcoin halving is going to be the dominant narrative for the next 10 months

A successful spot Bitcoin ETF will be like rocket fuel for it’s price 🚀

With the Ethereum Merge narrative being played out last year and no other prominent stories, he does make a great point.

The money tends to get sucked into Bitcoin and if things like an ETF do happen… that'll be heavily focused around Bitcoin. The next sort of narrative and with the Bitcoin halving coming other things (cryptos) will bleed.

Nutty’s takeaway: From my perspective, all of Brian’s arguments do make total sense. The only caveat we would take heed of is looking at the past and expecting the same to repeat in the future. Although the past is well used as a guide, there’s no guarantee it will repeat.

Food for thought. 🍎

ON CHAIN DATA DIVE 📊

Recently Bitcoin took a bit of a dip down to the $29,000 mark. Usually with a dip like this there’s always going to be a group of investors who panic sell.

Taking a look at the Bitcoin Transfer Volume from Short-Term Holders in Loss to Exchanges chart, we can see that some panic selling did indeed happen...😱

As the price continued to dip, the market witnessed over 20,000 coins being sold at a loss, marking this period as one of the highest capitulation events this year from short-term holders.

*Capitulation basically means that investors are surrendering, giving up on their position and taking whatever money they can, at a loss.

This selloff consisted mostly of buyers who purchased Bitcoin around the $30,000 mark. $30k has proved to be a tough psychological barrier for the market as panic selling increases when Bitcoin dips below this price.

Zooming out a little, there’s a completely different story for long-term holders.

The chart below tracks the time since individual coins were last moved.

All-time highs have been broken for every category of the Bitcoin supply last active chart. These are:

1+ Years: 69.11%

2+ Years: 55.69%

3+ Years: 40.12%

5+ Years: 29.09%

Looking at the chart below these numbers are only going up. The long-term holders are showing off those diamond hands and aren’t going anywhere anytime soon. 💎

Nutty’s Takeaway: With every market there will always be investors who concede their positions and sell at a loss when the price starts to dip, and investors who hold no matter what. Bitcoin is no different and from these charts that’s pretty clear.

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

If a computer is connected to the internet and starts running the Bitcoin software, it becomes part of the Bitcoin _______.

A) Network

B) Node

C) Protocol

D) Blockchain

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) Network 🎉

A computer ("node") that connects to the internet and runs the Bitcoin software, becomes part of the Bitcoin network.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.