GM to all of you nutcases. It’s Crypto Nutshell #807 callin’ the shot… 🎯🥜

We’re the crypto newsletter that’s more unpredictable than a road trip that turns into absolute mayhem… 🚗🩸

What we’ve cooked up for you today…

🏦 Rates stay steady

🦈 Why this shark sold

💎 Stacking

💰 And more…

Prices as at 2:10am ET

RATES STAY STEADY 🏦

BREAKING: Fed holds interest rates steady, crypto markets shrug as focus shifts to new chairman

As expected the Fed held rates steady on Wednesday.

The federal funds rate stays at 3.5% to 3.75% - unchanged for the first time since July.

Inflation remains "somewhat elevated," the Fed said, and uncertainty is still high.

Two officials dissented. Governors Stephen Miran and Christopher Waller both wanted a 25-basis-point cut. The rest voted to hold.

Crypto shrugged

Bitcoin dipped briefly from $89,600 to $89,000 after the news, then recovered.

It ended the day flat. Ethereum held near $3,000.

The muted reaction makes sense.

Markets had priced in a 97% chance of no change going in.

As it stands, the next cut isn't expected until June at the earliest.

Gold stole the show

While Bitcoin sat still, gold ripped 6% higher to a record above $5,400.

Silver and platinum posted even bigger percentage gains.

Asked about the rally, Fed Chair Jerome Powell pushed back. "Don't take too much message into that macro economically," he said. Gold bulls clearly didn’t listen

The dollar wildcard

Some analysts say the real easing is happening through the dollar - not interest rates.

The U.S. dollar just hit four-year lows. Trump has shrugged it off, saying "the value of the dollar is great."

But market watchers see a signal. "President Trump may effectively be cutting rates on the Fed's behalf by letting the dollar slide," said Bloomberg's David Ingles.

A weaker dollar typically helps risk assets like Bitcoin.

Whether that boost arrives remains to be seen…

What's next

Fed Chair Jerome Powell's term ends in May.

On Polymarket, Rick Rieder now leads the odds to replace him at 42%, ahead of Kevin Warsh at 27%. (It’s worth pointing out that Rick Rieder is a current BlackRock executive)

For now, the Fed is in wait-and-see mode. And it appears so is crypto. 🚀

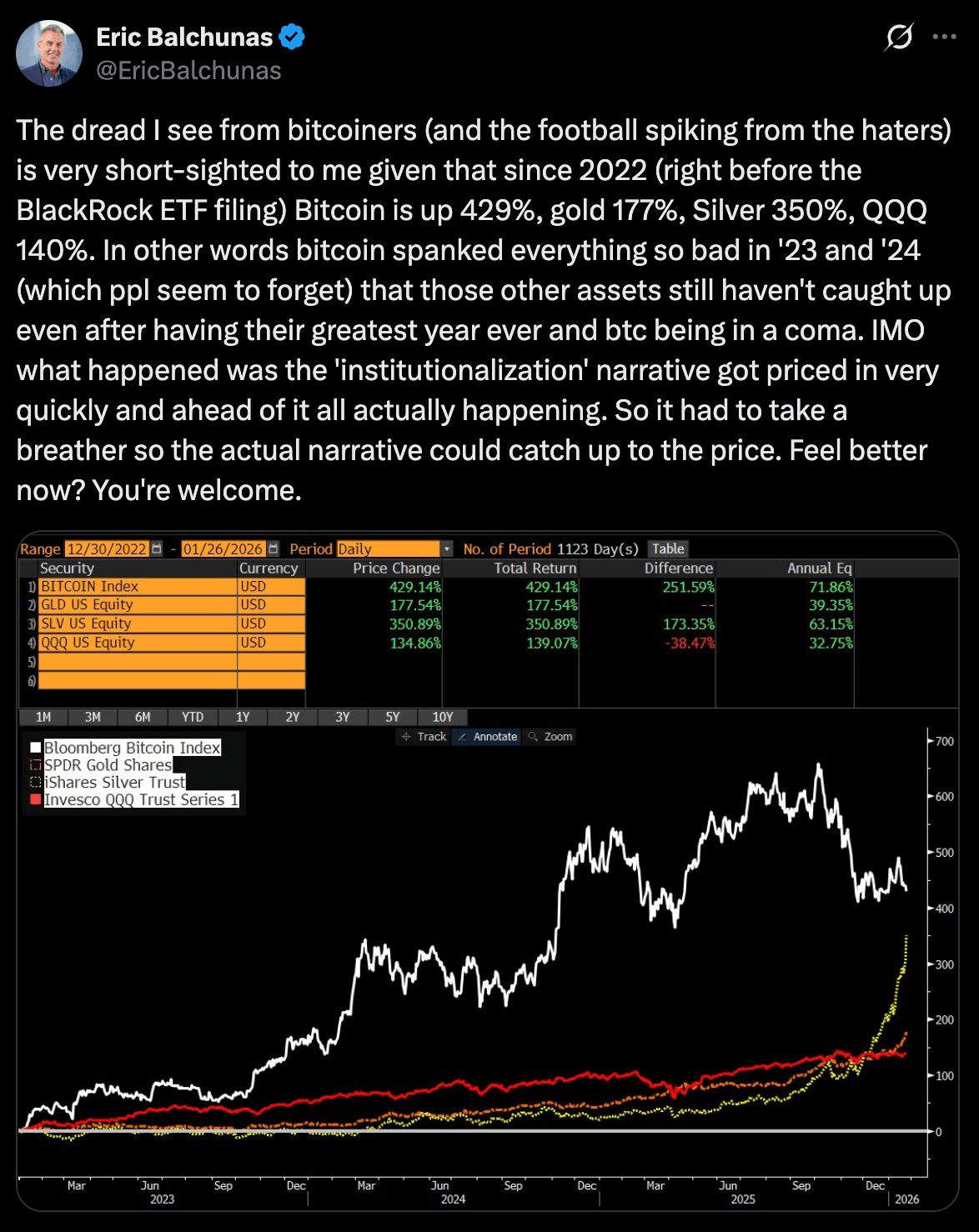

With all that said, we want to share a very interesting statistic that Bloomberg ETF analyst Eric Balchunas posted yesterday.

According to Balchunas, since 2022 Bitcoin is up 429%, silver 350% and gold 177%.

Sometimes you really do need to zoom out…

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

WHY THIS SHARK SOLD 🦈

When Shark Tank star Kevin O’Leary dumps 27 positions in an asset class, you pay attention.

Because he’s an institutional-style allocator who cares about liquidity, compliance, and survivability, not narratives.

In his latest interview, O’Leary said he sold 27 positions after seeing the analysis from his team, and that move helped him avoid the worst of the October meltdown.

He still took hits on the majors, but he made one thing very clear:

“Some of those poo coins are never coming back.”

That’s the part most retail still doesn’t internalize.

In a real drawdown, capital doesn’t “diversify.”

It compresses.

And Kevin explains why the long tail dies.

He’s been talking to the kinds of allocators who move real size: index teams, institutions, sovereign wealth-style investors.

These people aren’t trying to own 27 different coins.

They’re trying to own the smallest number of assets possible, while capturing the majority of the upside, with the least compliance headache.

And when they run the data, O’Leary says the result is “depressing”:

“You get 97.2% of all the alpha of the entire crypto market with simply 2 positions, BTC and ETH. That's it. You don't need anything else.”

That’s basically the whole story of this cycle.

Bitcoin and ETH are where serious money clusters. Everything else is fighting for the scraps.

So if you’re wondering why some alts still feel dead even when Bitcoin stabilizes… this is why.

The “Shark” doesn’t care what’s trendy.

He cares what survives. 🦈

STACKING 💎

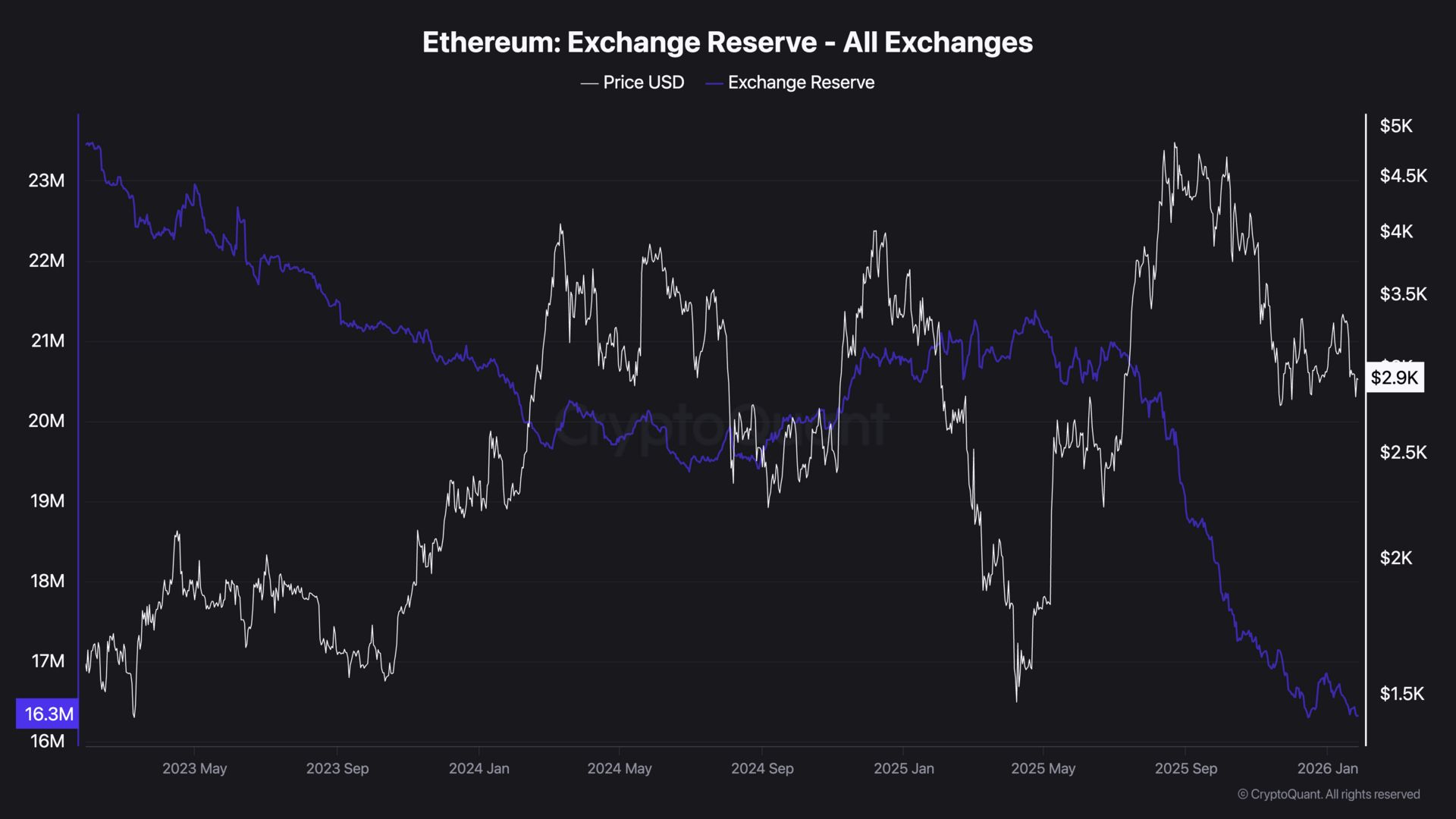

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 16.32 million ETH are left on exchanges.

That's just 13.58% of the entire supply.

Since the start of 2026, another 464,068 ETH has been withdrawn.

ETH's been under pressure. Sentiment's turned sour. Fear's running hot.

And yet... exchange balances keep draining.

That's not panic. That's conviction. Retail might be shaken, but veteran holders aren't flinching.

They're stacking. 💎

CRACKING CRYPTO 🥜

Fidelity to Enter Stablecoin Market With Ethereum-Based 'Digital Dollar'. Wall Street giant Fidelity will enter the stablecoin world with the upcoming launch of its Ethereum-based "Digital Dollar" (FIDD).

Steak 'N Shake Adds $5M To Strategic Bitcoin Reserve. Steak ’n Shake has added $5 million in Bitcoin to its Strategic Bitcoin Reserve, crediting its Bitcoin adoption for driving sales growth.

White House to meet with crypto, banking executives to discuss market structure bill. A vote on the legislation was delayed earlier this month after hitting resistance over how it proposes regulation regarding stablecoins.

Coinbase prediction markets go live in all 50 US states via Kalshi. The full rollout comes after an earlier limited launch and as prediction markets are seeing record levels of activity and revenue.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

How often does Bitcoin adjust its mining difficulty?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Every 2,016 blocks 🥳

Bitcoin adjusts mining difficulty every 2,016 blocks, which should take approximately two weeks at the target rate of one block every 10 minutes.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.