Today’s edition is brought to you by DeleteMe

Take back control of your data. Learn more and get 20% off your plan at joindeleteme.com/CRYPTONUTSHELL

GM to all of you nutcases. It’s Crypto Nutshell #761 monitorin’ the signals… 📻🥜

We’re the crypto newsletter that’s more adventurous than a kid discovering a treasure map that could change everything… 🗺️🏴☠️

What we’ve cooked up for you today…

📉 Texas buys the dip

🥀 A tragic mistake

😱 Are long-term holders selling?

💰 And more…

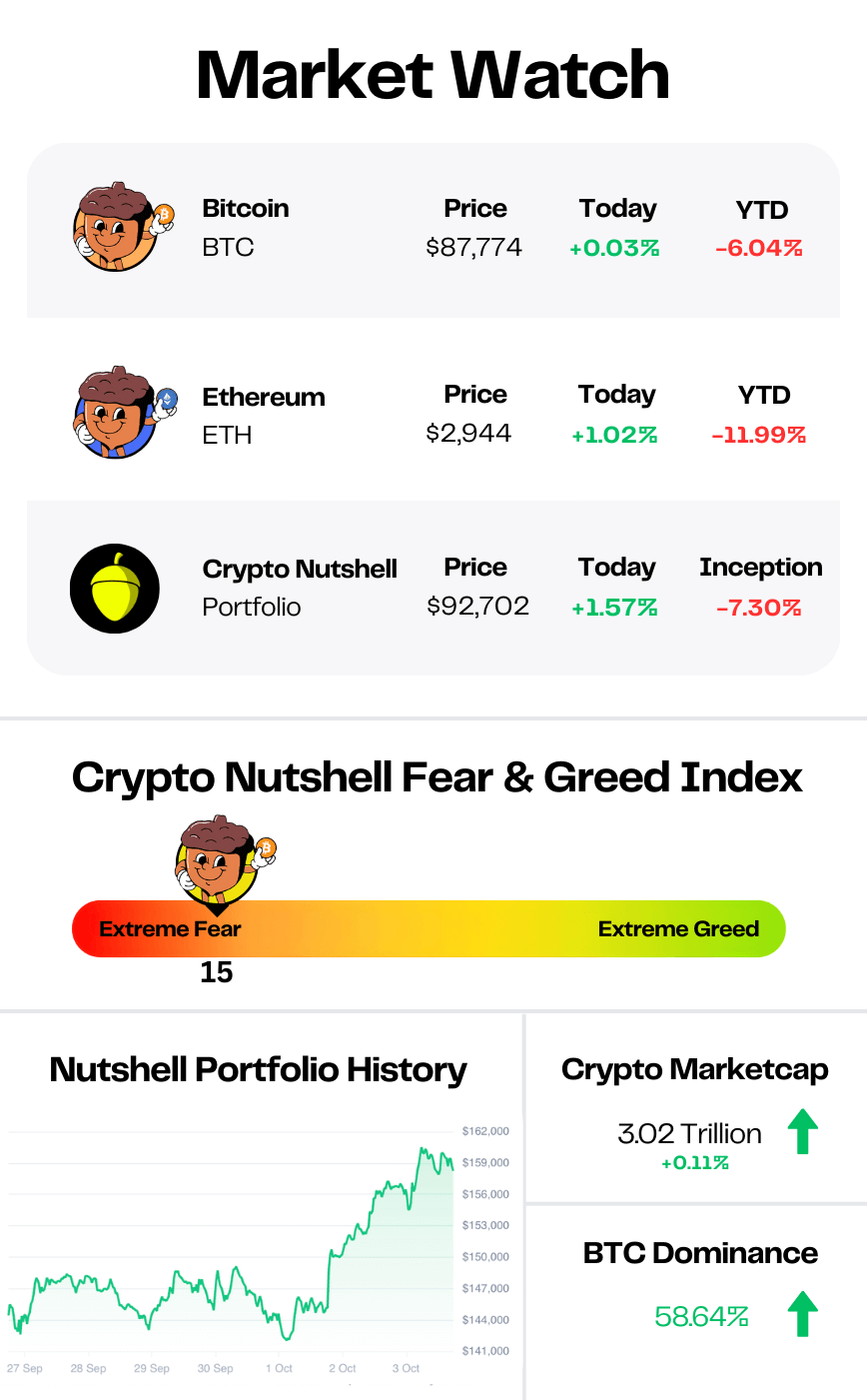

Prices as at 2:30am ET

TEXAS BUYS THE DIP 🤑

BREAKING: Texas Buys $5M in BTC ETF as States Edge Toward First Government Crypto Reserves

Texas just pulled the trigger.

The state has started building its Texas Strategic Bitcoin Reserve with a $5 million purchase of BlackRock’s IBIT ETF, the first step toward a $10 million allocation.

Senator Charles Schwertner was blunt about the logic:

[Texas] “should have the option of evaluating the best performing asset over the last 10 years”

For now, the position sits alongside:

~$667 million dollars in SPY

~$34 million dollars in a Janus Henderson fund

And now, its first Bitcoin ETF

A spokesman for the comptroller called IBIT a “placeholder for the first direct state funds investment” in Bitcoin.

The goal is still direct self custody once the legal and custody framework is ready.

Texas also did something else: it bought the dip.

Texas Blockchain Council president Lee Bratcher confirmed the purchase went through on November 20th around $87K, calling it the reserve’s first allocation and the first Bitcoin buy by a US state.

It’s not huge in dollar terms…

But it is a precedent.

One US state has now:

Budgeted for Bitcoin

Bought a spot ETF as a regulated entry point

Stated publicly that self custody is the endgame

It now gives every other state a ready-made playbook for treating Bitcoin as a treasury asset, not just a speculative trade. 🚀

YOUR PERSONAL INFO IS BEING SOLD ONLINE… 😳

And no - it’s not just your phone number.

Data brokers are selling your name, address, phone, age, job, income level, and even info about your family. All without your consent.

That’s why the Crypto Nutshell Team uses DeleteMe.

DeleteMe finds your personal data across hundreds of shady broker sites - and gets it removed. Automatically. All year round.

Since signing up, we’ve gotten reports showing how much of our info was found and deleted - including 100+ listings across dozens of websites we didn’t even know existed.

Here’s what DeleteMe helps you reduce risk of:

Identity theft and phishing scams 🎣

Stalking and doxxing 🕵️

Targeted harassment based on your job, politics, or online presence 💻

Personal data leaks involving your family 🧑🤝🧑

The best part?

It’s completely hands-off. DeleteMe’s privacy experts handle everything.

👉 Learn more and get 20% off your plan at joindeleteme.com/CRYPTONUTSHELL and use promocode CRYPTONUTSHELL at checkout!

Take back control of your data. You deserve privacy.

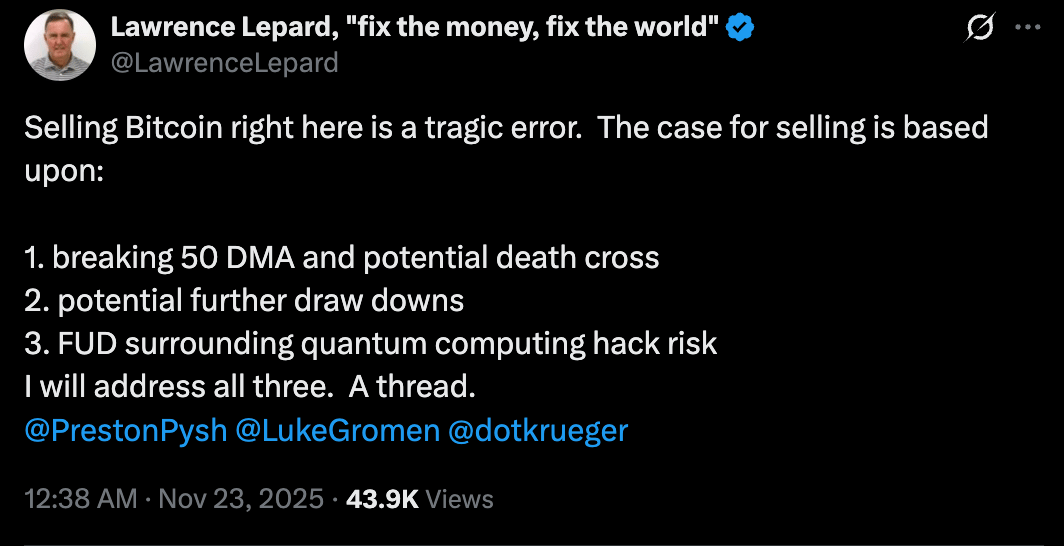

A TRAGIC MISTAKE 🥀

Most people panic-sell bottoms.

Larry Lepard calls them out.

If you don’t know Larry: he’s a veteran macro investor, gold fund manager, and one of the earliest traditional-finance guys to publicly embrace Bitcoin as the ultimate monetary debasement hedge.

He’s been screaming the macro truth long before Wall Street caught on.

And this weekend, as crypto puked again, he dropped one of his clearest threads yet:

People selling here are making a tragic mistake.

Why?

Lepard breaks down the 3 big fears driving the panic:

His response?

None of it matters when the macro freight train is about to hit. Because for Lepard, the only thing that drives Bitcoin long-term is this:

Massive monetary debasement is inevitable - and very close.

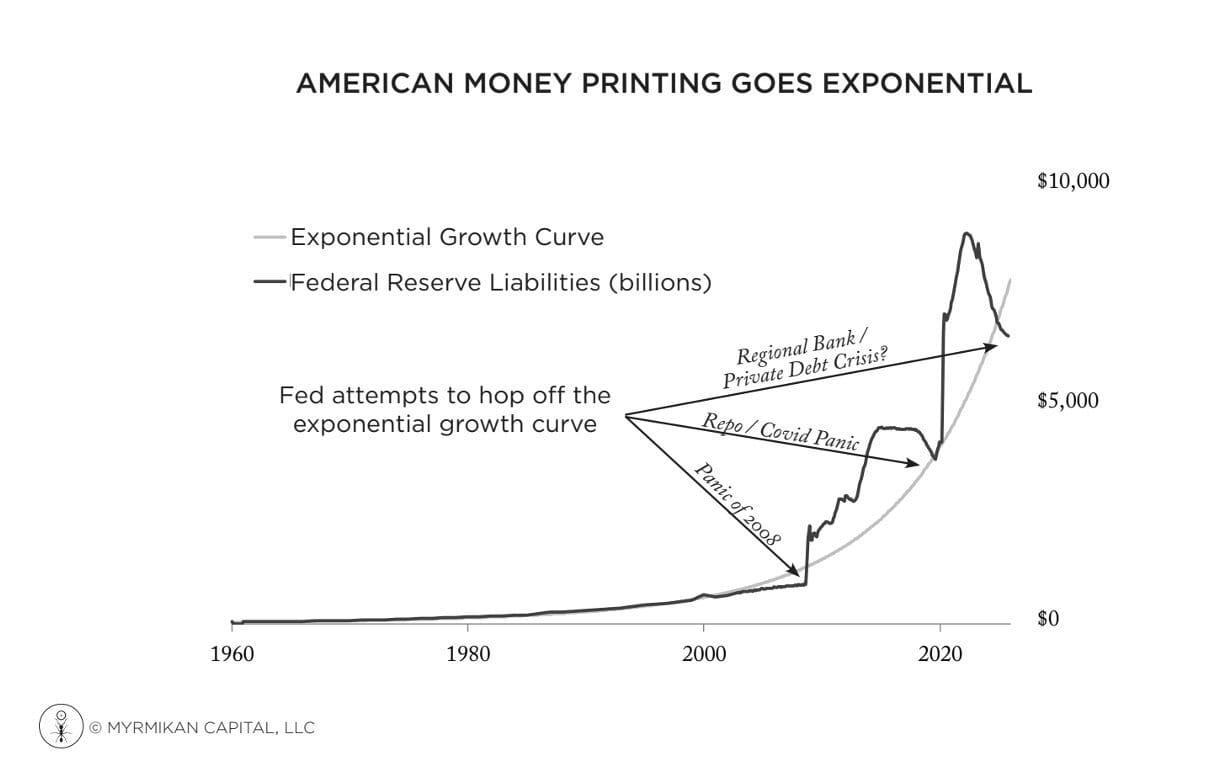

He points to Dan Oliver’s famous chart on Fed policy:

Every single time the Fed tries to slow the exponential growth of money… They get forced right back into printing.

Every. Single. Time.

And according to Lepard? We’re at that point again.

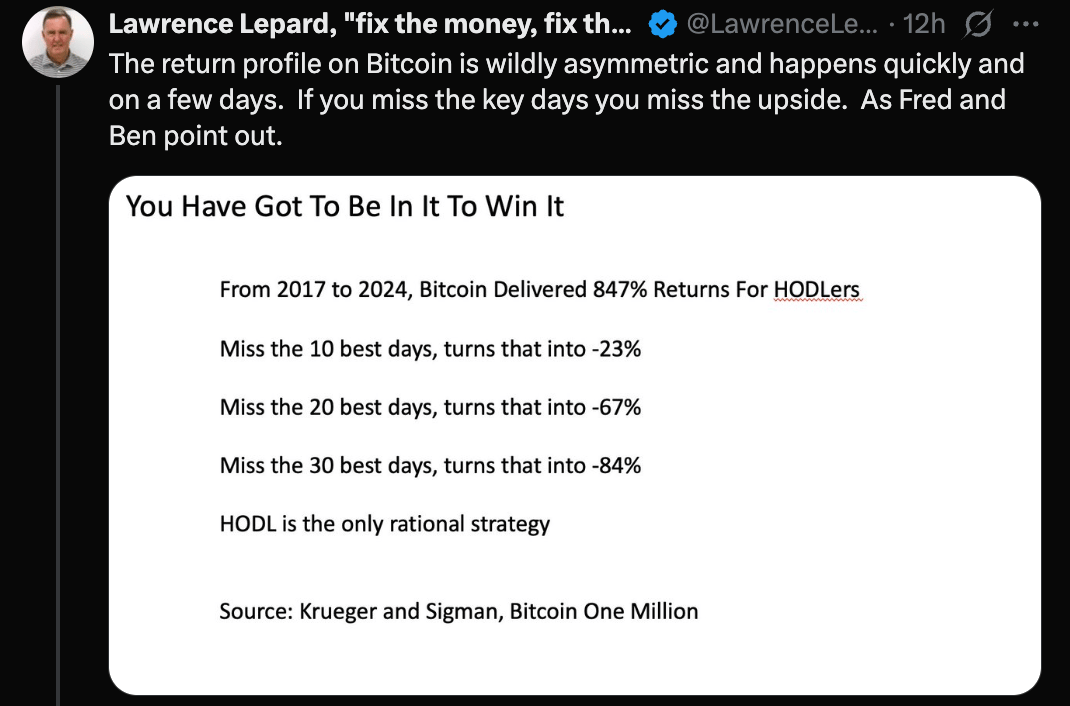

This is the setup Bitcoin was built for. But here’s the part most people ignore:

Bitcoin’s upside comes in bursts. If you miss the burst, you miss the cycle.

Lepard reminds everyone:

Lepard’s message is simple:

Bitcoin is the most asymmetric upside bet on the planet.

Selling now - on fear, indicators, or headlines - is how investors blow generational trades.

If you believe debasement is coming (and it is)…

If you believe Bitcoin wins (and it does)…

You don’t sell the shakeout.

You embrace it.

Because when Bitcoin moves… it moves without warning.

And without mercy for anyone who sold too early.

The God candles don’t wait for you. 🕯️

ARE LONG-TERM HOLDERS SELLING? 😱

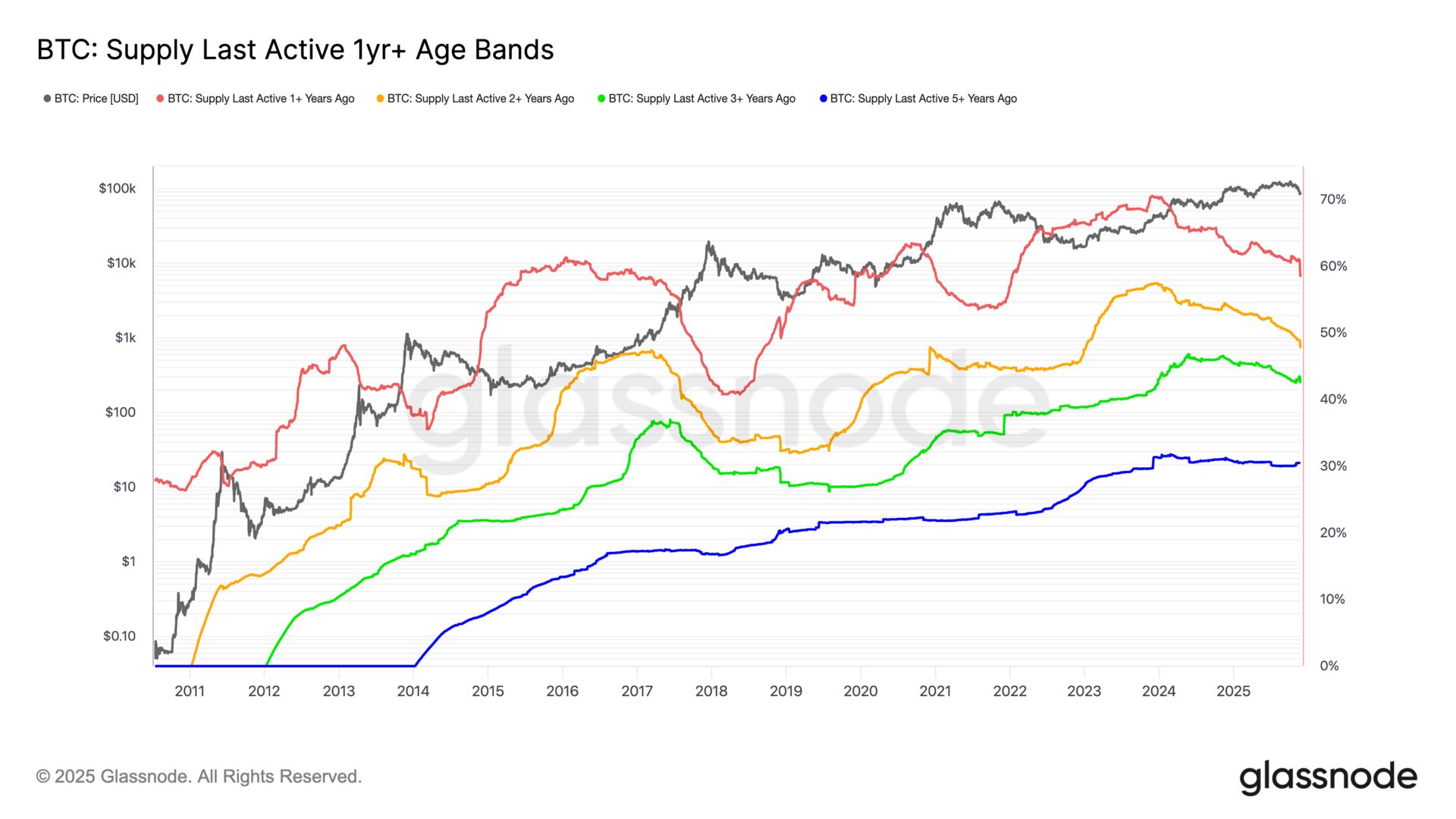

Let’s check in on one of our favourite metrics: Bitcoin’s supply last active 1+ years ago.

It’s a simple but powerful signal - tracking how much BTC has remained untouched as a percentage of total circulating supply.

Here’s the logic:

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

Here’s the latest supply breakdown vs. two weeks ago:

🔴 Supply last active 1+ years ago: 58.57% (down from 60.76%)

🟠 Supply last active 2+ years ago: 47.69% (down from 48.97%)

🟢 Supply last active 3+ years ago: 42.48% (down from 42.87%)

🔵 Supply last active 5+ years ago: 30.51% (up from 30.45%)

Even with this correction, almost 59% of all Bitcoin has not moved in a year.

Yes, that is down a bit from two weeks ago, and we can see it in the mid-range cohorts:

Some 1–3 year coins are moving.

But the 5+ year base actually grew, with more BTC aging into that deepest conviction bucket.

That is not a picture of long-term holders abandoning ship. It is a classic rotation:

Older mid-cycle holders are taking profit or de-risking, while the very old supply stays glued in place and more coins age into that 5+ year bracket.

When that much supply is locked away, it does not take a huge wave of new demand to flip the script. 🚀

CRACKING CRYPTO 🥜

Inside the JPMorgan boycott drama defending Bitcoin treasuries being kicked off major indexes. MSCI consultation paper and JPMorgan's positioning resulting in some major fallout across social media to defend DATs like Strategy.

Japanese watchdog to require exchanges to hold liability reserves. According to a Nikkei report, Japan’s Financial Services Agency may soon require crypto companies to hold reserves to compensate users affected by security breaches.

Why Bitcoin Is Underperforming Equities Despite Bullish Catalysts. Gains in AI-fueled stocks and heavy crypto leverage have widened the gap between bitcoin and equities.

CFTC Acting Chair Pham seeks CEOs for innovation council amid expanding crypto oversight. The CFTC's Acting Chair, Caroline Pham, is seeking chief executives to bolster a newly formed CEO Innovation Council.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which Ethereum upgrade enabled withdrawals of staked ETH for the first time?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Shanghai 🥳

The Shanghai upgrade finally allowed validators to withdraw ETH from the staking contract. 🔓

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.