GM to all of you nutcases. It’s Crypto Nutshell #695 anchorin’ down… ⚓🥜

We're the crypto newsletter that's more epic than a warrior defending Sparta against an empire with just 300 men... ⚔️🛡️

What we’ve cooked up for you today…

🏦 It’s still cheap?

🚂 Ethereum is a trainwreck

📈 New all-time high

💰 And more…

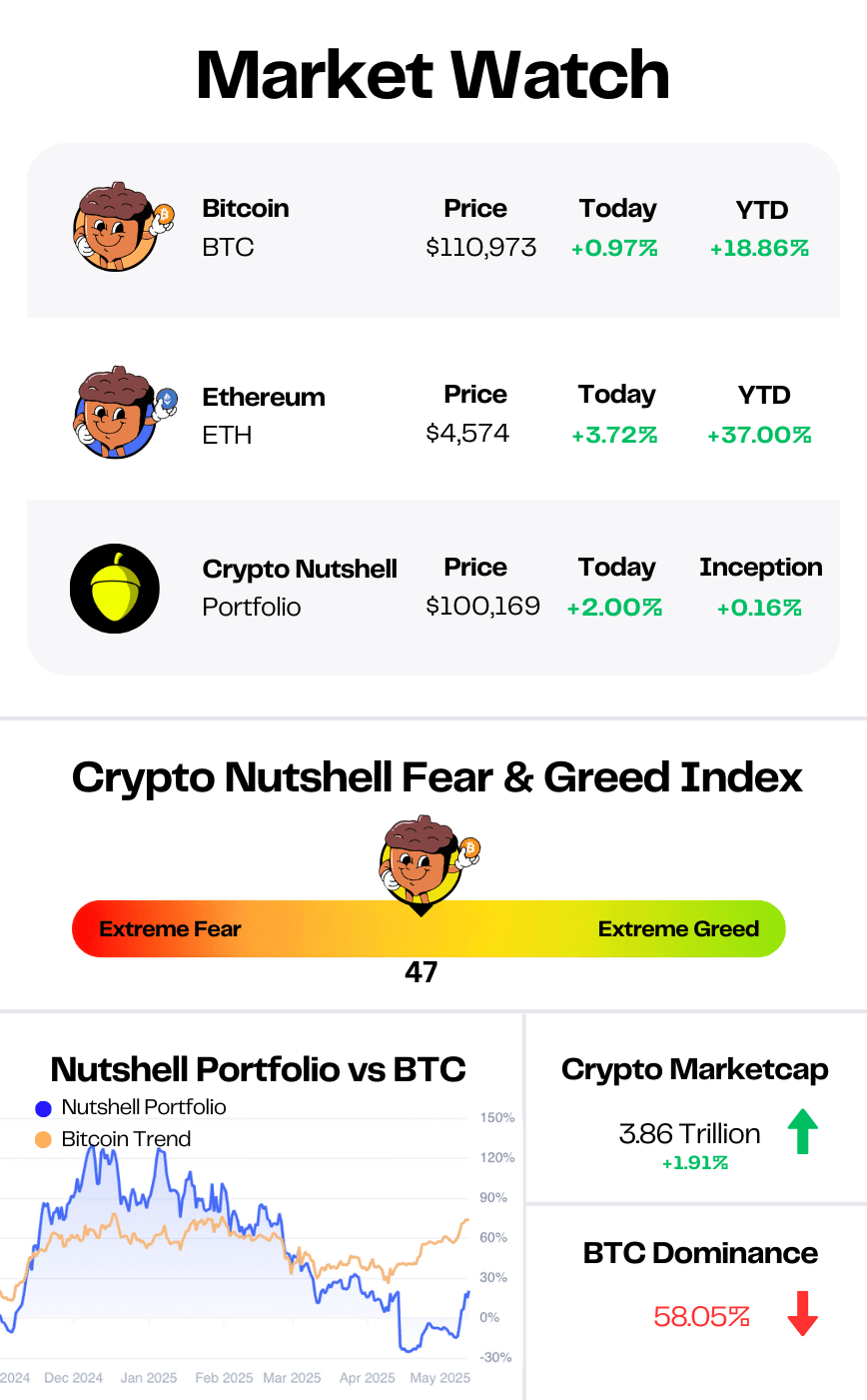

Prices as at 3:20am ET

IT’S STILL CHEAP? 🏦

BREAKING: Standard Chartered calls Ethereum and ETH treasury companies 'cheap' at current levels

Ethereum just smashed a new all-time high of $4,953 this week.

But according to Standard Chartered, the rally is only just getting started…

In a series of notes, the bank’s head of digital assets Geoffrey Kendrick said both ETH and the wave of Ethereum treasury companies remain “cheap at today’s levels.”

His year-end target? $7,500 - with a long-term path toward $25,000 by 2028. 🤯

The numbers backing that call are staggering.

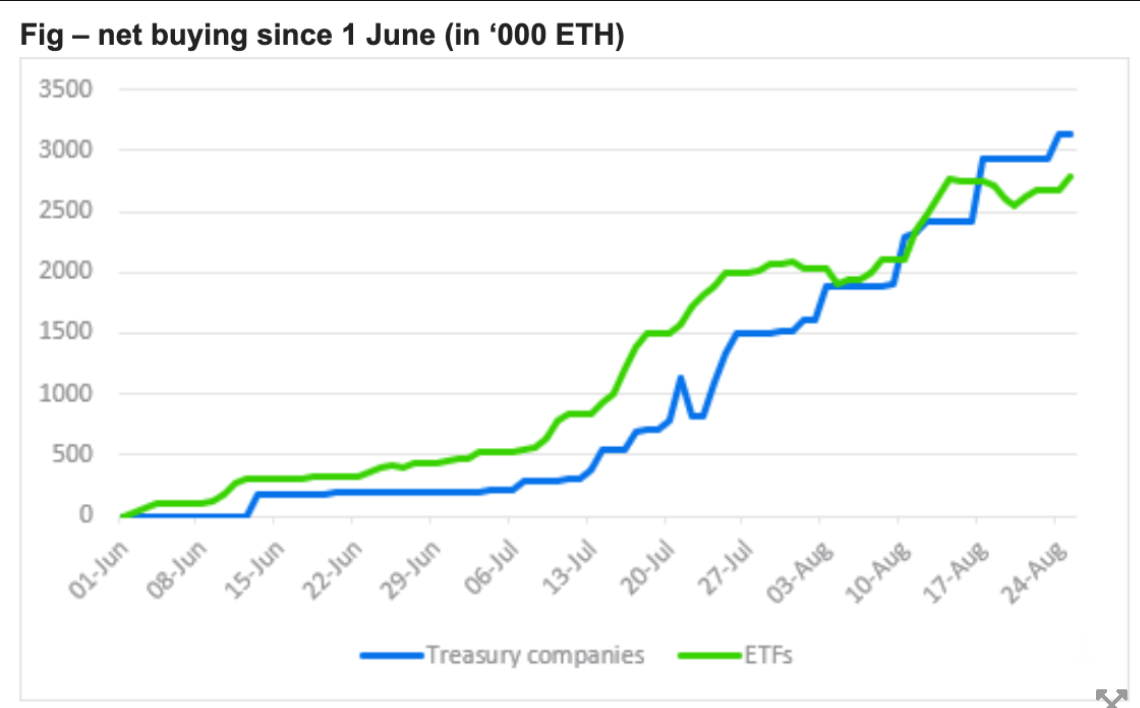

Since June, ETH ETFs and corporate treasuries have absorbed 4.9% of all circulating ETH - one of the fastest accumulation streaks in crypto history.

Treasury firms alone have bought 2.6%, while ETFs have taken another 2.3%.

For comparison, Bitcoin ETFs and treasuries only managed to grab 2% of BTC supply during their early boom in 2024.

“Although these inflows have been significant, the point is that they are just getting started.”

Kendrick predicts ETH treasury firms could ultimately own 10% of the supply - with BitMine Immersion already targeting 5% on its own.

And ETF flows confirm the trend.

On Monday, Ethereum funds saw $444M in inflows - more than double Bitcoin’s $219M. Year-to-date, ETH is up 32.6%, outpacing BTC’s 17.3%.

And yet, ETH treasury stocks like SharpLink Gaming and BitMine Immersion still trade at discounts - even though they earn a 3% staking yield on top of price gains.

Kendrick called the valuation gap “unjustified,” with SBET even pledging buybacks if its NAV multiple falls below 1.0.

The dip to ~$4,400 this week? Kendrick called it a “great entry point.”

The bottom line: Ethereum’s breakout isn’t just hype. It’s being locked up at a historic pace by ETFs and treasuries, while regulators greenlight staking and stablecoins.

The supply shock is real - and Standard Chartered says the upside has only just begun. 🚀

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

ETHEREUM IS A TRAINWRECK 🚂

We’ve been glazing Ethereum a lot lately… so let’s balance things out with a contrarian take.

Not everyone in the space is convinced ETH is the chosen one.

This week, Fred Krueger - mathematician, ex–hedge fund manager, and diehard Bitcoiner - laid out 4 reasons why Ethereum is a trainwreck (his words, not ours):

1. Institutions Haven’t Picked a Chain 🏦

Right now, the buzz is that Ethereum is the chain institutions have chosen to settle on.

But BlackRock, Fidelity, JPMorgan… they’re testing across multiple blockchains.

Ethereum is one choice, but Solana, Avalanche, Polygon, and private chains are all in play. Right now - there’s no clear monopoly.

2. Stablecoins Tell Another Story 💵

The biggest real-world use case? Stablecoins.

And ETH doesn’t dominate there: Tron rules emerging markets, Solana is growing fast with USDC. Tokenization experiments may start on ETH, but they often bridge out.

3. Liquidity 🌊

Yes, ETH has the deepest liquidity and most mature DeFi stack.

But institutions ultimately care about cost, speed, and compliance. That’s why Visa pilots on Solana, not Ethereum.

4. The “Chosen One” Narrative Is Marketing 📢

A lot of the “institutions chose ETH” story is coming from Ethereum treasury companies and ETH-aligned firms.

In reality? Institutions are chain-agnostic. They’ll use whatever rails work best.

The Bottom Line:

Fred’s view: ETH is the first stop… but not the final answer.

The real world is multi-chain and pragmatic:

ETH for credibility and liquidity

Solana/Tron for stablecoin flows

Avalanche/Polygon for experiments

Bitcoin for ultimate settlement

Some interesting points to chew on.

We don’t agree with Fred’s full take on Ethereum - but we do agree the future won’t be winner-take-all. It’ll be multi-modal.

And remember: Fred Krueger is a diehard Bitcoiner.

He’s always going to tilt BTC > ETH.

But always good to balance out perspectives. ⚖️

NEW ALL-TIME HIGH 📈

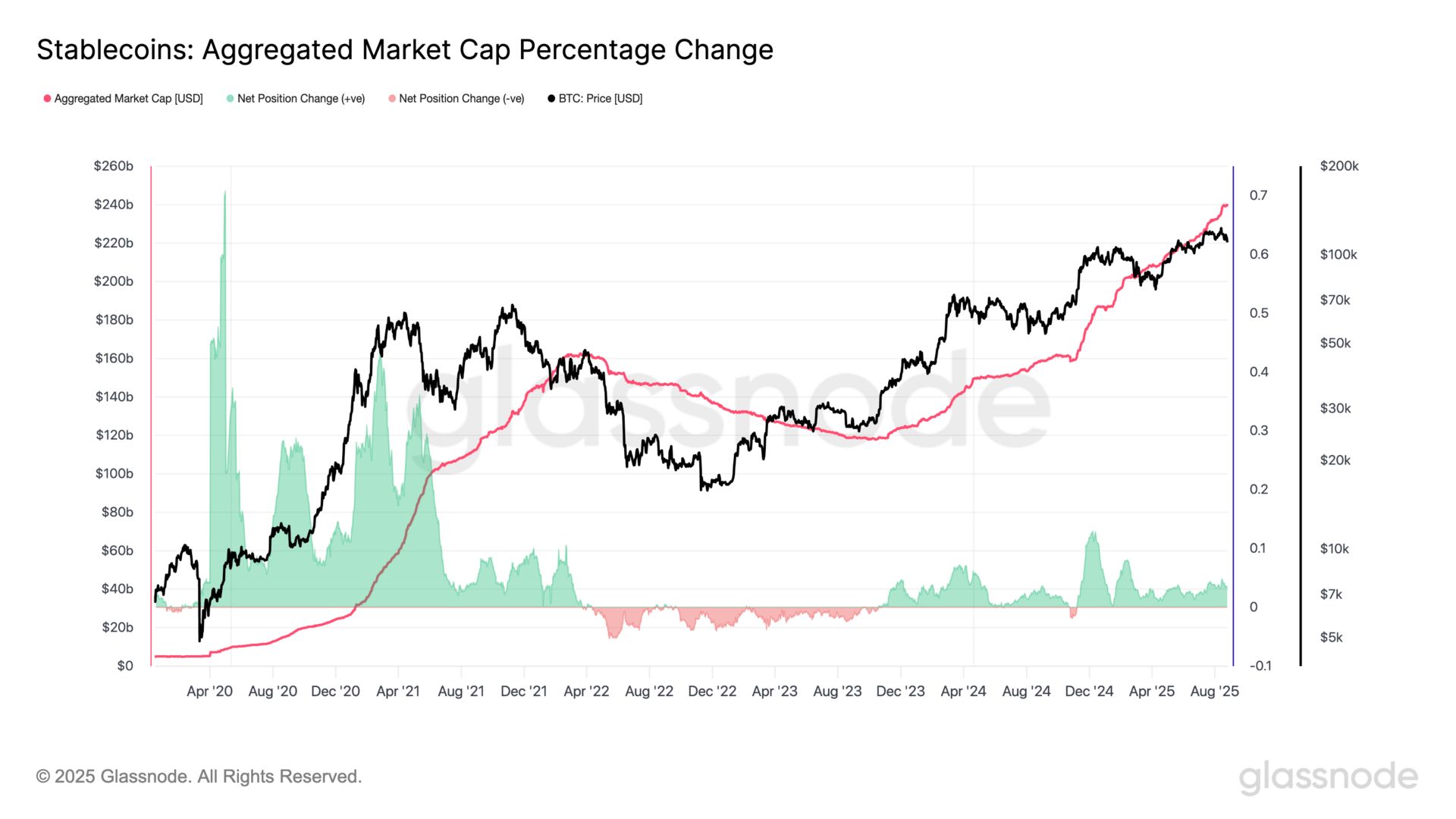

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Two weeks ago, stablecoin supply sat at $234.57B.

Today? $240.40B.

That’s a $5.83B surge in just 14 days — and a brand-new all-time high. 🚀

Since January 1st, supply has exploded by $55.36B. 🤯

Let that sink in.

Why does this matter?

Because stablecoins aren’t just digital dollars. They’re dry powder.

Fresh capital. Parked on-chain. Locked. Loaded.

And history is crystal clear: stablecoin supply doesn’t follow rallies… it fuels them.

They’re not the aftermath of bull runs - they’re the spark. 🔥

CRACKING CRYPTO 🥜

Trump Media taps into CRO boom taking 19% of supply in massive $6.42B acquisition strategy. Trump Media partners with Nasdaq-listed Yorkville and Crypto.com to establish $6.42 billion CRO-focused entity.

Binance stablecoin inflows top $1.6B, signaling traders positioning for rebound. Binance sees $1.65 billion in stablecoin deposits amid $1 billion ETH withdrawals, according to CryptoQuant data.

Hut 8 (HUT) Gains on Power Capacity Expansion Plan. Investment bank Roth Capital viewed the plans as a "notable step-up" with potential to "materially re-rate the stock."

Bitwise files to launch a spot Chainlink ETF in latest push for single-token crypto funds. Bitwise filed an S-1 witht the U.S. SEC for a Chainlink ETF that would track LINK’s price as fund issuers aim to bring more crypto funds to market.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which Ethereum upgrade made ERC-721 NFTs possible?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: ERC-721 standard 🥳

The ERC-721 standard defined unique, non-fungible tokens — paving the way for CryptoKitties, BAYC, and more. 🎨🐒

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.