GM to all of you nutcases. It’s Crypto Nutshell #748 followin’ the north star… ⭐🥜

We're the crypto newsletter that's more relentless than a detective chasing clues through dreams within dreams... 💤🧠

What we’ve cooked up for you today…

📈 New Wall Street predictions

🇺🇸 Eric Trump “Q4 Will Be Unbelievable”

📉 Still going down

💰 And more…

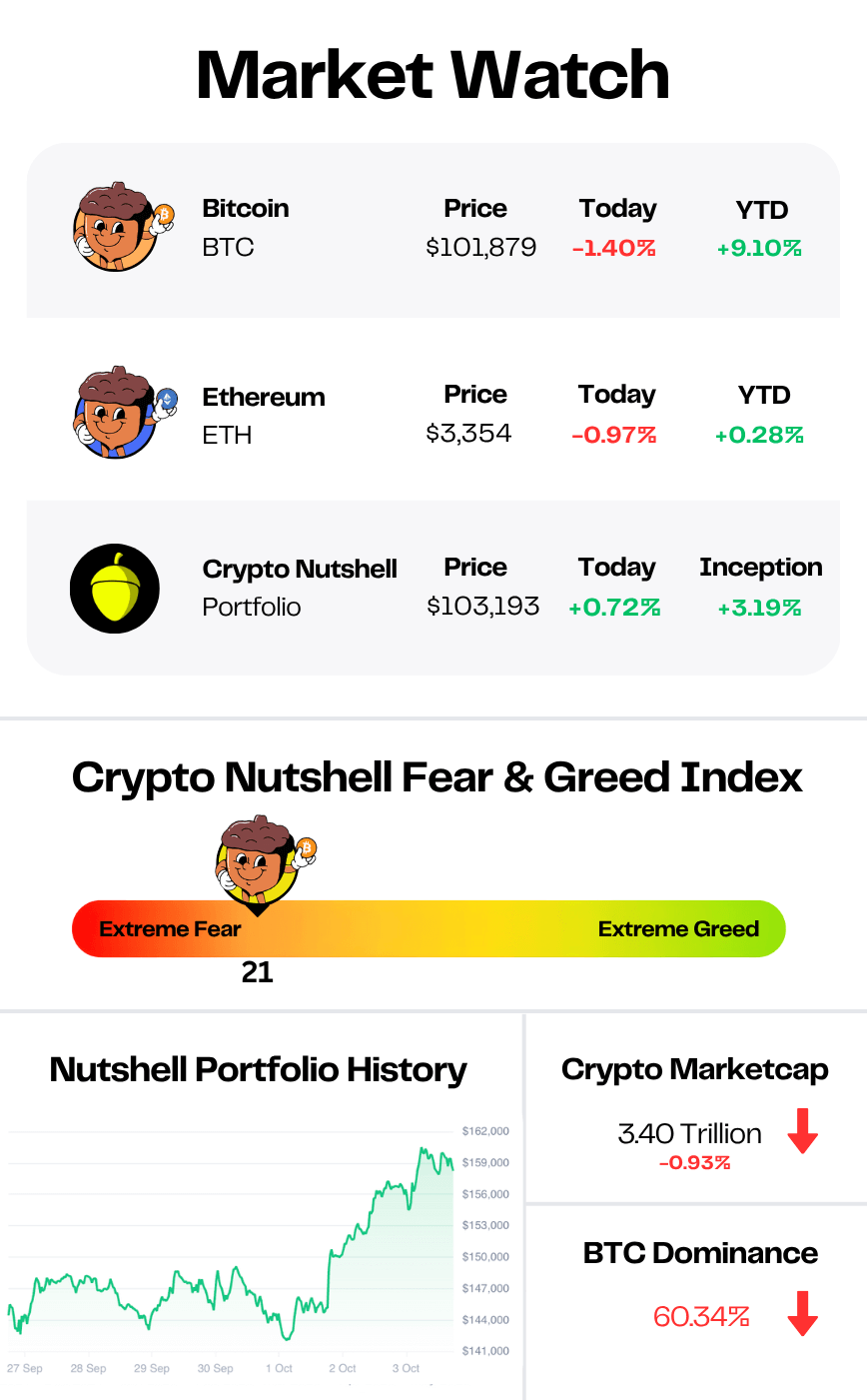

Prices as at 2:15am ET

NEW WALL STREET PREDICTIONS 🤑

BREAKING: JPMorgan sees bitcoin price reaching about $170,000 within the next 6 to 12 months

Two of the biggest names in finance just dropped fresh Bitcoin forecasts - and they couldn’t be more different.

JPMorgan sees a near-term surge, while ARK Invest’s Cathie Wood just trimmed her ultra-bullish long-term view.

Let’s start with JPMorgan.

The bank now values Bitcoin at roughly $170,000 based on its gold-adjusted fair value model.

Analysts say the recent leverage washout - including October’s record $19B liquidation cascade - is “likely behind us.”

With derivatives reset and gold volatility rising, they believe Bitcoin looks increasingly attractive on a risk-adjusted basis.

If BTC were to match just two-thirds of gold’s private investment base, its market cap would need to climb 67% - putting Bitcoin near that $170K mark within six to twelve months.

In other words, JPMorgan thinks the worst of the pain is over and the next leg higher could already be loading.

Cathie Wood, meanwhile, is playing the long game.

She still sees Bitcoin dominating the next decade - but with one caveat.

Stablecoins are moving faster than expected, especially across emerging markets.

They’re becoming the “digital dollars” of the world - a role Wood once thought Bitcoin would fill.

“Stablecoins are usurping part of the role we thought Bitcoin would play” she said.

As a result, ARK has cut its 2030 bull case from $1.5M to $1.2M per Bitcoin.

Still, Wood insists Bitcoin’s core thesis remains intact: it’s “digital gold” not digital cash - and institutions are only just getting started.

So where does that leave us?

JPMorgan is calling for $170K by mid-2026.

Cathie Wood is calling for $1.2M by 2030.

Short term or long term - both see the same direction of travel. 🚀

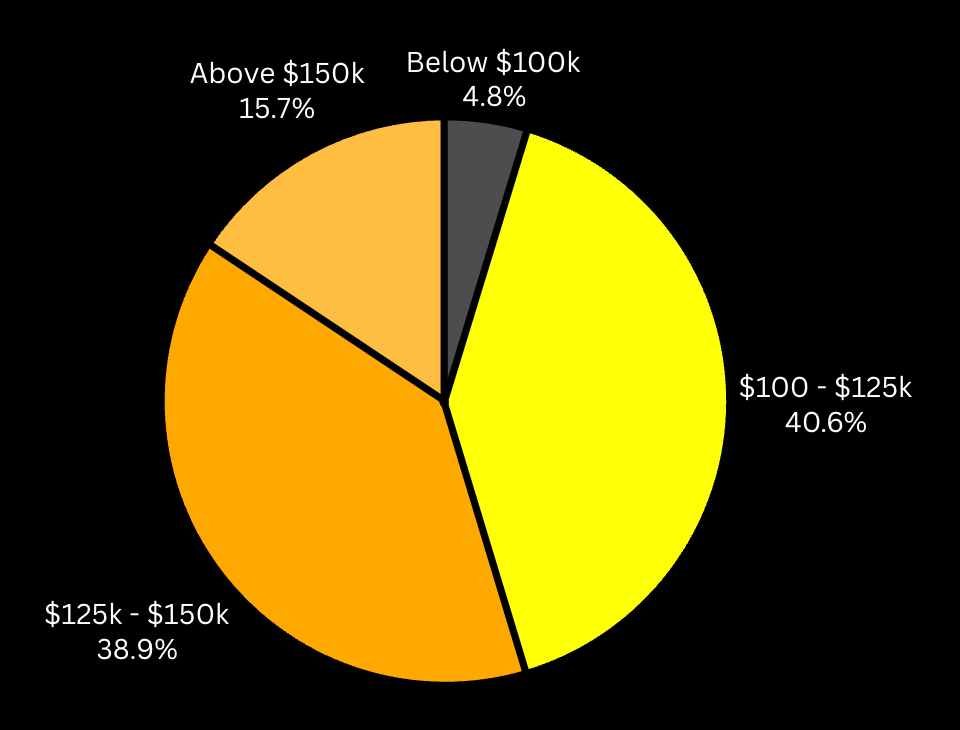

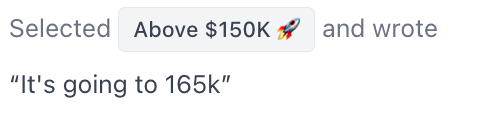

What Our Readers Think 🧠

Yesterday we asked where you see Bitcoin closing out 2025 - and the results are in:

A huge 95.2% of readers believe Bitcoin will finish the year above $100,000.

But the crowd is split between two main camps:

$100K–$125K: 40.6% of votes

$125K–$150K: 38.9% of votes

Only 4.8% think Bitcoin will end the year back below six figures, while 15.7% are aiming higher with calls for above $150K. 🚀

Wall Street can debate models all day, but our readers are sending a pretty clear message:

Bitcoin might wobble, but most of you still see it closing 2025 strong.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

ERIC TRUMP: “Q4 WILL BE UNBELIEVABLE” 🇺🇸

Eric Trump - son of the President and Executive Vice President of the Trump Organization - just dropped one of the most bullish takes we’ve heard all year.

In his latest interview with NYNEXT, he said:

“The future is incredible. The future is bright. I think Q4 is going to be unbelievable for a host of reasons. I’ve always said Bitcoin will surpass a million dollars.”

But here’s where it gets interesting - he wasn’t just talking the talk.

He actually knows the macro:

“With quantitative easing starting tomorrow, you’re going to see rate drops. You see what’s happening with M2 - money supply is skyrocketing. And Q4 has always been the strongest quarter for crypto.”

That’s not a guess - that’s real understanding.

He’s connecting QE, liquidity, & Bitcoin — the same forces every top macro analyst in the world watches.

So when the President’s son is out here referencing M2 and easing cycles, you know he’s not just a spectator.

He gets it.

If he’s right, and the floodgates of liquidity are about to open…

Q4 won’t just be good - it could be unbelievable. 🎆

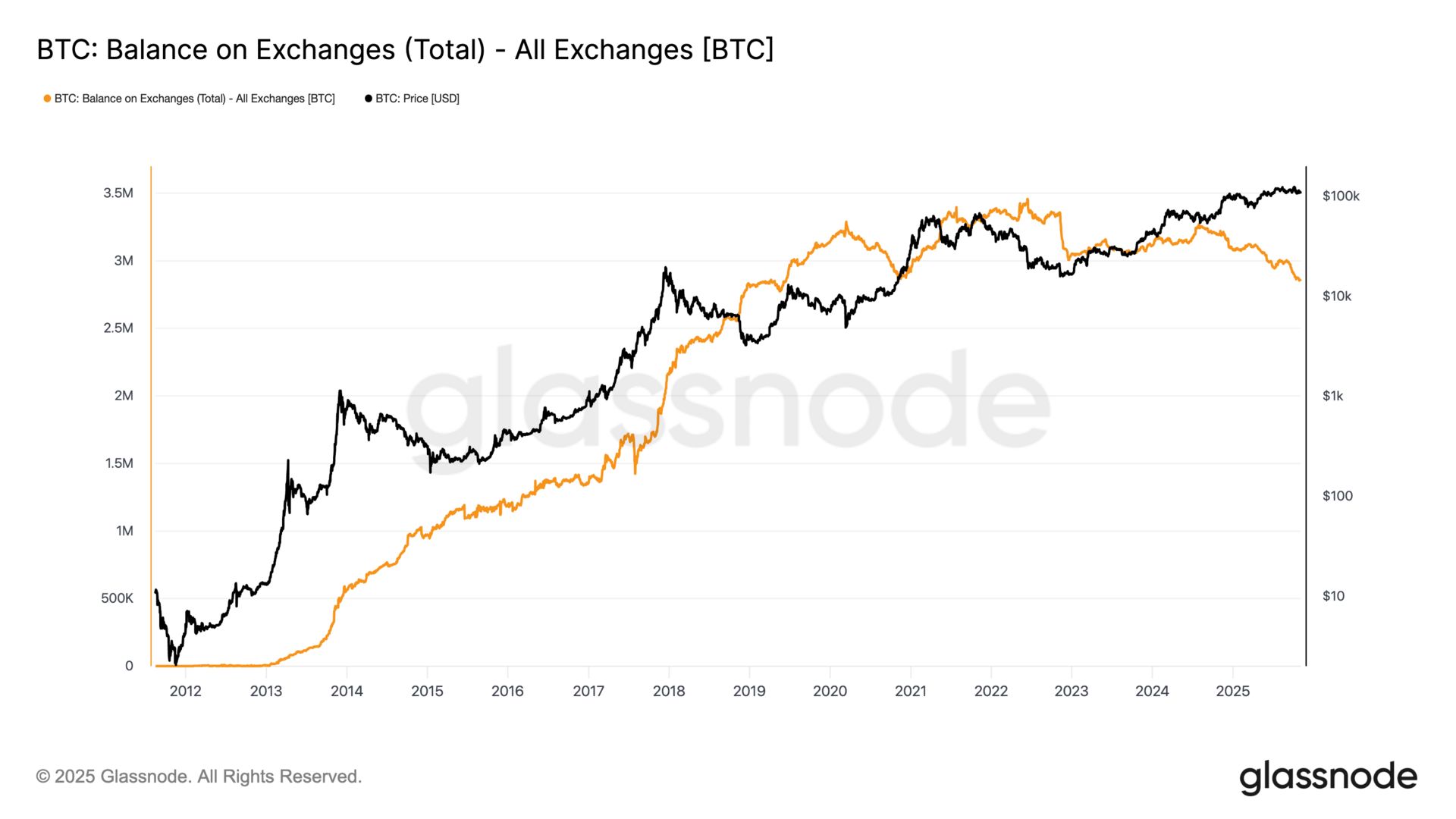

STILL GOING DOWN 📉

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Just 2,850,852 BTC now sit on exchanges - 14.29% of the total supply.

Since January, another 228,203 BTC (worth ~$24.5 billion) has been pulled off the market.

We haven’t seen exchange balances this low since 2019, when Bitcoin traded near $8,000.

And just like we saw with Ethereum yesterday, there’s no surge in BTC deposits.

Even through the current correction, balances are trending downwards.

That says it all. This isn’t panic - it’s OG whales taking profits, not dumping their bags. 🐳

CRACKING CRYPTO 🥜

Solana ETFs are outperforming Bitcoin: Is SOL siphoning BTC liquidity? A week of outflows from Bitcoin/Ethereum funds contrasts with steady Solana inflows. What changes if the pattern persists?

Ray Dalio warns Fed is stimulating the economy into a bubble. Economist and hedge fund veteran Ray Dalio warns that the Federal Reserve's easing of monetary policy is dangerous amid high asset prices and rising debt.

Bitcoin, MSTR, COIN, IREN Headed Lower as U.S. Stocks Sink. Continuing a steep slide begun in July, Michael Saylor's Strategy has now turned lower on a year-over-year basis.

Robinhood cautious on adopting corporate bitcoin treasury: 'Is it the best use of our capital?' Robinhood’s crypto revenue rose 300% to $268 million in the third quarter, helping drive higher overall revenues of $1.27 billion.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What does a rising exchange reserve typically signal in crypto markets?

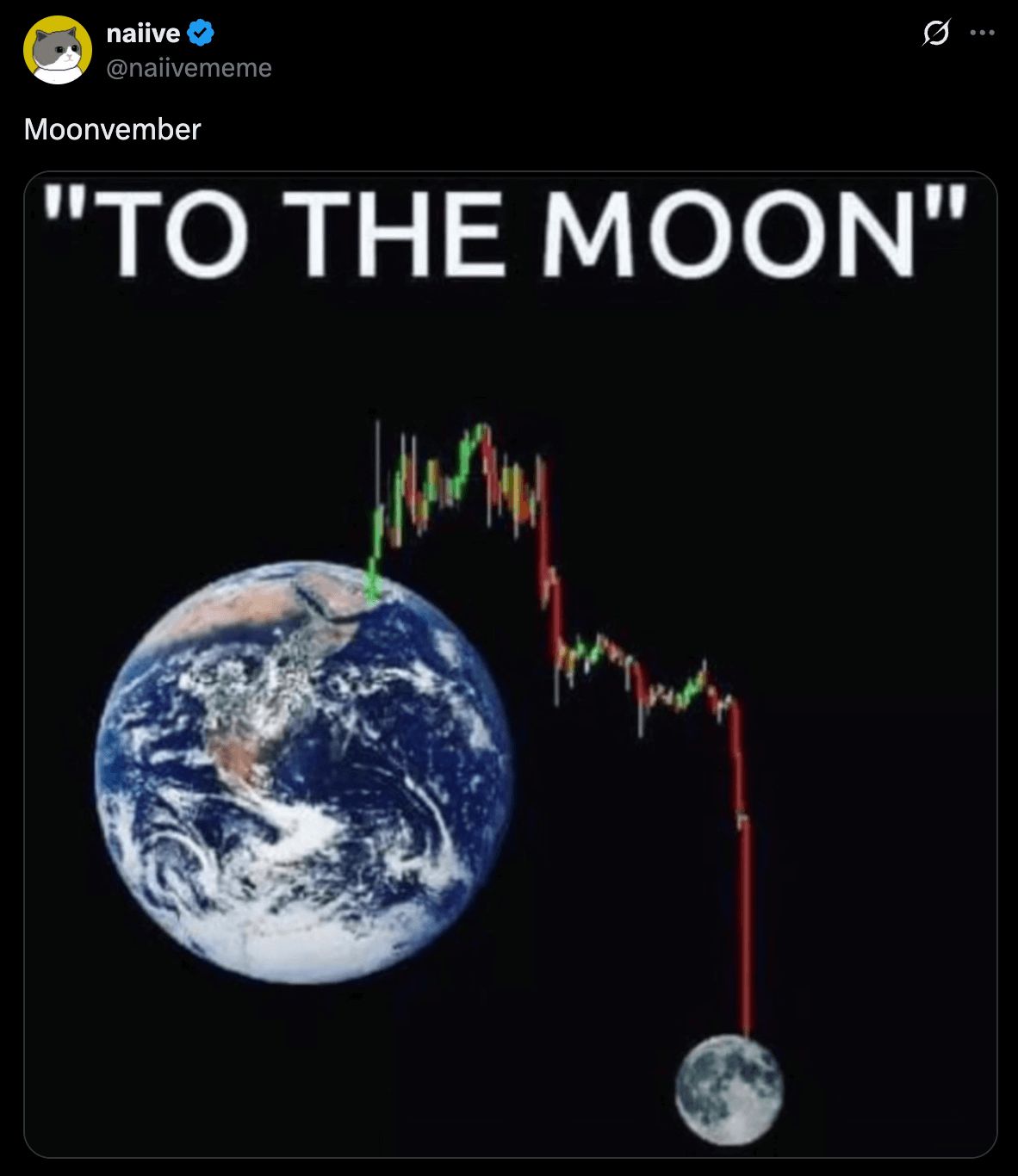

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Increased selling pressure 🥳

When exchange reserves climb, it often means traders are sending coins to exchanges — a sign of potential sell pressure. 📉

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.