Today’s edition is brought to you by Kirin Wallet

GM to all of you nutcases. It’s Crypto Nutshell #742 writin’ the plays… 📓🥜

We're the crypto newsletter that's more thrilling than a race against time to stop a doomsday device from detonating... ⏱️💣

What we’ve cooked up for you today…

😱 The Fed issues a warning

🇺🇸 The USA needs more Bitcoin

📈 The setup

💰 And more…

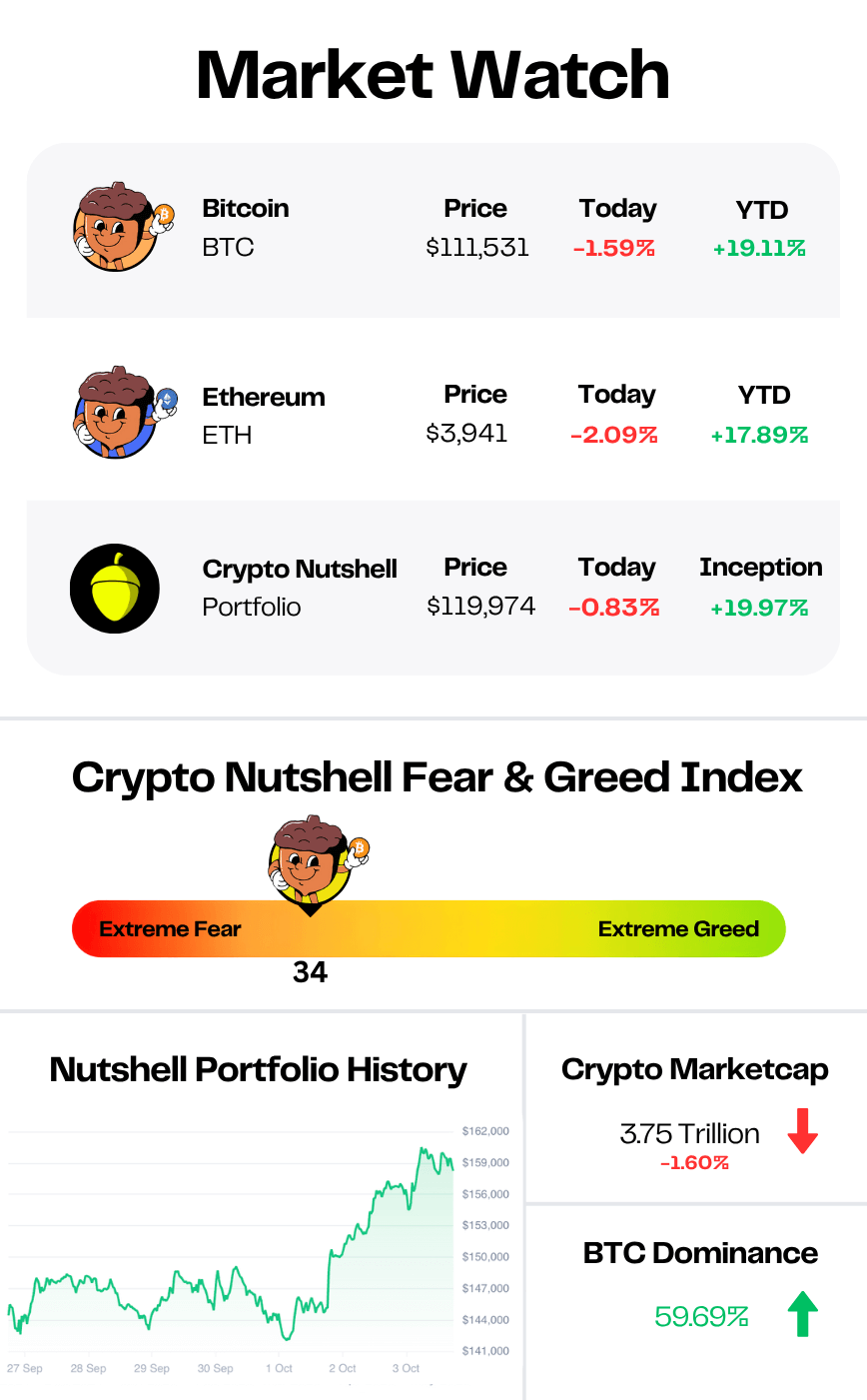

Prices as at 3:20am ET

THE FED ISSUES A WARNING 😱

BREAKING: Bitcoin Tumbles Back to $110K on Fed's Powell's Hawkish Comments

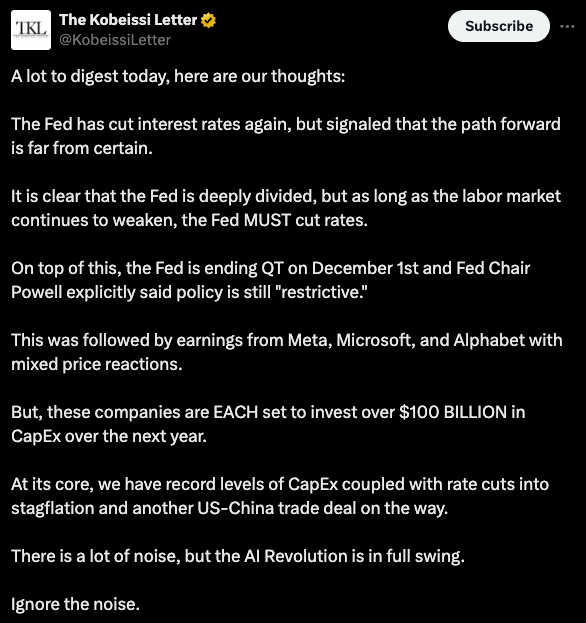

As expected, The Fed cuts rates again this week.

And instead of rallying, Bitcoin slipped back to $111K, down almost 2% on the day…

It should have been bullish. A rate cut means cheaper borrowing and more risk-taking.

But this one came with a warning.

Jerome Powell called the expected December cut “far from a foregone conclusion.”

And that single line flipped the market.

Traders who had priced in easy money got hit with reality.

Stocks and crypto dropped in sync.

Bitcoin fell as low as $109K, breaking below short-term support. RSI readings flirted with oversold levels on the 4-hour chart, and prediction markets on Myriad saw bullish odds slide from 75% to 58%.

Still, the bigger picture hasn’t changed.

The Fed’s benchmark rate is now at its lowest level in three years, and balance sheet reduction will stop on December 1. (aka QT is coming to an end)

Liquidity is coming - just not fast enough for impatient traders…

Analysts remain split.

Oxford Economics warned that “future moves are becoming more contentious” while Coin Bureau’s Nic Puckrin said Bitcoin is showing a “potential double top pattern” with “daily volumes dropping off a cliff.”

Yet 21Shares strategist Matt Mena sees the setup differently:

“November has historically been one of Bitcoin’s best-performing months… averaging 46% returns. We remain moderately risk-on and see a credible path for Bitcoin to break its all-time high before year-end.”

Short-term sentiment has once again turned shaky.

But the long-term story hasn’t changed. ⚡

Crypto trading is broken - it’s complicated, fragmented, and expensive.

But here's what the pros know: there are still thousands of hidden gems, you just need the right platform to catch them before everyone else.

Introducing Kirin Wallet - the all-in-one AI-powered crypto trading app.

✅ AI-Powered Intelligence: Real-time sentiment analysis and live updates

✅ Zero Complexity: No-KYC, one app for everything

✅ High Commission: Earn up to 75% of trading fees from referrals

✅ Built for Everyone: Buy crypto with Apple Pay or Credit Card

While others fumble with multiple apps, Kirin users are already positioned for the next 100x.

Join 100,000+ users and download Kirin Wallet now on the App Store or join the waitlist for Google Play.

Your next big win is waiting.

THE USA NEEDS MORE BITCOIN 🇺🇸

When the son of the U.S. President starts talking up Bitcoin on a mainstream podcast, you have to pay attention.

On The Iced Coffee Hour, Eric Trump, executive vice president of the Trump Organization and son of Donald J. Trump, said what almost no government official has dared to say out loud:

“The government should definitely have certain crypto assets on their balance sheet - mainly Bitcoin.”

Pressed on why, Eric didn’t hesitate:

“Because it’s the single greatest-performing asset of the last decade - up roughly 70% a year, every year.”

He even called out Germany for selling its Bitcoin stash too early - a move that cost them billions in potential gains.

Eric’s argument is simple:

If governments hold gold, bonds, and foreign reserves to protect their wealth, why not hold Bitcoin, the best-performing asset of the modern era?

When asked if the government should actively be buying Bitcoin to add to their stash, he left no room for interpretation:

“Yeah, 100%”

When the son of the leader of the free world says the U.S. government should be actively buying Bitcoin…

You know he gets it.

When conversations like this are happening in the Oval Office… you know what comes next. ⚡

THE SETUP 📈

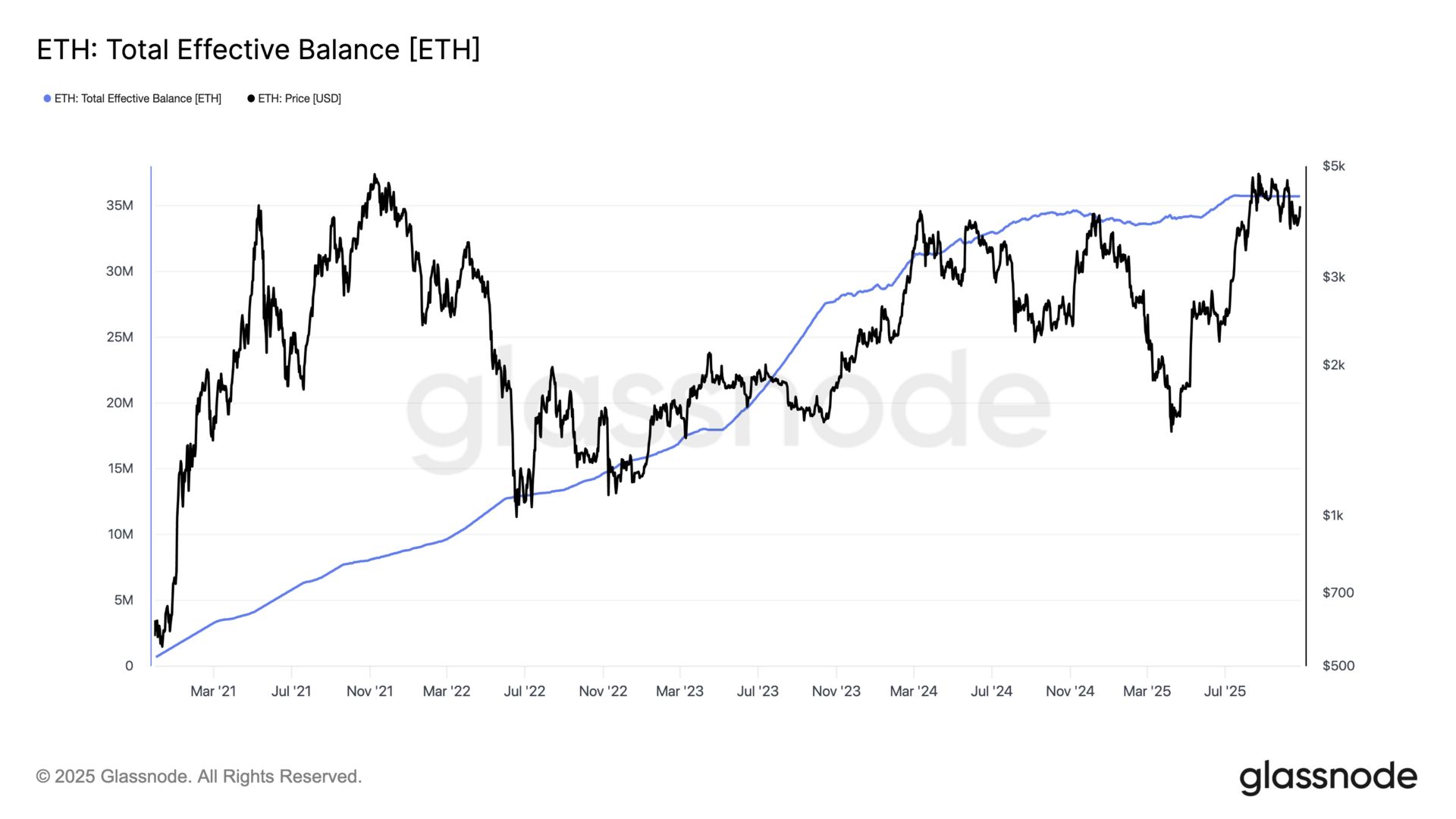

Time for check in on Ethereum’s supply side dynamics.

To do that we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

35.7 million ETH is now locked in staking - up +1.76M ETH this year, worth roughly $7.4 billion.

That’s 29.45% of the entire supply, almost one-third of all Ethereum off the market.

This isn’t background noise. It’s a slow-burn supply squeeze in motion.

Every week, more ETH vanishes into staking contracts while liquid supply keeps drying up.

And when demand finally collides with a shrinking float…

ETH doesn’t just climb. It erupts. 🚀

CRACKING CRYPTO 🥜

$500M BTC credit: Is Metaplanet proving crypto treasuries are momentum trades? Bitcoin-backed buybacks don't de-risk a treasury stock, they turn it into a levered, flow-driven bet on Bitcoin that can supercharge rallies and magnify the fade.

Germany’s AfD urges government to treat Bitcoin as strategic asset. Germany’s main opposition party, AfD, has warned of MiCA overregulation, urging regulators to treat Bitcoin separately from other crypto assets and consider it as a strategic reserve asset.

Investors Flock to MegaETH’s $450M Token Sale as Ethereum Founders-Backed Project Smashes Target. The high-speed Ethereum layer-2 drew nearly nine times its target as over 14,000 investors rushed in.

MetaMask parent Consensys pursues IPO with JPMorgan and Goldman. Consensys plans to follow in the footsteps of other crypto firms like Circle and Bullish and launch an initial public offering.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What does NUPL measure in Bitcoin analysis?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Percentage of supply in profit or loss🥳

NUPL gauges how many coins are in profit vs. loss — helping identify greed or capitulation zones. 📊

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.