GM to all of you nutcases. It’s Crypto Nutshell #765 patchin’ up wounds… 🩹🥜

We’re the crypto newsletter that’s more intense than a lone soldier fighting to survive behind enemy lines… 🎯🪖

What we’ve cooked up for you today…

🏦 Vanguard pivots

⚡️ The only future currency

📈 Inflows are back

💰 And more…

Prices as at 2:35am ET

VANGUARD PIVOTS 🏦

BREAKING: Vanguard clients can trade funds holding crypto like Bitcoin, XRP and Solana starting this week

Remember when the Bitcoin ETFs launched last year and Vanguard had no interest in offering them?

Check out the clip below…

Well they finally caved in… (Probably after they saw that BlackRock’s Bitcoin ETF is now it’s most profitable)

After years of sitting on the sidelines, the world’s second largest asset manager is opening the door to crypto for its 50 million clients.

Starting this week, Vanguard will let customers trade ETFs and mutual funds that primarily hold cryptocurrencies on its brokerage platform.

That includes funds tied to Bitcoin, Ethereum, XRP and Solana, treated the same way it already treats gold and other “non-core” assets.

For a firm that spent years saying “no crypto” this is a major pivot.

Here’s what Vanguard had to say:

“Cryptocurrency ETFs and mutual funds have been tested through periods of market volatility, performing as designed while maintaining liquidity… The administrative processes to service these types of funds have matured, and investor preferences continue to evolve.”

This shift comes after months of internal review and growing pressure from both retail and institutional clients.

Vanguard previously refused to offer access to spot Bitcoin ETFs when they launched in early 2024, even as:

Spot Bitcoin ETFs grew from roughly $25 billion in assets to around $125 billion in under two years

Ether ETFs expanded toward $20 billion

New products rolled out for XRP, Solana, Dogecoin, Litecoin and more

Vanguard completely missed that first wave.

A few key points to keep in mind:

Vanguard will support most crypto ETFs and mutual funds that meet regulatory standards

Products tied to obvious memecoins or assets not supported by the SEC will still be barred

The firm says it has no current plans to launch its own in-house crypto ETFs

This is not about Vanguard becoming a “crypto company.” It is about giving its $11 trillion client base access to regulated wrappers.

And that is the real story here.

While prices are still in a mid-cycle slump. And sentiment remains fragile.

In the background, the largest players in traditional finance keep doing the same thing:

They are not arguing about whether crypto belongs.

They are building more ways for their clients to own it.

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

THE ONLY FUTURE CURRENCY ⚡️

Elon Musk doesn’t talk about Bitcoin often.

But when the richest man in the world does talk about it, people listen.

Yesterday, in a new podcast appearance, Musk framed Bitcoin in a way almost no one else does:

“Energy is the true currency. This is why I said Bitcoin is based on energy.”

He then went one step deeper:

“You can’t legislate energy. You can’t just pass a law and suddenly have a lot of energy… It’s very difficult to generate energy.”

In other words:

Governments can print money 💵

But they can’t print energy ⚡️

Bitcoin is anchored to something real.

Something physical. Something scarce.

He then dropped the long-term bomb:

“[In the future] probably we won’t have money… we’ll just have energy power generation as the de facto currency.”

The takeaway:

While most people still think Bitcoin is just a speculative asset… the world’s richest man is framing it as stored energy for the digital age.

Bitcoin isn’t just money. It’s a new base layer for value itself.

And that’s why it will win. 🏆

INFLOWS ARE BACK 📈

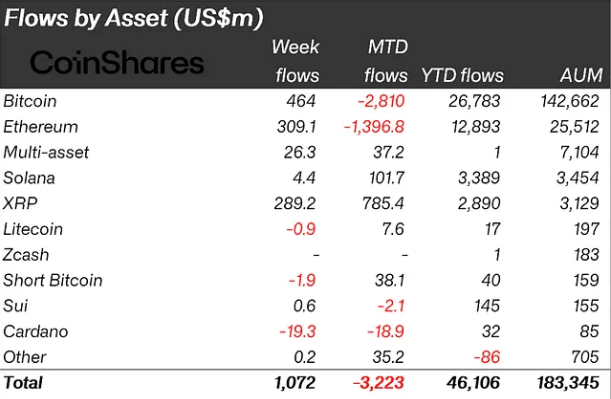

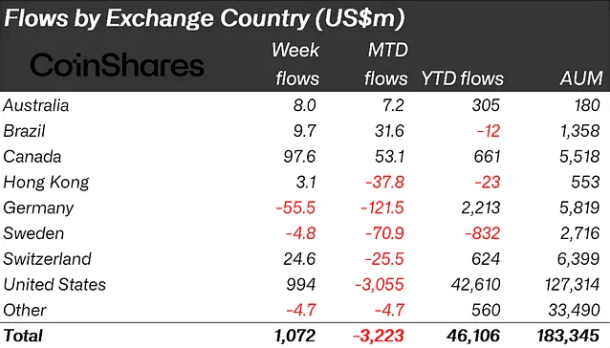

Digital asset funds finally saw inflows, with $1.06 billion coming in last week.

That’s a sharp turnaround in sentiment following 4 consecutive weeks of outflows that totalled $5.7 billion.

Let’s break it down.

Bitcoin saw the largest inflows at $464 million.

Ethereum also saw substantial inflows totalling $309.1 million.

Whilst XRP saw its largest ever weekly inflow at $289.2 million.

Regionally, flows were concentrated in the U.S. which saw $994 million in inflows.

Canada and Switzerland followed with inflows of $97.6 million and $24.6 million respectively.

So what caused this sudden flip in sentiment?

According to CoinShares, institutions moved after Fed member John Williams said policy is still “too restrictive.”

Rate cut odds for December jumped from around 35% to 87%.

Less pressure from the Fed. More confidence in liquidity.

And for the first time in a month, the flows are finally pointing in the right direction. 📈

CRACKING CRYPTO 🥜

Bitcoin ETFs end brutal November with a late $70M inflow. Bitcoin ETFs ended November with a rare $70M inflow after $4.3B outflows, signaling seller fatigue as December hinges on thin liquidity.

Strategy sets up $1.4B cash reserve, lifts Bitcoin stash to 650,000 BTC. Strategy builds a $1.44B USD reserve for dividend stability to strengthen market resilience alongside its holdings of 650,000 BTC.

BitMine (BMNR) Bought 97K in ETH Ahead of Fusaka Upgrade. The firm has increased the pace of purchases from the previous week despite sitting on large unrealized losses on its Ethereum bet.

First Chainlink ETF set to begin trading on Tuesday as exchange signs off on Grayscale's LINK fund. Over the past few weeks, several crypto ETFs have launched in the U.S., including ones tracking Litecoin, HBAR, XRP and SOL.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the primary goal of rollups on Ethereum?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Reduce transaction costs and increase throughput 🥳

Rollups execute transactions off-chain, then post compressed data to Ethereum, improving throughput and cost efficiency. ⚙️

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.