GM. Crypto Nutshell dropping in hot! 🫶 🥜

The crypto newsletter that won't deceive you like a prestigious magician with a dangerous rivalry... 🎩✨

Today, we’ll discuss:

One Bitcoin users costly mistake 😭

Is Bitcoin being manipulated? 😱

Old coin supply continues to grow 🌴

And more…

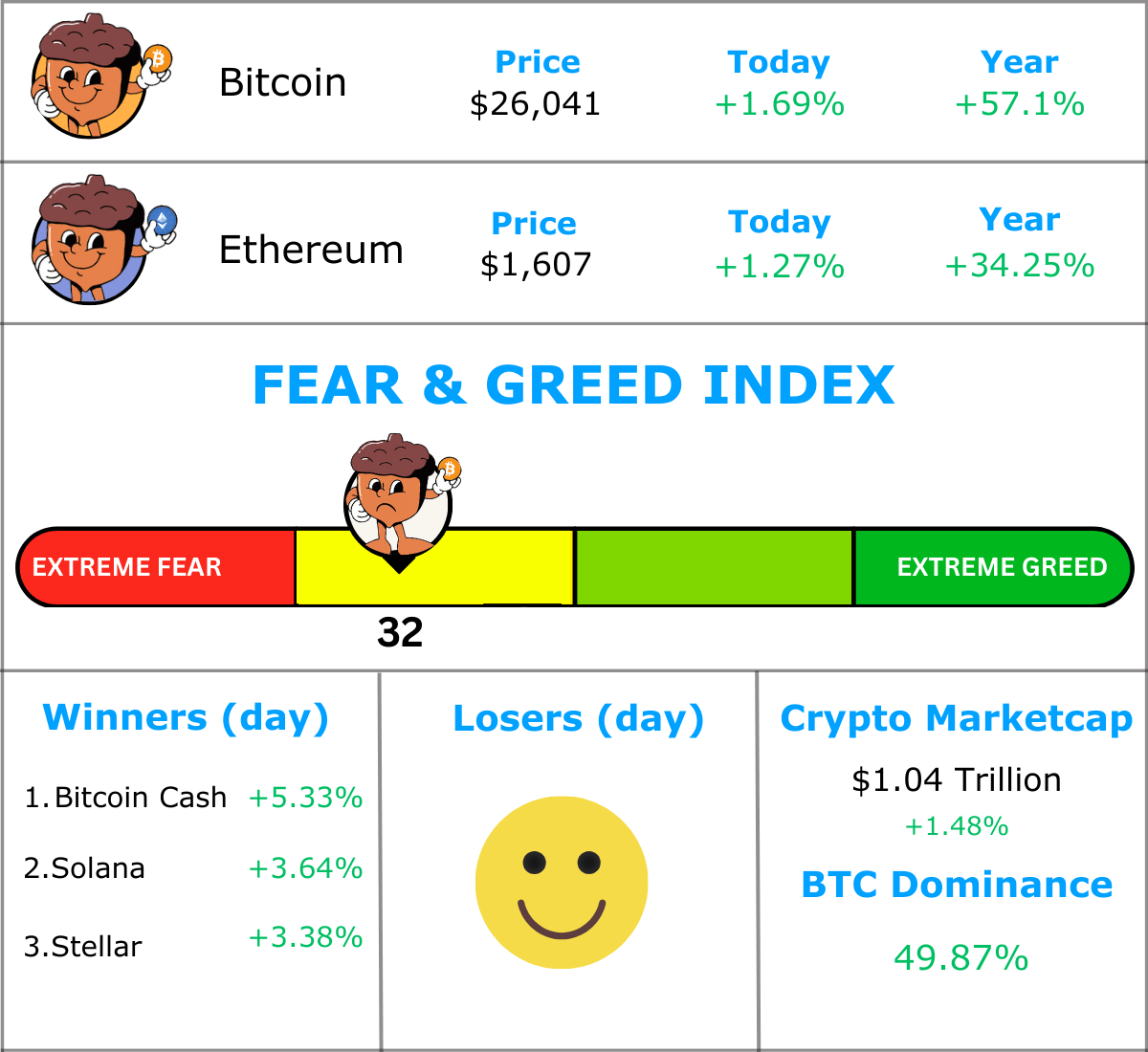

MARKET WATCH ⚖️

Prices as at 7:50am ET

Only the top 20 coins measured by market cap feature in this section

A COSTLY MISTAKE 😭

JUST IN: Bitcoin user’s costly error leads to record transaction fee of $510,000

According to on-chain data, a Bitcoin user has spent a MASSIVE 20 Bitcoin (~$510,000) in transactions fees. To make matters worse, the user was only transferring 0.074 BTC…

What a mistake to make.

The average transaction fee at the time of this error was only $2.176, making this the highest ever recorded fee on the Bitcoin network.

Chun Wang, co-founder of F2Pool (where the transaction originated) has come forward offering to temporarily hold the 20 BTC. If no one claims the fee, then it will be redistributed to miners.

But it gets even crazier. Somehow they haven’t noticed this blunder and have carried on sending transactions…

How does someone lose $510,000 and not even notice? 😳

TOGETHER WITH STRATEGY BREAKDOWNS 📂

There are lots of business newsletters but Strategy Breakdowns is our favourite.

Do you want to know the secrets & hacks that helped build the world's greatest companies like Amazon, Tesla and Youtube?

The Strategy Breakdown reveals all by:

Breaking down top companies strategy playbooks 🚨

Showcasing hidden growth hacks that helped build behemoths 🐘

Providing practical strategies to become a better thinker 🧠

It’s an easy & fun 3-min read, and the best part is they’re 100% FREE. They’re also a fortnightly read (so you won’t be spammed!)

Click the button below and you’ll automatically be added to their list👇

Sponsored

Strategy Breakdowns

A 3-minute email on the strategy playbooks and growth hacks that built the world's greatest companies. Join 110,000+ readers from Google, Meta, Atlassian, Stripe, Snapchat and more.

BITCOIN MANIPULATION 🤔

If you’ve been following crypto markets in 2023, the price action over the last few months has been… strange. 👽

After hitting a 2023 high in July, Bitcoin & crypto has been trending down. Despite what seems like constant good news.

wtf is going on? 🤔

Is the market being manipulated?

Today, Mark Yusko, founder and CIO of Morgan Creek Capital joined Altcoin daily to break it down.

He thinks something is wrong.

Although uncertain, he believes a major reason is that big players like BlackRock and other asset managers are manipulating the price. Their ultimate goal? Accumulate a larger position.

How would they do this?

By shorting Bitcoin.

When you “short” an asset you're making a bet that the price will go down. This is how you do it:

You borrow an asset via a contract and sell it at its current price.

At a date in the future, you buy back the asset and return it to its owner.

If the asset price went down, you have made a profit and you keep the difference. If the asset price goes up, you make a loss on the difference.

By shorting an asset in large quantities, it can:

Increase selling pressure 📈

Drive the price down 📉

Although a theory, Mark believes it would be the obvious thing to do if big players were certain of an ETF approval.

“If your goal is to accumulate an asset - you actually don’t go out and buy the asset and tell everybody you’re buying. What the really smart investors have done over the years is they actually go out and short a little bit of the asset & then tell everybody how crappy it is in interviews and stuff, & then go buy it when the price goes down.”

Short the asset, push the price down & accumulate as much as possible. Then profit all the way up. 🤑

Sneaky. 🧐

Bottom Line: Let’s say Yusko’s theory is true and big players are pushing the price down to build a position.

This isn’t necessarily a bad thing.

Not only can they accumulate at lower prices, but we can too. 😉

OLD COIN SUPPLY CONTINUES TO GROW 🪴

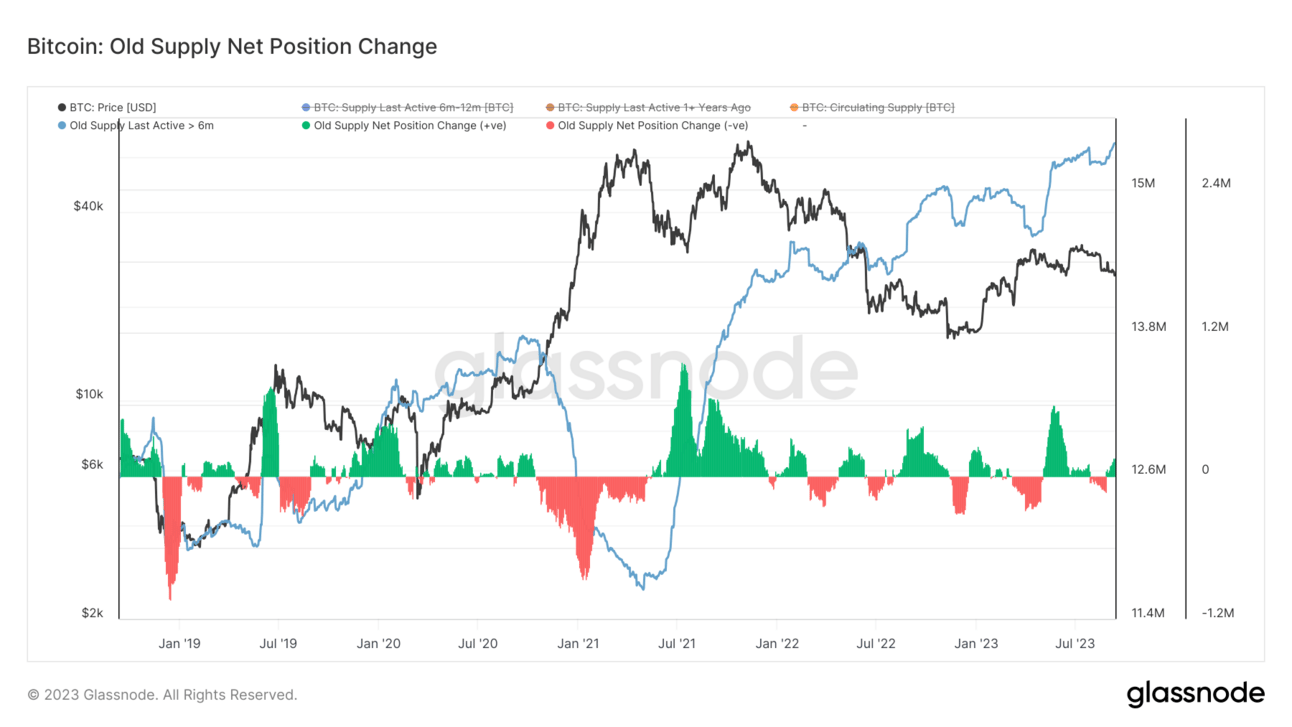

Today we’ll be taking a look at Bitcoin’s Old Supply Net Position Change. This chart is useful for gauging the general sentiment of the market. When we say old Supply, we are referring to coins being held for longer than 6 months.

Here’s how to interpret the chart:

🟢 Positive values: indicate net increase in old supply. Coins purchased 6 months ago are aging faster than 6 month+ coins are being spent.

🔴 Negative values: indicate net decrease in old supply. 6 month+ old coins are being spent faster than young coins are maturing.

🔵 Total Old Supply

The old supply tends to plummet when Bitcoin reaches a new all time high. Take a look at the chart below. You’ll see a large 🔴 spike as Bitcoin approaches it’s all time high. Then a large 🟢 spike once the price starts to drop.

Let’s zoom this chart in and see what’s happened around the price drop from $29,000 to ~$26,000.

We saw a significant increase in the old coin supply at the end of August. This increase has continued throughout September so far, with over 158,000 BTC entering the old supply on September 11.

The old coin supply took a dip during August but has since recovered and is back to pushing all time highs.

Can you believe that 15,391,911 Bitcoin haven’t moved in over 6 months?

Keep in mind that the circulating supply of Bitcoin is only 19,482,856…

So ~79% of Bitcoin’s supply is in the hands of long term holders. That’s a wild stat. 🤯

WHAT WE’RE READING 📚

Want to get even smarter in Crypto before the bull run? Check these out.

p.s. both completely free

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

CRACKING CRYPTO 🥜

CAN YOU CRACK THIS NUT? ✍️

Where do Bitcoin transaction fees go?

A) Bitcoin miners

B) Bitcoin blockchain

C) Satoshi Nakamoto

D) A random wallet address

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) Bitcoin miners 🥳

Transaction fees incentivize miners to validate transactions and subsidize the diminishing block subsidy, helping support network security by keeping miners profitable.

GET IN FRONT OF 10,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.