GM to all 10,768 of you. Crypto Nutshell droppin’ in. 🚎 🥜

We’re the crypto newsletter that's more electrifying than a teenager swinging through the streets of New York City... 🕷️🏙️

Today, we’ll be going over:

🤔 Is the US Government about to shutdown?

🔥 Prepare for October…

📉 Exchange balances are falling off a cliff

💰 And more…

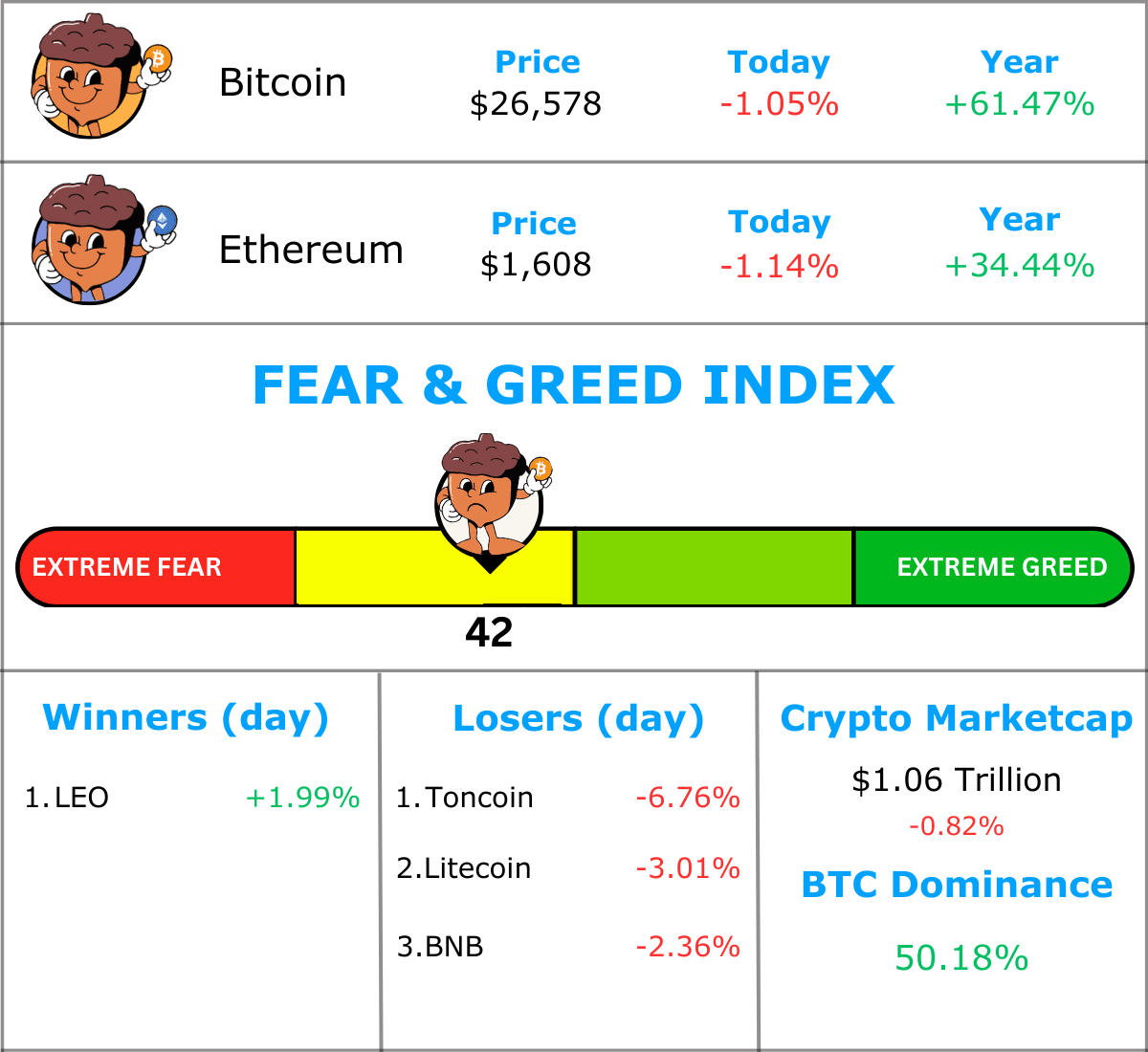

MARKET WATCH ⚖️

Prices as at 6:30am ET

Only the top 20 coins measured by market cap feature in this section

US GOVERNMENT SHUTDOWN? 😱

JUST IN: The SEC could stop processing applications if the U.S. government enters a partial shutdown, which would likely include crypto ETF proposals.

The US Government is barrelling toward a shutdown unless Congress can agree to pass a spending bill by the end of the month. For more context on what a Government shutdown means checkout this short article.

The man himself, Gary Gensler (SEC Chair) had this to say:

“The public should understand that we will largely be a skeletal staff … so the normal oversight we have on markets will not be possible .. for [however] many days [a shutdown] happens.”

We’ve seen this before when the US Government shutdown for 35 days from late 2018 to early 2019 which restricted SEC operations.

How does this impact Crypto? 🙄

Well the SEC is supposed to make decisions on the outstanding Bitcoin ETF applications in mid October. Some have speculated that these were going to be approved this year (more on this in the next section).

BUT a shutdown definitely throws a spanner in the works…

The SEC’s court cases with Binance and Coinbase could also be impacted. However during the last shutdown, Federal courts continued as normal so we’ll have to wait and see on this one.

It’s not 100% confirmed that this shutdown will happen, we just thought we’d give you a heads up on what could possibly play out…

Checkout the Full article here.

TOGETHER WITH MINDSTREAM 🧠

It’s no secret that keeping up with AI developments is complicated.

Between learning the newest tools and knowing the latest news, Artificial Intelligence can feel overwhelming.

But it doesn’t have to. That’s where MINDSTREAM steps in.

Makes keeping up with the latest AI breakthroughs dead simple ✅

Helps you stay on top of the latest AI Tools to improve your productivity 🔨

Delivered straight to your inbox every single day in a 5 min read 📨

The cherry on top? They’re also completely FREE just like us.

Subscribe now by hitting that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Mindstream

The hottest AI newsletter around. News, opinions, polls and so much more. Join us for free!

JUST WAIT FOR OCTOBER… ⏰

Bitcoin & Crypto has been trading more like a stable coin over the last few months.

But fear not - macroeconomic expert Raoul Pal thinks it’s all about to change from October onwards.

Why?

2 reasons:

First - there’s a bunch of spot Bitcoin ETF deadlines coming up right in the middle of October.

Raoul isn’t alone in this either, Eric Balchanus, the senior ETF analyst at Bloomberg, also thinks there’s a good chance of approval. He has the approval odds at 70% by EOY. 🔥

(this is all contingent on if the U.S Government does not shut down…)

BTW - Here’s the dates to keep an eye on, highlighted in yellow.

BlackRock’s ETF = iShares Bitcoin Trust

Second - Raoul believes we are going to see an increase of liquidity from October onwards. This means the FED pausing / cutting interest rates & turning on the money printer. 🖨️

Annnnd just today, Raoul’s prediction is playing out. At the FOMC meeting, the FED decided to pause interest rates.

This is good for Bitcoin & crypto. 😁

Bottom line: There’s one more thing Raoul didn’t point out. Bitcoin historically kills it in October. 🤑

Check out these historical monthly returns:

Our view? Strap in for October. 😈

BALANCE ON EXCHANGES DROPPING 📉

Bitcoin balance on exchanges has just hit a year-to-date low.

Exchange balances have been declining since 2020 when they peaked at 3,185,433 BTC. Interestingly 2023 started to buck this trend with balances increasing to a YTD peak of 2,414,018 BTC. 🤔

Currently there is 2,290,720 BTC on exchanges.

With the circulating supply at 19,490,587 BTC.

Only ~11.75% of the Bitcoin supply is available for sale on exchanges. Crazy.

The last time exchange balances were this low was March 2018…

So what’s going on here?

The decreasing exchange balance simply means investor’s are losing faith in the safety of exchanges. Coins moving off exchanges also suggests a longer term hodling strategy for many.

Essentially - investors are gearing up for some upward price action. 🚀

The decreasing exchange balance could also play a part in a future supply shock for Bitcoin. Think about it. We have some HUGE events coming up.

Bitcoin halving: results in reduced supply

Bitcoin ETF: results in increased demand

It all comes down to simple economics. Reduced supply and increasing demand means what?

That’s right. The price must go up! 📈

As a side note, if you are in it for the long run you should at least get yourself a cold storage wallet. It’s the easiest way to make sure your crypto is safe. Just ask all the people who lost their crypto with the collapse of FTX and BlockFi… 😢

As the age old saying goes “Not your keys, Not your coins”

Shameless Ledger plug (it’s what we use personally) 😎

p.s we earn commission on each sale

CRACKING CRYPTO 🥜

WHAT WE’RE READING? ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

CAN YOU CRACK THIS NUT? ✍️

Which is the second largest cryptocurrency measured by market cap?

A) USDT

B) BNB

C) Bitcoin

D) Ethereum

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Ethereum 🥳

At the time of writing the top 4 cryptocurrency’s are:

Bitcoin: $527B

Ethereum: $195B

USDT: $83B

BNB: $32B

GET IN FRONT OF 10,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.