GM to all 62,527 of you. Crypto Nutshell #289 comin’ in peace... 👽 🥜

We’re the crypto newsletter that's more thrilling than a group of hackers orchestrating a massive cyberattack to steal billions of dollars... 💻 💰

What we’ve cooked up for you today…

🏦 ETF weekly update

🤑 Greatest macro bet of all time

💸 Bitcoin shortage

💰 And more…

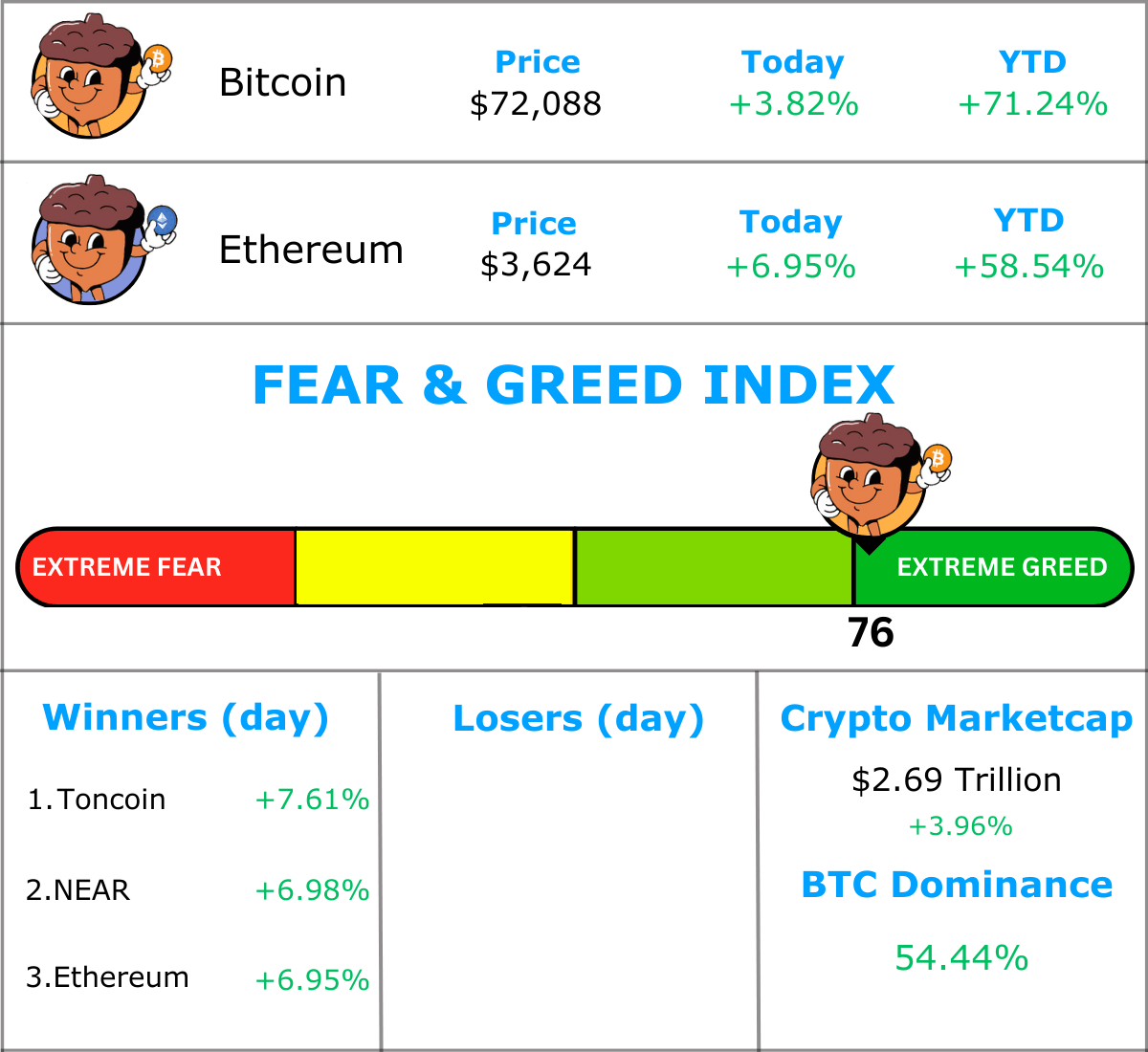

MARKET WATCH ⚖️

Prices as at 6:35am ET

Only the top 20 coins measured by market cap feature in this section

ETF WEEKLY UPDATE 🏦

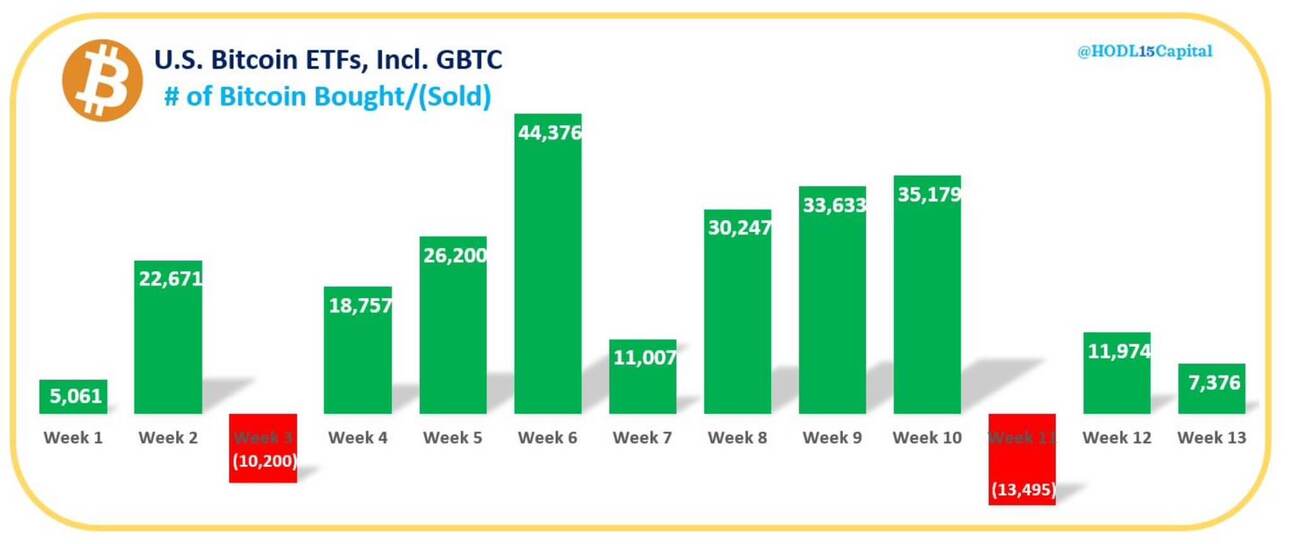

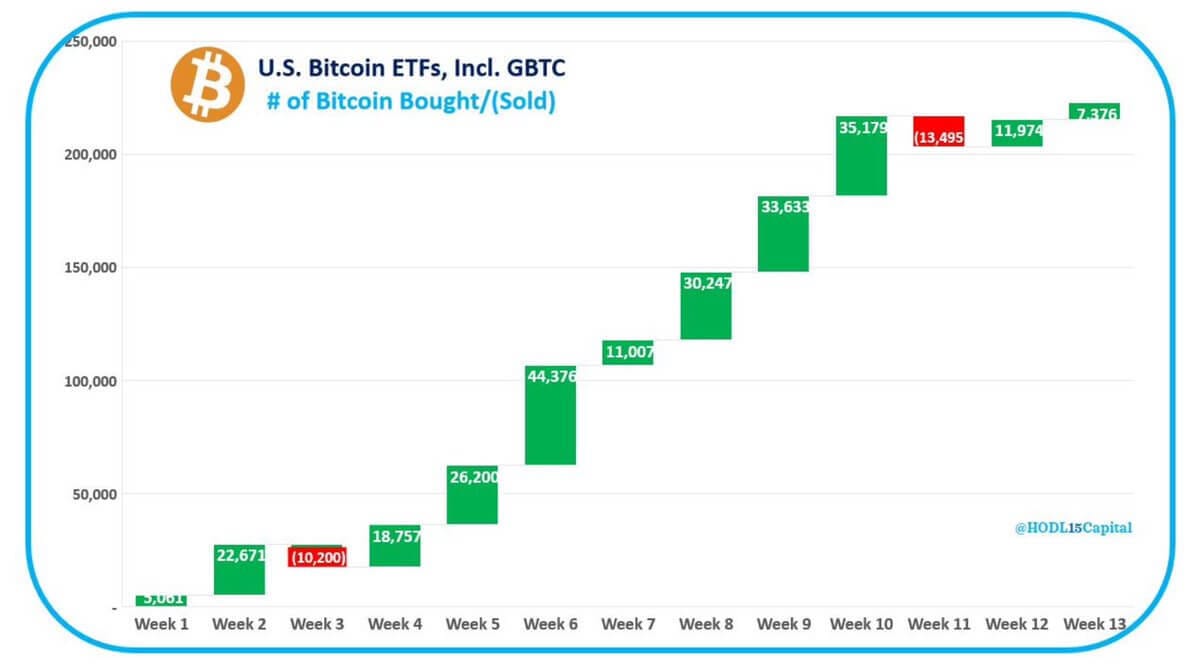

BREAKING: Last week the Bitcoin ETFs purchased 7,376 Bitcoin

Week 13 of the ETFs saw them purchase an additional 7,376 Bitcoin. (including Grayscale outflows)

That’s ~$512.8 million at todays prices.

But more importantly it represents 120% of the newly mined supply.

Meaning that the Bitcoin ETFs alone are enough to eat up all newly created Bitcoin…

Week 13 flows brings total inflows to the Bitcoin ETFs to 222,800 BTC.

The gap between BlackRock and Grayscale is currently at 58,853 Bitcoin.

We’ll likely see BlackRock flip Grayscale by the halving.

Oh and by the way, the halving is less than two weeks away.

This halving will see the daily new supply of Bitcoin drop from 900/day to 450/day.

That’s a BIG deal.

Perhaps due to anticipation for the halving, today we’re seeing Bitcoin inch closer to a new all-time high.

This truly is a perfect storm. 🌩️

First we saw a demand shock.

Supply shock is coming in just 10 days time.

Get ready for what’s to come…

TOGETHER WITH THE PHENOM CRYPTO ♟️

One reason we love crypto? The returns. 😍

In a bull market? No other asset can compete. It’s not uncommon to see 5x, 10x or even 100x plus returns.

With the Bitcoin Halving coming up, the next crypto bull-run is just around the corner.

That’s why we read The Phenom Crypto.

They share the best kept secrets on the latest DeFi & small-cap crypto trends. 🤫

The best part?

Just like us, they’re completely free.

Slam that big subscribe button and it’ll automatically add you to their list.

If you’re not a fan, you can always unsub. Nothin’ to lose. 🎉

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

GREATEST MACRO BET OF ALL TIME 🤑

This is the greatest macro bet of all time.

That’s the message out from Dan Tapiero.

For those of you who don’t know Dan Tapiero, he’s:

CEO & CIO at 1RoundTable Partners and 10T Holdings - a growth equity fund focused on digital asset

Co-founder of Gold Bullion International (GBI)

30+ years of experience in macro and commodity investing

Speaking with Anthony Pompliano at Bitcoin Investor Day, Dan made a bold statement:

“This really is the greatest macro bet of all time. On Bitcoin, on the digitisation of all assets, on the fact that I think all value is going to sit somewhere on some blockchain.”

That’s big coming from someone so heavily involved in the gold space.

And with decades of macro investing experience…

Dan also explained a simple way to build wealth with Bitcoin:

“The way to really build wealth is to HODL. It’s crazy to think that you can just sit there and be long and not do anything… But you’ve taken a risk that 99% of people are not willing to take.”

It does sound insane that you can simply do nothing and build substantial wealth.

But you get compensated for taking on that additional risk.

And you’ll continue to be compensated the longer you hold.

“Historically, investors who bought and held Bitcoin for at least 5 years have profited, no matter when they made their purchases.”

That’s all there is to it.

Dan also gave his price prediction for this Bitcoin cycle:

“In this cycle, I would say $200,000 to $300,000 is reasonable, in the next 12 - 24 months.”

That’s between a 2.9x - 4.3x from where we are today.

Bitcoin is simple.

Just buy it, hold it, and you will be rewarded.

BITCOIN SHORTAGE 💸

Today we’ll be taking a look at the classic Bitcoin HODL Waves.

Each coloured band shows the percentage of Bitcoin that last moved within that time period.

As the colours get darker, the age bands get older (purple being the oldest, representing coins last moved 10+ years ago).

We’ll just be focusing on coins last moved 6+ months ago. (long-term holders)

Here’s the breakdown:

6m - 12m: 8.07%

1y - 2y: 11.34%

2y - 3y: 9.57%

3y - 5y: 13.76%

5y - 7y: 10.11%

7y - 10y: 4.95%

>10y: 16.15%

That’s ~73.95% of the Bitcoin supply not moving for more than 6 months…

Which leaves “only” ~26.05% of the supply available for new buyers.

That’s wild.

There simply isn’t that much Bitcoin available for sale right now.

And with the ridiculous amount of demand coming in from the ETFs…

Combined with the halving…

Things are about to get real crazy.

Real soon.

CRACKING CRYPTO 🥜

FTX discount sale of $1.9 billion locked Solana faces creditor fury. FTX sold its Solana holdings at steep discount to crypto venture capital firms, spurring strong creditor's criticism.

Bitcoin bulls nudge at $70K as BTC price sees 'not typical' weekend. Bitcoin zeroes in on the weekly close with unusual weekend strength as BTC price support hinges on $69,000 holding.

The history of Bitcoin halvings — and why this time might look different. Every Bitcoin halving has come a year or two before a new all-time high, except the upcoming 2024 April event.

Bitcoin Sees Third Best Quarterly Trading Volume in 3 Years. The last time Bitcoin recorded similar trading volumes was in Q1 and Q2 2021.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) 2014 🥳

In 2014, Mt. Gox was hacked and thousands of Bitcoins were stolen; the company filed for bankruptcy shortly thereafter.

GET IN FRONT OF 62,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.