GM to all of you nutcases. It’s Crypto Nutshell #745 keepin’ it together… 🔗🥜

We're the crypto newsletter that's more intense than a scientist racing to save humanity from a dying planet... 🌍🚀

What we’ve cooked up for you today…

🐳 What does this whale know?

🎭 Some much needed hopium

😨 Uncertainty

💰 And more…

Prices as at 2:15am ET

WHAT DOES THIS WHALE KNOW? 🐳

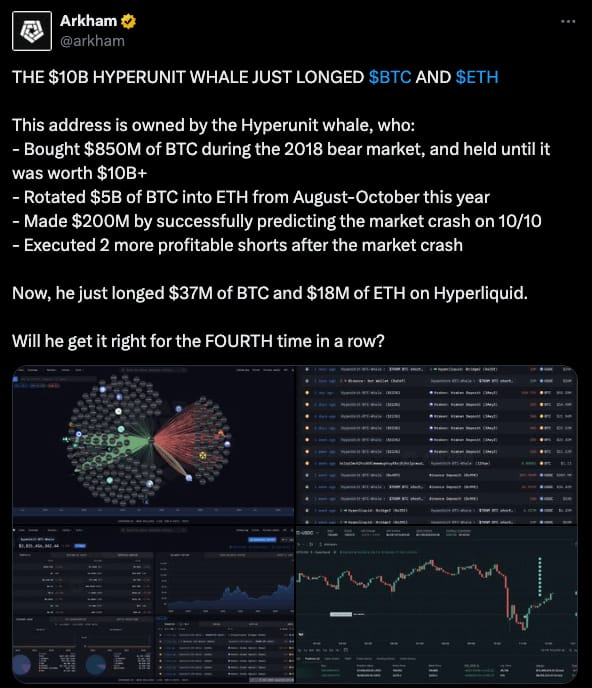

BREAKING: Crypto whale who nailed the October crash opens $55M BTC and ETH longs

The trader who perfectly called last month’s crypto crash just flipped bullish, and he’s backing it with $55 million.

HyperUnit, the whale who pocketed $200 million shorting Bitcoin during the US–China tariff selloff, is now long both BTC and ETH.

Arkham reports HyperUnit opened $37 million in Bitcoin longs and $18 million in Ethereum longs on Hyperliquid.

It’s his fourth major directional bet in less than two months.

And this isn’t a newcomer guessing at charts.

HyperUnit has been around since 2018, reportedly buying $850 million in Bitcoin during the bear market. That stack is now worth over $10 billion. When he moves, the market pays attention.

At the time of writing, Bitcoin sits at $107,000, still down more than 15% from its all-time high.

And Ethereum sits 27% lower. Right now, fear dominates, with the Crypto Fear & Greed Index at just 27 out of 100.

But signs of a bottom may be starting to appear…

Data from Santiment shows 209,000 fewer BTC on exchanges compared to six months ago. That points to tightening supply.

“Despite Bitcoin's market value dropping 14% since its all-time high back on October 6th, an encouraging sign is the fact that BTC is generally staying off of exchanges… Overall, when a coin's supply is not moving to exchanges, the risk of further sell-offs are limited.”

Even Bitwise CEO Hunter Horsley believes the recent correction is being driven by old whales cashing out after life-changing gains, not panic selling:

“They’ve got 100-1000x more wealth. They want to make sure it stays that way. They expect it will go higher but can also have periods of volatility. They’ve got life to live / it can be emotionally taxing to see $100M or 1/3 of their wealth gone in a bear market, even if temporary.”

If HyperUnit’s right again, this might be the bottom everyone’s been waiting for. 🐳

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

SOME MUCH NEEDED HOPIUM 🎭

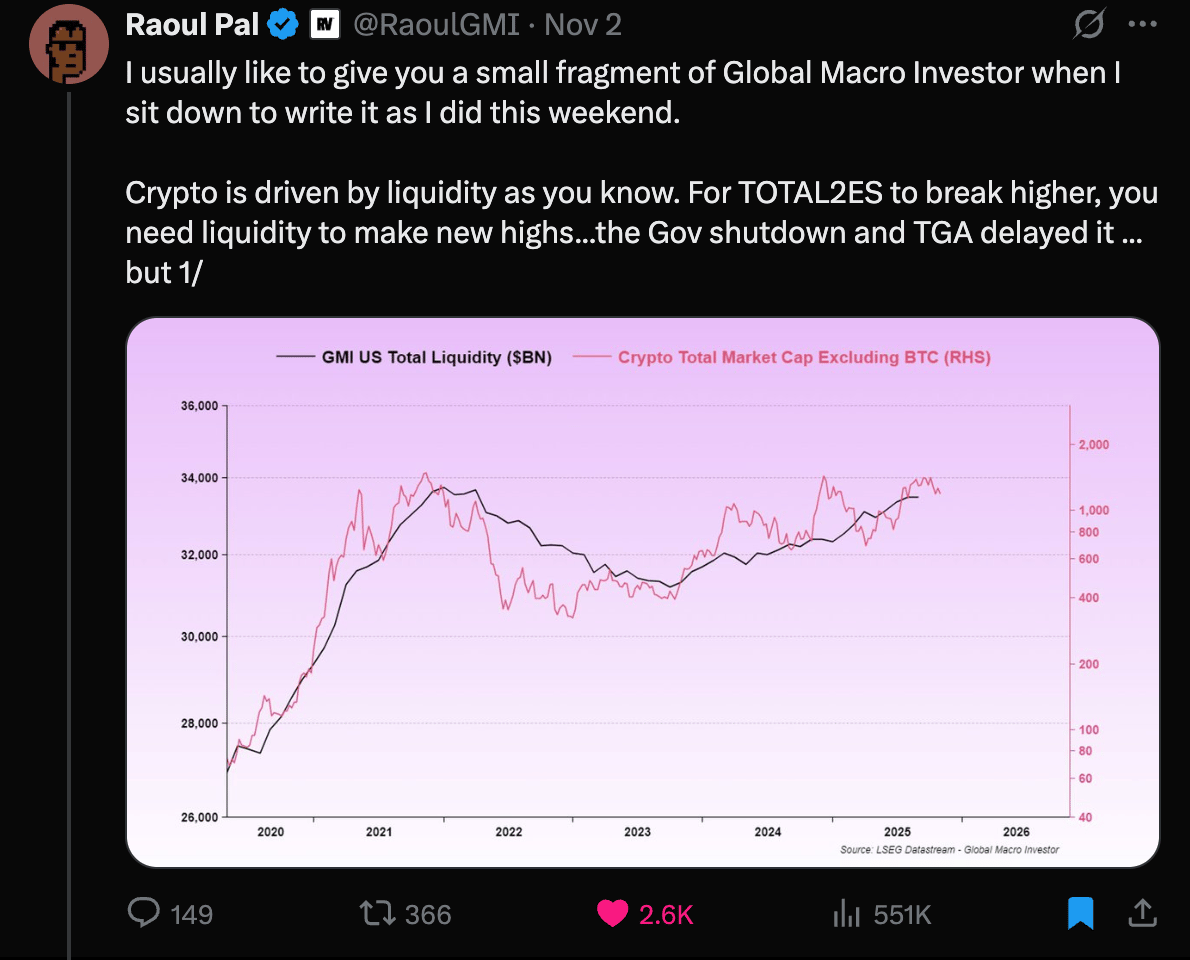

With crypto in the red today, Raoul Pal - founder of Global Macro Investor - just dropped a thread full of some much needed hopium.

His message in a nutshell?

Liquidity is inevitable, play the long game.

Here’s what he tweeted today as to why crypto has been choppy lately:

Translation: the market’s not broken - liquidity’s just been paused.

But that pause is soon to be ending.

Raoul shared new Global Macro Investor data showing that the biggest liquidity wave is still ahead.

Why? Because of how the debt cycle shifted after COVID.

When governments extended debt maturities to five years, they effectively pushed the next major liquidity flood into 2026.

That’s where his “Everything Code” thesis kicks in - the process where massive debt gets monetized, forcing liquidity back into the system.

In plain English:

Money printers everywhere are warming up.

The only thing missing has been timing.

But as the government reopens and spending resumes, that pent-up liquidity starts to flow again. Which sets the stage for the next big leg up in both crypto and equities.

If Raoul’s right, the real flood hasn’t even started yet. 🌊

UNCERTAINTY 😨

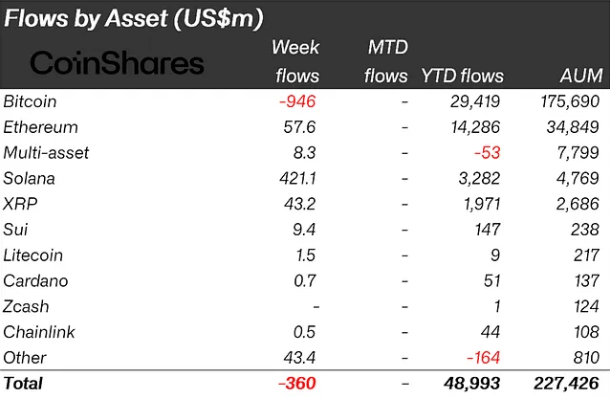

Digital asset funds saw outflows totalling $360 million last week.

As a result, year-to-date inflows have now dropped to $48.99 billion.

Let’s break it down.

Bitcoin ETFs were the only major digital asset products to experience outflows last week, totalling $946 million.

Whilst Solana saw inflows of $421.1 million, it’s second largest on record.

Ethereum also saw inflows of $57.6 million last week.

From a regional perspective, the U.S. led with outflows of $439 million.

Germany, Switzerland, and Canada saw inflows of $32.0 million, $30.8 million, and $8.5 million respectively.

Despite the interest rate cut, investors interpreted Jerome Powell’s comments on a December cut as “not a foregone conclusion.”

This hawkish tone, combined with the government shutdown has left markets in a state of uncertainty.

And remember…

Markets absolutely hate uncertainty.

CRACKING CRYPTO 🥜

Bull or bear? Today's $106k retest could decide Bitcoin's fate. A historical pivot: How $106,400 has shaped Bitcoin's support, resistance, and trading strategies

Strive (ASST) to Offer High-Yield Preferred Stock SATA. The preferred shares, dubbed SATA, are set to carry an initial 12% annual dividend, payable monthly in cash.

Michael Saylor’s Strategy kickstarts November with $45M Bitcoin buy. Strategy bought another $45 million worth of Bitcoin, but the pace of investments remains slow compared to September.

Custodia ruling a 'speed bump' not a roadblock for crypto banks, says TD Cowen. A ruling last week declaring that Custodia is not entitled to a master account is not the end of the road, said a TD Cowen analyst.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which DeFi platform pioneered the concept of automated market makers (AMMs)?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Uniswap 🥳

Uniswap revolutionized trading with automated liquidity pools, eliminating traditional order books. 💧

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.