GM to all of you nutcases. It’s Crypto Nutshell #614 spittin’ flame… 🔥🥜

We're the crypto newsletter that's more magical than discovering a hidden world through the back of a wardrobe... 🧥❄️

What we’ve cooked up for you today…

💰 Corporate adoption

🐳 The whale whisperer

🔥 Three in a row

💰 And more…

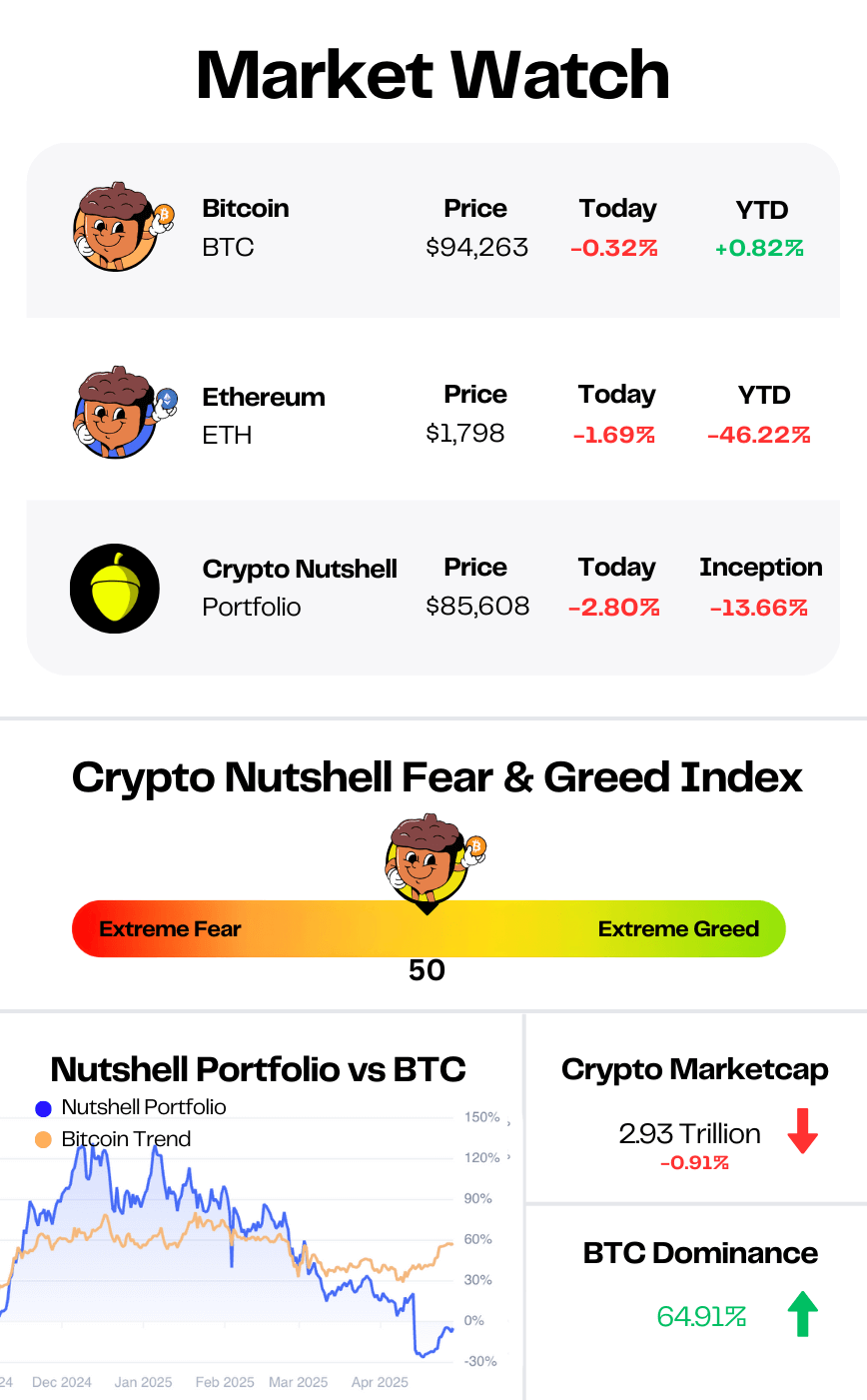

Prices as at 4:50am ET

CORPORATE ADOPTION 💰

BREAKING: Strategy and its corporate copycats could add $330 billion to Bitcoin treasuries in next five years

Saylor just keeps stacking…

Last week, Strategy (formerly MicroStrategy) added another 1,895 BTC for $180 million.

This brings Strategy’s total holdings to 555,450 Bitcoin — over 2.6% of total supply, now worth more than $52 billion.

And they’re not done yet. (But you already knew that…)

Strategy has now moved from its original $21B “21/21 Plan” to a new “42/42 Plan” — aiming to raise $84 billion (half equity, half debt) for more Bitcoin buys through 2027.

Despite a Q1 paper loss of $5.9B under new accounting rules, analysts aren’t blinking:

Bernstein: Reiterated Outperform, $600 target

Benchmark: Raised to Buy, $650 target — calling Strategy’s approach “audacious”

But Saylor’s not the only one stacking hard…

Semler Scientific added 167 BTC last week for $16.2M, bringing its total stack to 3,634 BTC.

That’s over $340M in Bitcoin — funded mostly through stock sales.

But the real headline?

According to Bernstein, corporate Bitcoin allocations could hit $330 billion over the next five years, as more cash-rich firms follow Strategy’s lead.

What’s fuelling the fire:

Trump’s pro-crypto pivot, including a U.S. Strategic Bitcoin Reserve

The SEC’s reversal of SAB 121, clearing banks for crypto custody

Global regulatory clarity from the UK, EU, and Asia

Bottom line:

The Bitcoin standard is spreading — fast.

Public company FOMO is real.

And this wave is only just starting to build. 🌊

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

THE WHALE WHISPERER 🐳

“Habibi... speaking to the sovereign wealth funds here across the region, they are all in on AI and blockchain… and have only just started.”

When Raoul Pal talks, it’s worth listening.

Because he’s not guessing.

He’s not speculating.

He’s in the room.

Raoul Is Perhaps the Most Connected Macro Investor on Earth

While everyone in crypto is debating charts…

Raoul is in the Middle East, talking directly to the people actually moving the money.

And what are they saying?

Blockchain + AI are now core to their economic future.

They’ve barely started — and they’re in it for the long run.

Pay Attention to the Middle East

Places like The UAE and Saudi Arabia aren’t just oil-rich — they’re future-rich.

They’ve already:

Built crypto mining hubs 🏗️

Funded AI infrastructure 🤖

Backed Web3 startups 🌐

And now, according to Raoul?

They’re going all in.

The New Power Centers Are Here

The U.S. has made it clear — they’re holding and stacking Bitcoin.

Don’t be surprised if Dubai, Abu Dhabi, or Riyadh start making Bitcoin headlines in the next few months.

Because Raoul is a whale whisperer, and his message is clear:

The whales are moving.

And they won’t move slow. 🏎️

THREE IN A ROW 🔥

The streak is heating up…

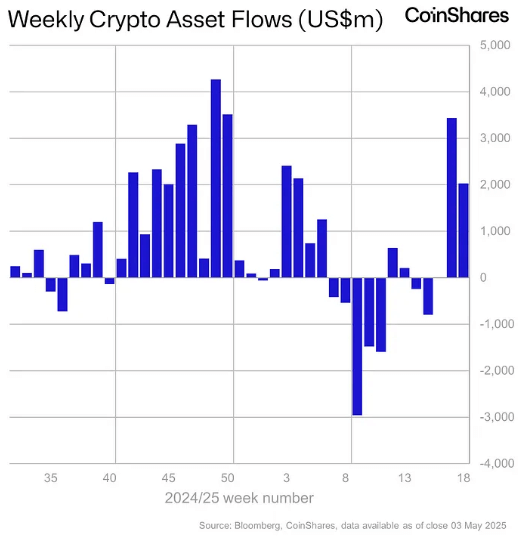

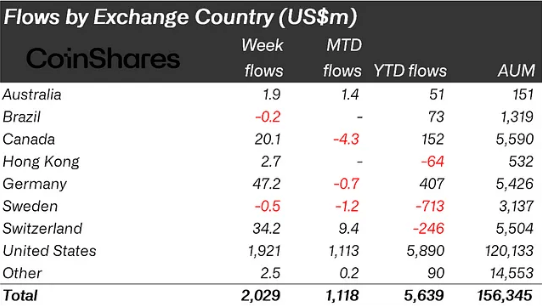

Last week marked the third straight week of inflows into digital asset funds — raking in $2.03 billion.

That brings the 3-week total to a massive $5.5 billion.

Let's break it down.

Bitcoin once again led the pack with $1.84 billion in inflows.

Ethereum followed with its second straight week of positive flows, attracting $149.2 million.

XRP and Solana also posted solid gains, bringing in $10.5 million and $6 million respectively.

U.S. investors were responsible for the lion’s share of last week’s flows, contributing $1.92 billion.

Germany, Switzerland and Canada followed with inflows of $47.2m, $34.2m and $20.1m respectively.

Thanks to the recent uptick in prices, total assets under management have now risen to $156.34 billion.

That’s the highest level recorded since mid-February.

With inflows holding strong across the board, all eyes are now on whether digital asset funds can keep this momentum going. 👀

CRACKING CRYPTO 🥜

Litecoin climbs on hopes of ETF green light from SEC. Litecoin investor confidence builds amidst potential SEC green light for a spot exchange-traded fund (ETF).

Bitcoin Treasury Firms' 'Dry Powder' Could Push Prices Up Significantly. Issuance capacity among bitcoin-holding companies could translate to tens of billions in market buying power.

VanEck files for BNB ETF, first in US. The asset manager is the first to attempt listing an ETF holding the native token of Binance's BNB Chain.

‘King of Crypto’: House Democrats to walk out of hearing following concerns over Trump-backed crypto efforts. A spokesperson for Rep. French Hill said they encourage Waters to “reconsider.”

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What does DAO stand for in the crypto world?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Decentralized Autonomous Organization 🥳

A DAO runs on smart contracts, allowing token holders to vote on proposals — no CEOs, just code and community. 🧠🤖

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.