Today’s edition is brought to you by Crypto Nutshell Pro.

Uptober is here, the 3 most important month in crypto are about to begin. To celebrate, Crypto Nutshell Pro is opening 5 new spots, each day next week. Click here to join now the waitlist now!

GM to all of you nutcases. It’s Crypto Nutshell #719 patrollin’ the streets… 👮🥜

We're the crypto newsletter that's more gripping than a thief pulling off a mind-bending heist inside dreams... 🌀💼

What we’ve cooked up for you today…

😱 Only weeks away

🐳 Whales are hungry

📉 Sell off?

💰 And more…

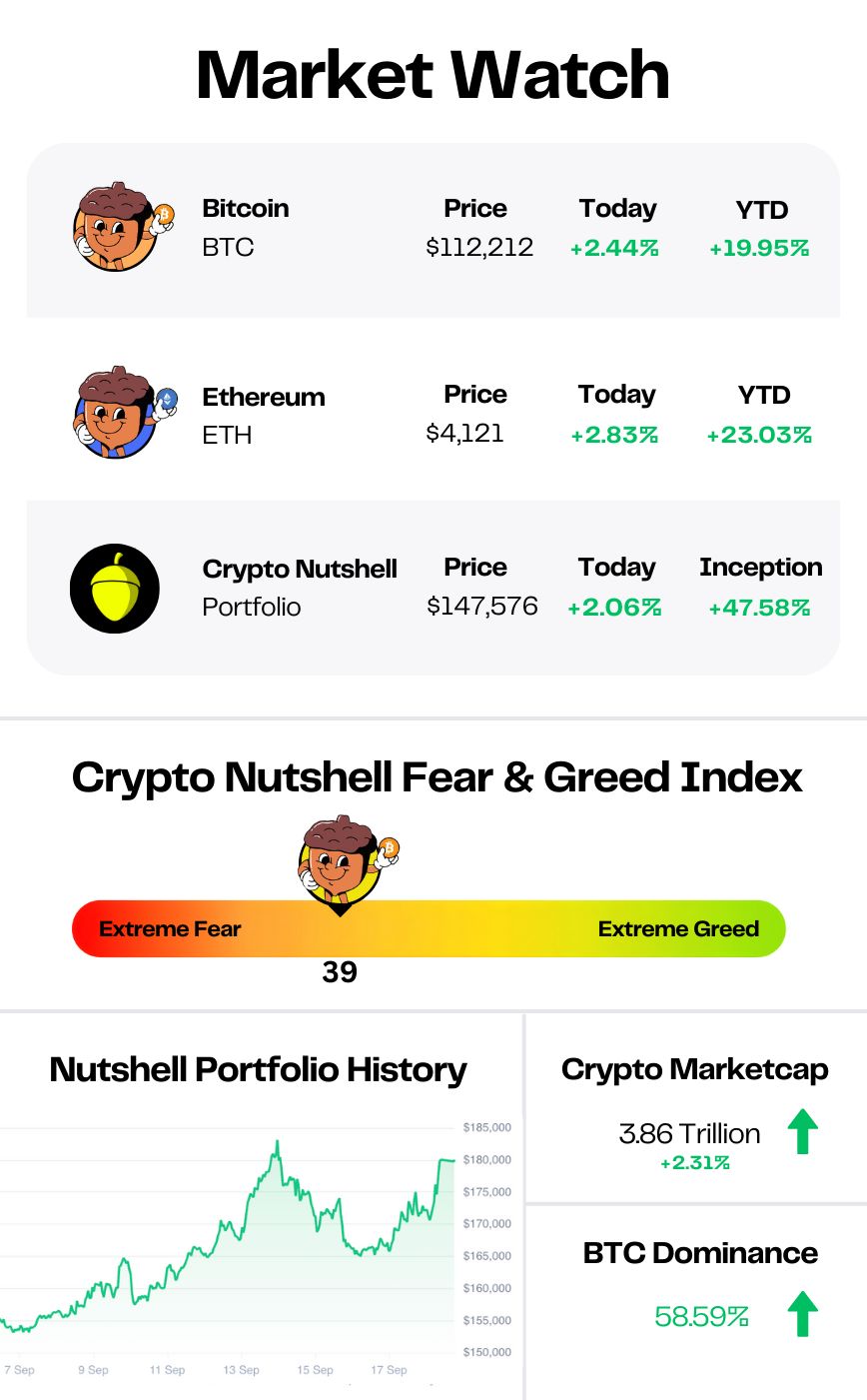

Prices as at 4:35am

ONLY WEEKS AWAY 😱

BREAKING: Analysts say Solana ETFs could be weeks away following flurry of amended filings

The Bitcoin and Ethereum ETFs have been out for a while now…

But what about Solana?

Well according to analysts, the Solana ETFs are only weeks away.

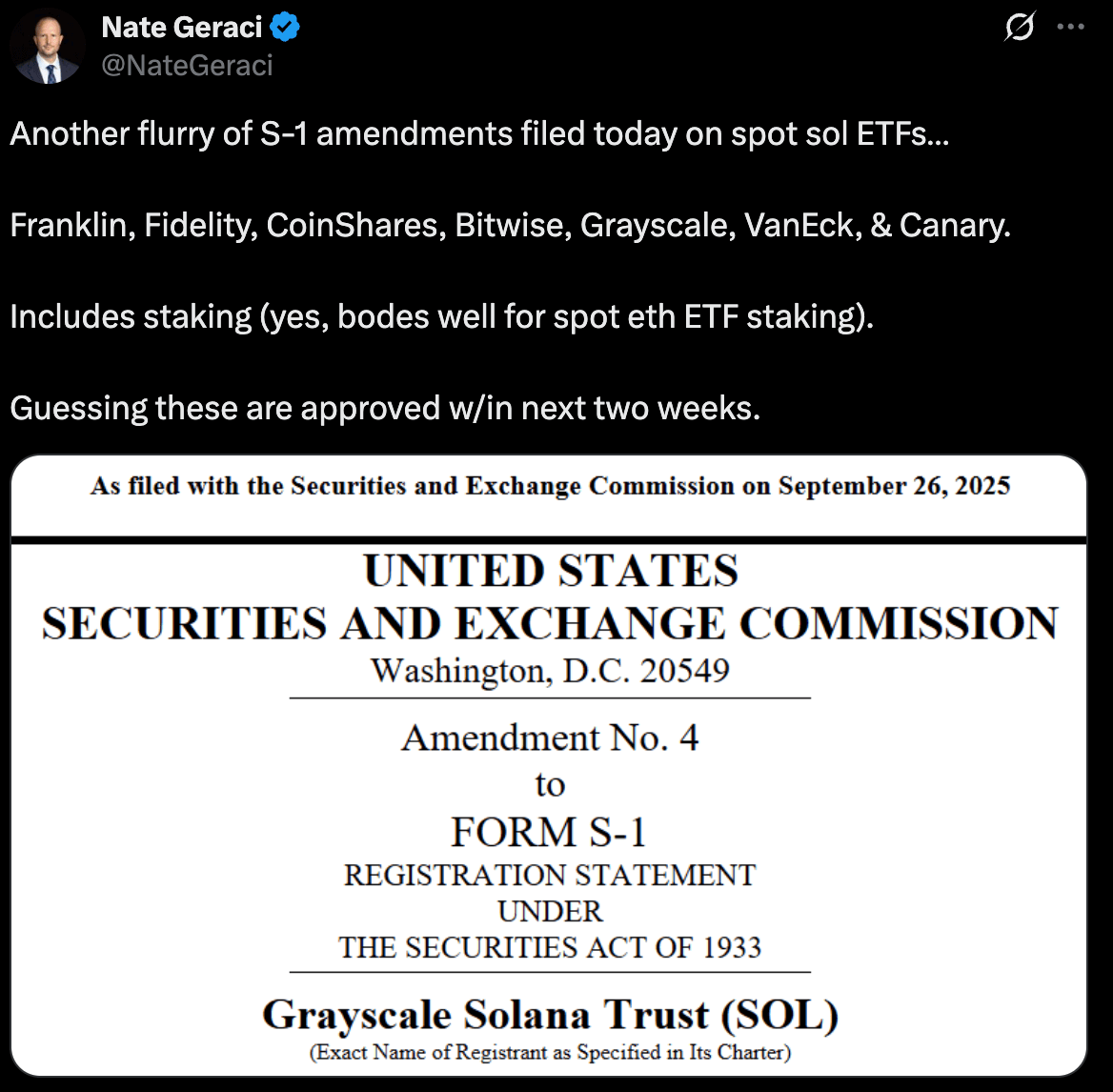

On Friday, a wave of amended filings hit the SEC - with Fidelity, Franklin Templeton, Bitwise, Grayscale, VanEck, CoinShares, and Canary Capital all updating their S-1s for spot Solana ETFs.

This wasn’t a random flurry.

Analysts say the coordinated timing points to back-and-forth with regulators - and potentially, approvals within weeks.

“Solana ETFs likely coming to an exchange near you in coming days/weeks.”

Nate Geraci, president of ETF Store, went even further:

That puts mid-October on the calendar - a month already primed for crypto catalysts.

And the new filings didn’t just refresh paperwork - they added something big: staking.

Fidelity’s updated document notes it will stake some or all SOL holdings to earn yield, a move that could make Solana ETFs more attractive than their Bitcoin and Ethereum counterparts.

Analysts say this feature could also set the stage for long-awaited ETH ETF staking approval, reshaping demand across both assets.

Why This Matters

Solana has long been under-owned by institutions compared to BTC and ETH. That’s changing fast.

REX-Osprey’s Solana Staking ETF launched this summer with $300M AUM.

Bitwise’s European Solana staking product pulled $60M in just five days.

Pantera Capital called Solana “next in line” for institutional adoption.

With U.S. spot ETFs now on the verge of launch, SOL is being positioned as the breakout altcoin of this cycle.

The Bottom Line: Bitcoin had its ETF moment in January. Ethereum followed in July.

Now, all signs point to Solana’s turn - and the timing couldn’t be better.

With approvals potentially landing in October, staking built in, and institutions circling, SOL is stepping onto the big stage.

This isn’t just another altcoin launch. It’s the start of Solana’s institutional era. 🚀

Warning! 🚨 Nutshell Pro Is OPENING SOON

‘Uptober’ is about to begin. ⚠️

We’re entering the 3 most important months in crypto history - and to celebrate, Crypto Nutshell Pro is opening just 5 new spots per day next week.

First in, first served.

Once they’re gone, they’re gone.

If we ever open again, it’ll be at higher prices.

WHALES ARE HUNGRY 🐳

First it was corporate treasuries buying crypto. Then it was ETFs.

Now the financial advisors are circling.

They are hungry for crypto. 🦈

Matt Hougan - CIO of Bitwise and one of the sharpest institutional voices in crypto - just shared some eye-opening numbers from his latest webinar with several hundred financial advisors:

“Are you allocating in client accounts today?”

36% said yes.

“How soon do you plan to allocate new capital to crypto?”

53% said within 1-6 months.

Why are these numbers important?

Well Matt Hougan has been running these polls for over 7 years.

Normally, the “planning to allocate” bucket is tiny. 5-15% at best.

He says he’s never seen anything close to 53%.

Here’s why that matters:

Financial advisors control trillions in client assets. And unlike retail, when they buy, they buy in size.

Over a third are already allocating ✅

More than half are lining up to allocate within months ⏳

And this is just one slice of the pie 🥧

The message is clear:

The whales are getting hungry.

And they’re coming for crypto. 🐳

SELL OFF? 📉

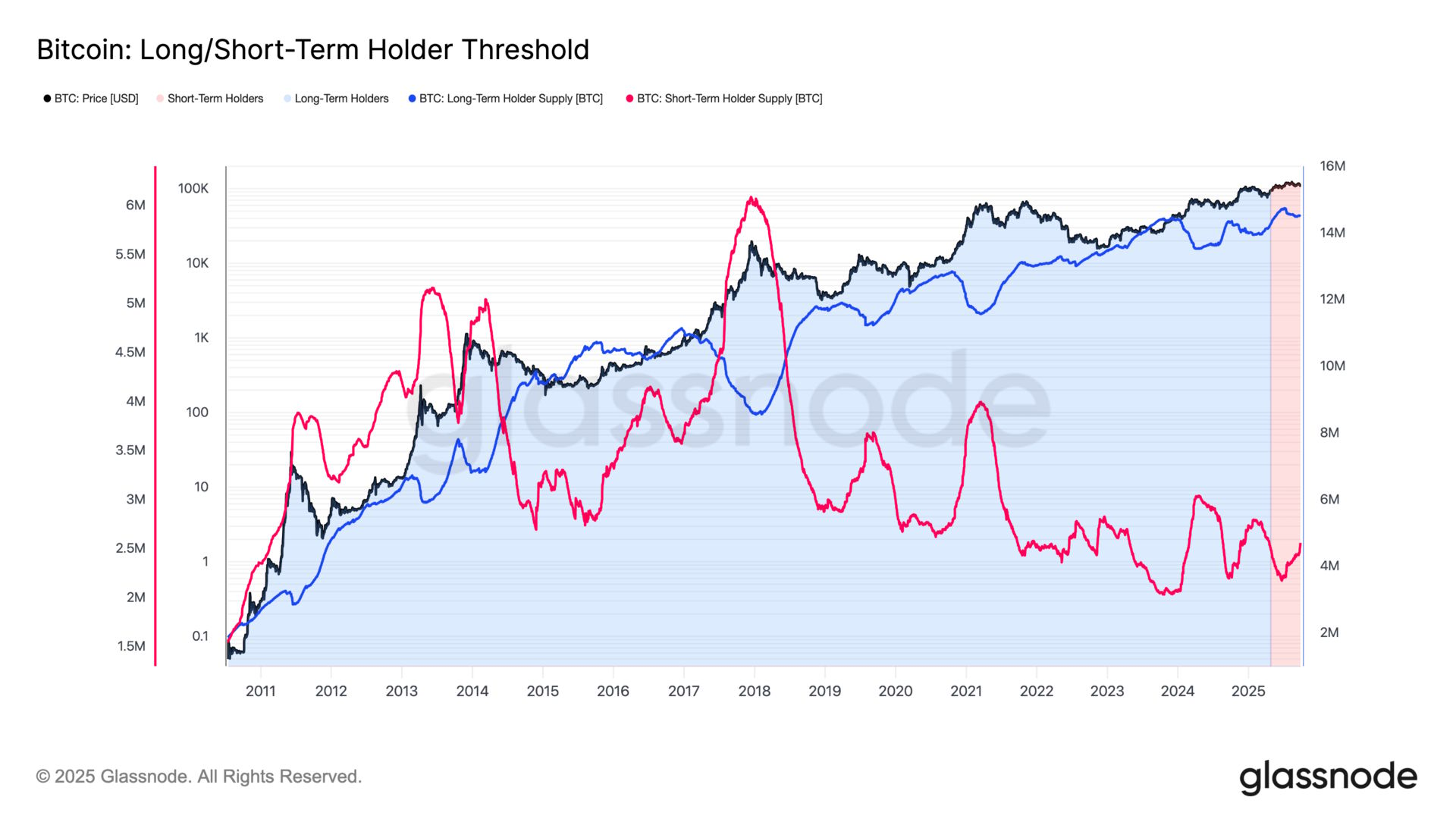

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): Coins held for less than 155 days

🔵 Long-Term Holders (LTHs): Coins held for more than 155 days

🟥 Short-Term Holder Cost Basis: All coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: All coins purchased in this price range are LTHs

This metric is powerful because it shows exactly what price range long and short term holders bought their Bitcoin at. 🔍

The new key cutoff date is April 26, 2025 - when Bitcoin was hovering near $94K.

Anything bought before that? Long-term (LTH).

After? Short-term (STH).

Here’s the breakdown:

LTHs: 14.49M BTC → 72.70% of supply

STHs: 2.56M BTC → 12.84% of supply

Over the past two weeks, long-term holders unloaded a net 19,869 BTC - indicating some level of profit taking.

Likely as a result of the correction…

But let’s keep perspective: more than 70% of all Bitcoin is still locked up in long-term hands.

That’s massive. Conviction hasn’t gone anywhere - the base remains rock solid. 🚀

CRACKING CRYPTO 🥜

The clock is running out on Bitcoin's $200k dreams in 2025. Major institutions and analysts including Standard Chartered, Bitwise, and Arthur Hayes, predicted a $200,000 BTC price by December.

Expect major BTC corrections before new all-time highs. Bitcoin will perform like Nvidia and record several major corrections on its path to new all-time highs, analyst Jordi Visser said.

Peter Schiff Explains Why Strategy (MSTR) Should Have Bought Gold Instead of Bitcoin. Discover why analysts see a slow grind for bitcoin, the support and resistance levels to watch and Peter Schiff brings back the gold-versus-bitcoin debate.

Spot Ethereum ETFs see largest outflow week since inception, as ETH reclaims $4,000. BlackRock's industry-leading Bitcoin and Ethereum funds held up slightly better than those of Fidelity, its chief rival in the space.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What was the item famously purchased in the first real-world Bitcoin transaction?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Two pizzas 🥳

In 2010, Laszlo Hanyecz spent 10,000 BTC on two Papa John’s pizzas — now known as Bitcoin Pizza Day. 🍕

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.