GM to all of you nutcases. It’s Crypto Nutshell #786 ringin’ in the year… 🎉🥜

We’re the crypto newsletter that’s more relentless than a survivor navigating a lawless wasteland where chaos rules… 🚗🔥

What we’ve cooked up for you today…

🏦 It’s over?

🛒 Which are you buying?

📉 Is this weakness?

💰 And more…

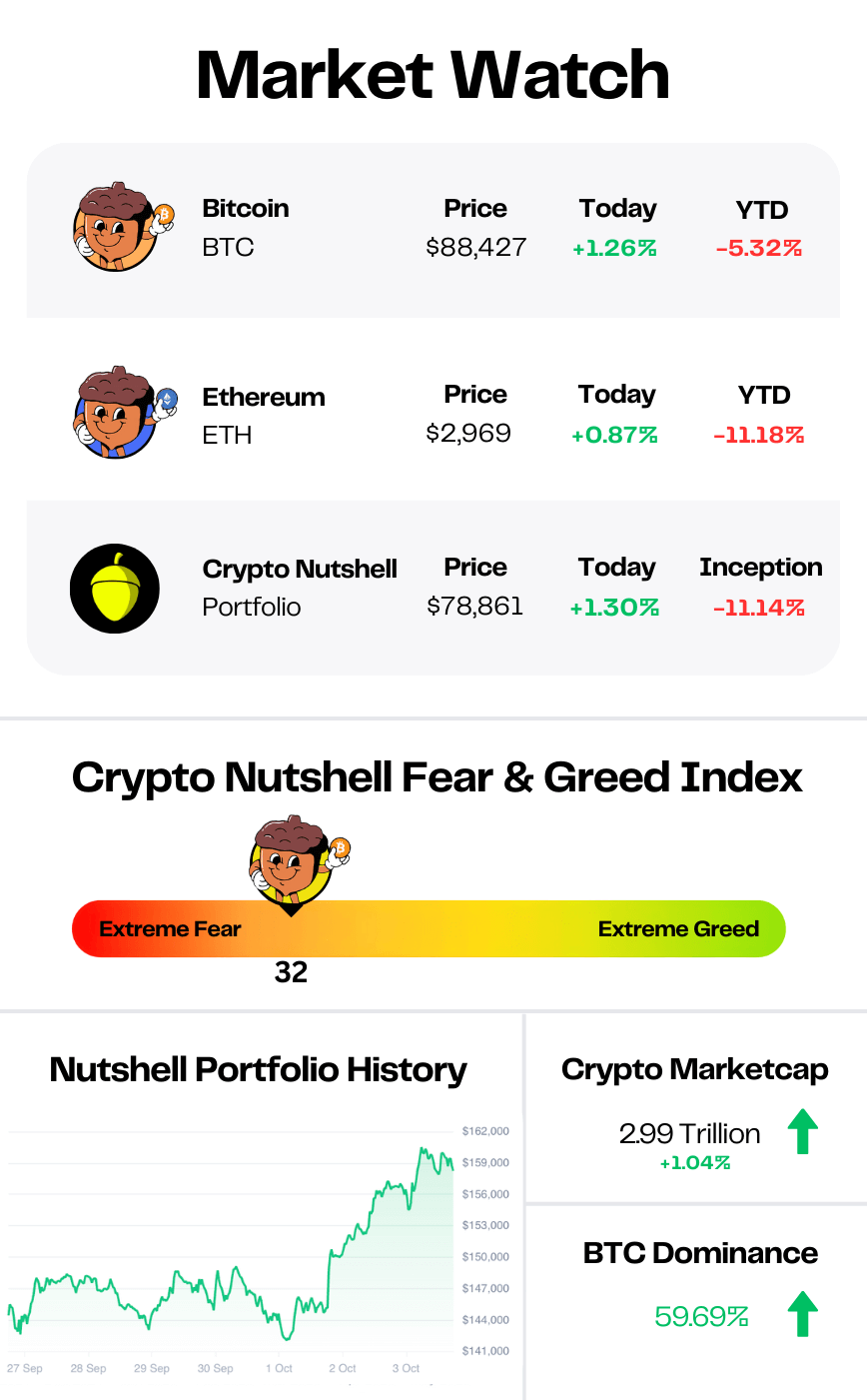

Prices as at 2:35am ET

IT’S OVER? 🏦

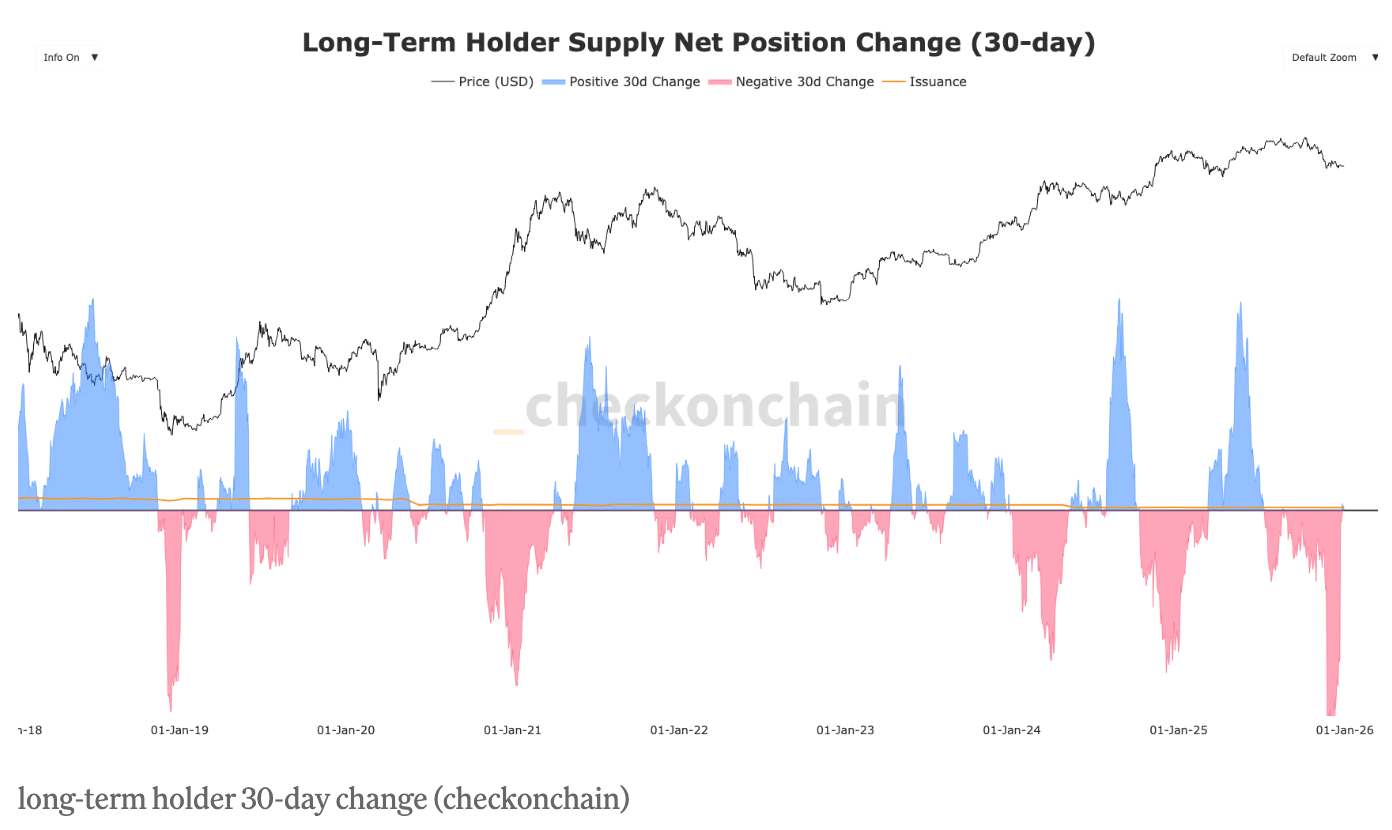

BREAKING: Long-term holders turn net accumulators, easing a major bitcoin headwind

Long-term Bitcoin holders just stopped selling.

For the first time since July, long-term holders (LTHs) - entities holding BTC for at least 155 days - have flipped to net accumulation.

They've added roughly 33,000 BTC on a 30-day basis, according to data from checkonchain.

LTH selling has been one of the two largest sources of sell pressure this year, alongside miner capitulation.

During the 36% correction from October, LTHs sold over 1 million BTC - the largest distribution since 2019, when Bitcoin hit its $3,200 bear market low.

This cycle has seen three major LTH distribution waves:

March 2024: 700,000+ BTC sold at $73,000

November 2024: 750,000+ BTC sold at $100,000

October 2025: 1 million+ BTC sold during the 36% drop

Now the trend has finally reversed.

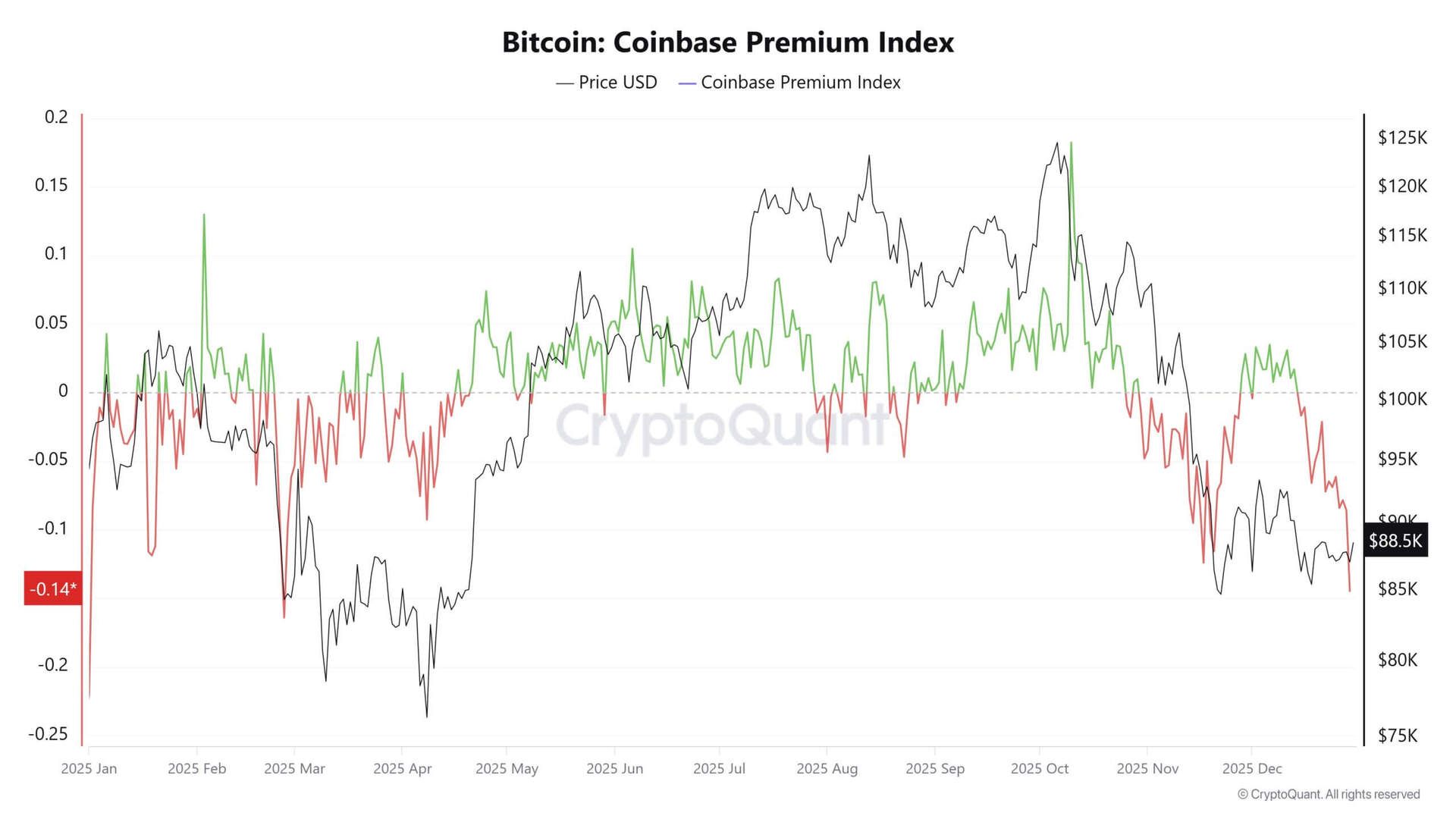

U.S. selling pressure persists

The Coinbase Premium Index hit -0.14 on December 30 - the weakest reading since February.

The index has been negative for 16 straight days. During that stretch, Bitcoin failed to close a week above $90,000.

A similar setup also played out in February. The premium crashed, Bitcoin dropped below $80,000, then recovered.

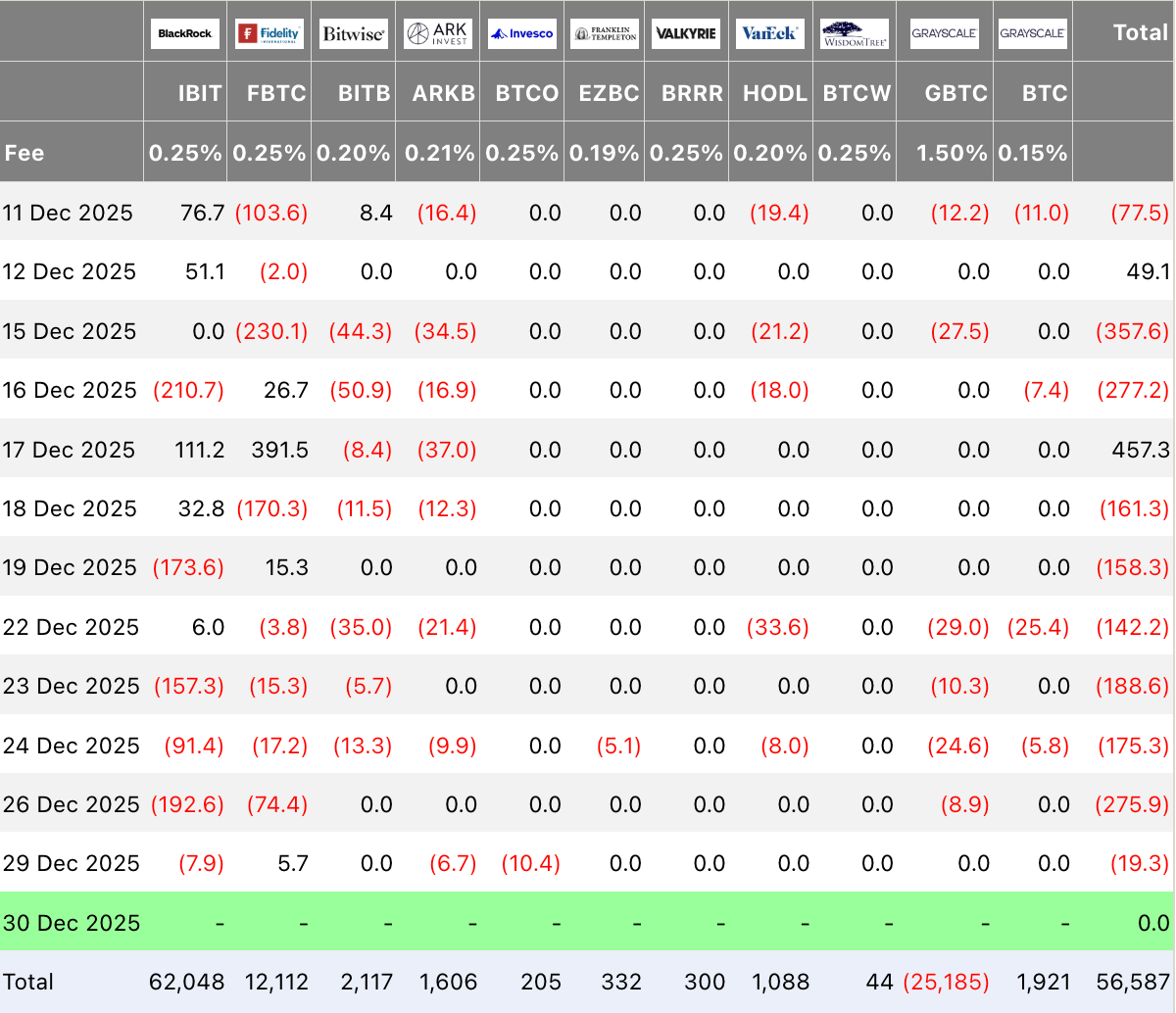

Spot Bitcoin ETF outflows continued in December for the second consecutive month, though withdrawals declined significantly since November.

Why this matters

CryptoQuant founder Ki Young Ju confirmed: "Bitcoin long-term holders stopped selling."

Roughly 10,700 BTC shifted into long-term holding status in late December.

Analysts still believe that Bitcoin could drop below $80,000 if U.S. selling continues. But structurally, one of the two major sell pressure sources just flipped.

Miners capitulated weeks ago. Long-term holders stopped distributing.

If U.S. institutional demand returns - signalled by a positive Coinbase Premium - the path of least resistance shifts.

The setup is in place. We'll see in January whether it's enough. 🚀

Exxon and Chevron Have an Unlikely New Competitor

Energy giants like Exxon and Chevron are buying land in America’s lithium hotspot. Now they’ve got a new neighbor. EnergyX has now acquired 35k gross acres in Southwest Arkansas, right next door. With tech that can recover 3X more lithium than traditional methods, they’re aiming for America’s lithium crown. General Motors already invested. Join them and 40k people as an early-stage EnergyX investor today.

Energy Exploration Technologies, Inc. (“EnergyX”) has engaged Nice News to publish this communication in connection with EnergyX’s ongoing Regulation A offering. Nice News has been paid in cash and may receive additional compensation. Nice News and/or its affiliates do not currently hold securities of EnergyX.

This compensation and any current or future ownership interest could create a conflict of interest. Please consider this disclosure alongside EnergyX’s offering materials. EnergyX’s Regulation A offering has been qualified by the SEC. Offers and sales may be made only by means of the qualified offering circular. Before investing, carefully review the offering circular, including the risk factors. The offering circular is available at invest.energyx.com/.

WHICH ARE YOU BUYING? 🛒

Grant Cardone hasn’t historically been a Bitcoiner.

He’s a real-estate billionaire, founder of Cardone Capital, and someone whose audience is built on property, cash flow, and old-school wealth building, not crypto Twitter.

Grant Cardone is known for real-estate

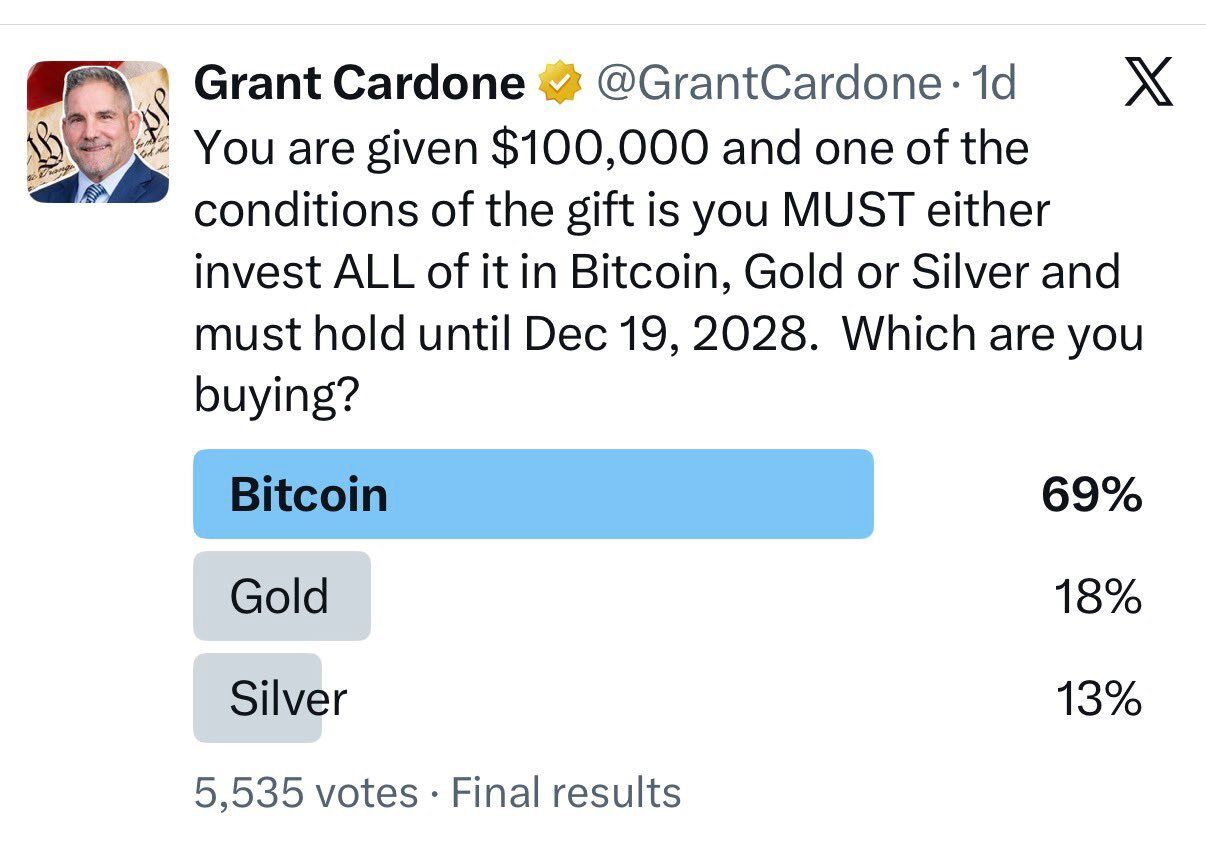

That’s why his poll this week surprised people:

Bitcoin won by almost 4x.

Grant followed up with the real question:

Some critics immediately dismissed the poll, claiming Grant’s audience was “biased toward Bitcoin.”

That’s when Peter Schiff stepped in.

Peter Schiff is the most vocal gold bull and Bitcoin critic alive. He’s spent over a decade calling Bitcoin a bubble and gold the only real money.

So he ran the exact same poll.

Bitcoin still won by a wide margin, even with an audience that actively dislikes it.

So what gives?

If Bitcoin is the clear preference, why are gold and silver the ones ripping right now, printing all-time highs?

This is the part most people miss.

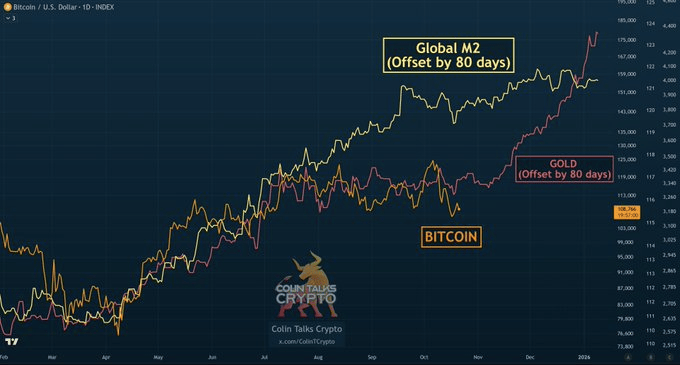

As we’ve been pointing out for months, Gold tends to move first when liquidity conditions shift.

Then Bitcoin tends to follow, usually with a lag of ~6 months.

We’ve seen this play out repeatedly.

Gold leads.

Silver follows with leverage.

Bitcoin arrives last, but moves the fastest.

Gold & silver lead. Bitcoin follows - violently. 💣

IS THIS WEAKNESS? 📉

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Two weeks ago, the total stablecoin supply sat at $270.73 billion.

Today it's $268.93 billion.

That's a $1.80 billion decrease in the past 14 days.

At first glance, that looks like weakness. But context matters.

Bitcoin's been grinding lower. Fear's elevated. ETF flows remain choppy.

And despite all that... stablecoin supply only dropped $1.8 billion.

Zoom out and the picture gets even clearer.

Stablecoin supply is still up $80.49 billion year-to-date.

Stablecoins aren't just digital dollars. They're dry powder.

Billions in ready-to-deploy capital, already on-chain, waiting for conviction to flip. 🔥

CRACKING CRYPTO 🥜

Recent Bitcoin crashes cry "manipulation" as on-chain data catches market maker dumping. Bitcoin's violent whipsaw drew accusations of manipulation, but the data reveals a market structurally vulnerable.

Ethereum Hits Record 8.7M Contract Deployments in Q4 2025. Ethereum set a quarterly record with 8.7 million smart contracts deployed in Q4 2025, driven by RWAs, stablecoins and infrastructure growth, Token Terminal data shows.

Grayscale seeks U.S. listing for Bittensor ETP in first institutional bet on decentralized AI. The filing marks the first attempt to bring TAO, Bittensor’s native token, to U.S. markets through a regulated investment product.

David Beckham-backed supplements firm quits Bitcoin buying strategy after raising $48 million. Bitcoin was changing hands at about $114,000 at the time of the announcement, but has since fallen to about $88,000.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When Uniswap airdropped 400 UNI tokens to early users in September 2020, what was the initial value?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Around $1,200 🥳

The 400 UNI tokens were worth around $1,200 at launch (roughly $3 per token). At UNI's all-time high of $44 in May 2021, that same airdrop was worth over $17,000. It remains one of crypto's most valuable airdrops, rewarding anyone who'd used the protocol before September 1, 2020.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.