GM and welcome to The Crypto Nutshell 🥜, your daily burst of crypto intel. We mix expert analysis, the freshest on-chain data, and the latest news with a dash of meme magic. All served compactly right into your inbox every single day. Today we’ll cover:

Whats going on with these Bitcoin ETF applications??? 💰

Is it Ethereum’s time to shine? ☀️

A deep dive into this quarters volume and market depth data ⚓️

And more…

MARKET WATCH ⚖️

Ready to rumble? 🥊

Let's pull back the curtain on Bitcoin and Ethereum's market prices, while also unearthing today's juiciest crypto news. Get set, it's showtime!

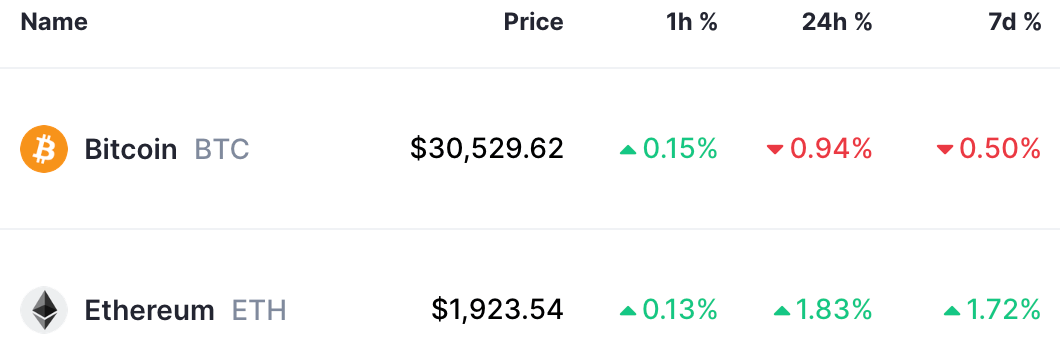

Prices as of 7:45am ET

By now you would have seen the huge news that came out yesterday, the SEC stating that the BTC ETF applications were inadequate. No need to fear, things appear to be back to the way we were and we await the SEC’s decision once again.

In response to the SEC's feedback, Fidelity Investments led a group of firms including Invesco, VanEck, 21Shares, and WisdomTree in refiling their applications for spot-Bitcoin ETFs.

Notably, all of the updated applications now mention that Coinbase will handle market surveillance for their funds, a detail absent from earlier versions.

EXPERT OF THE DAY - PENTOSHI 🐧

Today’s expert of the day is @Pentosh1, an anonymous technical analyst that regularly posts his charts, trades & theses on twitter.

He has amassed an audience of 700,000 followers despite posting behind an anonymous penguin pseudonym for one reason - he has been blistering accurate.

Pentoshi believes that it's Ethereums time to shine over Bitcoin now, with targets at year highs $2059 & $2148.

Not only did he call the Bitcoin & Ethereum top in 2021, but he also was spot-on with price action all the way down.

With Bitcoin getting all the love this year up 87% with Ethereum only up 63% - Pentoshi's latest call is that it's now Ethereums time to shine.

ON CHAIN DATA DIVE 📊

Lets take a quick look at the most recent on chain data.

First up, Bitcoin's readily available supply to buy is teetering on the brink of historic lows.

If the big players are eyeing to pocket more Bitcoins, they're likely to shell out more than today's going rate. Consequently, given the simple law of supply and demand, we might be on the cusp of witnessing a noteworthy surge in Bitcoin's value.

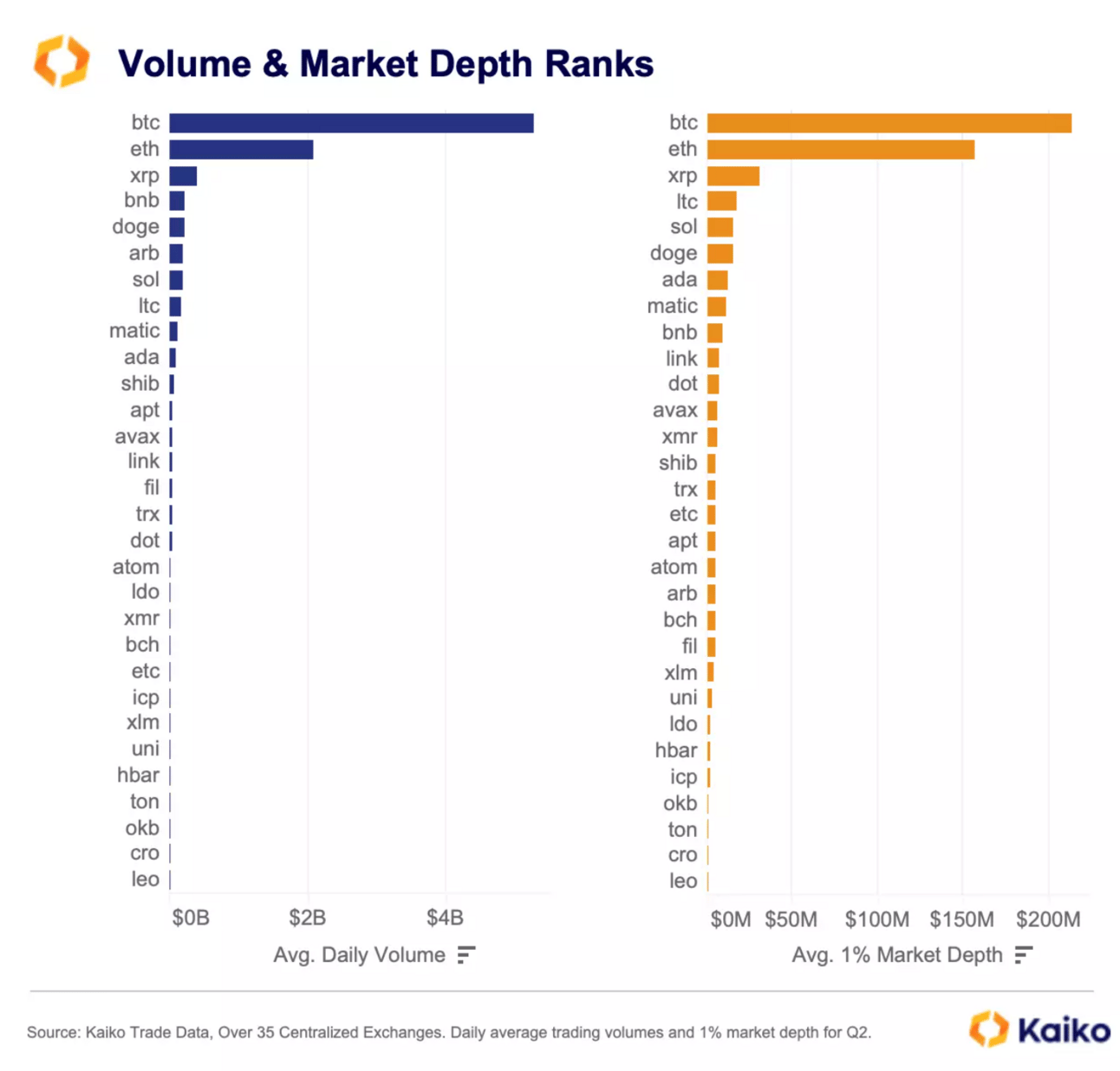

The standout tokens in terms of volume this quarter were:

XRP - Leaping two spots to rank third in volumes this quarter, investors are eagerly positioning for an imminent SEC v Ripple ruling. The token is also making waves with a volume surge on Korean exchanges.

ARB - Arbitrum's native token ARB debuts at 6th in volumes this quarter, outpacing several Layer 1s, propelled into the top 30 tokens by its robust market cap.

BCH - Despite being listed on the prominent EDX exchange alongside BTC, ETH, and LTC, Bitcoin Cash (BCH) languishes at 21st in trading volumes, casting it as the odd one out.

Lets examine the market depth rankings for the quarter.

A token with 'deep' market depth signifies plenty of open orders, easing its exchange at fair prices. Conversely, weaker market depth allows larger orders to sway the price more easily.

FIL - Depth plunged this quarter to a gloomy 21st, down from 8th, following its identification as a security in an SEC lawsuit.

ATOM - After being labeled a security by the SEC, market depth took a nosedive from 13th to 18th this quarter.

BNB - Despite being Binance's native token, market makers continue to shy away from BNB, leaving it at 9th for depth, despite being the third largest non-stable coin in market cap.

CRACKING CRYPTO 🥜

As the SEC hints at rejecting spot Bitcoin ETF applications, Bitcoin value tumbles below $30,000. This event underlines the ongoing regulatory hurdles in the crypto market, reminding us that the quest for broader Bitcoin access through ETFs is still mired in complexities.

In a thrilling journey from being a fringe technology to global recognition, cryptocurrencies are still considered to be in their 'early majority' phase of adoption. To unlock their full potential and reach mass adoption, they must leap the 'chasm' that separates early adopters from the majority, suggesting an exciting road ahead for the world of digital assets.

Mind Network, a web3 data security platform, has scored $2.5M in seed funding from prominent investors, including Binance Labs. This capital injection will propel its mission of enhancing user control over personal data and financial transactions.

Litecoin, one of the oldest digital currencies, has surprisingly spiked by 24.6% to $105 within the last 24 hours, despite no clear triggering event. This surge could potentially be linked to the recent SEC's exclusion of Litecoin from its list of 'unregistered securities', contributing to a positive market sentiment.

TRIVIA TIME ✍️

⛏️ Bitcoin miners are rewarded for successfully mining a ____

A) Bitcoin

B) Hash

C) Cube

D) Block

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Block 🎉

What did you think of today's Newsletter?

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.