Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all you crypto nuts. Crypto Nutshell #362 takin’ a lap... 🐩 🥜

We’re the crypto newsletter that’s more heroic than a group of teenagers saving the world from demogorgons... 👾🏢

What we’ve cooked up for you today…

🏦 Australia ETF launch

💲 When To Sell Your Bitcoin

🤔 Market cycle - where are we?

💰 And more…

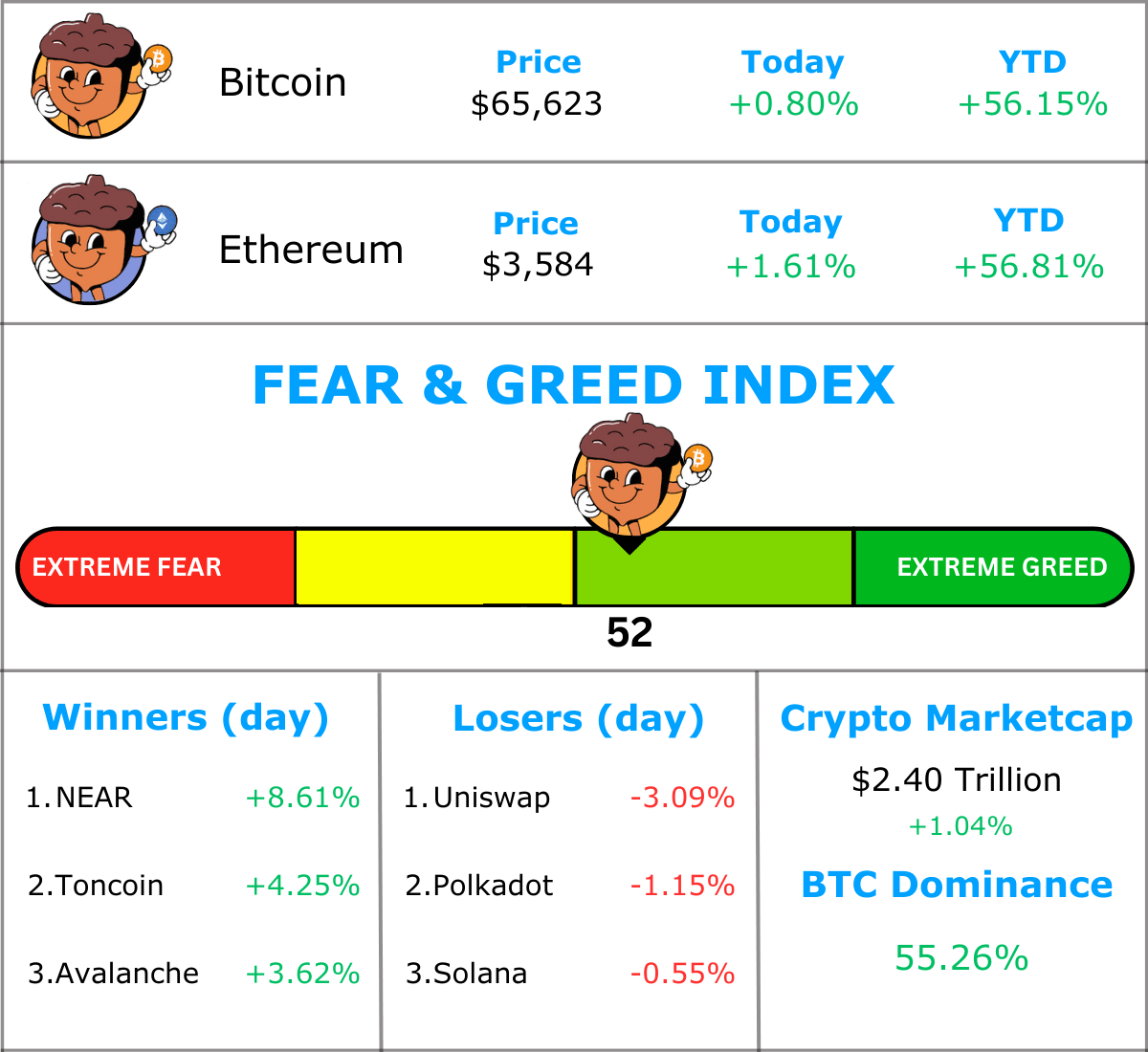

MARKET WATCH ⚖️

Prices as at 5:25am ET

Only the top 20 coins measured by market cap feature in this section

AUSTRALIA ETF LAUNCH 🏦

BREAKING: ASX’s first Bitcoin ETF taps $1.3M volume on first trading day

The first Bitcoin ETF to launch on Australia’s largest stock exchange (ASX) closed its first day of trading with $1.3 million in trade volume.

That’s quite a lot less than the US Bitcoin ETFs…

On the first day of trading, the US Bitcoin ETFs did a combined $4.5 billion in trade volume. (averaging $450 million each)

Keep in mind, the Australian ETF market is significantly smaller than the US market. ($192 billion vs $8.1 trillion)

This is what VanEck’s deputy head of investments and capital markets Jamie Hannah had to say:

“Notwithstanding the Australian market being a lot smaller than the U.S. and most of our flow being retail rather than institutional, there is a possibility that we may follow a similar path.”

Continuing on, Hannah added:

“We have had a significant amount of retail and professional investors express strong interest in getting Bitcoin exposure through ASX.”

In other ETF news…

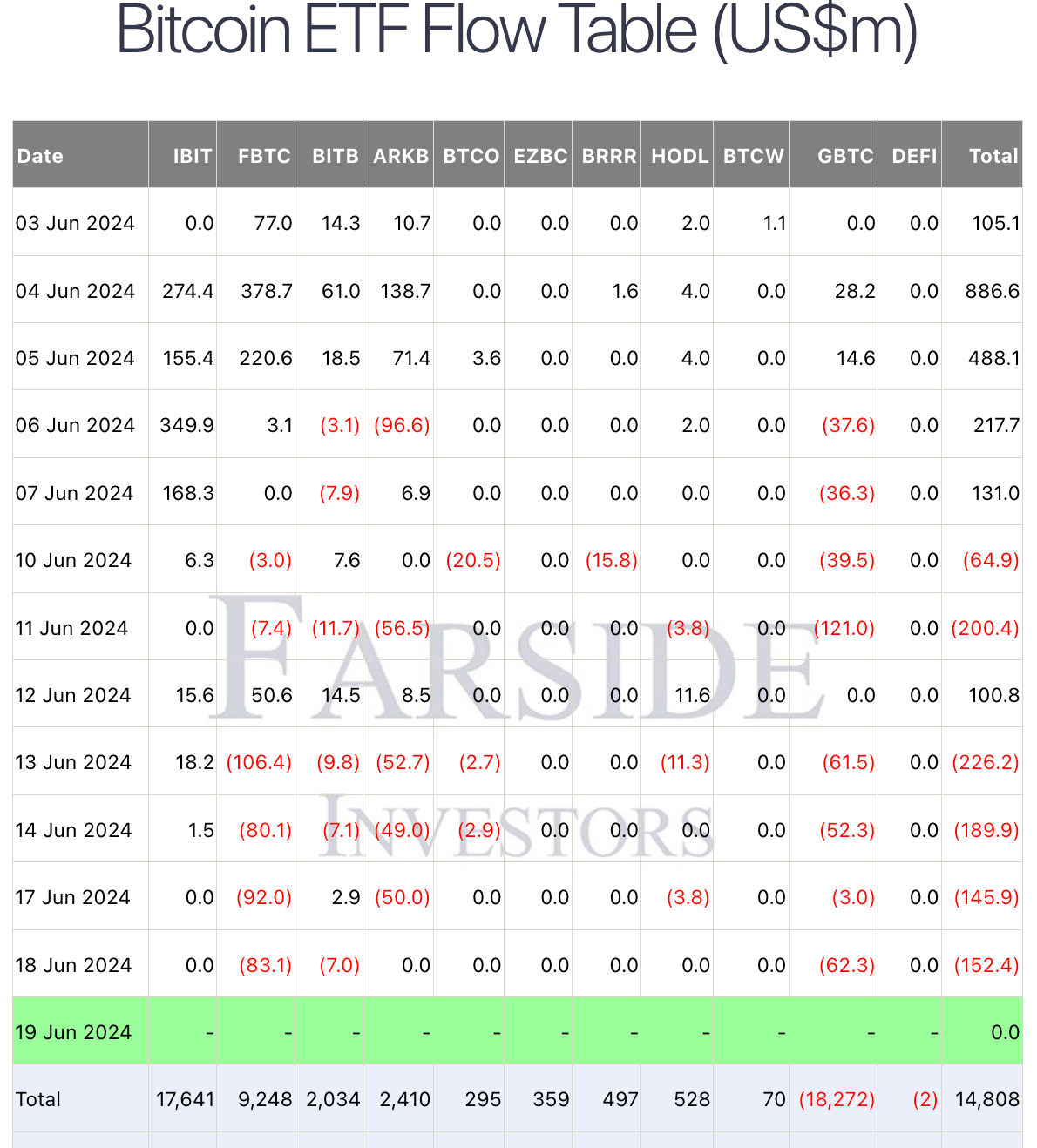

It’s been a rough week again for the US Bitcoin ETFs.

So far weekly outflows are are at $298.3 million.

(The US stock market was closed this Wednesday)

It’s also the 4th outflow day in a row. 😱

It’s going to take a BIG Thursday and Friday to turn this weekly outflow around.

START MAKING EVERY TRANSACTION COUNT 💳

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.*

WHEN TO SELL YOUR BITCOIN 💲

It’s the question everyone has to ask themselves at some point:

When do you sell your Bitcoin?

$100,000? $1 million? $10 million?

According to Michael Saylor:

You do not sell your Bitcoin.

Bitcoin Prague 2024 just wrapped up last week.

The highlight of the event was a keynote by Michael Saylor titled: 21 Rules of Bitcoin.

The entire talk was a masterclass. Although we can’t cover all 21 rules of Bitcoin, some of the best were:

Rule 5: Bitcoin is the only game in the casino that we can all win

Rule 8: Everyone gets Bitcoin at the price they deserve

Rule 10: Tickets to escape the Matrix are priced in Bitcoin

However, 1 rule in particular, stood above the rest:

Rule 20: You do not sell your Bitcoin

Here’s how Saylor broke it down:

“Bitcoin has been going up 50% a year, for the past 4 years. Every time you sold it, you gave up the best performing asset in the world to buy what?”

Put even more simply:

“Diversification is selling the winner to buy the loser.”

Keep in mind, Michael Saylor didn’t just make his money from building a successful company.

He’s also a ridiculously successful investor. Saylor made ~$500 million from early investments in Apple, Amazon, Facebook & Google.

Rule 20 will serve you well.

P.S If you have a spare 45 minutes, check out the full keynote here. (It’s well worth a watch.)

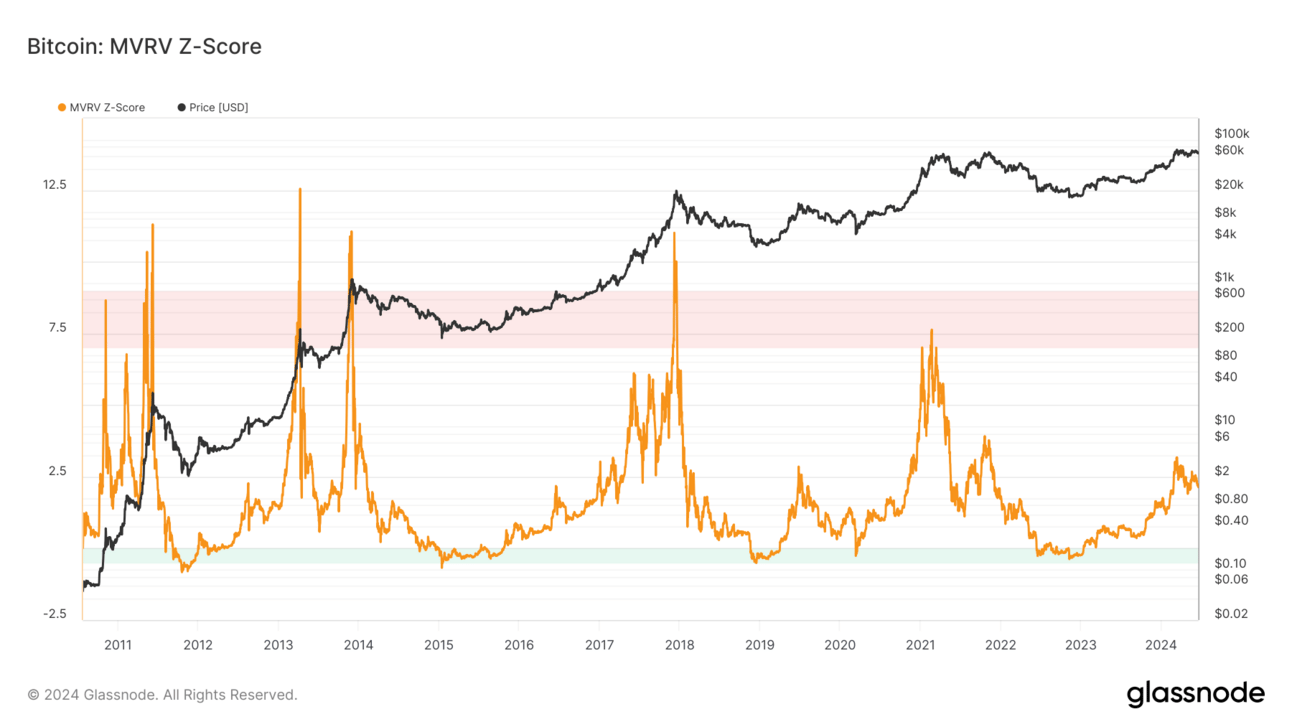

MARKET CYCLE - WHERE ARE WE? 🤔

Today we’ll be taking a look at the MVRV Z-Score.

This metric simply compares the market value to the realized value.

Market Value (Market cap): current price of Bitcoin multiplied by the circulating supply

Realized Value: the value of all coins at the price they were last moved

A market top (red zone) is categorised by market value being significantly higher than the realized value.

A market bottom (green zone) is categorised by market value being significantly lower than the realized value. (also the best time to scoop up cheap Bitcoin)

You can think about this metric as a market cycle gauge.

It visually breaks down where we currently are in the cycle.

Since the cycle bottom in November 2022, MVRV has been rallying. With some dips along the way of course.

Currently it’s at 2.13 (Two weeks ago it was at 2.55)

(MVRV follows the price of Bitcoin, that’s why it’s dipped so much over the last two weeks)

But, MVRV is still in-between the green and red zones.

Meaning we’re roughly in the middle of the cycle.

We’ve still got a long way to go before Bitcoin’s deemed “overvalued” by this metric.

Quick reminder that we’re also about to enter what Raoul Pal has dubbed the “banana zone”…

Expect this metric to drastically rise over the next few months. 🍌

CRACKING CRYPTO 🥜

Martin Shkreli, Barron Trump and Andrew Tate allegedly involved in Donald Trump token drama. Earlier today, Arkham announced a $150,000 bounty for the identity of the DJT token creator.

‘Insane amount’ of Bitcoin shorters are hoping it won’t go to $70K. An “insane amount” of Bitcoin short positions will be liquidated if Bitcoin returns to $70,000.

Binance Fined $2.2M by India’s Financial Intelligence Unit. Binance became the first offshore crypto-related entity, along with KuCoin, to be approved by India’s Financial Intelligence Unit (FIU) in May.

Bitcoin Whales Sold Over $1B BTC in Past Two Weeks. The selling coincides with net outflows from U.S.-listed bitcoin ETFs in the same period, data shows.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 4 years 🥳

Approximately every 4 years the amount of new Bitcoin entering the supply gets cut in half.

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.

*Terms and conditions apply. Offer valid for new users. Crypto investments involve risks; please do your research.