GM to all of you nutcases. It’s Crypto Nutshell #630 fuelin’ up… ⛽🥜

We're the crypto newsletter that's more magical than a boy discovering a golden ticket and a world of pure imagination... 🍫🎟️

What we’ve cooked up for you today…

🏦 Another BTC treasury company

💥 Bitcoin to $500,000 in 5 years

📉 Long-term holders selling?

💰 And more…

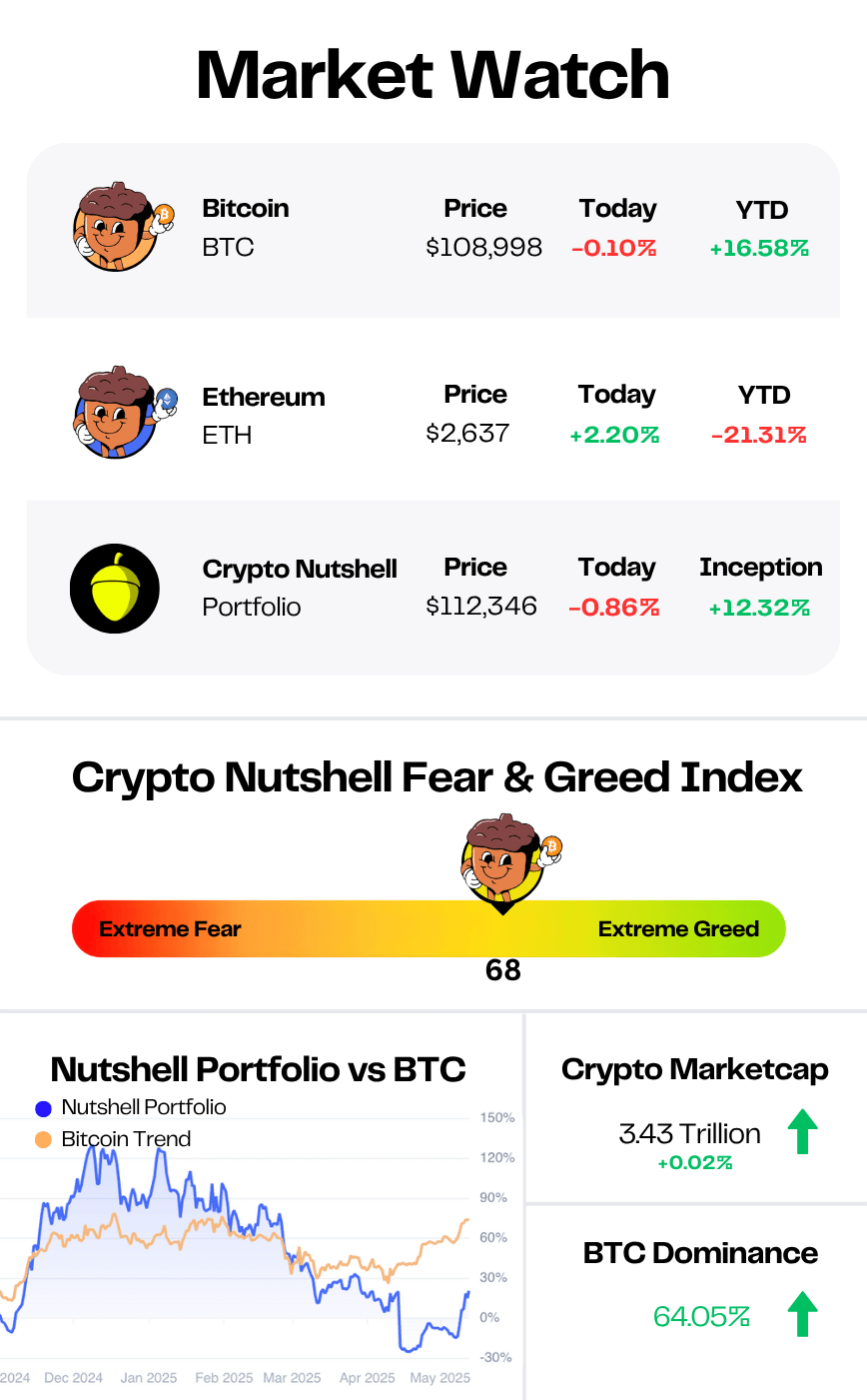

Prices as at 4:20am ET

ANOTHER BTC TREASURY COMPANY 🏦

BREAKING: Trump Media Group reverses stance, confirms $2.5B Bitcoin capital raise

After a day of denial, Trump Media just confirmed the rumours - and it’s massive.

They’re raising $2.5 billion to buy Bitcoin.

That’s right.

Trump’s media company is building a corporate BTC treasury, mirroring the Michael Saylor playbook.

The Breakdown:

$1.5B in stock sold at market price

$1B in convertible notes with a 35% premium

BTC custody handled by Anchorage Digital and Crypto.com

Funds expected to close May 29

According to CEO Devin Nunes, this isn’t just a bet on hard money:

“We view Bitcoin as an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets. This investment will help defend our Company against harassment and discrimination by financial institutions.”

That’s the official line.

Unofficially?

It’s the clearest sign yet that the Trump ecosystem is all-in on crypto - across NFTs, meme coins, ETFs, mining, and now a Bitcoin treasury.

Why It Matters:

Trump Media now joins a growing list of public companies stacking sats - including Strategy, MetaPlanet (Japan’s MicroStrategy), GameStop, and Semler Scientific.

The $2.5B war chest would make it one of the largest corporate BTC buys ever, likely vaulting Trump Media into the top 5 Bitcoin-holding firms globally.

Market analyst Jesse Myers predicts that at this pace, institutions could own 50% of all Bitcoin by 2045.

And this isn’t just symbolic.

Despite what you think about them…

The Trump family’s shift from real estate to hard assets is no longer a meme.

It’s a multi-billion dollar bid for financial and political leverage.

And it’s happening on-chain. 🚀

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

BITCOIN TO $500K IN 5 YEARS 💥

In his latest interview with Altcoin Daily, macro investor Larry Lepard just laid out one of his biggest long-term calls yet:

“In five years, I could easily see Bitcoin at $500,000.”

And that’s not a random guess - it’s based on decades of market data and a detailed trendline model Larry follows.

Who Is Larry Lepard?

Managing Partner at Equity Management Associates 💼

Harvard-trained investor with 40+ years of experience 🎓

One of the strongest voices for sound money & Bitcoin adoption 🧠

When Larry talks long-term valuation, it’s not hype. It’s math.

His Model Says This:

Based on Bitcoin’s 5-year power law trendline, here's where the numbers land:

Base case: $326,000

+1 standard deviation: $667,000

+2 standard deviations: $1.85 million

And historically?

“Bitcoin has hit 2 standard deviations above trend in every cycle.”

Even the 10-year trendline projects over $1 million, and the 20-year model puts it at $7 million.

Why It Matters

This isn’t about price targets for attention.

It’s about understanding what happens when a scarce asset collides with a flood of fiat:

“There’s a massive wall of fiat money coming - and it’s going to chase Bitcoin.”

From real estate to bonds to bank accounts - we’re talking hundreds of trillions in capital, and Bitcoin’s just getting started at a ~$2T market cap.

Final Take

Larry’s not throwing out $500K as some wild moonshot.

He’s saying: based on the data, based on the cycles, that might be the floor 5 years from now.

Not the peak. Not the dream. The base case.

$500,000 Bitcoin by 2029 isn’t crazy.

It might be the most reasonable bet on the table. 🔒

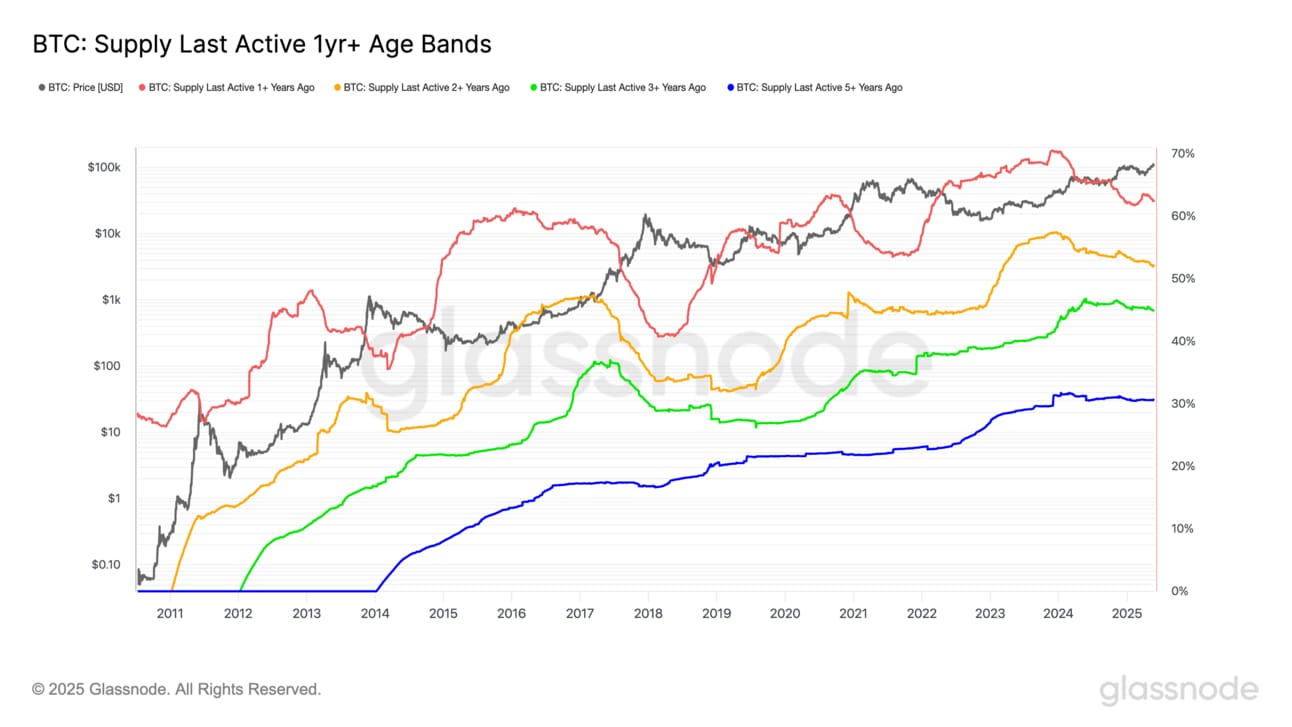

LONG-TERM HOLDERS SELLING? 📉

Let’s check in on one of our favourite metrics: Bitcoin’s supply last active 1+ years ago.

It’s a simple but powerful signal - tracking how much BTC has remained untouched as a percentage of total circulating supply.

Here’s the logic:

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

Here’s the latest supply breakdown vs. two weeks ago:

🔴 Supply last active 1+ years ago: 62.36% (down from 63.82%)

🟠 Supply last active 2+ years ago: 52.07% (down from 52.25%)

🟢 Supply last active 3+ years ago: 44.87% (down from 45.12%)

🔵 Supply last active 5+ years ago: 30.60% (up from 30.61%)

Long-term supply dipped across the board…

But even after a new all-time high just five days ago, 62.36% of all Bitcoin still hasn’t moved in over a year.

Some profit-taking was inevitable.

Yet the pullback is minor - and the strongest hands are still holding tight.

No advanced degree needed here:

Shrinking supply + growing demand = 🚀

CRACKING CRYPTO 🥜

Strategy's Michael Saylor rejects on-chain Proof-of-Reserves due to 'liability'. Strategy's Michael Saylor calls proof-of-reserves a security threat, igniting Bitcoin community backlash over transparency concerns.

USDC issuer Circle moves forward with initial public offering on NYSE. USDC issuer Circle has launched an initial public offering 24,000,000 shares of its Class A common stock.

Wall Street Giant Cantor Debuts $2B Bitcoin Lending Business. The financing will help Maple Finance, a major crypto lending platform itself, to speed up its growth, CEO Sidney Powell said.

Cetus poses community vote to possibly return 100% of funds to users affected by $223 million exploit. Cetus stated it can use its cash and token reserves, as well as a Sui Foundation loan, to recover stolen assets from its recent exploit

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which two software engineers created Dogecoin as a joke in 2013?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Billy Markus and Jackson Palmer 🥳

Billy Markus and Jackson Palmer launched Dogecoin as a parody of crypto hype — little did they know it would become a multibillion-dollar meme fueled by Elon and Reddit.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.