Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all 96,759 of you. Crypto Nutshell #550 floatin’ by… 🦦🥜

We're the crypto newsletter that's more magical than a group of kids biking through the night to help an alien phone home... 🚲🌕

What we’ve cooked up for you today…

🏦 Rebrand

🕵️ Who’s buying?

📉 Big deal

💰 And more…

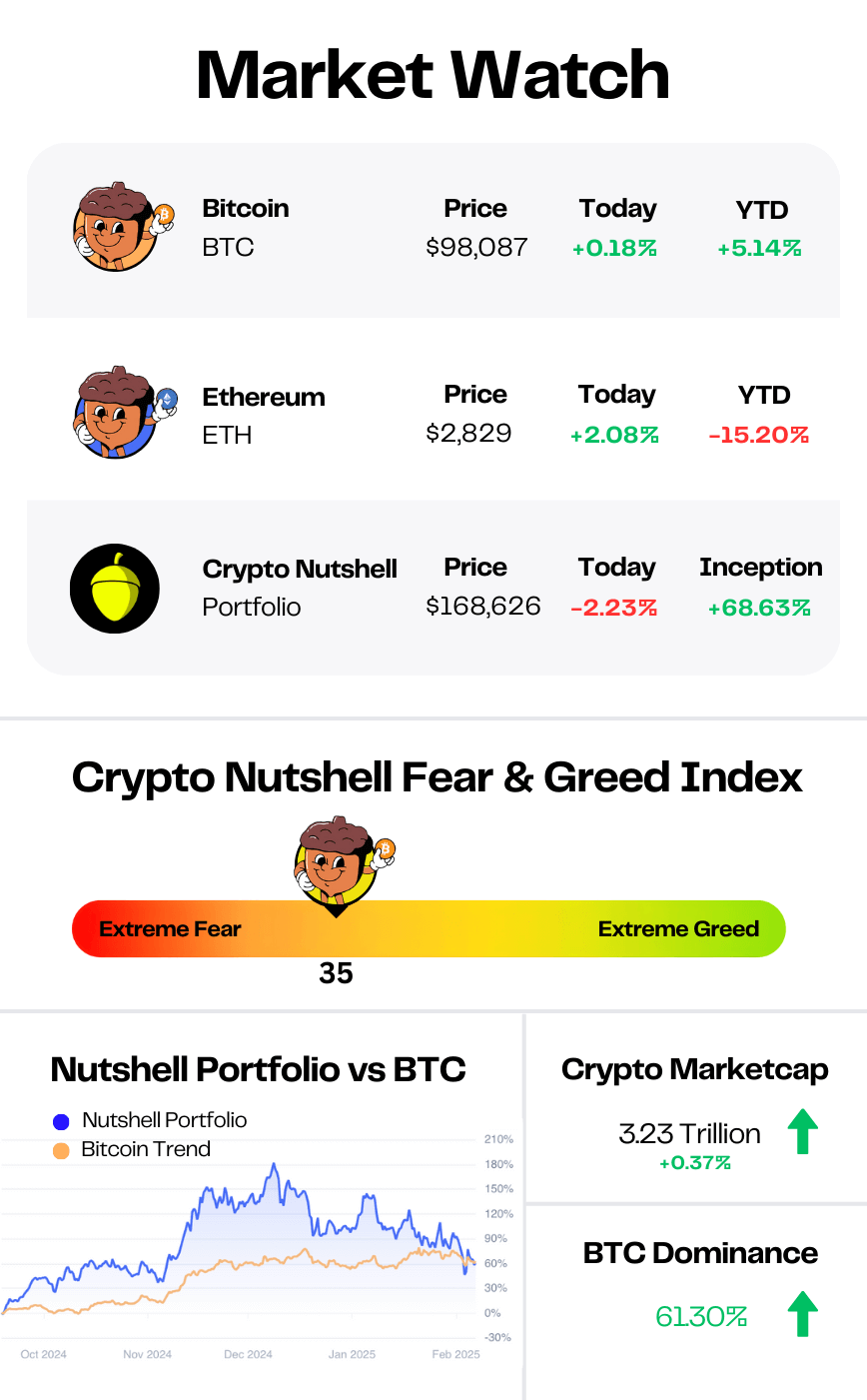

Prices as at 2:55am ET

REBRAND 🏦

BREAKING: MicroStrategy rebrands as 'Strategy' in move to emphasize its Bitcoin position

It was only a matter of time.

We all know that MicroStrategy is “all-in” financially when it comes to Bitcoin…

But now they’ve gone all in on the marketing side of things as well…

Earlier today Michael Saylor announced MicroStrategy’s new name is officially “Strategy”. (The logo also includes the famous Bitcoin logo)

The company’s core business operations will remain the same following this rebrand.

Since Strategy adopted Bitcoin as a treasury reserve asset, it’s market cap has exploded to a staggering ~$85 billion.

(It’s going to take a while to get used to calling them “Strategy”…)

The large majority of Strategy’s market cap is based on it’s Bitcoin holdings, so this rebrand makes complete sense.

Here’s the official statement from Strategy:

“This brand simplification is a natural evolution of the company, reflecting its focus and broad appeal. The new logo includes a stylized “B”, signifying the company’s Bitcoin strategy, and its unique position as a Bitcoin Treasury Company. The brand’s primary color is now orange, representing energy, intelligence, and Bitcoin.”

And here’s what Strategy CEO, Phong Le, had to say:

“Strategy is innovating in the two most transformative technologies of the twenty-first century – Bitcoin and artificial intelligence… Our new name powerfully and simply conveys the universal and global appeal of our company, and the value we bring to the strategies of our shareholders, customers, partners, and employees.”

To be fair, there was never anything “Micro” about their Bitcoin strategy.

The Big Game Is Just Around The Corner… 🏈

Alright, football fans - the Super Bowl is just around the corner.

To celebrate, Crypto.com is kicking off with something special - Sports Event Trading.

Sports Event Trading on Crypto.com is where you can trade your predictions on all the upcoming showdowns.

Here’s How It Works:

US$100 Payout for Each Correct Contract

Make a simple Yes/No call on your favorite games - if you’re correct, you can profit US$100 per winning contract.Trade Any Time Before Kickoff

Open or close your contracts up to the start of the game - no need to miss out on the market.Fast Settlements

Payment for correct outcomes arrives in 1 business day after the event.Multiple Funding Options

Trade with USD or instantly convert 350+ crypto to USD on the Crypto.com App or Web.Fully Regulated & Available in All 50 States

Enjoy the confidence of a CFTC-regulated derivatives product that keeps things transparent.

How To Get Started:

Create an Account

Sign up here with a few quick steps.Trade Your Prediction

Pick Yes or No on a game's outcome - no complicated mechanics.Get Paid

If your prediction is correct, you’ll earn US$100 per contract.

Don’t sit on the sidelines - make your view count this Super Bowl season!

Sign up now with referral code NUTTY and grab your $10 bonus to kickstart your trading.

*Sports Event Trading is a derivatives product offered by Crypto.com | Derivatives North America, a CFTC-regulated exchange. Trading on CDNA involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on

CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

WHO’S BUYING? 🕵️

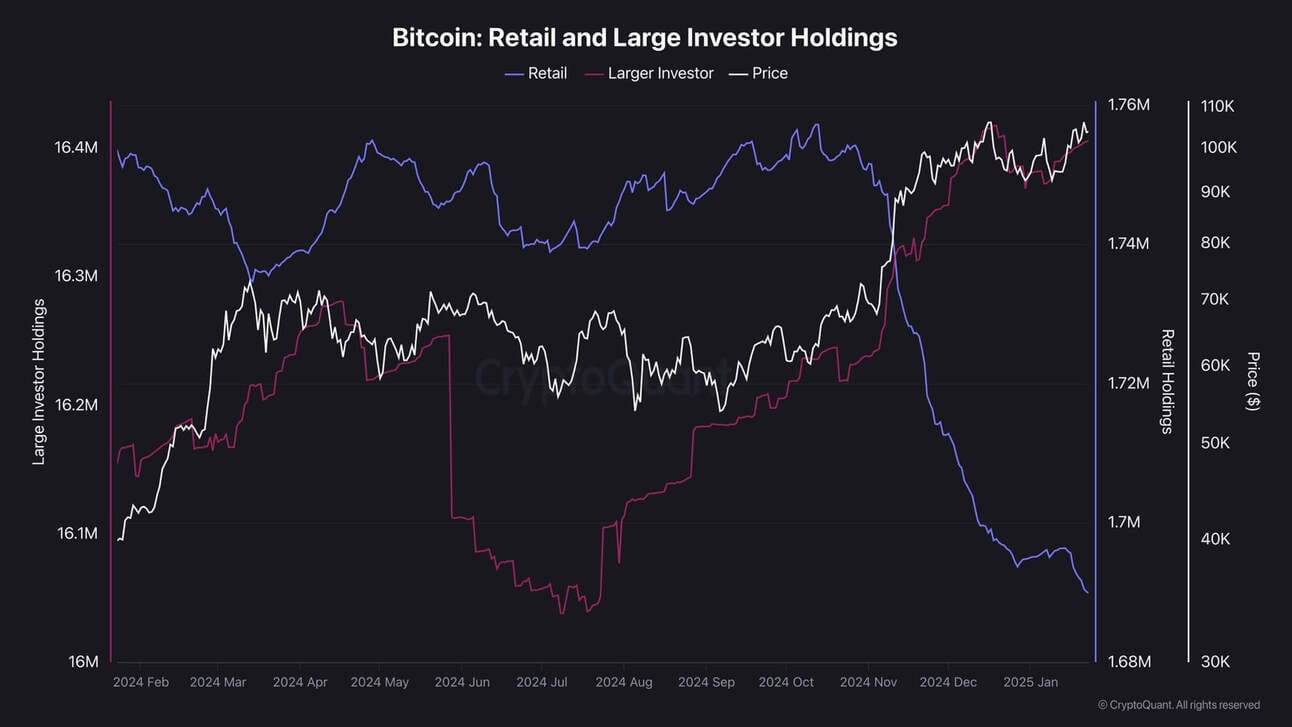

This week saw the largest liquidation event in crypto history—even bigger than the collapse of FTX. (that’s insane)

But for every seller, there’s a buyer.

So, who was buying?

First off, earlier this week, technical analyst Pentoshi noted heavy ETF buying:

This was later backed up by Matt Hougan, Bitwise's Chief Investment Officer:

So far in 2025, Bitcoin ETF buying is up ~68.41% compared to 2024.

Then when you look on-chain, who’s buying becomes abundantly clear:

It’s the same old story:

Retail holders are panic selling

Institutions are snapping up cheap coins

That’s why they’re called "smart money."

PSA: Don’t let them take your coins.

It’s the oldest trick in the book…

BIG DEAL 📉

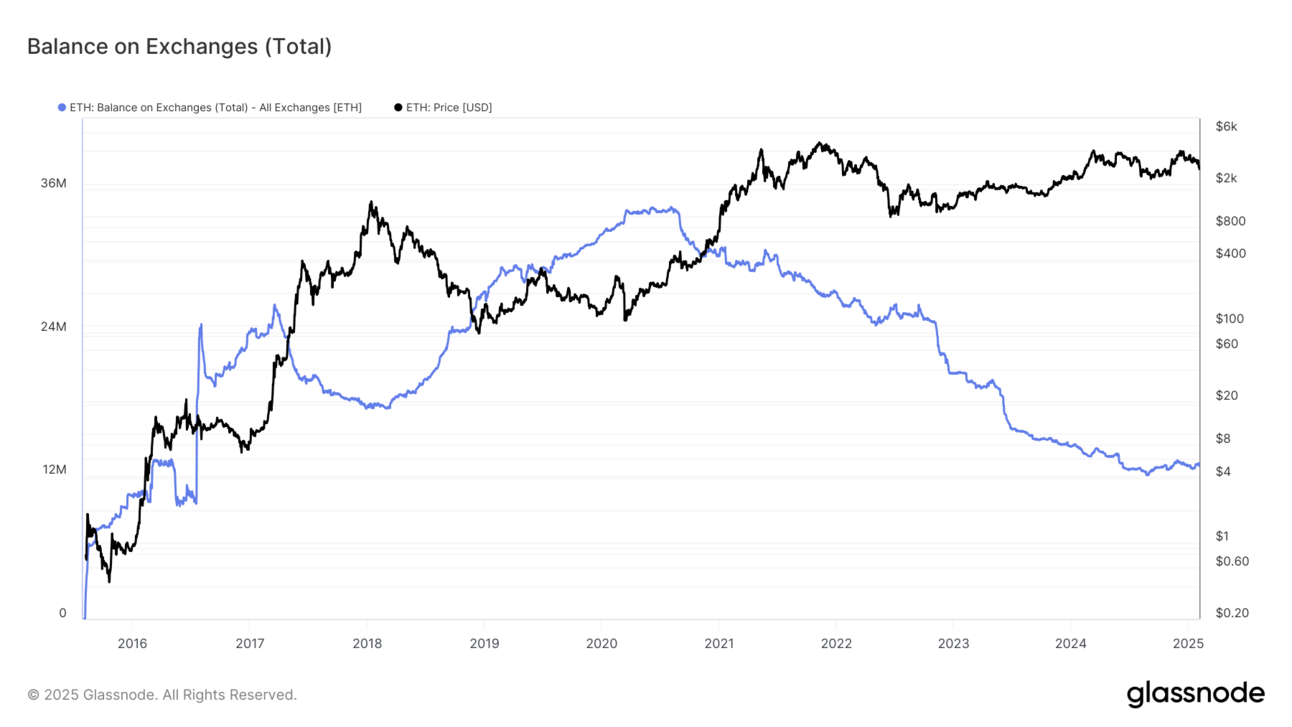

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Currently there is 12,834,566 Ethereum available for sale on exchanges.

That’s ~10.69% of the entire circulating supply.

But…

That’s also marks an increase of 235,818 ETH over the last two weeks.(~$651.34 million at today’s prices)

These are the “panic sellers” we were talking about in the previous section. (Even though that section focused on Bitcoin, the same applies to Ethereum)

When ETH is transferred to an exchange, we can safely assume that it’s for the purpose of selling.

However…

Why don’t we zoom out a little?

Over the last year, ETH exchange balances have decreased by 1,141,702 ETH!

That’s ~$3.17 billion at today’s prices.

And with ~89.31% of the supply no longer sitting on an exchange…

That’s a big deal.

CRACKING CRYPTO 🥜

XRP Ledger resumes activity after second outage in three months. Ripple's XRP Ledger resumes operation after second outage raises concerns about the network stability and resilience.

SEC is scaling back its crypto enforcement unit. The SEC’s 50-person crypto unit is getting a shakeup with some staff reassigned to other areas, The New York Times reports.

Blackrock Plans to Launch a Bitcoin ETP in Europe. The fund would be based in Switzerland and BlackRock could start marketing it as soon as this month.

Sen. Warren takes a stand on crypto debanking and criticizes banks for closing accounts. The Federal Deposit Insurance Corporation released 175 documents on Wednesday morning tied to how the agency supervised crypto-related activity.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

Sponsored

Carbon Finance

The #1 visual investing newsletter. Read by 45,000+ investors.

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Namecoin 🥳

The first Altcoin was Namecoin, developed based on the cods of Bitcoin in April 2011.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.