Today’s edition is brought to you by TLDR Newsletter - catch up on the latest tech, startup, and coding stories.

GM to all you crypto nuts. Crypto Nutshell #366 scared’ to look..🫣 🥜

We’re the crypto newsletter that’s more gripping than piecing together the past in a high-stakes murder mystery... 🕵️🔍

What we’ve cooked up for you today…

📉 Why is Bitcoin dumping?

🌅 Emergency hopium

🤷♂️ Who is selling?

💰 And more…

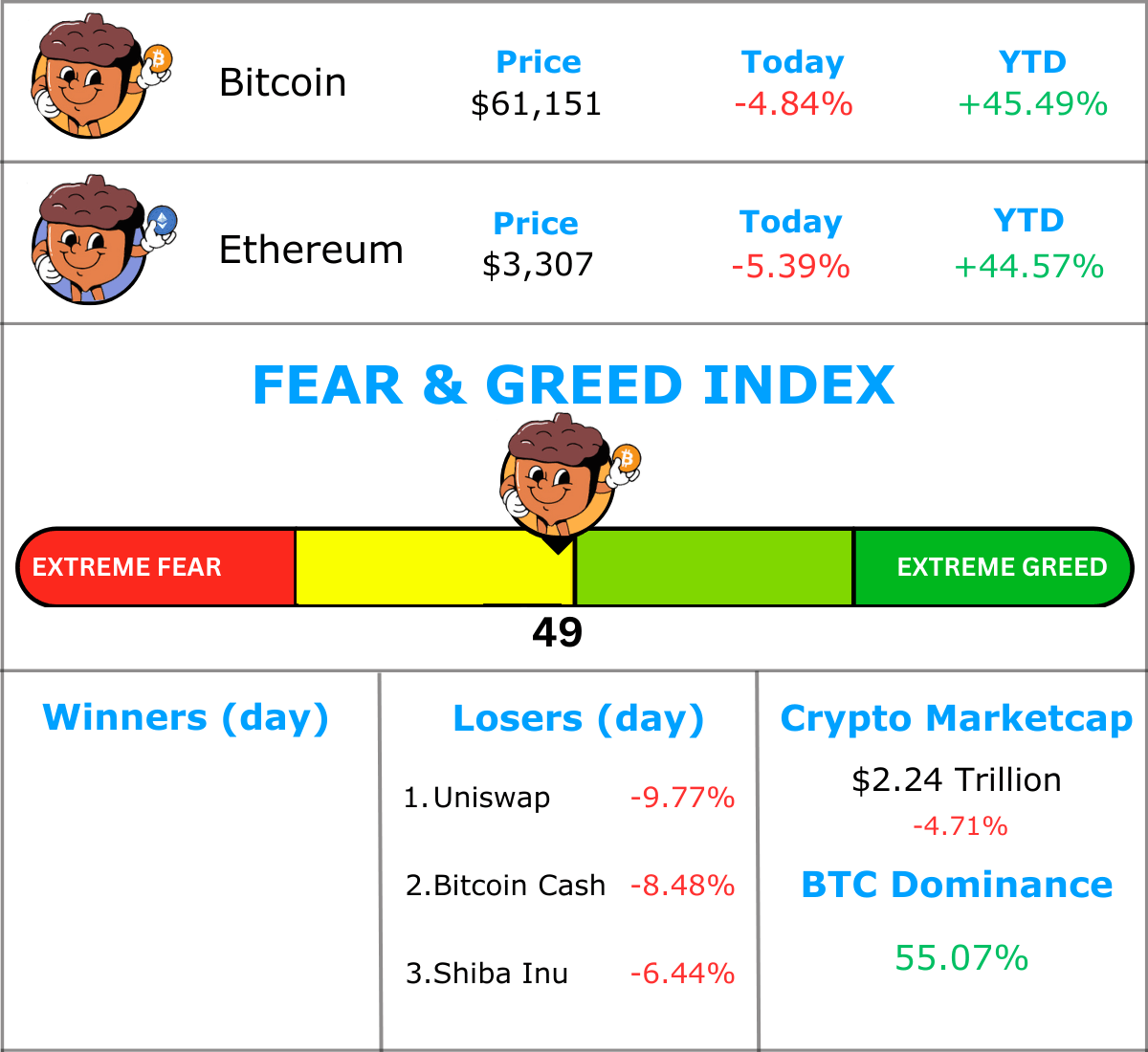

MARKET WATCH ⚖️

Prices as at 9:30am ET

Only the top 20 coins measured by market cap feature in this section

WHY IS BITCOIN DUMPING? 📉

BREAKING: Mt. Gox trustee to start Bitcoin repayments in July

So, Bitcoin just dropped to ~$61,000… (it’s been a rough month to say the least)

What’s going on?

Well… $9 billion worth of Bitcoin might soon be dumped on the market.

BTC down 4.94% in the last 24 hours

Defunct Bitcoin exchange Mt. Gox announced that it will begin repayments to customers in July of this year. (key word here is “begins”, meaning it won’t happen all at once)

Here’s the official statement:

“The Rehabilitation Trustee has been preparing to make repayments in Bitcoin and Bitcoin Cash under the Rehabilitation Plan… The repayments will be made from the beginning of July 2024.”

In May, the exchange transferred over 140,000 BTC (~$9 billion) into a new wallet.

This was the first on-chain movement of funds from the collapsed exchange in over 5 years.

Many are speculating that this could add significant sell side pressure to Bitcoin. (once repayments have been made)

Mt. Gox went offline due to multiple hacks back in 2014 which resulted in 850,000 Bitcoin being stolen from the exchange.

That was back when Bitcoin was just ~$600…

Now, these forced HODLers are getting their coins back with prices at ~$61,000.

It’d be unreasonable not to expect some selling from these HODLers.

(not many can resist cashing out a 100x return on investment…)

So, that’s why Bitcoin is currently on a downtrend.

The uncertainty around this potential sell off has investors a lil’ spooked. 😨

STAY UP TO DATE ON ALL THINGS TECH 🤖

Love Hacker News but don’t have the time to read it every day? Try TLDR’s free daily newsletter.

TLDR covers the best tech, startup, and coding stories in a quick email that takes 5 minutes to read.

No politics, sports, or weather (we promise).

Subscribe for free now and you'll get their next newsletter tomorrow morning.

EMERGENCY HOPIUM 🌅

Mt. Gox unleashing $9 billion of sell pressure onto the market? 😬

The German government dumping $3 Billion in Bitcoin holdings? 😳

Bitcoin getting crushed & altcoins nuking? 🫣

There’s so much doom & gloom in crypto markets right now.

We are all in dire need of some hopium.

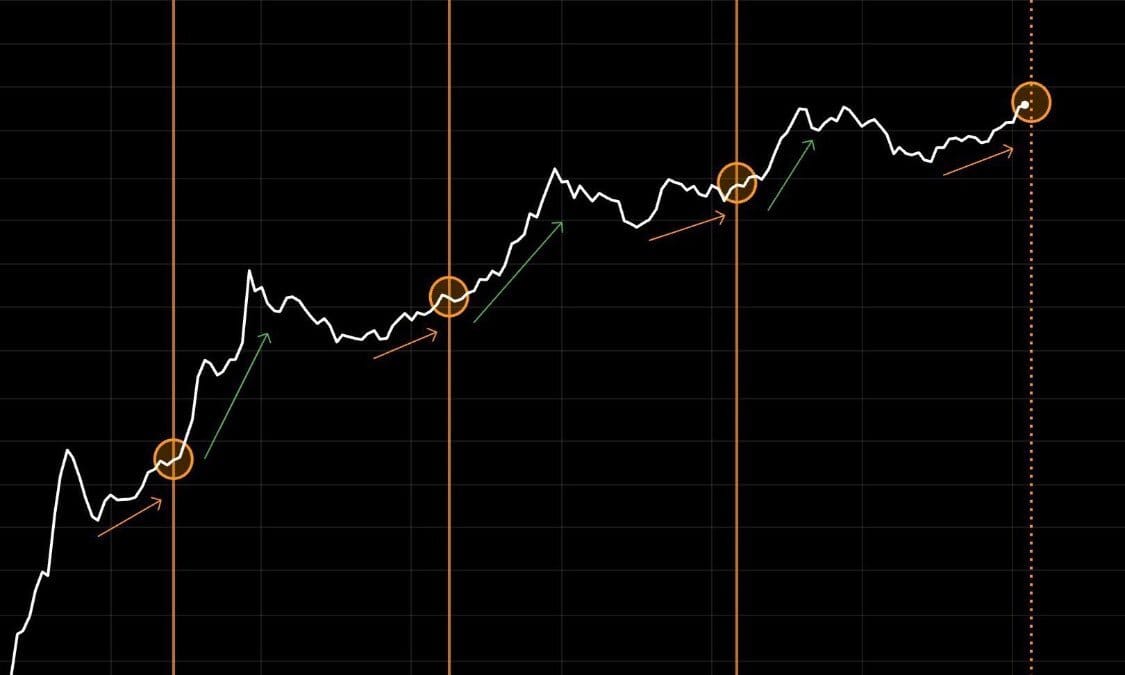

Here’s some emergency hopium in 2 charts:

1. It’s done this before

Bitcoin has done this exact same thing, in the 3 previous cycles.

After the halving, we have ~100 days of consolidation.

Then, a parabolic move up.

2. Price action of 2024 closely mirrors 2016 & 2020 cycles

Another way to look at this is comparing our current cycle against the same points in 2016 and 2020:

Spookily similar. 👻

Finally, some perspective:

Bitcoin is still up +40% year to date.

Over the past 12 months it’s up +100%.

In times like these, there’s a Michael Saylor quote we love:

“Bitcoin’s volatility is the price you pay for it’s outperformance.”

Even though it doesn’t feel like it, price dips like these are gifts. 🎁

WHO IS SELLING? 🤷♂️

As we discussed earlier, Bitcoin’s price has been falling over the course of June.

And with the Mt. Gox repayments scheduled for July, it could fall even further.

That begs the question…

Who is selling? 🤷♂️

Well, why don’t we take a look at some on-chain data and find out.

The easiest way to work out who’s selling is to look at the Long / Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): coins that have been held for less than 155 days

🔵 Long-Term Holders (LTHs): coins that have been held for more than 155 days

🟥 Short-Term Holder Cost Basis: all coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: all coins purchased in this price range are LTHs

The LTH / STH threshold is currently at 21st January 2024, back when Bitcoin was ~$41,500.

All coins purchased before this date are classified as LTHs.

All coins purchased after this date are classified as STHs.

Today there is currently 14,126,981 Bitcoin in the hands of LTHs. (71.65% of the circulating supply) 💪

Whereas the amount of coins held by STHs is only 3,302,056. (16.75% of the circulating supply)

So, to answer the question of who’s been selling…

It’s the short-term holders.

Since April 2024, the amount of BTC held by short-term holders has decreased by 99,519.

Whereas the amount of LTH’s has increased.

Clearly they’re holding out for higher prices and not spooked by current market dynamics.

Unlike the short-term holders…

CRACKING CRYPTO 🥜

Metaplanet to issue $6.26M in bonds for Bitcoin purchase, shares up 12%. Learn about Metaplanet's plans to issue 1 billion yen in bonds for Bitcoin purchases and the surge in their shares.

Bitcoin and Ethereum transaction fees plummet to lowest level in 7 months. The low gas fee on Ethereum is attributed to activity moving away from Ethereum’s base layer to its layer-2 network after the March Dencun upgrade.

Majority of Japanese Institutional Investors Plan to Invest in Crypto in Next Three Years. 54% of respondents said they planned to invest in cryptocurrencies in the next three years and 25% of firms said they had a positive impression of digital assets.

Bitcoin Plunges Below $63,000 as Markets Tumble. Bitcoin plunges below $63,000 as markets tumble. The global cryptocurrency market cap is down 4% in the past day.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

The data in a blockchain gets stored in ________ .

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Blocks 🥳

Data is stored in a decentralized manner across a network of computers or nodes where blocks are chained together

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.