GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that's more refreshing than realizing you're a wizard on your 11th birthday... ⚡🧙

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Elon Musk SELLING Bitcoin? 😳

The amount of coins in profit…💰

And more…

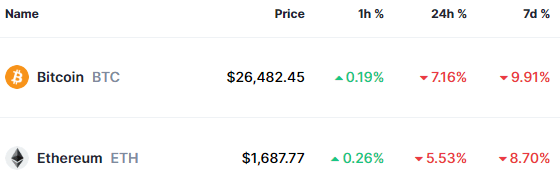

MARKET WATCH ⚖️

BTC Dominance is currently at 49.52% and the current crypto market cap is $1.06T ▼5.96%

Biggest Winners of The Day 🤑

None today… It’s been a rough one ☹️

Biggest Losers of The Day 😭

XRP (XRP) ▼12.94%

Litecoin (LTC) ▼12.91%

Bitcoin Cash (BCH) ▼10.42%

Only the top 20 coins measured by market cap feature in this section

All price data as of 8:25am ET

WHY DID THE MARKET JUST DUMP? 🤷

JUST IN: Bitcoin’s price fell approximately 9% in the span of 10 minutes, hitting a new 2-month low. 😱

The fall in Bitcoin came several hours after The Wall Street Journal reported that SpaceX (Elon Musk) have sold their Bitcoin holdings totalling $373 million.

Ryan Rasmussen, a researcher at Bitwise Asset Management had this to say:

“This is one of the most brutal minute-by-minute selloffs we’ve seen in the history of bitcoin, The current speculation is it’s an Elon Musk/SpaceX-driven selloff.” He noted that this latest dramatic decline is “short-sighted and largely retail-driven.”

Now everyone knows that Elon has been pretty vocal about crypto in the past, but it’s yet to be confirmed if the SpaceX selloff is the major cause of the dip.

Some analysts have hinted that the dip may have been the result of more rate hikes, others have said it’s due to unfavourable economic news in China and the bearish movement in the US stock market on high-risk assets.

EXPERT OF THE DAY 💰

With the news out today that SpaceX has sold off the entirety of its $373 million dollar stash of Bitcoin, today we’re going to delve into the predictions of SpaceX CEO & founder, Elon Musk.

Does Elon hate Bitcoin? 😡

Why did he sell? 😱

What changed to make him dump Bitcoin? 😭

Let’s take a look at Elon’s journey into Bitcoin & everything he’s said on the topic for some clues. 🕵♀

A timeline of Elon's Crypto journey:

February 2019 - Elon first begins to seriously consider Bitcoin & cryptocurrency. Appears on an ARK Invest podcast and calls Bitcoin “quite brilliant” also stating “there’s some merit to Ethereum.”

April 2019 - Elon mentions Dogecoin for the first time. Tweets: “Dogecoin might be my fav cryptocurrency. It’s pretty cool.” 🐕

December 2020 - Michael Saylor and Elon Musk have a twitter exchange about Bitcoin. Saylor tells Musk to do his shareholders a $100 billion favour and add Bitcoin to the Tesla balance sheet. Offers to share his Bitcoin playbook with Musk.

February 2021 - Tesla announces they had purchased $1.5 billion in Bitcoin and that they have plans to accept Bitcoin as payment.

July 2021 - Elon Musk speaks at the ‘The B Word’ conference. Reveals that he personally owns Bitcoin, Ethereum & Doge. Confirms that SpaceX has Bitcoin on its balance sheet. States he owns significantly more Bitcoin than Dogecoin or Ethereum.

July 2022 - Tesla announces that it had sold off 75% of their Bitcoin holdings into fiat currency. Elon on an earnings call states that it was prudent for Tesla to maximise its cash position given economic uncertainty. Adds that “This should be not taken as some verdict on Bitcoin.”

November 2022 - Elon in a twitter spaces states “there is a future for Bitcoin, Ethereum and Doge.” Says that Twitter / X.com is open to incorporating a crypto wallet on the platform “down the road.”

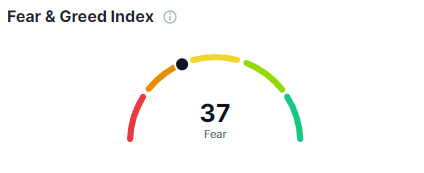

July 2023 - Elon Tweets “Doges ftw”

August 2023 - Wall Street Journal reports that SpaceX has sold off the entirety of its $373 million Bitcoin holdings. No comment from Elon.

Nutty’s takeaway: There’s two ways you can look at Elon’s journey into Bitcoin. The optimistic take or the pessimistic take. 🧐

Optimistic take: Elon Musk is clearly a fan of Bitcoin, Ethereum & Dogecoin. He has never said anything negative about them, outside of energy usage concerns for Bitcoin mining which have since been addressed.

It’s staggering that the world’s richest and arguably most influential man is a holder of Bitcoin & also added them to his companies balance sheets. 5 years ago if you told a Bitcoin holder this would unfold, they wouldn’t of believed you.

Pessimistic take: Actions speak louder than words. Elon has sold off the the majority of his Bitcoin holdings in Tesla & the entirety of the holdings in SpaceX. Despite not saying anything negative about them, he clearly doesn’t have that much conviction in the long term future if he’s selling them off.

Nutty’s take: It’s an eccentric temperamental billionaire doing what an eccentric temperamental billionaire does. Even though he likes Bitcoin and Crypto, he buys and sells based off his whims & emotions like a new trader. 🦋

Most of all, he enjoys the attention and spectacle of it all.

Besides, if you were the richest man in the world, would you really care?

Bottom line: Should you be worried? 🤔

Based off all the information out on the market, we don’t think so. Unless there’s something we don’t know about, this is just a case of Elon being Elon.

ON CHAIN DATA DIVE 📊

So Bitcoin finally decided to do something…

The price moved, but not in the way we were all hoping for. 😥

Lets take a quick look at the data and see where we’re at.

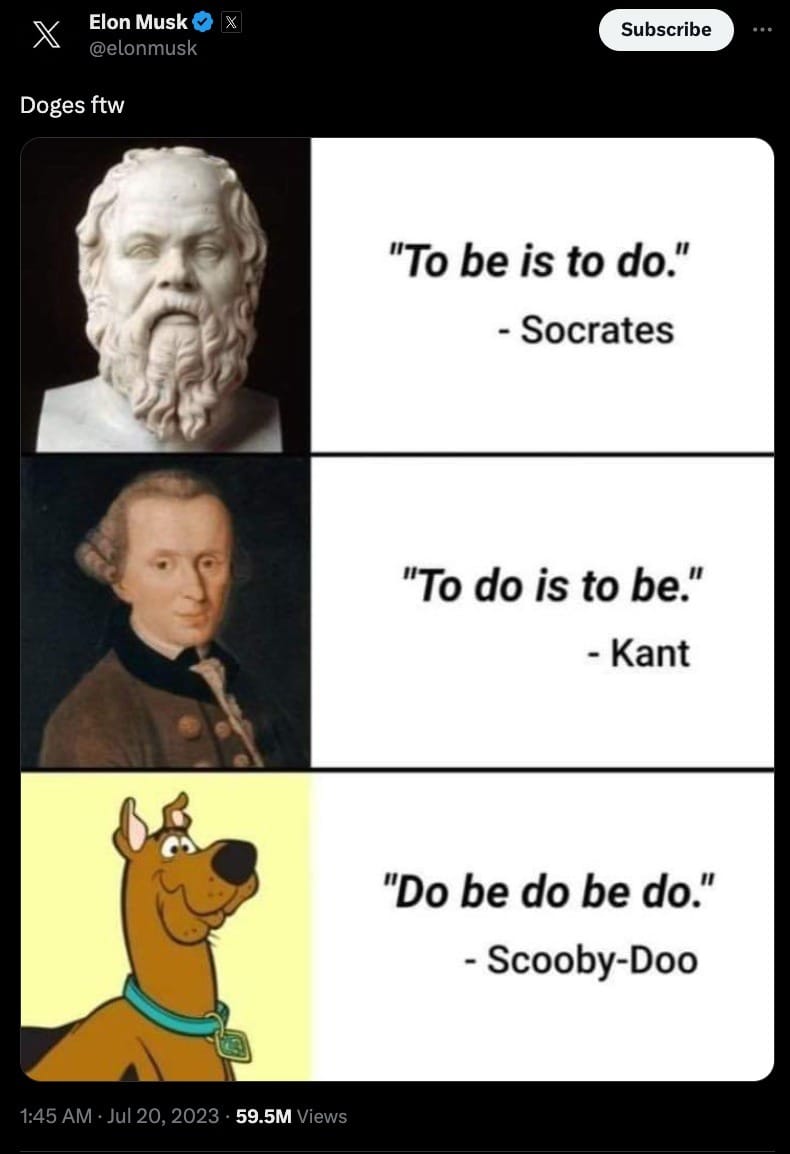

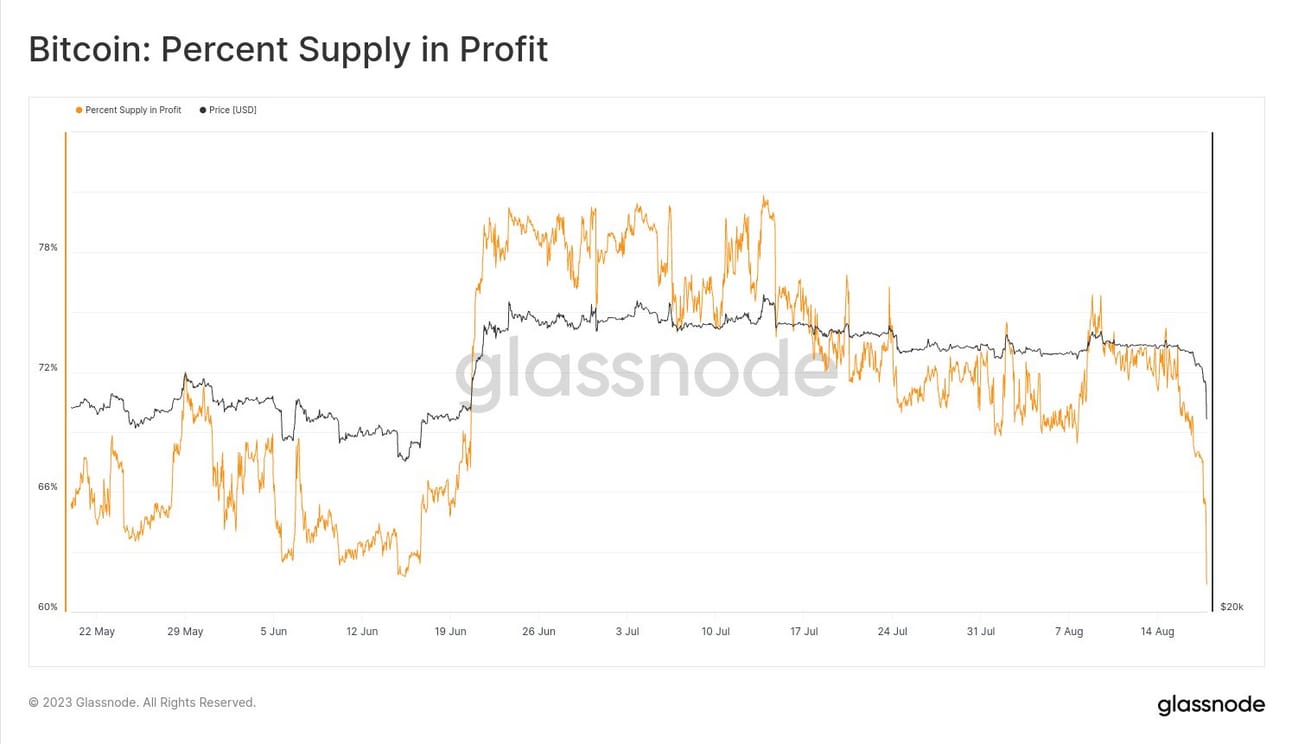

Glassnode warned that this was likely to happen. In their last weekly report they mentioned that there was a large cluster of short-term holders who purchased Bitcoin between $25,000 and $31,000.

These short-term holders are represented by the red bars in the chart below. Notice how the amount of short-term holders is significantly larger compared to the long-term holders (blue bars) at this price range.

Glassnode had this to say:

“On a shorter timeframe, it could be argued to be a slightly top heavy market, with many price sensitive investors at risk of falling into an unrealized loss.”

Glassnode was 100% spot on. 🎯

Take a look at the chart below. The percent of coins in profit dropped from 71% to 61%.

We all know that short-term holders are way more price sensitive than long-term holders. As the price of Bitcoin immediately dropped to ~$25,500, selling pressure from short-term holders increased, some taking the loss.

Nutty’s Takeaway: This price dip appears to also have been the result of an unproportionally large amount of short-term holders at the $25,000 to $30,000 price range. With the announcement of SpaceX having potentially sold all of their Bitcoin, this caused a panic amongst short-term holders and was like adding fuel to fire.🔥

However Bitcoin has stabilised for now and is currently trading at around $26,500.

Stay tuned for more.

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

What is considered the first altcoin?

A) Litecoin

B) Namecoin

C) Ethereum

D) Dogecoin

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Namecoin 🎉

The first altcoin, Namecoin (NMC), was released in April 2011, three years after Bitcoin; it was designed to be an alternative currency to Bitcoin.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.