GM to all of you nutcases. It’s Crypto Nutshell #744 holdin’ steady… ⚓🥜

We're the crypto newsletter that's more unpredictable than a genius hacker playing mind games with the entire world... 💻🌀

What we’ve cooked up for you today…

📈 Bitcoin’s IPO moment

🧨 Why isn’t Bitcoin Exploding?

😨 Shakeout

💰 And more…

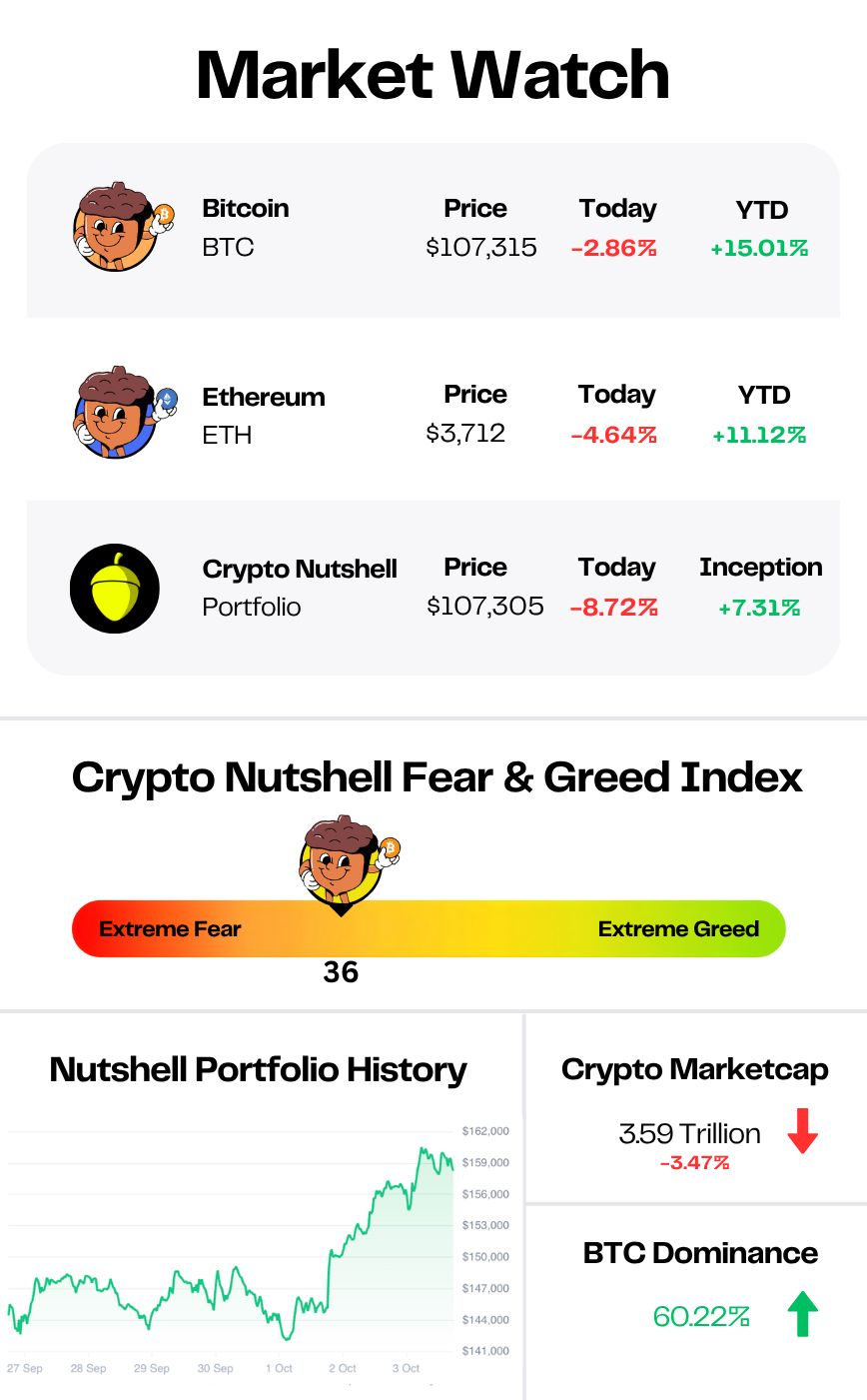

Prices as at 2:23am ET

BITCOIN’S IPO MOMENT 📈

BREAKING: 'Bitcoin's Silent IPO': Analyst Addresses BTC's Lame Price Action in Viral Weekend Essay

Bitcoin isn’t broken. It’s maturing.

That’s the latest from asset manager Jordi Visser, whose weekend essay “Bitcoin’s Silent IPO” went viral on Crypto Twitter.

His take flips the frustration on its head.

While stocks, gold, and tech are hitting new highs, Bitcoin has moved sideways for months.

Visser says that’s not weakness - it’s exactly what happens during an IPO-style distribution phase.

“Early investors aren’t panic selling… They’re methodically distributing their positions. They don’t want to crater the price. They’ve waited years for this moment. They can wait a few more months to do it right.”

The logic is simple.

Bitcoin’s early believers - miners, whales, OG holders - finally have the liquidity to sell without crashing the market.

ETFs, corporate treasuries, and sovereign funds have created the bid they’ve waited for since 2010.

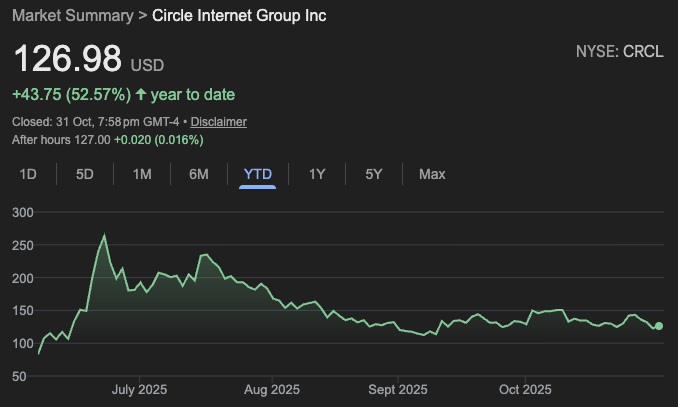

Jordi uses Circle’s post IPO consolidation as an example

And on-chain data backs it up. Dormant coins are moving again, quietly transferring from early whales to new institutional holders.

This isn’t a bear market. It’s a changing of the guard.

From cypherpunks to corporations. From early adopters to institutions. From concentration to distribution.

Visser calls it Bitcoin’s “liquidity event” - the same kind of digestion phase that Amazon, Google, and Facebook went through after their IPOs.

Sideways, slow, and painfully boring… until the overhang clears.

“Once the patient accumulation by institutions has absorbed the OG supply, the path becomes clearer… Expect the sentiment to remain poor for a little while longer but be wary because there will be no signal. It will just start because the good news is already present.”

We know that this consolidation is frustrating, but it’s not failure.

It’s evolution - the quiet handoff from old money to new, and the foundation for Bitcoin’s next chapter. 😎

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

WHY ISN’T BITCOIN EXPLODING? 🧨

Following his viral “Bitcoin’s Silent IPO” essay, Jordi Visser went even deeper today on Anthony Pompliano’s podcast - answering the question everyone wants to know:

If everything looks bullish, why isn’t Bitcoin already ripping to new highs?

Jordi Visser isn’t just some crypto influencer writing Bitcoin essays.

He’s a 30+ year Wall Street veteran and president & CIO of Weiss Multi-Strategy Advisors, a $3 billion macro fund.

His current take is refreshingly grounded:

“Every possible thing you’d want for Bitcoin is happening right now: The government is supporting it. The financial guardrails are shifting. We’re seeing news after news about the system becoming more digital.”

So why hasn’t price followed?

According to Visser, as he outlines in his viral essay, we’re in what he calls “Bitcoin’s IPO phase.”

Over the last few months, some of the earliest and largest holders - think OG miners, early whales, and long-time investors - have been distributing portions of their positions, just like insiders do before a company lists publicly.

Not panic selling. Just healthy ownership rotation before the next leg up

Once that redistribution finishes, that’s when he believes the next leg begins.

He then pointed out that Bitcoin’s fundamentals have never looked better:

Volatility is now near historic lows - under 30%.

Correlation with stocks and gold keeps falling.

Institutional access is broadening every month.

Visser summed it up simply:

“This thing is going to move higher… Once this consolidation is done and the fundamentals take over, I think we’re going to see acceleration.”

So if Bitcoin feels “boring” right now - good.

It’s exactly what it needs before it’s next big move. ⚡

SHAKEOUT 😨

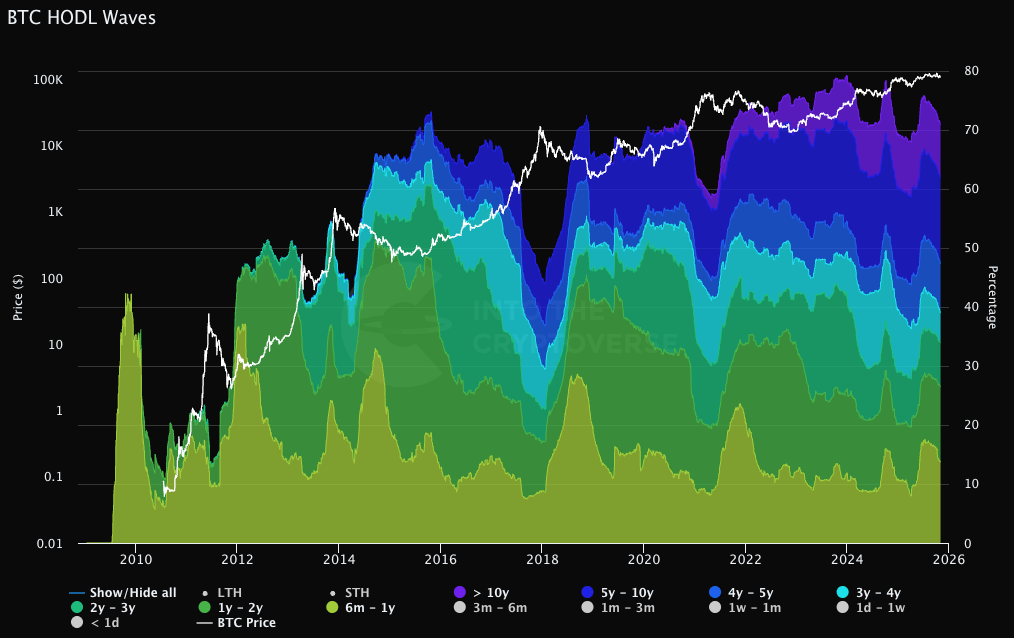

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 13.71% (down from 14.13%)

1y - 2y: 12.81% (up from 12.57%)

2y - 3y: 7.36% (down from 7.51%)

3y - 4y: 5.15% (down from 5.60%)

4y - 5y: 8.34% (up from 8.23%)

5y - 10y: 14.46% (up from 14.13%)

>10y: 9.05% (up from 9.04%)

TL;DR: 70.88% of all Bitcoin hasn’t moved in over six months. 🔒

That’s a 0.9% drop from two weeks ago. It’s a small pullback, not a breakdown.

The 6–12 month group saw the biggest decline as short-term holders unloaded during recent volatility.

The 1–2 year band keeps climbing, showing coins aging into stronger hands.

Older supply is rising too. The 4–10 year group inched higher, and the 10+ year base keeps expanding. These are holders who never flinch.

The small dips in the 2–4 year range look like rebalancing, not fear. Coins are shifting between time bands, not flooding back to exchanges.

The takeaway: Bitcoin’s foundation is still strong. Long-term holders continue to tighten supply, and conviction remains high. The base is solid, and every shakeout leaves stronger hands behind. 💎

CRACKING CRYPTO 🥜

US-China trade deal marks the biggest de-escalation yet for global markets. US-China trade tensions ease as President Trump announces a deal suspending tariffs, removing non-tariff measures, and boosting soy purchases.

Bitcoin ends October in red, but now enters its biggest month for gains. Bitcoin ends October in the red but enters historically bullish November, as Fed cuts, China trade easing and shutdown politics set the macro stage.

BTC Whitepaper Published This Day in 2008. Once envisioned as peer-to-peer cash, Bitcoin’s journey reflects both mainstream triumph and existential tension.

Elizabeth Warren rebuffs defamation allegations from Changpeng Zhao through lawyer. Warren's lawyer asserts that the Senator's statement that CZ pleaded guilty to a criminal money laundering charge was factual, and thus not defamation.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What did Ethereum’s Dencun upgrade introduce to reduce Layer 2 transaction costs?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Data blobs 🥳

Data blobs (EIP-4844), part of the Dencun upgrade, introduced data blobs, cutting rollup fees by over 90%. 💨

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.