GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter less puzzling than waking up in a maze with no memory of how you got there... 🌀🧠

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Crypto Expert: What happens when the Bitcoin ETF is approved? 🤑

The Bitcoin Realized Cap💰

And more…

MARKET WATCH ⚖️

BTC Dominance is currently at 50.11% and the current crypto market cap is $1.13T ▼1.94%

Biggest Winners of The Day 🤑

Polkadot (DOT) ▲1.11%

Cardano (ADA) ▲1.03%

Solana (SOL) ▲0.17%

Biggest Losers of The Day 😭

Shiba Inu (SHIB) ▼6.55%

Bitcoin Cash (BCH) ▼5.60%

Litecoin (LTC) ▼3.71%

Only the top 20 coins measured by market cap feature in this section

All price data as of 8:35am ET

PAYPAL AND LEDGER JOIN FORCES 🤑

JUST IN: Ledger partners with PayPal to provide crypto access for U.S. customers.

It seems like PayPal has been on a roll recently with all of these crypto announcements…

Just last week they announced their US dollar backed stablecoin, PayPal USD (PYUSD).

Today, they have announced a strategic partnership with Ledger.

This partnership aims to provide users with a seamless and secure platform to purchase Bitcoin, Ethereum, Bitcoin Cash and Litecoin. The purchased digital assets will then be automatically transferred to the users Ledger hardware wallet.

One thing is clear. The big companies are preparing for the bull market. Buckle your seat belt. Don't just look at the charts, look at what's going on... 👀

EXPERT OF THE DAY 💰

This expert believes that IF the spot Bitcoin ETF is approved, it’s going straight to $150,000. 🚀

Tom Lee is the head of research at FS Insight and a regular contributor on CNBC.

Just yesterday, he appeared on CNBC and laid out 2 scenarios he foresees playing out for Bitcoin.

One in which the spot Bitcoin ETF is approved and one in which it is denied.

In a scenario in which the ETF is NOT approved, Lee predicts that the Bitcoin price will head north from where it is at currently, but we won’t see it get above $100,000.

In a scenario in which the ETF IS approved, Lee predicts that demand for Bitcoin is going to far surpass the daily supply of Bitcoin, forcing it’s price up to somewhere in between $150,000 to $180,000.

I think that the demand will be greater than the daily supply of Bitcoin, so the clearing price… is over $150,000, it could even be $180,000.

Lee says he’s making these price predictions off the models from FS Insight analyst, Sean Farrell. 🤓

The odds of a spot Bitcoin ETF getting approved currently sit at 65%. 🤞

ON CHAIN DATA DIVE 📊

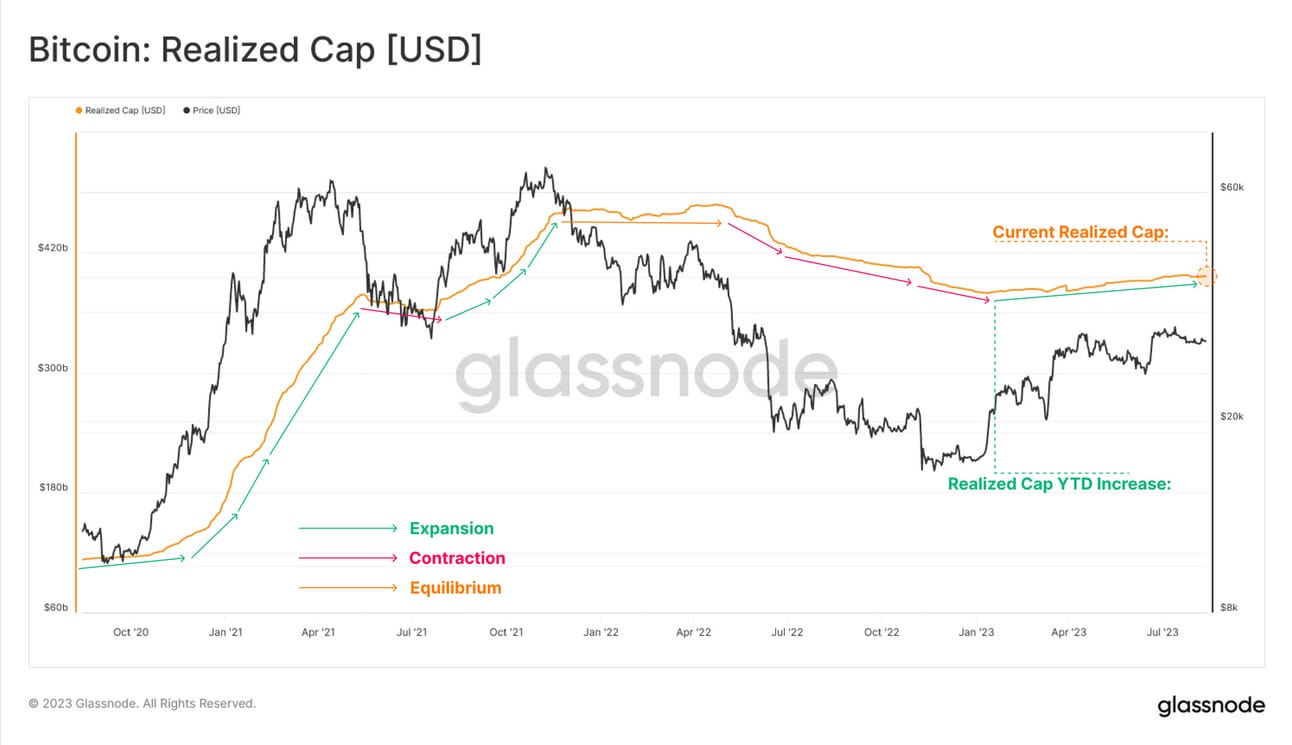

Today we’ll be taking at look at the Bitcoin Realized Cap. This is one of the most important on-chain metrics. It allows us to see the cumulative capital inflow since the start of Bitcoin.

Realized Cap tracks the total value of all coins the last time they were moved. Realized Cap increases when coins move at prices higher than they were purchased for.

It is also known as the average acquisition price of each coin.

$16 Billion in value has flowed into Bitcoin year to date. 😱

Although this represents an enormous amount of money coming in, the climb up is quite shallow…

The Realized cap is continuing to grow but at a very modest pace, unlike the explosive growth we saw in 2021 and 2022. 🐢

It’s also useful to split the Realized Cap into the long-term and short-term holder groups:

Long-term: Hold for greater than 155 days (excludes exchange reserves)

Short-term: Hold for less than 155 days (excludes exchange reserves)

The wealth held by short-term holders has experienced an increase of +$22 Billion so far this year.

The wealth held by long-term holders has experienced an almost equal reduction of -$21 Billion.

Two key outcomes for this chart:

Short term holders have been chasing the market higher, meaning the average acquisition price has been increasing (44% increase).

Coins purchased at prices below $24K in Q1 are now maturing into long-term holder status, resulting in a reduced average acquisition price for long term holders (6.4% decrease).

Nutty’s Takeaway: So we can see that the Realized Cap is increasing but at a slow rate. This is usually another indicator that we are in an accumulation phase for Bitcoin. The smart money investors are accumulating cheap coins and moving them on to cold storage wallets. 🥶

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

Miners are rewarded for successfully mining a ___.

A) Bitcoin

B) Hash

C) Block

D) Node

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Block 🎉

Bitcoin miners get a reward for mining a block.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.