GM to all 67,631 of you. Crypto Nutshell #512 lockin’ in… 🎮 🥜

We're the crypto newsletter that's more mind-bending than navigating a dream within a dream within a dream... 💭🌀

What we’ve cooked up for you today…

🏦 The never ending Bitcoin bid - MicroStrategy

👑 Why you need at least 1 Bitcoin

📈 Another one

💰 And more…

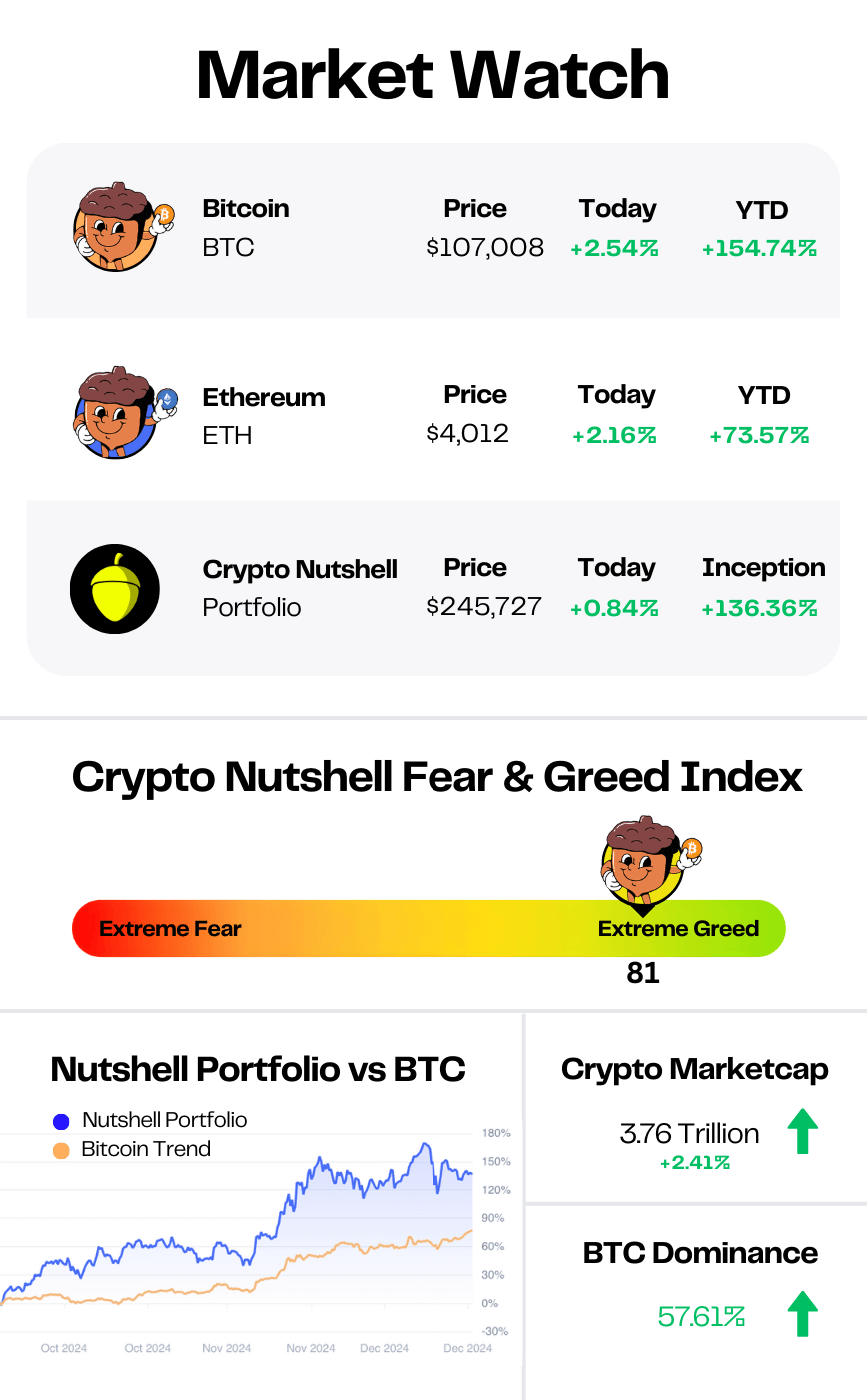

Prices as at 5:30am ET

THE NEVER ENDING BTC BID 🏦

BREAKING: MicroStrategy Boosts Bitcoin Holdings to 439,000 BTC Following Nasdaq 100 Inclusion

Before we get into today’s opening story, we just wanna say…

Bitcoin hit ANOTHER all-time high. 🥳

Out of nowhere Bitcoin shot up from ~$104,000 all the way to a new high of $107,780.

Can we crack $110,000 before the end of 2024?

We think so…

Anyways, let’s get back to the opening story.

We all knew this was coming… (If you read yesterday’s newsletter)

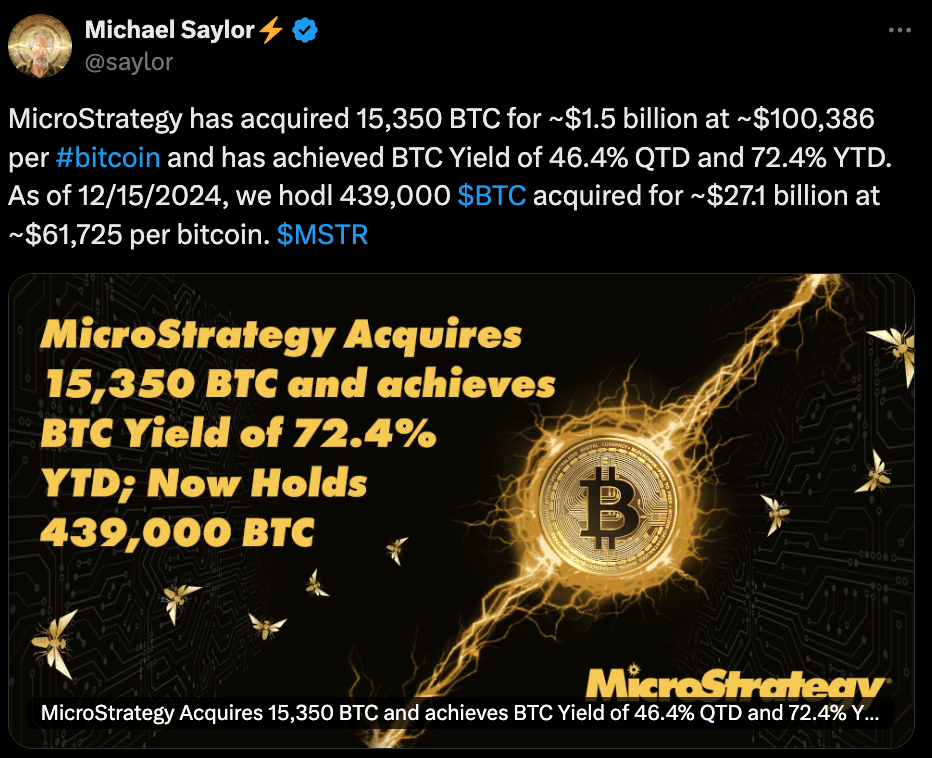

MicroStrategy just announced another Bitcoin buy after Saylor teased it on Sunday.

This time MicroStrategy acquired an additional 15,350 Bitcoin for ~$1.5 billion. (Average price of ~$100,386 per BTC)

(MicroStrategy’s first purchase since entering the Nasdaq 100)

This brings MicroStrategy’s total holdings to 439,000 Bitcoin, acquired for ~$27.1 billion. (Average price of ~$61,725 per BTC)

With this latest announcement, MicroStrategy now holds ~2.09% of Bitcoin’s total 21 million supply.

And at today’s prices, MicroStrategy’s Bitcoin holdings are worth ~$46.51 billion.

Which means they’re sitting on unrealized profits of ~$19.41 billion.

Saylor teased this latest purchase, posting this on Sunday

This latest purchase also means that MicroStrategy has purchased Bitcoin six weeks in a row, with the previous 5 weeks being:

December 8: 21,550 Bitcoin for ~$2.1 billion

December 1: 15,400 Bitcoin for ~$1.5 billion

November 24: 55,500 Bitcoin for ~$5.4 billion

November 17: 51,780 Bitcoin for ~$4.6 billion

November 10: 27,200 Bitcoin for ~$2.03 billion

In total, that’s $17.13 billion worth of Bitcoin being purchased in the last 6 weeks.

Nothing but ridiculous…

There’s also some other big news on the Bitcoin for corporations side of things.

From today, Fair value accounting rules from FASB take effect…

And before you fall asleep, we’ll quickly explain why this is such a big deal.

Under the old system:

Companies had to record the losses if an asset (Bitcoin) dropped below its purchase price

Buuuut they couldn’t record any gains even if the asset increased above the purchase price

That doesn’t make any sense right? 🤔

Now under the new system, companies can record both fair value gains and losses on their Bitcoin holdings in net income.

This is a HUGE change and makes adopting a Bitcoin strategy MUCH more attractive to US based companies.

Maybe now we’ll see even more MicroStrategy copycats emerge…

DeFi: Shaping the Future of Finance

Explore how DeFi Technologies Inc. (CAD: DEFI & US: DEFTF) bridges traditional finance and the $3T digital asset market. With innovative strategies and global expansion, DeFi is redefining the investment landscape. Gain exposure to Bitcoin, Web3, and beyond with regulated, secure solutions.

WHY YOU NEED AT LEAST 1 BITCOIN 👑

Bitcoin is on a unstoppable path to $10 million per coin.

Your top priority for 2025 should be accumulating at least 1 full Bitcoin.

That’s just one of the insights that came out of our newest interview with mathematician Fred Krueger.

Fred Krueger is the fastest growing Bitcoiner in the space - and for good reason.

If you haven’t heard of him, here’s Krueger’s credentials:

Worked on Wall Street for close to a decade 💼

Extremely successful entrepreneur - has exited 10+ companies, with some exits in the tens of millions 💰

Studied mathematics, with a P.H.D from Stanford University 📚

Although we can’t break down our full interview, here are 3 highlights:

1. Do NOT Buy A House

Fred believes if you are buying a house as an investment vehicle, you are making a massive blunder:

“You are buying at the absolute peak of a 30-40 year real estate boom. You are buying at the absolute top of the market. You’re tying yourself down for 30 years with a mortgage. So what? So you can have a dinner party and say you own this house?”

What should you do instead?

Buy Bitcoin.

2. One Event Could Send Bitcoin To $500,000 Overnight

Fred foresees one event that could unfold in 2025, that would send Bitcoin to $500,000 overnight:

“If this thing goes through, it’s kind of like a nuclear bomb. Does it break the Power Law? Yeah. It goes to $500,000 immediately.”

The crazy part?

The market is predicting a 40% chance of it happening. 🤯

3. You Need To Get To 1 Whole Bitcoin In 2025

Krueger describes Bitcoin as the most asymmetric opportunity he’s ever seen.

He argues accumulating at least 1 full Bitcoin should be your top priority of 2025:

“You have to get to 1. Right now, that’s the goal. You have to get to 1 whole Bitcoin. Figure out whatever it takes to get to 1 Bitcoin. Do whatever it takes. Sell a kidney.”

For all of the insights, including Fred’s exact price prediction for 2025 - you’ll have to check out the full interview here.

We’d highly recommend giving it a full watch. (It’s one of our best)

Dropping a like & subscribe would be hugely appreciated as well! 🫡

P.S. As always, to celebrate our return to Youtube we are again giving away $100 in crypto to 3 lucky readers.

To enter:

Head on over to the Crypto Nutshell Youtube channel & hit subscribe! (if you haven’t already!)

Check out our latest video, with Fred Krueger. Hit that like button & drop a comment on the video.

When finished, submit the below poll with a ‘done!’ 👇

YouTube Giveaway!

That’s it!

We’ll randomly draw winners in 48 hours from now & shoot you an email!

ANOTHER ONE 📈

That’s ten in a row now!

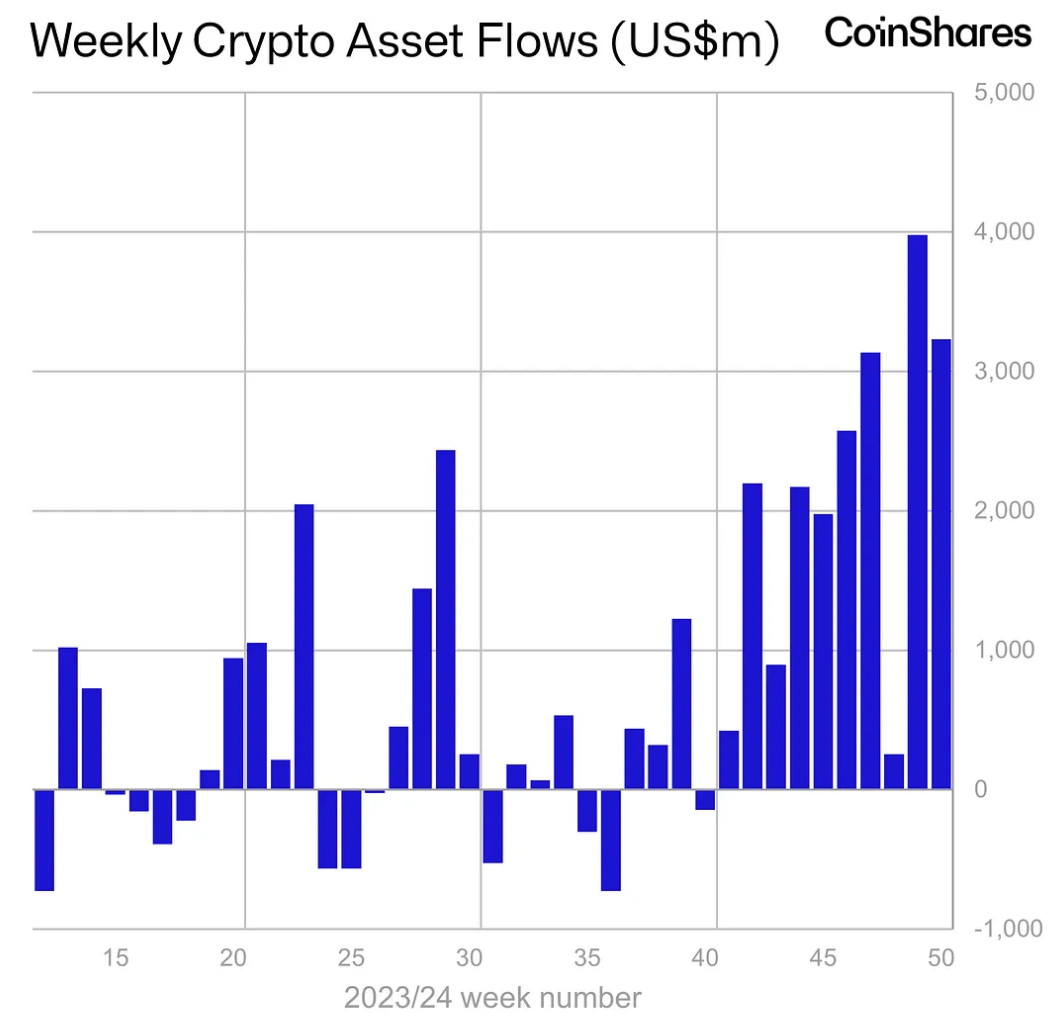

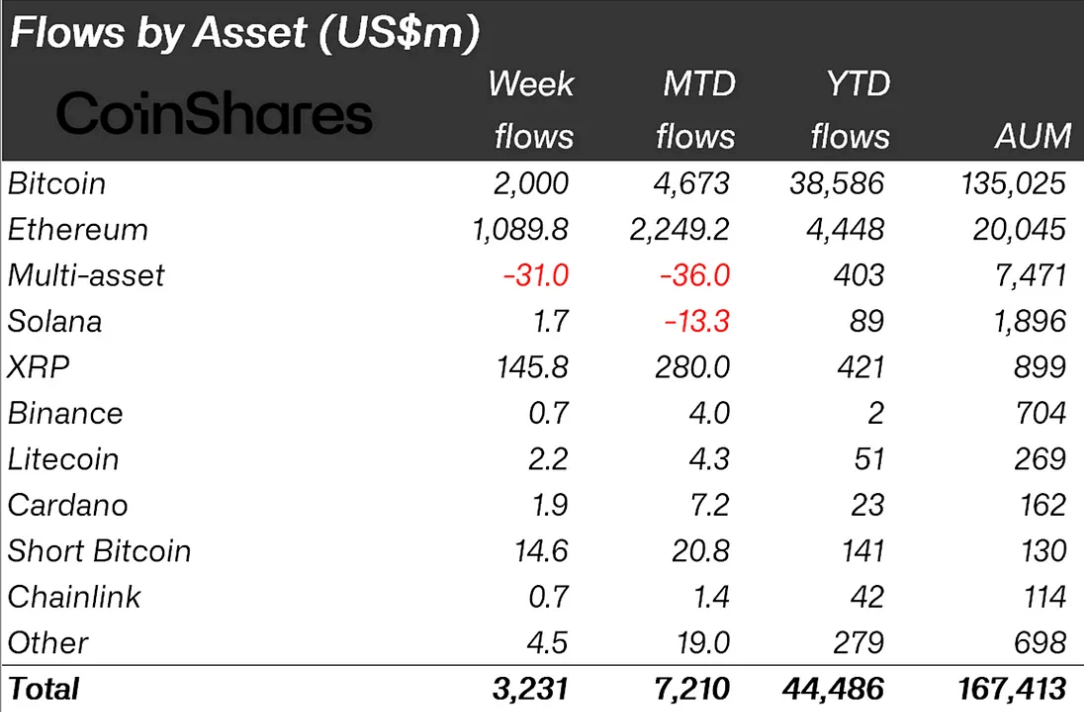

Last week Digital asset funds saw another HUGE week of inflows totalling $3.23 billion.

This also pushes year-to-date inflows to $44.5 billion, which is more than quadruple that of any other year. 🤯

Let’s break it down.

Bitcoin came out on top (who didn’t see that coming…), with inflows of $2 billion coming in for the week.

Ethereum had another great week seeing inflows of $1.09 billion.

And XRP continued it’s run with inflows of $145.8 million.

Solana also bounced back from last weeks outflows, experiencing inflows of $1.7 million for the week.

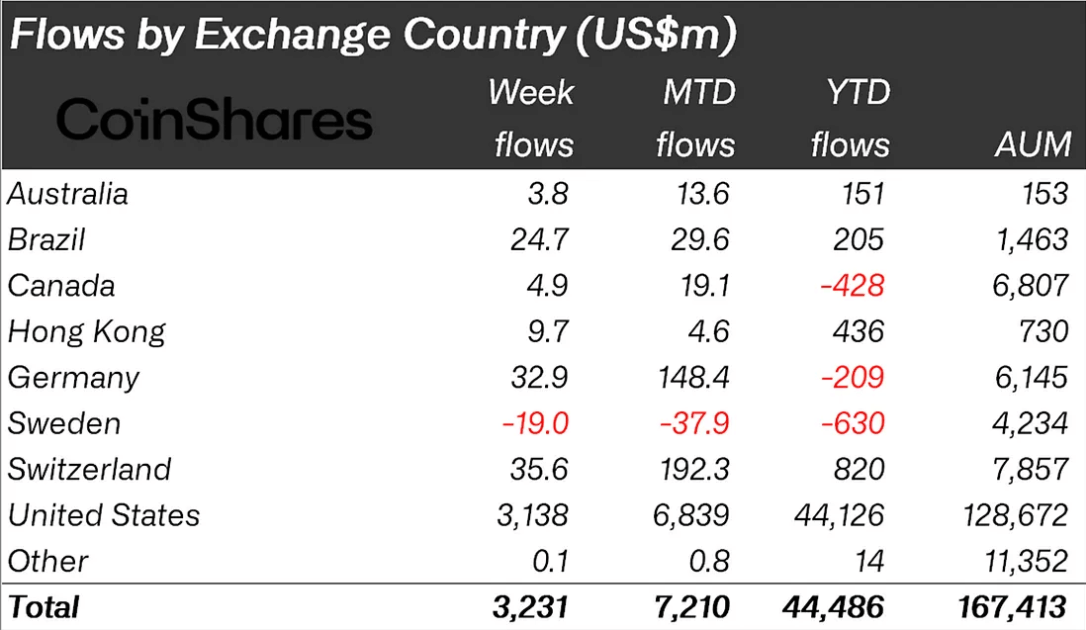

This positive sentiment was shared (mostly) around the globe.

The United States led the way experiencing inflows of $3.14 billion.

Whilst Switzerland, Germany and Brazil also had impressive weeks, seeing inflows of $35.6m, $32.9m and $24.7m respectively.

But…

Sweden’s outflow streak continued with $19 million in outflows for the week.

Another solid week for digital asset funds around the world. 🌏

If you were reading Crypto Nutshell before the US election, you would have heard us hammering the point that “markets hate uncertainty”.

And this is exactly what we were talking about…

Since the US election, Bitcoin funds have seen $11.5 billion in net inflows.

And Ethereum has experienced net inflows of $3.7 billion over the past 7 weeks. (A dramatic improvement in sentiment)

The US election was literally the turning point and the markets have been going bananas ever since. 🍌

CRACKING CRYPTO 🥜

Donald Trump reportedly plans to leverage $200 billion US Treasury fund for Bitcoin reserves. Leveraging Treasury's Exchange Stabilization Fund for bitcoin sets stage for global reserve race amid rising geopolitical competition.

El Salvador grants Bitget license for Bitcoin services. El Salvador has authorized Bitget to provide Bitcoin services in the country. The exchange is now seeking further approval to support more tokens.

SEC Approves Crypto Wallet Maker Exodus to List on NYSE American After Denying It in May. Exodus will list under its current ticker on NYSE American at the open of trading on Dec. 18.

With MicroStrategy joining the Nasdaq 100, analysts weigh what's next for the corporate bitcoin holder. MicroStrategy will enter the Nasdaq 100 on Dec. 23, 2024, the exchange confirmed late Friday night.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Twice weekly Bitcoin news

Crypto Pragmatist (link) - Actionable alpha 3x a week

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Dogecoin is an example of a...

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) “Meme coin” or altcoin 🥳

Dogecoin is the largest memecoin and launched in December 2013.

GET IN FRONT OF 67,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.