Today’s edition is brought to you by Compass Mining

Compass Mining makes Bitcoin mining accessible to everyone—whether you’re a total beginner or a seasoned investor. Start Mining Bitcoin today and they’ll even cover your first month of hosting!

GM to all of you nutcases. It’s Crypto Nutshell #574 fightin’ bears… 🥊🥜

We're the crypto newsletter that's more heart-racing than a high-speed train ride with assassins lurking in every car... 🚆🔫

What we’ve cooked up for you today…

🤔 Will the U.S purchase 1 million Bitcoin?

🙅 The market has this wrong

📈 Another all-time high

💰 And more…

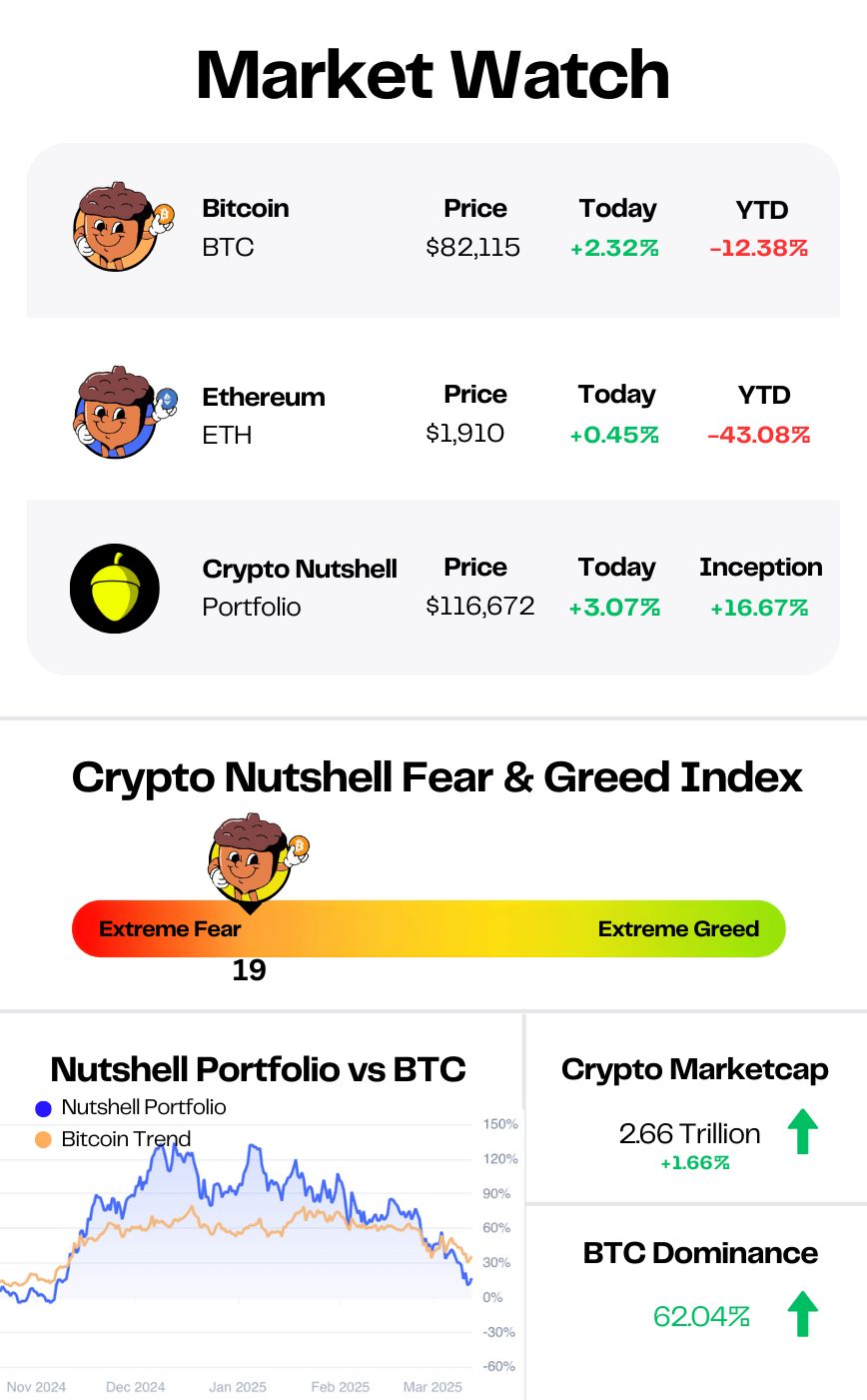

Prices as at 3:50am ET

WILL THE U.S. PURCHASE 1M BITCOIN? 🤔

BREAKING: Sen. Lummis reintroduces bill to create Trump's planned Strategic Bitcoin Reserve

Trump’s Strategic Bitcoin Reserve announcement left the community wanting more…

The announcement made no explicit plans to immediately purchase Bitcoin.

Instead, the U.S. government will not sell the ~200,000 BTC it currently holds.

(The executive order did confirm that they’ll be looking at budget-neutral ways to acquire more BTC in the future)

However…

Less than a week later, Senator Cynthia Lummis has reintroduced the BITCOIN Act - a bill that takes things one step further.

If passed, this bill would be a complete game-changer.

And it already has strong Republican backing…

So What is the BITCOIN Act?

Here’s a quick breakdown of the details:

1 Million Bitcoin Purchase – The U.S. Treasury would acquire 1M BTC over five years using funds diverted from the Federal Reserve and Treasury - not taxpayer dollars.

Decentralized Bitcoin Vaults – A network of cold storage facilities would be set up nationwide to hold the BTC securely.

Locked-In Holdings – Any BTC acquired must be held for at least 20 years before it can be sold. Even then, no more than 10% of the reserve can be sold in any two-year period.

Tackling the National Debt – Supporters argue that Bitcoin’s long-term growth could help reduce America’s $36 trillion national debt.

BITCOIN Act cosponsor Tommy Tuberville put it simply:

"Creating a Strategic Bitcoin Reserve is an important step in making sure the United States remains the strongest economy in the world… There’s no reason why we shouldn’t use Bitcoin to pay down our national debt."

So the question is: Will this pass?

Right now, the BITCOIN Act is backed solely by Republicans.

Meaning that passing it is an uphill battle unless it gains Democratic support.

That being said, the fact that this bill even exists (and already has 5 cosponsors) is a major shift in U.S. crypto policy. 🚀

TL;DR: The BITCOIN Act has real momentum, but whether it becomes law depends on gaining broader political support.

NOW ANYONE CAN MINE BITCOIN ⛏

Bitcoin mining is the backbone of the blockchain—confirming transactions and securing the entire network.

Without miners, Bitcoin wouldn’t exist.

But a common misconception is that mining is too complex or out of reach for the individual.

That’s where Compass Mining steps in…

Compass Mining makes Bitcoin mining accessible to everyone—whether you’re a total beginner or a seasoned investor. Their turnkey hardware solutions get you up and mining in as little as 48 hours!

Best of all, your mining revenue is transferred directly to your Bitcoin wallet with maximum uptime and efficiency.

Here’s how Compass Mining makes it simple:

Top-Tier Mining Hardware: Compass Mining will help you purchase and ship everything you need to be a successful miner. ⛏️

World-Class Hosting: Your hardware will be hosted at one of the world’s best facilities at favourable power rates. ⚡

Expert Support: A team of industry professionals will guide you every step of the way. 🧑🤝🧑

Here’s how to get your discount today:

Add any miner to your cart

Enter code CRYPTONUTSHELL at checkout

Get a $220 discount at checkout to cover one month of hosting using offer code CRYPTONUTSHELL.

Visit Compassmining.io to start mining today with Compass Mining!

THE MARKET HAS THIS WRONG 🙅

Over the weekend, the U.S. government officially declared Bitcoin and crypto as “strategic assets."

Markets initially pumped, then dumped, and now everyone is overthinking it.

Overall? Everyone has it wrong.

That’s the latest from Matt Hougan.

Matt Hougan, Chief Investment Officer at Bitwise, just released an investor memo explaining why the market has it all wrong on the Strategic Bitcoin Reserve.

In case you’ve been living under a rock…

On March 2, Trump announced a Strategic Crypto Reserve, including Bitcoin, Ethereum, Solana, XRP, and Cardano.

Then, on March 6, he signed an executive order officially establishing the Strategic Bitcoin Reserve and designating Bitcoin as a strategic asset.

Markets pumped, then dumped as investors scrambled for clarity.

The U.S. confirmed it would hold seized Bitcoin, but there were no explicit plans to start buying more.

Matt Hougan thinks the market is missing the bigger picture. Here are his 3 takeaways:

This is just the beginning.

Trump’s playbook is always go big, refine later. Expect clearer plans to buy Bitcoin and expand crypto initiatives as the year unfolds.This just triggered global FOMO.

If the U.S. is accumulating Bitcoin, other nations can’t afford to sit out.

El Salvador, Abu Dhabi, Bhutan - they’ve already bought. Who’s next?Once accumulated, U.S. Bitcoin is unlikely to be sold.

Bitcoin is now political - selling it would be a huge blunder for any administration.

Hougan believes the U.S. will now treat Bitcoin like gold - bought and held forever.

Why this matters:

Just last year, the U.S. was auctioning off its seized Bitcoin. Now, it’s calling it "strategic."

The shift is huge.

Bottom Line:

The U.S. just signalled that Bitcoin is a strategic asset.

Don’t miss the forest for the trees. 🌳

ANOTHER ALL-TIME HIGH 📈

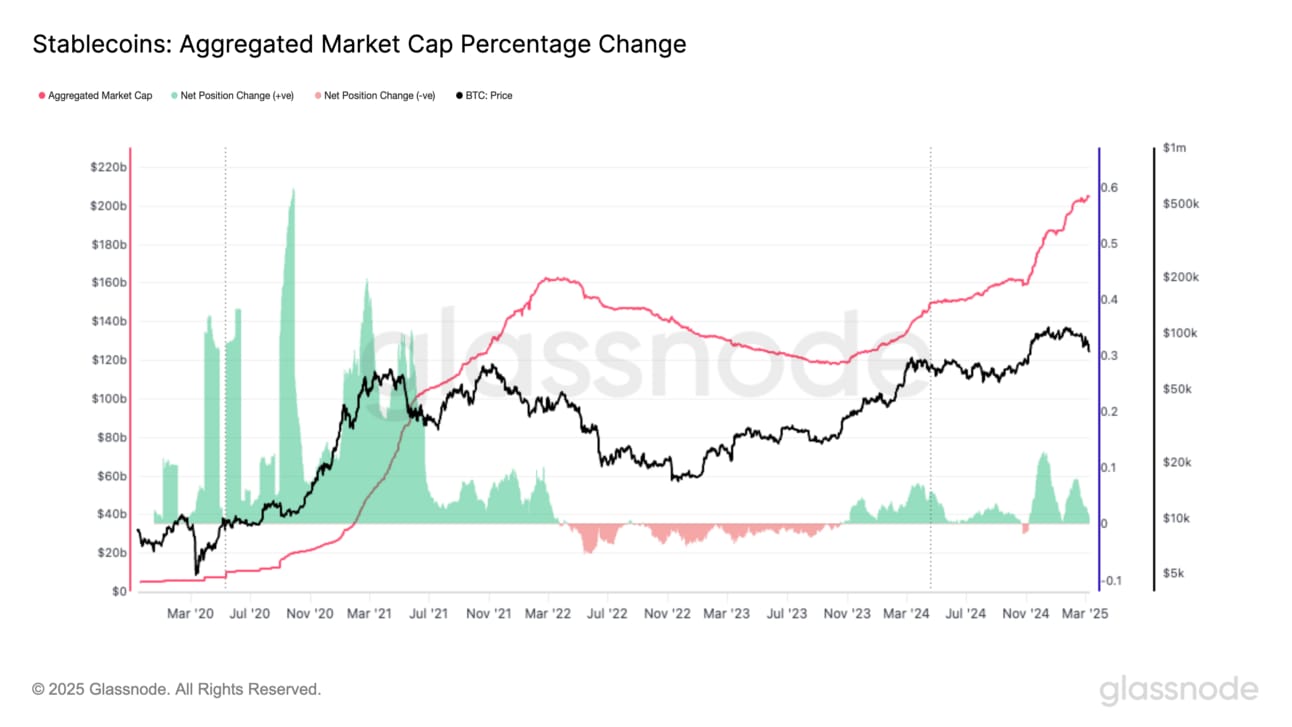

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

The last time we checked in on this metric, the stablecoin market cap was ~$202.50 billion. (12th of February)

Today that number has climbed to ~$204.55 billion. 📈

That’s an increase of ~$2.05 billion in the last two weeks.

And it also marks another all-time high!

Amidst all of the chaos, the stablecoin’s have continued to surge.

Year-to-date, we’ve seen an additional $19.50 billion enter the stablecoin supply.

And here’s why this matters even more…

Stablecoin liquidity is one of our key indicators for altseason.

Simply put:

More stablecoins in circulation = more dry powder to fuel larger pumps across the altcoin market. 💥

CRACKING CRYPTO 🥜

Texas doubles down on crypto with new $250 million Bitcoin reserve bill. Texas introduces new legislation aimed at establishing a $250 million Bitcoin reserve following the first bill passage.

Mt. Gox Moves Another $930M Bitcoin as Payout Deadline Looms. Wallets linked to Mt. Gox still hold $2.9 billion of assets, which are due to be paid out to creditors this October.

Franklin Templeton joins XRP race and VanEck eyes AVAX fund amid altcoin ETF craze. Bloomberg analysts recently estimated Litecoin ETFs have the highest chance of approval, followed by Dogecoin and Solana products.

Bitwise launches Bitcoin corporate treasury ETF. Its largest holding is Strategy’s stock, MSTR, and it also holds shares in several Bitcoin miners.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

______ is how the Ethereum network measures the computational effort required to execute transactions.

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Gas 🥳

Gas is defined as the unit of measurement for the computational power to perform tasks on the network.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.