GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that's as exciting as waking up with a magic ring that needs to be thrown into a volcano. 🧝💍

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Raoul Pal’s latest breakthrough 🤑

Bitcoin’s first weekly outflow in 4 weeks 😮

And more…

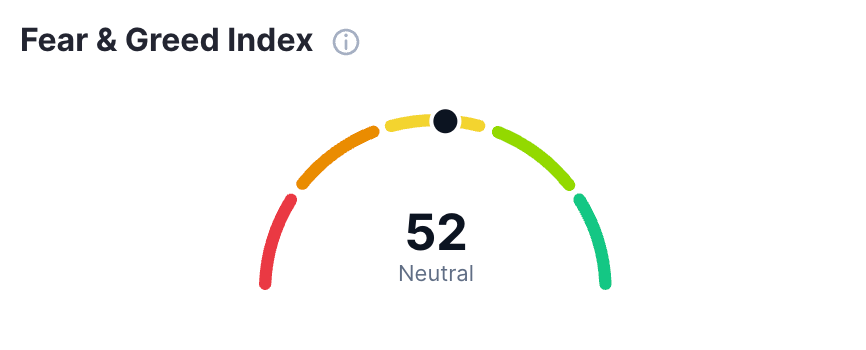

MARKET WATCH ⚖️

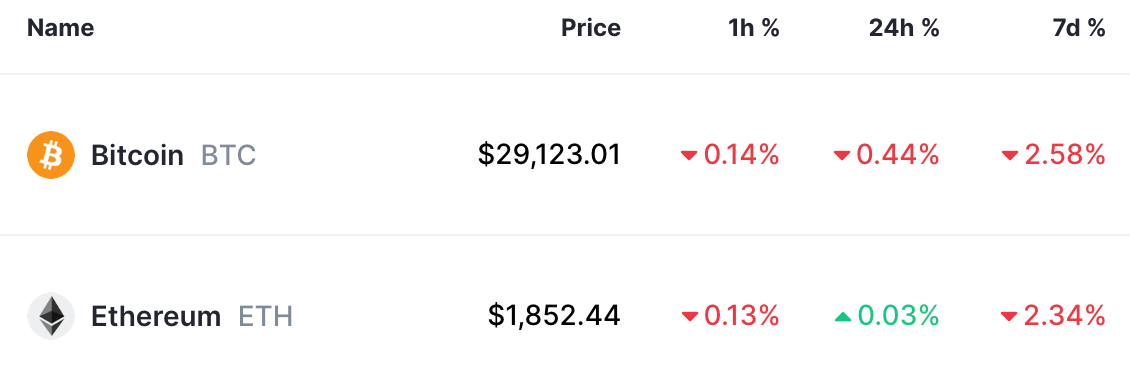

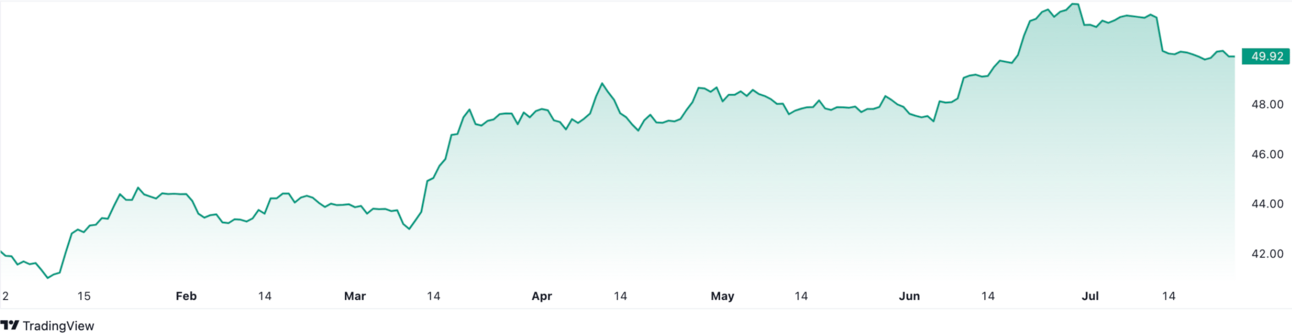

BTC Dominance is currently at 49.92% and the current crypto market cap is $1.17T ▼0.28%

Biggest Winners of The Day 🤑

Dogecoin (DOGE) ▲2.36%

Avalanche (AVAX) ▲1.21%

Biggest Losers of The Day 😭

Bitcoin Cash (BCH) ▼3.27%

Solana (SOL) ▼1.91%

XRP (XRP) ▼1.18%

Only the top 20 coins measured by market cap feature in this section

Why is Bitcoin down today?

The bullish momentum we experienced that caused Bitcoin to pump up 76% year to date seems to have faded as Bitcoin briefly dipped below $29,000.

Factors that caused this drop:

Expected interest rate increases from the Federal Reserve

Most major banks are still expecting the US to experience a sharp recession in 2023

Bitcoin whale exchange inflow hit a 1 year high of over 40% of the total volume (BTC moving onto exchanges)

Continued regulatory pressure against crypto exchanges (Binance, Coinbase etc.)

However, all of this hasn’t changed institutional investor’s long term outlook on the market. Massive institutions like BlackRock still filed for Bitcoin ETF’s despite this ongoing regulatory battle for crypto. Who’s betting against BlackRock?

In the long run, we still believe the price of Bitcoin will recover and Institutional investment is going to spark the bull run.

All price data as of 7:55am ET

Hey Nutcases, We Need Your Help… 🥜

We write up The Crypto Nutshell, every single day, completely free.

Our promise? It will always be free.

However.

We want to grow!

But - we don’t want to hand over cash to any giant companies to promote us.

We’d much rather give that money to you.

On that note…

The Bitcoin halving is just 9 months away..

We spent $2,500 on research, on-chain analysis & predictions from top crypto experts & put it in a 11-page, 2024 Bitcoin Halving Research Report.

We are giving it away to you, for free.

All you need to do is follow our newly launched Twitter, like, comment & retweet our tweet and we’ll send it your way.

On top of that we’ll be giving away $100 to one lucky nutter who shares us. 🎉

So everyone will get the report and one lucky nutter will walk away with a crisp $100. 💵

Checkout the tweet below for details on how to enter.

Thanks in advance & much love from the Crypto Nutshell Team. ❤️

EXPERT OF THE DAY - RAOUL PAL 💸

This expert believes the tide has turned and it’s only up for Bitcoin, Ethereum & Crypto until at least around 2025.

Macro Economic Investor and Real Vision founder Raoul Pal has come up with what could be a revolutionary hypothesis.

One in which he believes holds the power to predict asset prices with remarkable precision over the months to come.

He has fittingly named this breakthrough hypothesis ‘The Everything Code.’

Diving into the intricate interplay between multi-year liquidity cycles and government debt repayments, Raoul believes he’s discovered something profound.

Liquidity cycles - aka. how much money is sloshing around the economy - is what ultimately dictates the movement of all asset prices.

In his most recent interview with Bankless, Raoul unravels the connection between asset price growth and the growth rate of the money supply.

Raoul suggests that it’s not asset prices soaring, but rather, it’s just the devaluation of the underlying currency. Raoul’s ‘Everything Code’ is anchored in this revelation.

He switches the denominator for all assets to the global central bank balance sheets, which radically alters the lens through which we view market fluctuations.

What you’ll find is that, under this novel framework, practically all assets - be it stocks, bonds, real estate, gold, or silver - are treading water, showing no real growth.

However in high liquidity environments there’s 2 assets that do out-perform the rate of currency devaluation. 🤔

The first is technology - think your FAANGS - Facebook, Amazon, Apple, Netflix, Google.

The second? Bitcoin & Cryptocurrency.

Why is this?

Well when central banks turn on the money printers and there’s more money sloshing around, it needs to find a home somewhere. In this type of environment, the assets that perform best are the ones furthest out on the risk curve. What’s the furthest out?

Bitcoin & Cryptocurrency. 🤑

This year looks more bullish than even I expected … it looks very positive to me and I don't think we need to get worried until 2025.

Nutty’s takeaway: Whether you agree with Raoul’s take or not, he does bring up an extremely important point if you want to be a successful investor. Judging the performance of your investments based off a currency valuation = a fools errand.

Allow me to demonstrate:

Let’s say true inflation is 15% per year.

You make a $100,000 investment and you check it 10 years later and it’s worth… $404,555.77! 💰

Holy smokes!

You’ve knocked it out the park! A 4x increase in just 10 years?

But wait a second. Let’s adjust for true inflation.

When adjusted for true inflation your investment is actually worth… $100,000.

It has gone up at 15% compounded annually for 10 years.

You actually haven’t gained any value at all. You’ve just kept pace at the same rate of inflation. 🤯

Something to think about. 🤨

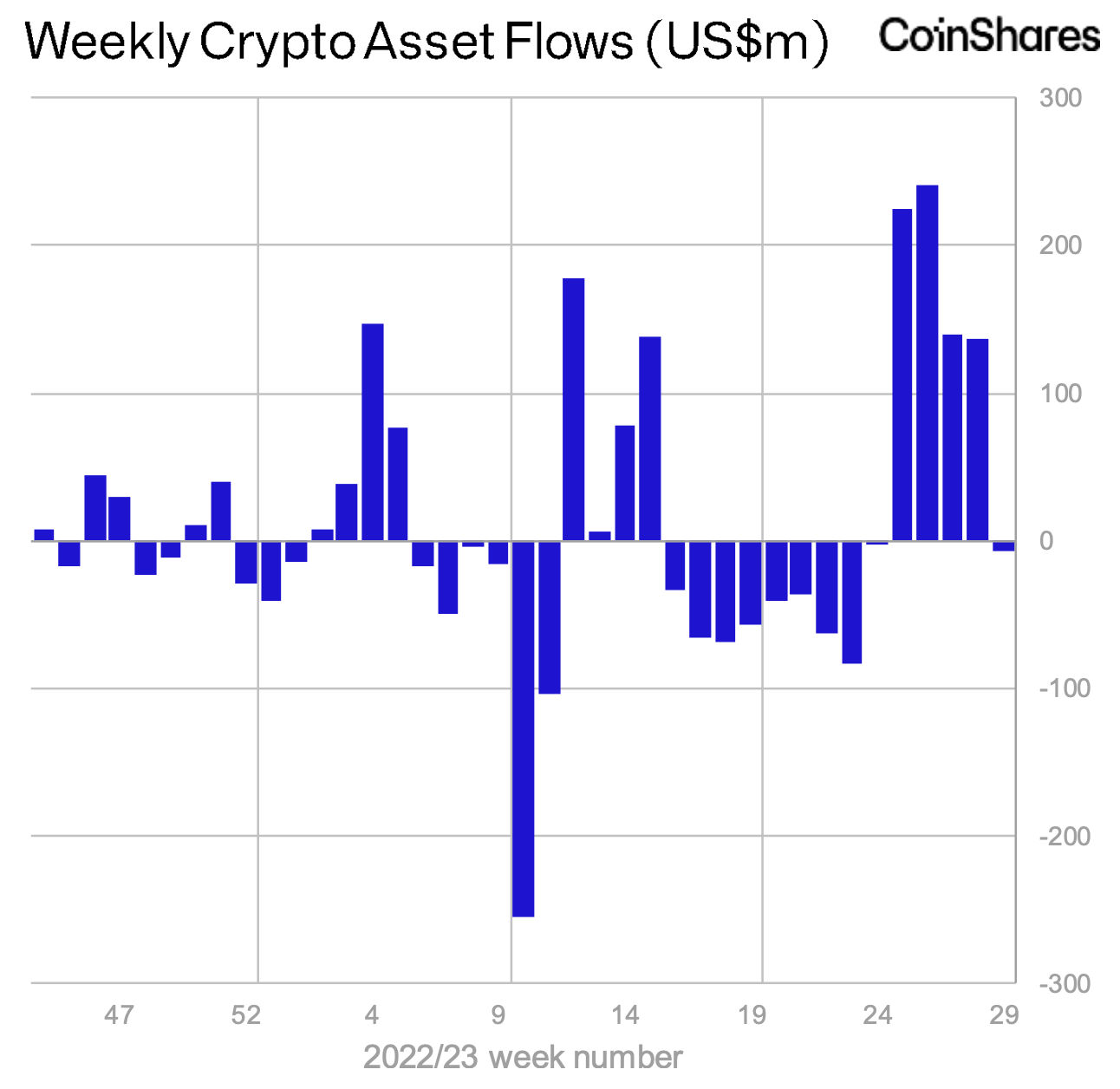

ON CHAIN DATA DIVE 📊

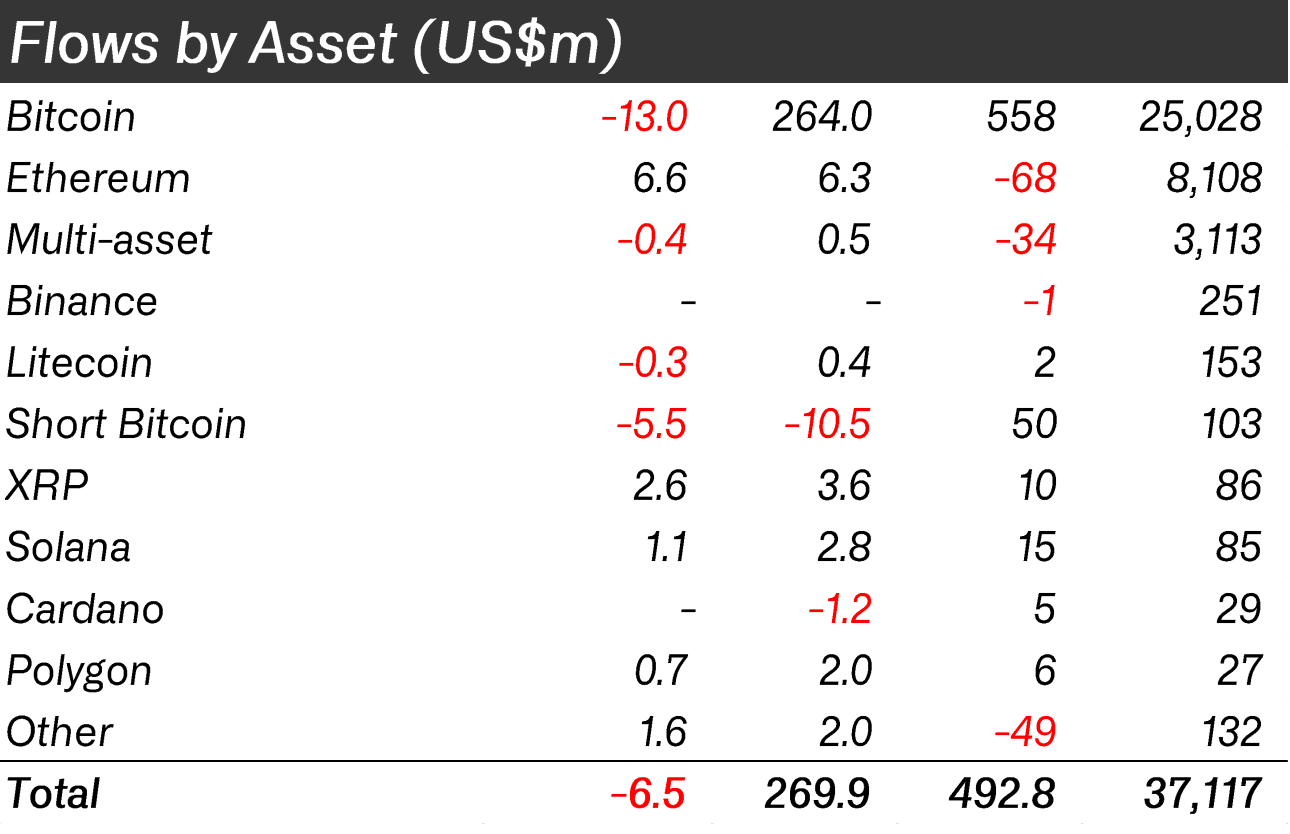

Digital Asset Investment Products saw $6.5 million in outflows this week after four consecutive weeks of inflows totalling $742 million.

This breaks the longest streak of inflows since 2021 and lines up with the price of Bitcoin dipping to its lowest point in a month.

Before going any further, just to be clear, we are talking about inflows and outflows for Digital Asset Investment Products NOT the inflows and outflows of the entire crypto market.

Digital Asset Investment Products are kind of like ETFs. They make getting into digital assets like Bitcoin much more accessible to a wider range of investors.

The sudden outflow seems to be the result of the recent wave of positive crypto new fizzling out. Let’s go over what happened.

The global asset management giant BlackRock filed for a Bitcoin ETF on June 15, which sparked a swarm of competitors to do the same.

This news was MASSIVE.

New life was breathed into the market and investors began piling money into BTC focused investment funds over the next month, setting the fastest pace since October 2021.

In other news, XRP’s court victory over the SEC was another HUGE win for crypto and a monumental step forward. This news also sparked another market surge with XRP rocketing up 72%.

From this ruling, confidence was restored in altcoins. Taking a look at the table below you’ll notice net inflows for Ethereum, XRP, Solana and Polygon.

However, Ethereum comes away as the king this week. Representing the largest inflows, totalling $6.6 million. Looks like a bit of momentum is ramping up for the second largest cryptocurrency.

Nutty’s Takeaway: The BlackRock ETF application and XRP court case win was HUGE news for the market. This sudden dip in price seems to be a mild market correction, nothing to lose sleep over. The ETF applications are simply to big of a deal to be ignored and we believe these will be the catalysts for the next bull run.

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

What was the first ever NFT art piece?

A) Bored Ape Yacht Club

B) Quantum

C) CryptoPunks

D) CryptoKitties

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Quantum 🎉

Surprisingly, Quantum by New York artist Kevin McCoy is considered the first NFT art project. Checkout this for a timeline of NFT history 😱

What did you think of today's Newsletter?

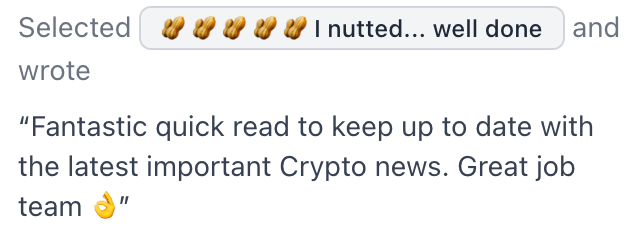

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.