GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that's less chaotic than a typical day at Dunder Mifflin Scranton branch...📑🏢

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Ethereum is looking seriously good right now 💃

Bitcoin’s supply dynamics 💰

And more…

MARKET WATCH ⚖️

BTC Dominance is currently at 50.50% and the current crypto market cap is $1.17T ▼0.85%

Biggest Winners of The Day 🤑

TRON (TRX) ▲0.52%

Dogecoin (DOGE) ▲0.03%

Polygon (MATIC) ▲0.01%

Biggest Losers of The Day 😭

XRP (XRP) ▼2.37%

Toncoin (TON) ▼2.22%

Solana (SOL) ▼1.54%

Only the top 20 coins measured by market cap feature in this section

JUST IN: SEC to seek interlocutory appeal in Ripple case 👩⚖️ 🤦♂️

Remember how just last month Ripple won their court case against the SEC, which ruled that the sale of XRP is not a security when sold to retail investors?

Yeah well the SEC is aiming to appeal that decision…

Things sure are getting interesting.

Will Ripple come out on top again? 🤔

Stay tuned for more. You know we’ll keep you updated.

All price data as of 7:45am ET

EXPERT OF THE DAY 💰

For todays expert prediction of the day, we are going to delve into Coin Gecko’s 2023 Q2 Crypto Industry report. 🦎

For those new into crypto, Coin Gecko is a hugely popular crypto price tracking site.

Along with Coin Market Cap (the largest in the space) Coin Gecko is the go to site for investors to see the state of play in the market.

Although the entire report is jam-packed with analysis and research on Bitcoin, Ethereum, DeFi, NFT’s & the general state of the market - what we’re going to zero in on is Ethereum.

Why?

Because it has the most juice 🧃

Let’s dive in.

Spoiler alert 🚨 - things are looking good for Ethereum.

Detailed in the report was some strong analysis of a multitude of factors as to why Ethereum is poised to perform well for the foreseeable future.

But really - it all boils down to one main point.

Ethereum’s supply dynamics are ridiculously good.

In case you’ve been living under a rock for the past 24 months, there have been two major changes that happened to Ethereum that have completely changed the way its supply works.

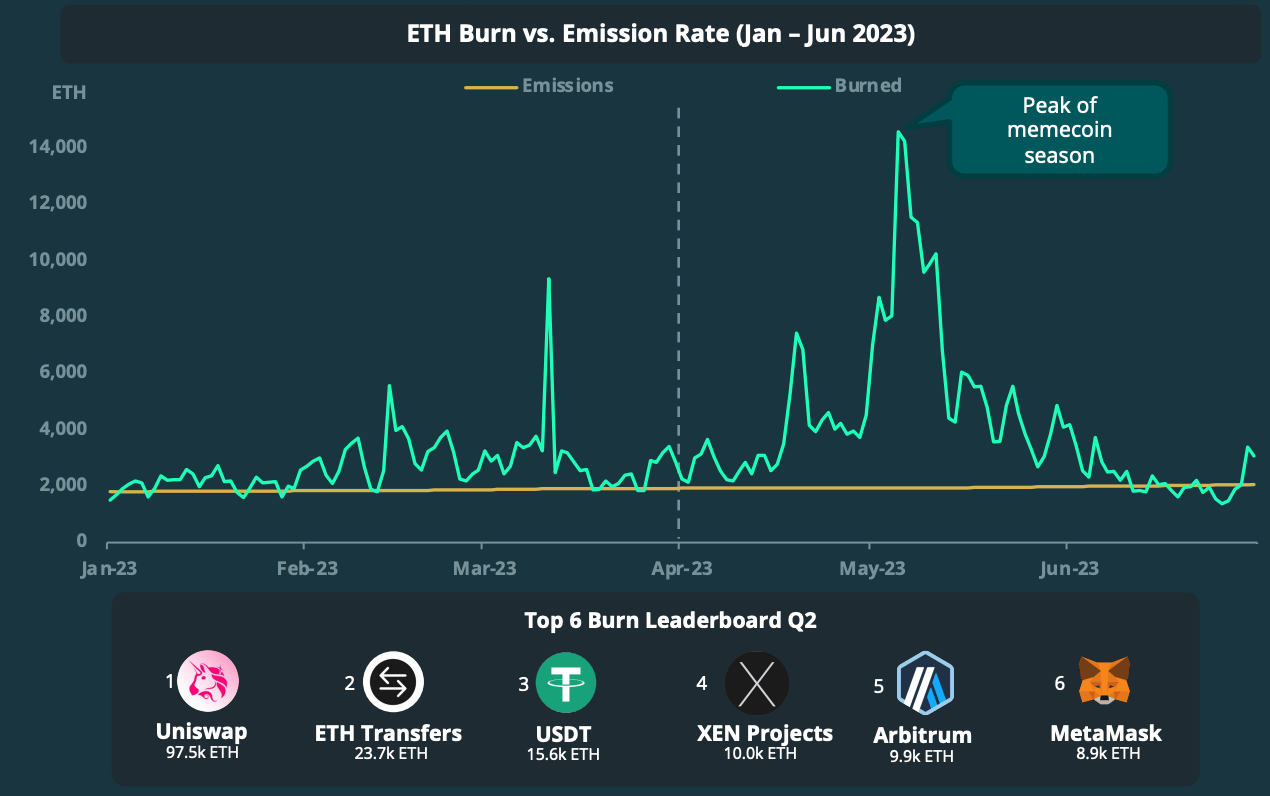

The London Upgrade - which implemented a burn mechanic to Ethereum transactions. Every time Ethereum is used or transacted with, instead of the base fee going to miners, it is now “burned” or removed from circulation 🔥

The Ethereum Merge - this switched the network from proof of work to proof of stake. Not only did this make the network WAY more energy efficient, but it also cut the supply issue by around 99%

This is insane. The Bitcoin Halving only cuts down its supply issuance by 50%. The Ethereum Merge cut its supply issuance by 99%! 📉

However, these two changes become even more insane when you combine them together. Ethereum supply issuance being cut by 99% COMBINED with the burn mechanism introduced in the London upgrade means that since the Merge, Ethereum has been deflationary.

Meaning as time goes on, there’s less and less Ethereum out there. In fact, before the Merge, Ethereum supply was increasing at around 3.17% per year.

Now? It’s decreasing at -0.28% per year. 😳

Coin Gecko pointed this out in their report & thanks to some crazed meme-coin trading in May this year, Ethereum’s burn rate is looking healthy.

Keep in mind, this is during a bear market. 🐻

But wait - it get’s better.

Unlike Bitcoin, you can stake your Ethereum and earn a small reward as it helps secure the network. Kind of like having cash in the bank and being paid interest on it.

The good news? - ETH staking saw big growth in Q2 2023 with it increasing by 30.3%. 📈

This just goes to show that holders still have huge conviction in Ethereum and are invested in its long term future.

So add all of these factors together and the road ahead looks bright for Ethereum holders. ☀️🏖️

Nutty’s takeaway: Things are looking GOOD for Ethereum. Like really good. Ethereum soared to huge gains in the 2021 bull-market, yet this was before the supply dynamics got overhauled & overall it became deflationary.

With supply cut so much, imagine what happens in the next bull-run, when demand skyrockets… 🚀

ON CHAIN DATA DIVE 📊

So the Bitcoin halving is due to happen in April 2024, but what exactly does this mean?

Well to understand the halving first we need to understand the supply of Bitcoin and how new coins are created.

Bitcoin is a uniquely scarce asset. There is a hard-capped limit of 21,000,000 coins that can ever exist. New coins are introduced to the circulating supply through a process known as Mining. Bitcoin Miners earn rewards in the form of new BTC for confirming transactions in the blockchain. To learn more about mining checkout our previous article here.

Taking a look at the chart below:

🟠 Circulating Supply: total amount of Bitcoin mined to date

🔴 Remaining Supply: amount of coins left to be mined

🔵 Percentage of Bitcoin Supply Mined to date

The real genius of the Bitcoin network is in the mining algorithm known as the Difficulty Adjustment. This algorithm basically keeps the rate at which new bitcoin can be mined at a constant 600 seconds.

The cool thing about this?

Using this algorithm we can determine that the last Bitcoin will be mined in the year 2140 😱

But what is the Bitcoin halving?

Well the amount of Bitcoin that miners earn as rewards for confirming transactions is cut in half every 210,000 Blocks and this event is what we refer to as the "Halving”.

On average 144 Blocks are produced every day. This means that the halving occurs roughly every 4 years. The chart above shows us the amount of new Bitcoin entering the supply over time, notice how it’s pretty constant and then it steps down every 4 years - that’s the effect of the halving.

Nutty’s Takeaway: The halving is a huge event for the Bitcoin community.

If you’re new to crypto, the halving and the 18 months that follow is usually the most hectic time for Bitcoin, everyone will be talking about it, the price will (hopefully) be exploding and all around it’s generally a lot of fun.

At the end of the day, it all comes down to simple supply and demand. If the rate of supply gets reduced and demand goes up, the price only has one way it can go…

Exciting times ahead. 🚀🚀

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

Ethereum fees are known as… ?

A) Petrol

B) Juice

C) Coal

D) Gas

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Gas 🎉

Gas refers to the fee, or pricing value, required to successfully conduct a transaction or execute a contract on the Ethereum blockchain.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.