GM to all 15,041 of you. Crypto Nutshell #127 stompin’ thru. 🐘 🥜

We’re the crypto newsletter that's less heart-wrenching than surviving a post-apocalyptic world with monsters sensitive to sound... 🙉👾

Today, we’ll be going over:

🤔 SEC divided on crypto regulations

🎇 Bitcoin’s price is about to double

💎 New all-time high reached

🤑 And more…

MARKET WATCH ⚖️

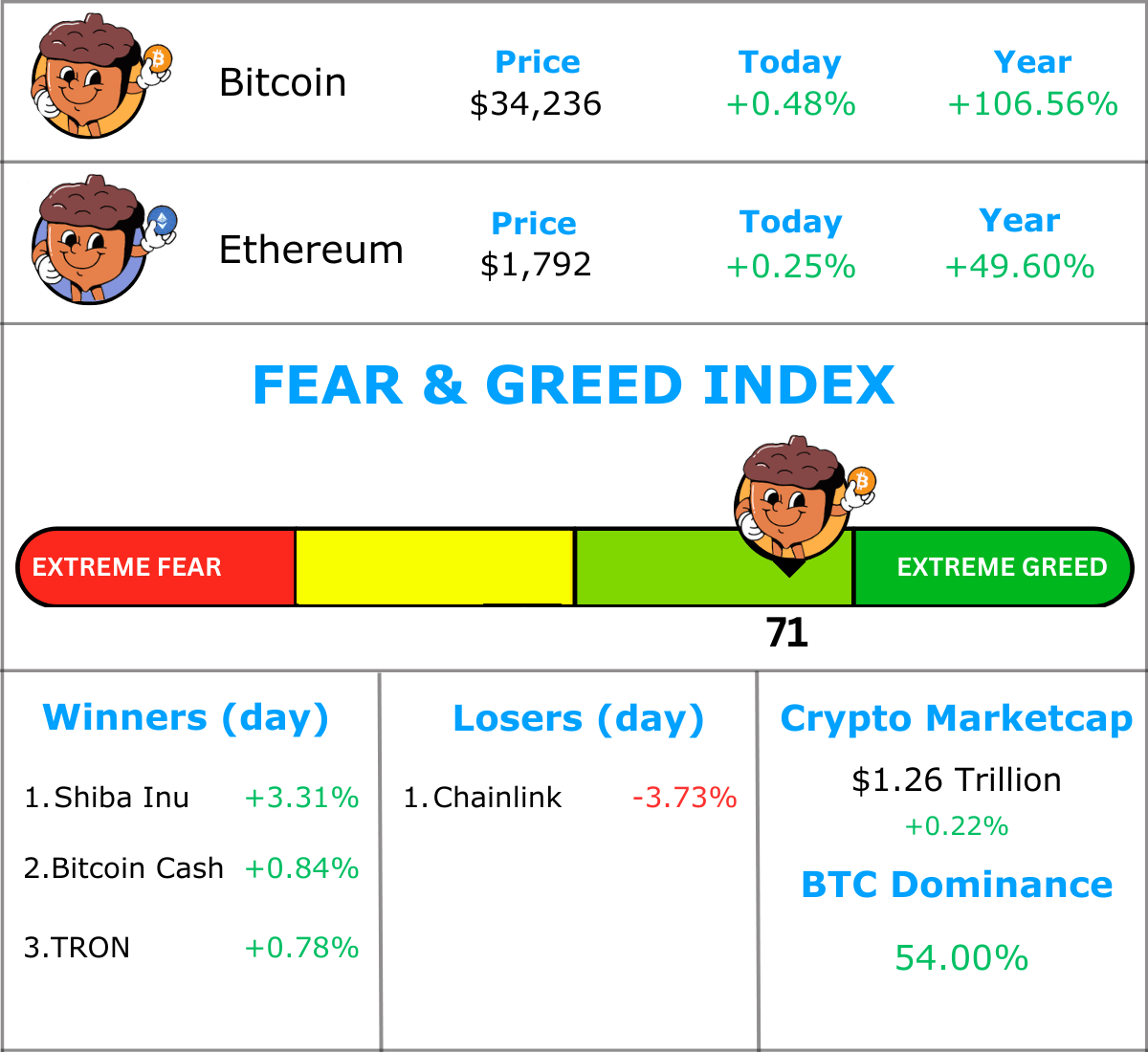

Prices as at 5:30am ET

Only the top 20 coins measured by market cap feature in this section

SEC DIVIDED ON CRYPTO? 🤔

BREAKING: Hester Peirce: SEC case against LBRY ‘unsettled me’

Once again, Hester Peirce has come forward distancing herself from a crypto related decision made by the SEC.

We spoke about the SEC commissioner a couple of days ago. Surprisingly Peirce is supportive of the Bitcoin ETFs and even questions why they have not yet approved one.

Back in March 2021, the SEC filed a lawsuit against LBRY, a blockchain based file sharing network.

The reason for this lawsuit?

The exact same thing the SEC sued Coinbase and Binance for this year.

Offering digital tokens without registering them as securities…

“The commission has brought many troubling crypto enforcement actions, but the LBRY… case has especially unsettled me.”

Unfortunately due to this legal battle, LBRY was forced to shutdown operations. However, due to its decentralisation, the network remains active.

Hester Peirce had this to say regarding LBRY’s shutdown:

“Are investors and the market really better off now after the Commission’s litigation contributed to the demise of a company that had built a functioning blockchain with a real-world application running on top of it?…This case illustrates the arbitrariness and real-life consequences of the Commission’s misguided enforcement-driven approach to crypto.”

Peirce raises a fair point. Who did this decision protect?

All it did was put an innovative company out of business…

“Our disproportionate reaction in this case will dissuade people from experimenting with blockchain technology, which LBRY aptly describes as ‘technology that enables dissent… A government of a free people should welcome dissent and the technologies that enable it.”

The SEC under Gary Gensler’s control has well and truly lost the plot.

TOGETHER WITH VENTURE SCOUT 🎯

Check out these returns from IPO to September 2021:

Google (Alphabet) 64.24x

Netflix 550.47x

Facebook 9.02x

Question: What do these companies all have in common?

Answer: They’re all software companies.

Software companies, in our opinion, offer the highest potential returns to investors. (outside the world of crypto 😉)

The problem?

Keeping up with software startups is f*cking difficult.

The SAAS world is practically impossible to keep up with.

That’s why we read Venture Scout.

It’s a high quality weekly report on all the latest and greatest software startups, so you can keep a finger on the pulse of one of the greatest opportunities of our generation.

The best part? Just like us, their reports are completely free.

Subscribe now by hitting that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

BITCOIN’S PRICE IS ABOUT TO DOUBLE 🎇

This week we saw Bitcoin rocket up from $29,000 to $34,000. A ~15% increase, all on the rumour of the Bitcoin ETF.

Which begs the question…

How high will it go on the actual approval? 🤔

That’s what today’s expert - James Lavish - answered in his latest interview.

James Lavish is the managing partner at the Bitcoin Opportunity Fund. He has decades of experience in the hedge fund industry.

Suffice to say, he knows how institutional players invest.

Lavish believes the move we saw this week is a major sign of the pent-up demand for Bitcoin.

He argues that the ETF news still isn’t baked into to the Bitcoin price.

Once we get news of actual approval? Lavish expects the price to double, with at least a 50% - 70% move upwards. 😯

“I do believe that once we have the 3-4 main ETFs approved, the market value of Bitcoin could double. Very quickly. That would not be a surprise to me, at all. It would actually surprise me if we don't double or at least have some sort of major, 50%, 60%, 70%, move on the actual approval.”

Nutty’s takeaway: Although such a huge move upwards seems insane… is it really?

A 100% move upwards would still put Bitcoin below its all time high.

With multiple ETF’s approved, the halving on the horizon and all the on-chain indicators better than ever before… is it insane?

Food for thought. 😉🥂

NEW ATH REACHED 💎🙌

For the last couple of days we have been focusing on Bitcoin’s short-term holders.

We think it’s about time we check back in on our diamond handed friends, the long-term holders (LTH).

Before going any further, LTHs refers to investors who have held Bitcoin for longer than 155 days. Statistically, the longer one holds Bitcoin, the less likely they’ll be spent.

Bitcoin’s recent price rally to $34,000 wasn’t enough to tempt LTHs into selling.

In fact, the amount of Bitcoin held by LTHs has just broken through an all time high of 14.9 million BTC.

This is equal to ~76.4% of the circulating supply. 😱

A larger volume of coins is maturing across the 155-day threshold than is being spent out of it.

Looking at the chart above you’ll notice that as the price peaks, the amount of Bitcoin held by LTHs dips a little. Everyone has a price. And some LTHs choose to lock in profits.

Something that hasn’t happened for a while…

Bottom Line: the amount of Bitcoin available for sale continues to dwindle.

The upcoming halving and ETF approvals are likely to increase demand for Bitcoin by A LOT.

And we all know.

Supply decreasing + demand increasing = price 🚀

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

The Intrinsic Value Newsletter

The weekly newsletter devoted to breaking down business and estimating their intrinsic value, in just a few minutes to read — Join 35,562 readers

Sponsored

Fast Food Club

The Official Fast Food Club. Get access to the world's largest group for fast food secrets, news, tips, menu hacks, and secret recipes. Once you subscribe you'll become a member.

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

CAN YOU CRACK THIS NUT? ✍️

What is staking?

A) The process of cooking a juicy steak

B) The process of creating new Bitcoins

C) A way to earn rewards for helping secure certain blockchains

D) A process exclusive to the Ethereum network for creating smart contracts

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) A way to earn rewards for helping secure certain blockchains 🥳

To learn more about staking checkout this Coinbase article.

GET IN FRONT OF 15,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research